The global gaming industry is valued at USD 200 billion and has nearly three billion users worldwide. What initially began as interactive spaces for multiplayer games post monetization channels within the online gaming segment has now evolved into a vast realm that facilitates in-game purchases, content creation, game design, and ideation.

The GST council bowled a googly for gaming companies. The nascent $2.8 billion gaming industry in India which is backed by global investors was shook by the imposition of taxes on online gaming companies on the total funds deposited.

The government had earlier announced the increase in GST rates from 18% earlier to 28%. But that’s not the only cause of concern the tax won’t just be charged on Gross Gaming revenue or the commissions online fantasy game companies earn. Instead the GST will be charged on the Contest Entry Amount which rather means applicable on entire sum of money the players deposit to play on the platform.

The Chairman of the Central Board of Indirect Taxes and Customs (CBIC), Sanjay Agarwal, has revealed that India is set to implement a 28 percent Goods and Services Tax (GST) rate on online gaming, effective from October 1.

Well, that’s not encouraging!

Companies engaged in ‘Real Money Games’ for instance Dream11 where you can make a virtual cricket team with top players from across the globe, will have a significant impact of the increased tax rates on their P&L.

In 2022, the real-money gaming segment dominated India’s gaming sector, constituting a significant 77 percent of the total revenues, which amounted to Rs 13,500 crore, as reported by FICCI-EY. The industry is poised for substantial growth, with revenues projected to reach Rs 16,700 crore in 2023 and a staggering Rs 23,100 crore in 2025.

However, the GST Council seems determined to claim a larger share of this lucrative industry.

Here’s the current scenario: Let’s say two individuals participate in a game, each depositing ₹100. Dream11 pools this money, making the pot ₹200. After deducting a 15% commission, the pot reduces to ₹170. Dream11 pockets ₹30, on which it pays an 18% GST, totalling ₹5.4 (for now this is ignoring all the other platform related expenses).

Now, the GST Council aims for a whopping 28%, not just on commissions but on the entire pot. This means, on a ₹200 pot, Dream11 might have to subtract a hefty ₹56 as GST.

This move significantly diminishes potential customer winnings. After Dream11 takes its commission, the remaining amount is subject to a 30% deduction as taxes, which adds to the government’s coffers.

This decision doesn’t only impact Dream11; the entire online gaming industry, including fantasy cricket, rummy, and poker, faces uncertainty. Additionally, the industry holds $2.5 billion in foreign investments. Such a drastic tax hike might scare off investors, potentially denting India’s appeal as a stable investment destination. The uncertainty surrounding the tax regime could breed doubt, making investors wary of putting their money in the segment going ahead.

The mobile gaming industry in India has experienced rapid growth, with a compounded annual growth rate of over 25 percent in recent years. This surge can be attributed to the widespread adoption of smartphones and affordable internet connectivity. Globally, the online gaming industry exceeded $200 billion by the end of 2022, with India contributing close to $2.8 billion.

Presently, India boasts around 500 million gamers, out of which 120 million are paying users. Dream11, a major player in the domestic market and the sponsor of the Indian Premier League (IPL), sustained its growth momentum in FY22. Its gross revenue surged by over 50 percent, reaching nearly Rs 4,000 crore. Similarly, Gameskraft, operating platforms like Rummy Culture and Gamezy, also experienced substantial growth, surpassing Rs 2,000 crore in revenue during FY22.

But wait, does this mean that the new GST regulations will also impact listed players like Delta Corp, Nazara Technologies and Onmobile? Well, not necessarily, the impact will be limited to extent of revenue contribution of Real Money Games Segment (RMCS) to these companies.

For instance, Delta Corp, a prominent gaming company, clarified that it’s already paying a 28 percent tax on its casino business, which constitutes a significant part of its revenue. The new 28 percent GST rate will impact the profitability of its online business, as the company previously paid an 18 percent tax on the same. This development has affected the company’s stock, causing a 20 percent drop and potentially delaying its planned IPO of its online poker unit, Adda52, by 6-9 months.

Despite these challenges, Delta Corp remains optimistic about its growth trajectory. The company has invested in expanding its core business, including ordering a new vessel in Goa, expected to become operational by September 2023. Additionally, plans are underway for the development of Deltin Entertainment City on 100 acres of land, with all necessary approvals in place.

Nazara Technologies, another significant player, clarified that the GST tax will apply only to the skill-based real money gaming (RMG) segment, which contributes slightly over 5 percent to the company’s overall consolidated revenues for FY23. Despite concerns about regulatory issues and taxation, Nazara Technologies has witnessed exceptional growth, with revenue increasing by 37 percent in FY22 and a remarkable 75 percent in FY23. The company’s strong financial position, with over Rs 600 crore in cash and cash equivalents at the end of March 2023, provides it with substantial flexibility and resilience in the face of challenges.

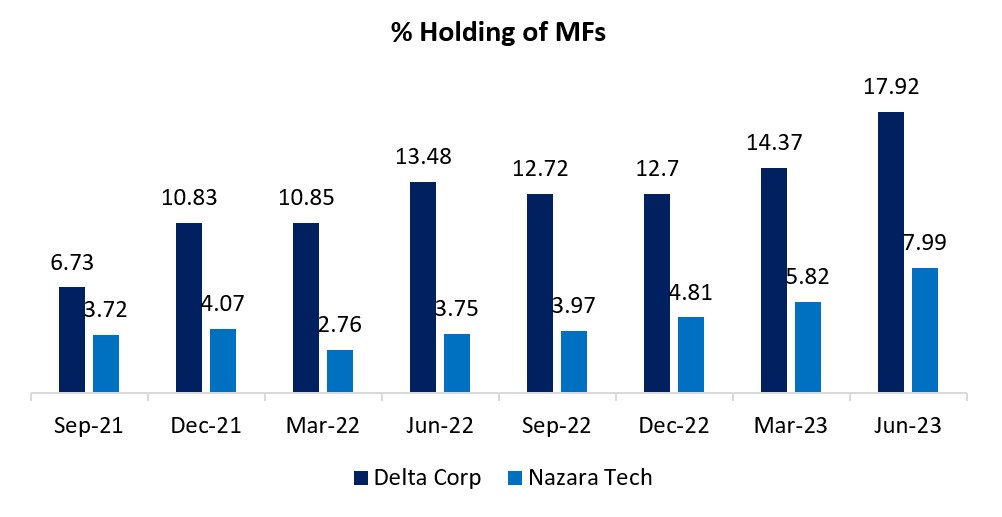

While the industry faces uncertainties, the overall trajectory is positive. For instance institutional investors like mutual funds have increased their holding in these companies.

|