Technical Overview – Nifty 50

The index showed some bullish momentum throughout the day but was unable to breach the 25,000 level. The benchmark index has moved into consolidation. On the 75-minute chart, the index has created a flag and pole structure, with a breakout of over 25,000.

The fact that the RSI (14) momentum indicator took support at the 60 mark and had a hidden positive divergence gave a confirmation of upside continuation. On the weekly and daily charts, the index is still moving higher above the important moving average (EMA), suggesting that the upward momentum is still in place. The MACD is still above the polarity and positive for the benchmark index.

Based on benchmark index OI data, a base formation may take place at the 24,800 level, where put writing is almost 61 lakhs. At 25,000, call writing is almost close to 80 lakhs, which might act as a resistance. The PCR value of the benchmark index is 1.19.

The view remains buy on dips. The support levels for the upcoming sessions are at 24,700 and 24,600 and resistance at 24,900 and 25,000, respectively.

Technical Overview – Bank Nifty

The banking index had a lagging day, and momentum lagged on both sides. The banking index consolidated throughout the session between 51,300 and 51,700. The index has formed another doji candlestick on the daily chart. The banking index is under pressure, thus underperforming the benchmark index.

The 41-point mark served as a base and support for the RSI (14) momentum indicator. The closing below the 10 and 20 DEMAs, which supported the index, indicates that the banking index remains under pressure. Despite the short-term positive momentum, the 10 DEMA has crossed below the 20 DEMA, indicating a sell in an up-trending market. On the daily chart, a negative MACD crossover indicates a lagging upward trend.

Based on benchmark index OI data, a base formation may take place at the 51,000 level, where put writing is close to 06 lakhs. At 52,000, call writing is almost close to 11 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.71.

The resistance and support levels for the upcoming sessions are 51,600, and 52,000 for resistance, and 50,950, and 50,450 for support.

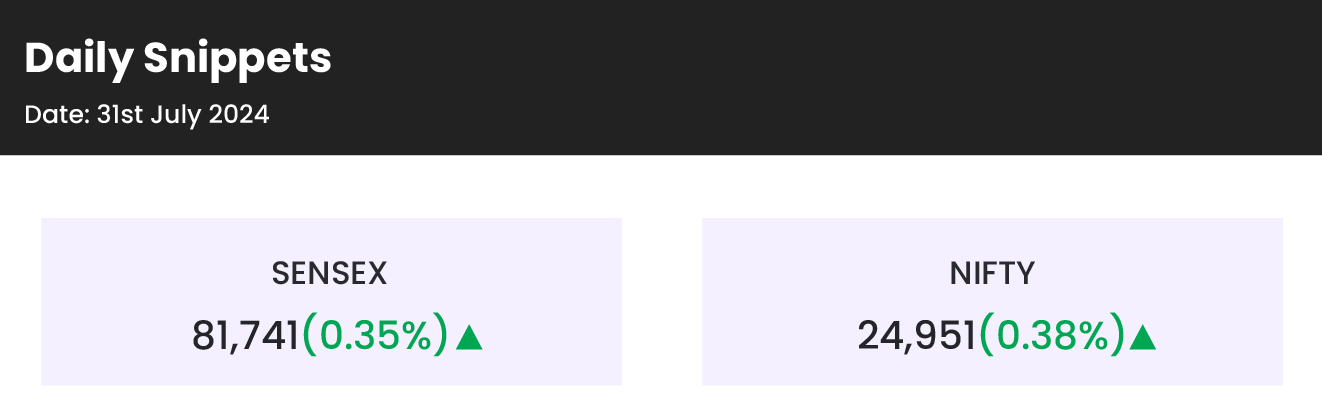

Indian markets:

- Indian markets closed higher, tracking gains in European and Asian equities ahead of the key US Federal Reserve’s interest rate decision due later on Wednesday.

- Among sectoral indices, Nifty Metal was the top gainer, rising 1.2%, followed by Nifty Pharma and Nifty Media, each up over 1%. On the downside, Nifty PSU Bank and Nifty Realty were the losers, both declining by 0.4%.

Global Markets:

- Asia-Pacific markets rose on Wednesday as investors evaluated China’s business activity data.

- Japan’s Nikkei 225 reversed earlier losses, climbing 1.49% after the central bank raised benchmark interest rates to around 0.25%.

- The broad-based Topix gained 1.45%. Japan’s retail sales grew 3.7% year-on-year in June, surpassing economists’ expectations of a 3.2% increase.

- Australia’s S&P/ASX 200 ended up 1.75%, reaching a record high of 8,092.3 following the release of the inflation report.

- South Korea’s Kospi rose 1.19%, with Samsung Electronics surging 3.58% after reporting a staggering 1,458.2% year-on-year increase in second-quarter operating profit. However, the small-cap Kosdaq dipped slightly, ending at 803.15.

- Hong Kong’s Hang Seng index was up 2.26% as of its final hour of trade, leading Asian markets. HSBC’s Hong Kong shares rose 3% after the bank’s profit exceeded estimates and it announced a $3 billion share buyback program.

- Mainland China’s CSI 300 gained 2%, driven by strength in real estate and healthcare stocks.

Stocks in Spotlight

- Torrent Power Shares surged over 16% to reach a new record high of Rs 1,898 on the NSE after the integrated power utility of the diversified Torrent Group reported outstanding earnings for the quarter ended June.

- BSE Shares closed over 6% higher, following the Securities and Exchange Board of India’s (SEBI) proposal for changes to Futures & Options (F&O) trading. Jefferies anticipates that the removal of the Bankex weekly contract could reduce EPS by 7-9% over FY25-27. However, Jefferies also suggests that gains from the spillover of trading activity from discontinued products could offset the EPS impact, and in the event of a moderate industry-wide impact from SEBI measures, potentially lead to EPS upgrades.

- GAIL India GAIL India’s share price jumped over 3% after the country’s largest gas distributor reported strong Q1 FY25 results, exceeding street estimates.

News from the IPO world🌐

- Ola electric IPO opens august 2 at ₹72-76 per Share

- FirstCry set to file final papers for $3-3.5 billion IPO

- Insurer Niva Bupa plans $360 million IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MIDSMALL HEALTHCARE | 1.2 |

| NIFTY METAL | 1.2 |

| NIFTY PHARMA | 1.1 |

| NIFTY MEDIA | 1.1 |

| NIFTY HEALTHCARE INDEX | 1.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2121 |

| Decline | 1833 |

| Unchanged | 83 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 40,743 | 0.5 % | 8.0 % |

| 10 Year Gsec India | 7.1 | 1.7 % | 8.1 % |

| WTI Crude (USD/bbl) | 75 | (1.4) % | 6.2 % |

| Gold (INR/10g) | 68,960 | 0.5 % | 2.5 % |

| USD/INR | 83.74 | 0.0 % | 0.8 % |

Please visit www.fisdom.com for a standard disclaimer