Daily Snippets

Date: 04th January 2024 |

|

|

Technical Overview – Nifty 50 |

|

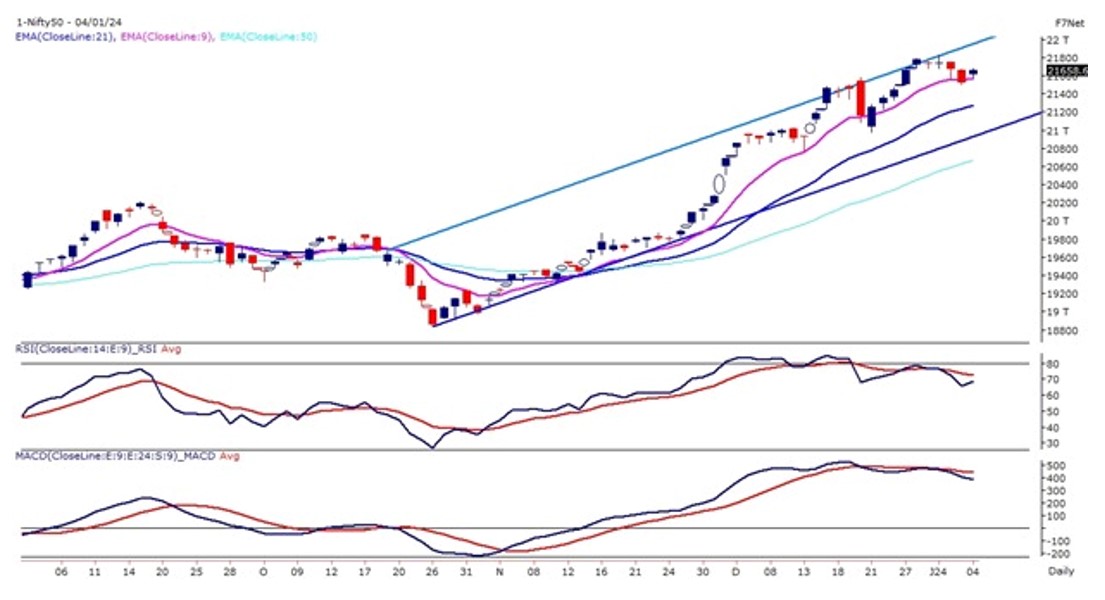

The Benchmark index on 04th Jan opened higher above 21,600 levels and traded with a bullish bias throughout the day. After two consecutive bearish candles, the Index formed a green candle on the daily chart which sustained above its 9 EMA.

The Nifty Realty Index was the major attraction for the day where the index gained more than 5% in a single day suggesting a breakout in the prices. The Nifty50 on the daily chart is trading within the rising channel pattern and prices have presently taken support near 9 EMA and formed a bullish candle on the daily chart.

The positive takeaway from today’s trading session was that the benchmark Nifty still appears to be the only bullish deal in the town after two bearish candles. The immediate support for the Index is placed at 21,500 – 21,400 levels and the upside are capped near 21,850 levels.

|

Technical Overview – Bank Nifty |

|

Smart turnaround from the Banking Index after two days of bearish momentum and the index formed a tall bullish candle on the daily chart with gains of almost 1 percent. The Bank Nifty on the daily chart is trading within a rising channel pattern and has sustained above its 9 EMA.

The Banking Index continues to trade above the breakout levels and is trading above its 9 & 21 EMA on the broader time frame. The momentum oscillator RSI (14) is reading near 70 levels and the momentum is strongly poised towards a bullish stance on the weekly chart.

The positive takeaway from today’s trading session was that the Bank Nifty still appears to be the only bullish deal in the town. The immediate support for the Index is placed at 47,800 – 47,600 levels and the upside is capped near 49,000 levels.

|

Indian markets:

- The domestic stock market saw a positive shift after a two-day decline, with the Nifty closing above 21,650. All NSE sectoral indices closed higher, led by gains in realty, financial services, and private bank shares.

- Volatility marked the day due to the expiry of weekly index options on the NSE. However, despite negative global cues, the market opened on a positive note and sustained its upward trajectory, closing near the day’s peak.

- This resurgence was supported by robust monthly business updates from major banks, highlighting strong credit growth. Notably, the realty sector surged in anticipation of heightened demand in the residential category, backed by encouraging housing loans disbursement data from banks.

- Meanwhile, in Asian markets, profit booking ensued following indications from the US Fed minutes suggesting a temporary halt in interest rate adjustments.

|

Global Markets

- Markets in Europe advanced across the board while its Asian stocks tumbled on Thursday. Chinese markets were battered by Fitch downgrading four major state-owned asset managers.

- French inflation figures showed consumer prices rising 3.7% year on year in December, a slight rise from 3.5% in November.

- Japan resumed trading after an extended New Year’s holiday during which it witnessed an earthquake and a collision at Tokyo’s Haneda airport involving Japan Airlines.

- The Caixin China General Services Business Activity Index rose to 52.9 in December compared with 51.5 in November, climbing for a 12th straight month. The survey also noted that the rate of growth was the fastest since July.

- US stocks lost ground on Friday after the Fed minutes revealed officials concluded that interest rate cuts were likely in 2024, though they appeared to provide little in the way of when that might occur.

|

Stocks in Spotlight

- Indian Hotels surged by more than 2 percent, reaching an unprecedented high, subsequent to Morgan Stanley’s upward revision of its target price for the stock. The new target stands at Rs 490, up from the previous Rs 450, suggesting a potential upside of 7 percent from the current levels.

- Following the power utility company Torrent Power signing four contracts with the Gujarat government totaling Rs 47,350 crore, its stock saw a 14 percent rally, reaching a new 52-week high. However, the stock later retraced some of these gains, closing 7.7 percent higher.

- Bajaj Amines experienced a 3.28 percent increase subsequent to its subsidiary, Bajaj Specialty Chemicals, being granted mega project status by the Maharashtra government.

|

News from the IPO world🌐

- Jyoti CNC Automation IPO price band fixed at Rs 315-331 per share

- IPOs to wathcout in 2024: Swiggy, firstcry, Ola Electric, Oyo, Portea Medical.

- Jyoti CNC Automation’s Rs 1,000 crore IPO to open on Jan 9

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | BAJFINANCE | ▲ 4.3 | | TATACONSUM | ▲ 3.6 | | NTPC | ▲ 3.5 | | ONGC | ▲ 3 | | INDUSINDBK | ▲ 2.8 |

| Nifty 50 Top Losers | Stock | Change (%) | | DRREDDY | ▼ -1.7 | | BPCL | ▼ -1.6 | | LTIM | ▼ -1.4 | | HCLTECH | ▼ -1.2 | | HEROMOTOCO | ▼ -1.1 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY REALTY | 6.76 | | NIFTY FINANCIAL SERVICES | 1.22 | | NIFTY PRIVATE BANK | 1.17 | | NIFTY BANK | 1.03 | | NIFTY PSU BANK | 1.03 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2509 | | Declines | 1346 | | Unchanged | 86 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,430 | (0.8) % | (0.8) % | | 10 Year Gsec India | 7.2 | 0.00% | 0.60% | | WTI Crude (USD/bbl) | 70 | (1.8) % | 0.0 % | | Gold (INR/10g) | 62,435 | 0.20% | 0.30% | | USD/INR | 83.29 | 0.1 % | 0.3 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|