Cover Image: Air India Maharaja reimagined by Fisdom content team using Midjourney Artificial Intelligence program

Hot Stuff: Air India, owned by TATA Group, stuck a record deal to add 470 planes from Boeing and Airbus into their fleet. It is one of the most significant orders in the history of the aviation industry.

About the deal:

- Air India is purchasing 220 aeroplanes from Boeing, a US-based aircraft manufacturer, and 250 passenger jets from Airbus, an aircraft manufacturer in Europe.

- Along with this, Air India has also signed an MOU with Rolls Royce for their 68 Trent XWB-97 engines, 12 Trent XWB-84 engines, and the highlight of all an order is for 40 GEnX and 20 GE9X that power Boeing 787 Dreamliner.

- The expenditure for this deal is expected to be around $82 bn, while the actual cost may be less due to incentives and discounts.

- The first of the new aircraft will enter service in late-2023, with the bulk to arrive from mid-2025 onwards.

Why is Air India making this move?

- It will be used to modernise and expand the Air India fleet. It will impact the global aviation industry and strengthen Air India’s position in domestic & international markets.

- It will benefit from cost savings in logistics, labour, and technology transfer. The creditworthiness of Tata son will allow the airlines to raise funds at lower rates of capital for financing the aircraft.

- Before this order, TATA Group has 220 aircraft, i.e.26% of the market, flying to 52 domestic and 38 overseas destinations. With this, its fleet size will double and surpass Indigo’s fleet of 308 aircraft i.e. 55% of the market, to become the largest airline operator on domestic routes.

- If things are managed well geopolitically, it may open opportunities for Air India to enter markets & capture traffic in countries like Vietnam, Thailand, Indonesia & Malaysia, facing challenges in the aviation market.

Tata Sons and Air India Chairman, Mr. N Chandrasekaran, commented on the occasion:

“Air India is on a large transformation journey across safety, customer service, technology, engineering, network and human resources. Modern, efficient fleet is a fundamental component of this transformation. This order is essential in realising Air India’s ambition, articulated in its Vihaan.

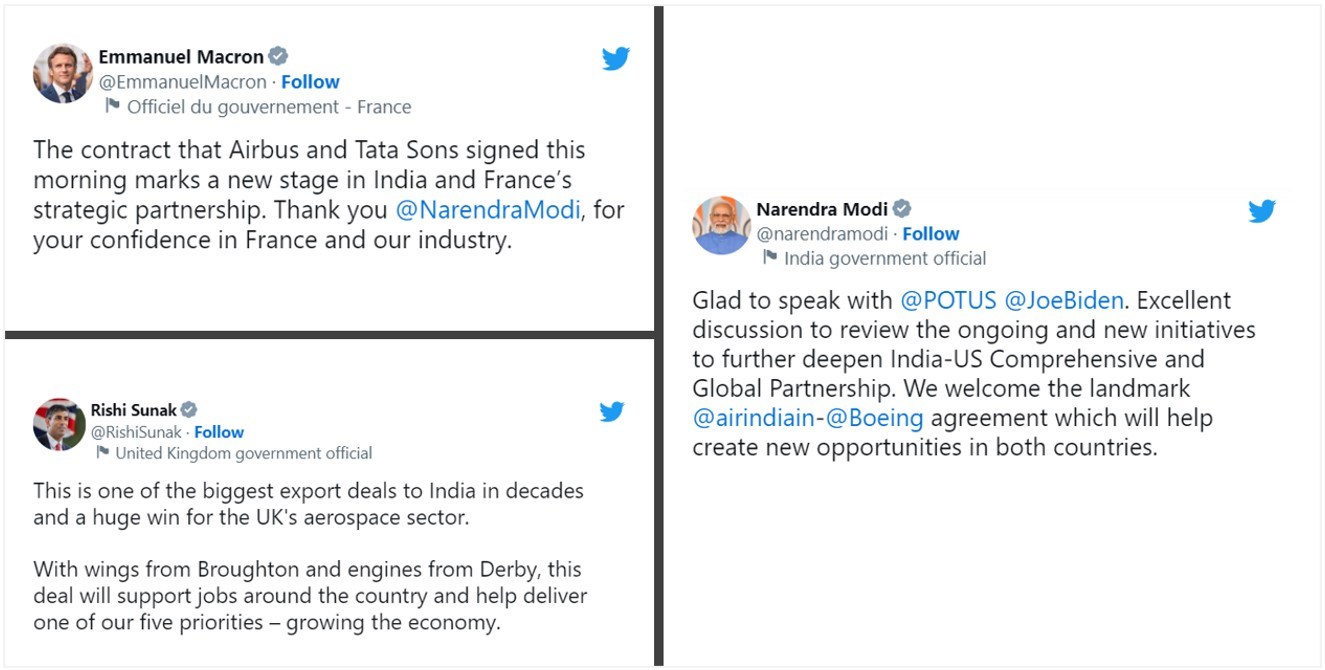

The geopolitical importance of the deal

Leaders of countries like France, the UK and the US reacted to this deal soon after the announcement.

Source: CMIE, Fisdom Research

The deal was much appreciated and considered a strong example of mutually beneficial cooperation which will create employment opportunities in all nations involved.

Is the move in line with the aviation industry trends?

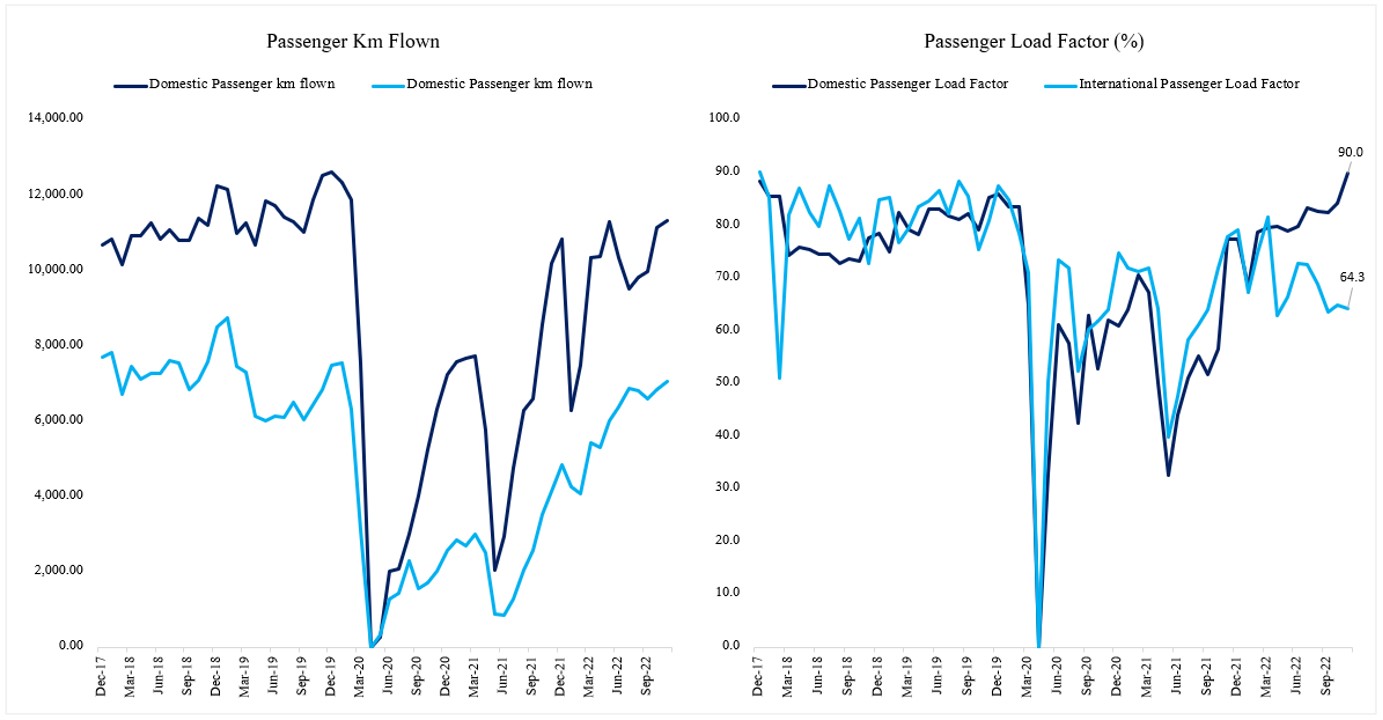

The announcement of adding 470 additional planes is in line with the industry trends. Below mentioned are a few indicators which signal the same.

- The passenger load factor is a metric of how much passenger carrying capacity has been used. Therefore, a higher passenger load factor means fewer empty seats in an aircraft.

- All global airlines’ passenger load has gradually increased over the past 15 years. The global passenger load factor has increased from 75.2% in 2005 to 82.6% in 2019, just before the pandemic.

- Air traffic has undoubtedly been increasing, so aircraft carry more passengers, and more seats are occupied. The aviation industry in India is moving towards full recovery post-Covid-19 pandemic-led disruption. Air Traffic in India is expected to grow at a CAGR of 7% through 2041, which is higher than the global average.

- As per ICRA, the domestic air traffic grew by 63% y-o-y between April-December 2022 with 9.86 crore travellers. India is also poised to move from 7th largest civil aviation market to the third largest in the next ten years. The domestic aviation industry is set to take over the UK and become the third largest in 2024.

Is India on the verge of an aviation boom?

- Strong growth prospects: During 2010, around 79 mn passengers travelled to/from or within India and by 2017, this number doubled to 158mn and is expected to go up to 520 mn in 2037. The Indian aviation market remains heavily underpenetrated. The existing domestic commercial fleet of around 700 aircraft is individually smaller than some of the world’s largest airlines. To meet the growing demand, almost every carrier in India is expected to place more orders in the next few years. India is one of the world’s fastest-growing aviation markets, and the country will likely need 2210 new aeroplanes in the upcoming couple of decades.

- Airline operators are betting big: India’s airline industry is poised for expansion, with approximately 1100 aeroplanes on order. Indigo has around 500 orders, and Akasa air has placed an order for 72 Boeing narrow-body aircraft. Airlines have placed huge orders for aircraft to satisfy the projected rise in demand for commercial air travel.

- Enhancing airport infra: India has 131 operational airports, of which 29 are international, 92 are domestic, and 10 are customs airports. In the last eight years, airports have increased from 74 to 141, likely crossing the 200 marks in the next 4-5 years. Along with this, the government of India is expected to invest $1.83 bn in airport infra by 2026.

- Government support: The BudgetFY24 proposal has highlighted the growing need for infra to handle the rapidly expanding air traffic capacity. The budgetary allocations towards the airline industry have declined from Rs. 10,667 crores in the previous budget to Rs. 3,113 crores for this year. However, this cut is because of the significant funding that used to go to the government that previously owned Air India. The UDAN scheme is closely linked to the revival of airports in India. According to data from Civil Aviation Ministry, 10.6 mn passengers have travelled under the UDAN scheme. The scheme has brought air travel to many tier 2 and tier 3 cities and made it accessible to Indians who could only dream of air travel. Along with this, the govt has permitted 100% FDI in Non-scheduled air travel services, seaplanes, and helicopter services under automatic routes. India’s Management, Repair and Operation market stands at $900 mn and is expected to grow to $4.33 bn by 2025 at a CAGR of 14-15 per cent. 100 % FDI is permitted for management and repair organisations.

Investor Takeaways:

The aviation industry in India is on the cusp of a strong revival. The scenario for the Indian aviation industry is changing much faster, with Air India being sold to TATA Group. Restructuring is taking place in the airline portfolio of TATA Group. Air Asia will merge with Air India Express, while Vistara will become a part of Air India. Current market leader Indigo has also made large purchases in the past few years, and we can also see the same results in the stock performance. The blockbuster order from Air India forms a part of India’s aviation industry revival & will help in the next leg of industry growth.

Performance Details: Top aviation companies

| Stock Name | 1 Year | 3 Year | 5 Year | % Away from 52-week high |

| Interglobe Aviation | -12.6% | 8.9% | 8.2% | 19.1% |

| SpiceJet | -40.1% | -24.2% | -23.2% | 72.7% |

| Jet Airways | -18.2% | 35.6% | -37.8% | 100.9% |

Data as on 18th Feb’23. Returns more than 1 year are CAGR, and less than one year are absolute.

Markets this week.

| 13th February 2023 (Open) | 17th February 2023 (Close) | %Change | |

| Nifty 50 | 17,859 | 17,944 | 0.5% |

| Sensex | 60,653 | 61,003 | 0.6% |

Source: BSE and NSE

- Markets witnessed volatility and ended on a positive note.

- The overall week was a volatile one amid rising concerns over further rate hikes and release of macroeconomic data points.

- CPI inflation in India rose by 6.52 percent in Jan’23 touching a three month high. The surprise rise in CPI inflation above expectations was on the back of jump in food inflation.

- Meanwhile WPI inflation has fallen in Jan’23 touching another low vis-vis previous months figures.

- Foreign institutional investors have sold equities worth Rs. 5,414 crore during the week, whereas DIIs bought equities worth 6,453 crore. On a month-to-date basis FIIs were net sellers with Rs. 1408 crore being sold and DIIs were net buyers with amount of Rs 9188 crore.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Tech Mahindra | ▲ +10.99% | Adani Enterprises | ▼ -6.73% |

| ONGC | ▲ +6.75% | IndusInd Bank | ▼ -4.00% |

| UPL | ▲ +5.95% | SBI | ▼ -3.99% |

| Apollo Hospitals | ▲ +4.49% | HDFC Life Insurance | ▼ -3.50% |

| Reliance Industries | ▲ +4.43% | SBI Life Insurance | ▼ -2.94% |

Source: BSE

Stocks that made the news this week:

?Kotak Mahindra Bank and IDBI Bank have been added to the FTSE Global Equity Index’s large cap segment as a part of semi annual rebalancing. Patanjali foods is the newest entrants in mid cap segment. There are expectations that inclusion of these stocks will bring in fresh foreign inflows in them. The addition of IDBI bank comes in as a surprise. The FTSE has also increased weightage of Indigo (InterGlobe Aviation) in the FTSE All World Index.

?Coming back to India, the NSE has made no changes in Nifty 50 index in its sic monthly rebalancing. However, there are changes in other indices. NSE India has added Adani Power and Adani Wilmar in broader market indices. Adani Power will now be part of Nifty 500, Nifty 200, Nifty Midcap 100, Nifty Midcap 150, Nifty LargeMidcap 250, and Nifty Midsmallcap 400 indices, whereas Adani Wilmar has been included in Nifty Next 50 and Nifty 100 indices, whereas

?Along with this Patym has been removed from large cap indices of Nifty Next 50 and Nifty 100 and moved to Nifty Midcap 100 and Nifty Midcap 150 indices.