Key takeaways:

The FY26 union budget focuses on accelerating growth, securing inclusive development, invigorating private sector investments, uplifting household sentiments, and enhancing the spending power of India’s rising middle-class

- Focus on Sustainable Growth

The budget emphasizes long-term economic growth over populist measures, with key drivers including consumption, investment, government expenditure, and exports. - Commitment to Fiscal Prudence

The fiscal deficit target has been achieved at 4.8%, reflecting strong fiscal management, with a clear path towards 4.4% in FY26, showcasing disciplined fiscal planning. - Continued Focus on Capex

Despite Capex plateauing, allocations remain significant with increased ministry-wise spending, supporting infrastructure and economic growth. - Rural Consumption & Tax Relief

Targeted measures to boost rural demand through agricultural support and tax relief, increasing disposable income and driving consumption growth. - Support for Startups & MSMEs

Government initiatives to enhance credit guarantees, promote AI funding for startups and support MSMEs, driving entrepreneurship and job creation. - Equity Strategy

Optimism around equities, especially large-cap(valuations are reasonable) and select mid-cap stocks, with a favorable view on sectors like power, consumer durables, financial services, capital goods(Stock-specific bets), industrials, and rural consumption as a broad theme. Investors should consider gradually deploying capital over the next six months rather than waiting for deeper corrections. - Fixed Income Strategy

Preference for medium to longer duration fixed income investments with a positive outlook on debt markets amid expectations of softening inflation. - Gold & Silver Outlook

A constructive view on gold and silver allocations as part of a diversified portfolio strategy

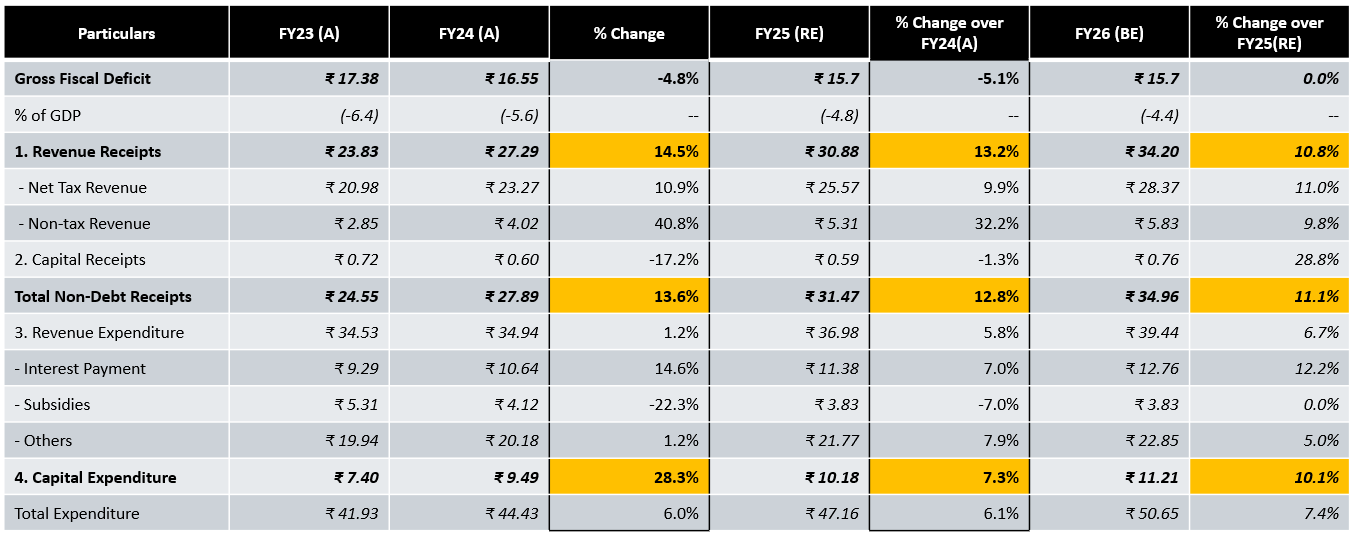

A Snapshot: Government finances

- The government’s fiscal framework reflects a balanced approach, with strong revenue from taxes and strategic borrowing to fuel growth. Prioritized spending on state development, infrastructure, and welfare schemes highlights a commitment to inclusive and sustainable economic progress.

(Source: Budget Document, Fisdom Research)

Fiscal discipline is in line with the announced glide path

- The fiscal deficit has been revised down from the budgeted 4.9% to 4.8%, reflecting strong fiscal management, with a clear target of 4.4% for FY26 underscoring the government’s commitment to fiscal prudence.

- Capital expenditure continues to grow at a healthy 10%(largely at nominal GDP growth rate) pace in FY26, highlighting sustained focus on infrastructure, while robust revenue growth supports a balanced fiscal approach, ensuring both growth and stability.

(Source: Budget Document, Fisdom Research)

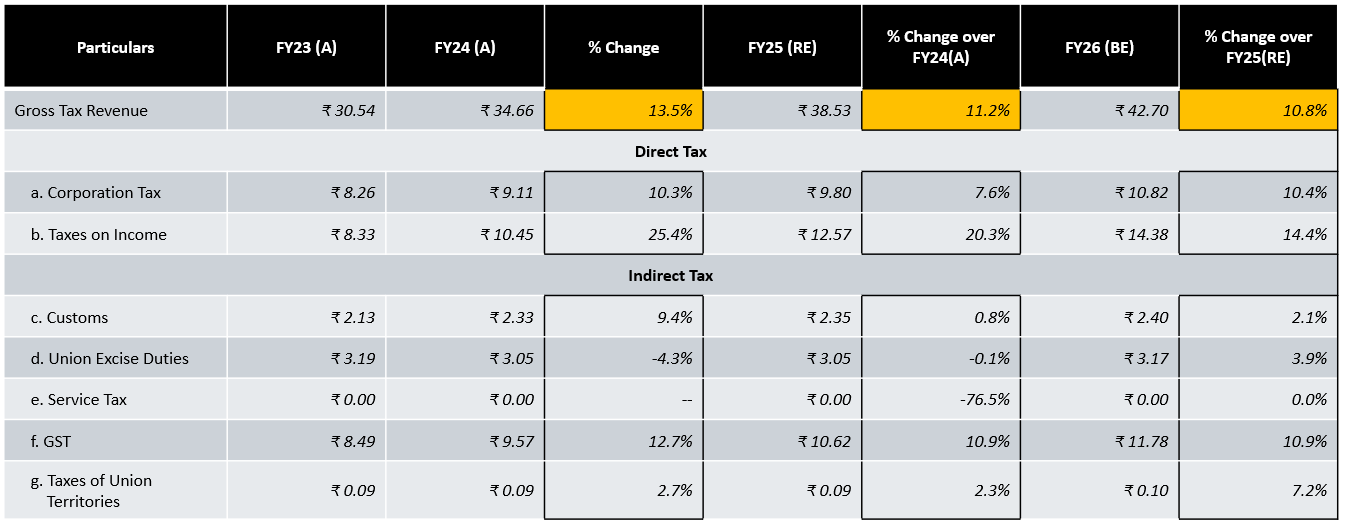

Realistic tax revenue targets

- The tax revenue growth projections are realistic, with FY25 (RE) figures closely aligning with budgeted estimates, reflecting strong revenue performance and minimal deviations.

- The moderate 10.8% growth expected in FY26 is supported by balanced growth in both direct taxes (14.4% in income tax, 10.4% in corporate tax) and indirect taxes (10.9% in GST), highlighting strong economic fundamentals and robust compliance trends

Sources of financing the fiscal deficit: market borrowings & small savings persist as the primary means of financing

- While market borrowings are slightly higher than expected, RBI’s proactive liquidity measures, including ongoing OMO purchases, are likely to cushion the impact.

- With a potential rate cut on the horizon, ample liquidity should support smooth transmission, keeping bond market volatility in check and the medium-term outlook positive.