Hot stuff this week: Treasury Secretary Janet Yellen has warned about the dangers of default.

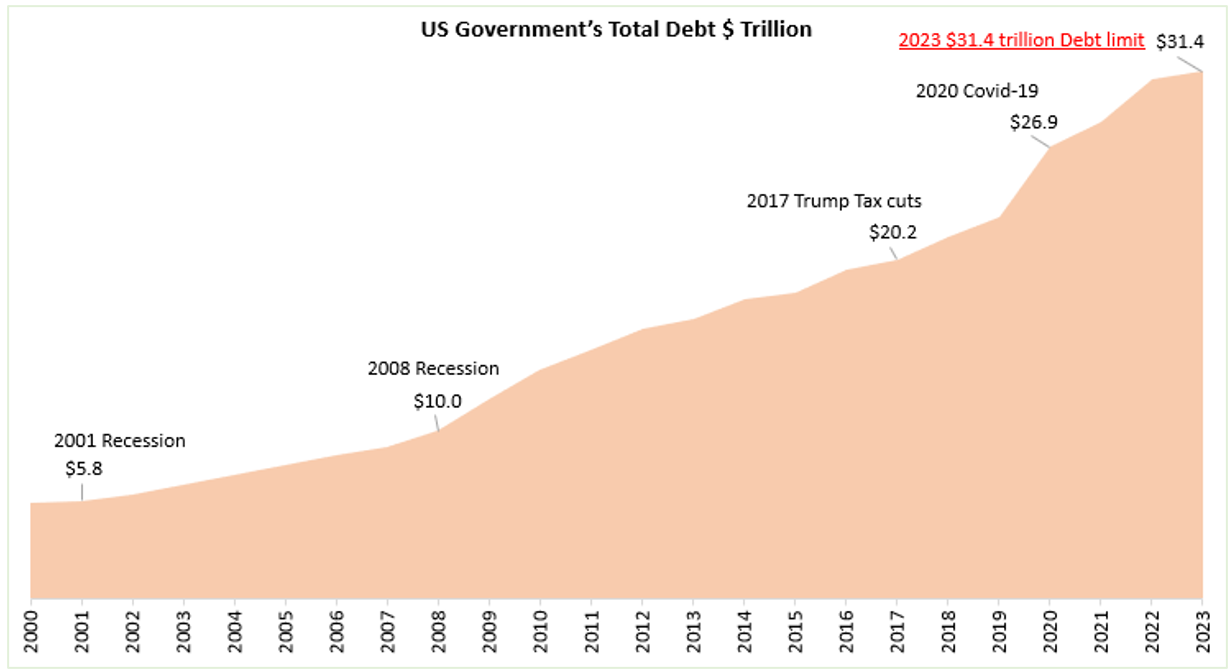

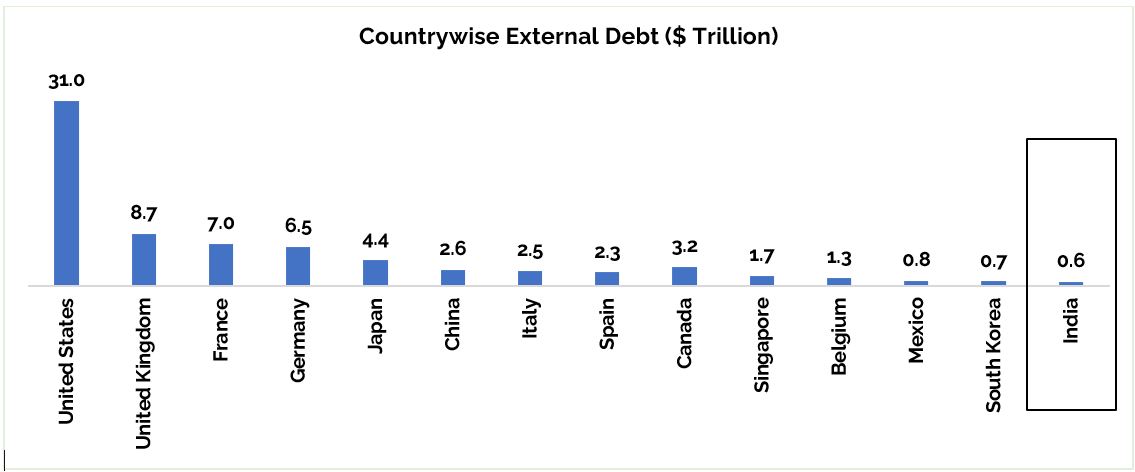

Over the last decade, Congress has approved massive spending, significantly increasing the United States’ national debt. Since 2009, this debt has nearly tripled, putting immense strain on the country’s financial resources.

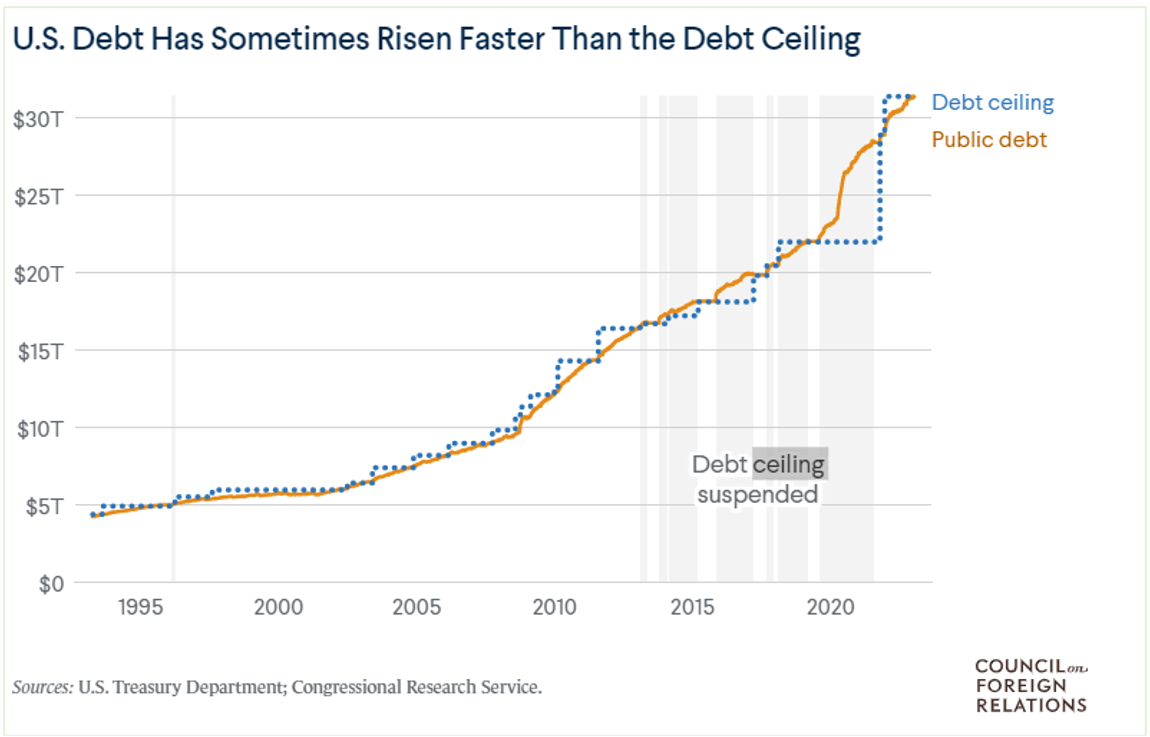

Despite a debt ceiling representing the maximum amount of debt the government can incur, the Treasury Department has repeatedly faced difficulties borrowing funds to pay for this debt. Treasury Secretary Yellen recently warned that the country could default on its debt as soon as June 1st if the debt ceiling is not raised.

Chart 1: Source: Federalreserve.gov, Fisdom Research

How did the US arrive at this situation this time?

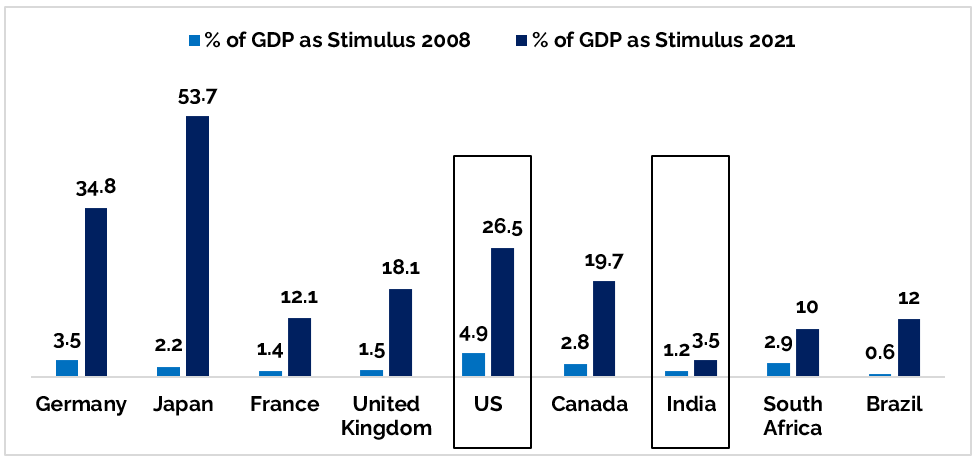

In response to the significant impact of the COVID-19 pandemic on the global economy, governments worldwide announced stimulus packages to ensure the smooth functioning of their economies. The US government was at the forefront of this effort, injecting six times the amount of stimulus it had injected during the 2008 Global Financial Crisis.

Source: Statista, McKinsey, Fisdom Research

The significant increase in US borrowing can be attributed primarily to the COVID-19 pandemic and the resulting economic downturn. The government implemented large stimulus packages to support businesses and individuals during the crisis. However, there were other unforeseen events, such as the Russia-Ukraine war and recent bank defaults, that the country may not have factored into its borrowing plans. These events have added to the economic uncertainty and potentially exacerbated the already precarious financial situation of the US.

Way ahead for the U.S.:

Hence, the probability of raising the debt ceiling limit is more even this time instead of suspending or postponing the same.

What would be the impact if the US were to suspend or postpone the debt ceiling limit?

If the US debt ceiling is suspended or postponed, the possibility of the country defaulting cannot be ruled out. This would create chaos for not only the US economy but also the global economy. The implications of reaching the debt ceiling are severe, including a downgrade of the country’s creditworthiness by credit rating agencies. This would increase the cost of borrowing for businesses and individuals, leading to a drop in consumer confidence and potentially triggering a recession in the financial market.

What is the current external debt situation in India?

India’s prudent fiscal and monetary policies have kept its external debt under control, allowing it to raise further debt to support economic expansion.

Source: Wikipedia. Fisdom Research

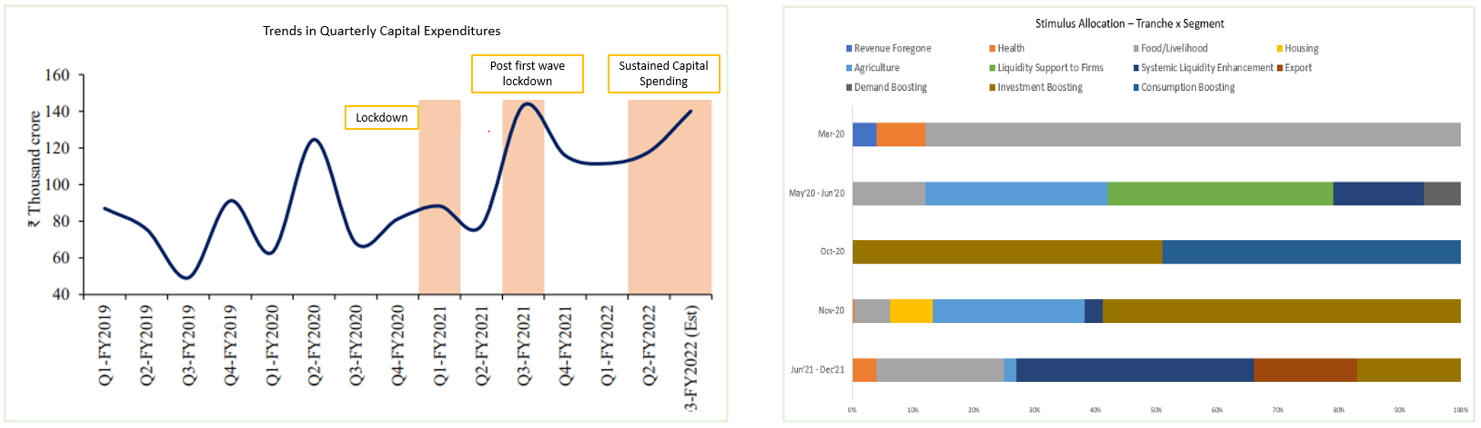

The government has implemented an agile and targeted stimulus program and prioritized critical areas while ensuring the safety and security of its citizens. This approach contrasts with advanced countries relying heavily on direct liquidity injections. India chose a top-bottom approach for the additional influx, focusing on public expenditure in segments offering the strongest multiplier effect. This prioritization is reflected in the mix of every stimulus tranche and India’s capital expenditure trajectory.

India’s well-managed fiscal and monetary policies have led to strong macroeconomic fundamentals, allowing strategic borrowing to support economic growth. This positions India well to resist global economic volatility caused by the worrisome situation in the US economy, and to create long-term wealth for investors.

Few of them are listed below:

| Parameters | US | India | Comments |

| S&P Manufacturing PMI | 50.2 | 57.2 | A reading above 50 indicates expansion. |

| S&P Services PMI | 53.6 | 62 | A reading above 50 indicates expansion |

| Inflation Target | 2% | 4% (+/-2%) | – |

| Current inflation rate | 7.6% | 5.7% | – |

Source: S&P Global, MoSPI, Fisdom Research. Latest data available for both countries.

Please follow the link provided to read about the placement of India’s other fundamental indicators.

Markets this week

| 2nd May 2023 (Open) | 5th May 2023 (Close) | %Change | |

| Nifty 50 | 18,125 | 18,069 | -0.31% |

| Sensex | 61,302 | 61,054 | -0.40% |

Source: BSE and NSE

- Indian equity indices closed on a negative note in the volatile week, influenced by various factors.

- The manufacturing PMI and GST data were positive, contributing to the overall sentiment.

- Earnings from Nifty 50 companies were released, with half of them reporting below-estimated growth.

- IT, metal, and cement stocks underperformed, resulting in weaker earnings for these sectors.

- On the other hand, banks, financials, and auto sectors surpassed earnings estimates, displaying stronger performance.

- Foreign institutional investors (FIIs) continued their buying spree in the week ending on May 5, acquiring equities worth Rs 5,527.76 crore.

- On the other hand, domestic institutional investors (DIIs) changed their stance and became net sellers, selling equities worth Rs 2,735.25 crore.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Maruti Suzuki India | ▲ +4.18% | IndusInd Bank | ▼ -6.90% |

| Asian Paints Ltd | ▲ +3.81% | HDFC Bank | ▼ -3.67% |

| Titan Company | ▲ +3.45% | UPL | ▼ -3.44% |

| SBI Life Insurance | ▲ +2.95% | HDFC | ▼ -2.64% |

| Bharat Petroleum | ▲ +2.20% | Sun Pharma | ▼ -1.74% |

Source: BSE

Stocks that made the news this week:

?Shares of HDFC Bank and Housing Development Finance Corporation Ltd plunged around 5 percent on Friday after an MSCI tweak indicated that the merged HDFC entity will have a lower weighting in the index. This could lead to $150-200 million in outflows.

?Dabur India, one of India’s leading consumer goods companies, experienced a decline in its share value of approximately 1.5 percent following the release of its financial results for the March quarter. The company reported a decrease in net profit of 0.5 percent, falling from Rs 294.3 crore in the year-ago period to Rs 292.7 crore.

?IDFC First Bank witnessed a surge of over 5% in its stock prices following its announcement of doubling its net profit to Rs 803 crore for the March quarter, which marked its highest ever quarterly profit. The bank’s net interest income also saw a substantial growth of 35% YoY, rising from Rs 2,669 crore in Q4 FY22 to Rs 3,597 crore. Additionally, the bank’s core operating profit grew by 61% YoY to Rs 1,342 crore.

?ONGC surged by over 3% following the government’s decision to lower the windfall tax on crude oil to Rs 4,100 per tonne, down from Rs 6,400 per tonne, with immediate effect. Notably, the government has retained the windfall tax on petrol, diesel, and aviation turbine fuel at zero. This move is expected to benefit ONGC and potentially stimulate the oil and gas sector, which has been facing headwinds due to fluctuating global oil prices and the expectations of economic slowdown.