Technical Overview – Nifty 50

The benchmark index witnessed a sell-off in the early hours of the day but recovered from the 24,200 level, which is serving as a solid base, to conclude nearly flat. On the 75-minute chart, the index revolves around the rising trend line. The benchmark index has been maintaining a higher level despite the index’s decreasing breadth due to certain big weights.

On a 75-minute timeframe, the momentum indicator RSI (14) formed a double bottom pattern at the support 47 level. As long as the MACD on a daily timeframe keeps rising and stays above its polarity, the upward trend should hold. The 10-DEMA served as support for the index, which now trades above the major DEMA, indicating an overall upward trend.

Diffusion Indicator: % of stocks above the RSI 50 mark of the benchmark index are at 80% and have a negative divergence to price.

Based on benchmark index OI data, a base formation may take place at the 24,200 level, where put writing is almost 20 lakhs. At 24,400, call writing is almost close to 33 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.91.

The support and resistance levels for the next sessions are at 24,250 and 24,150 and 24,450 and 24,550, respectively.

Technical Overview – Bank Nifty

A volatile day for the banking index, which saw a sell-off in the early going before sharply recovering and forming a Hammer Candlestick on the daily timeframe.

On a daily timescale, the momentum indicator RSI (14) indicates a hidden positive divergence, indicating that the upward momentum is expected to persist. The index took support at 20-DEMA and reversed from the same closing near-day high.

Based on benchmark index OI data, a base formation may take place at the 52,000 level, where put writing is close to 24 lakhs. At 52,500, call writing is almost close to 19 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.80.

For the next sessions, the resistance and support levels are 52,500, 52,750 for resistance, and 52,000, 51,750 for support.

Indian markets:

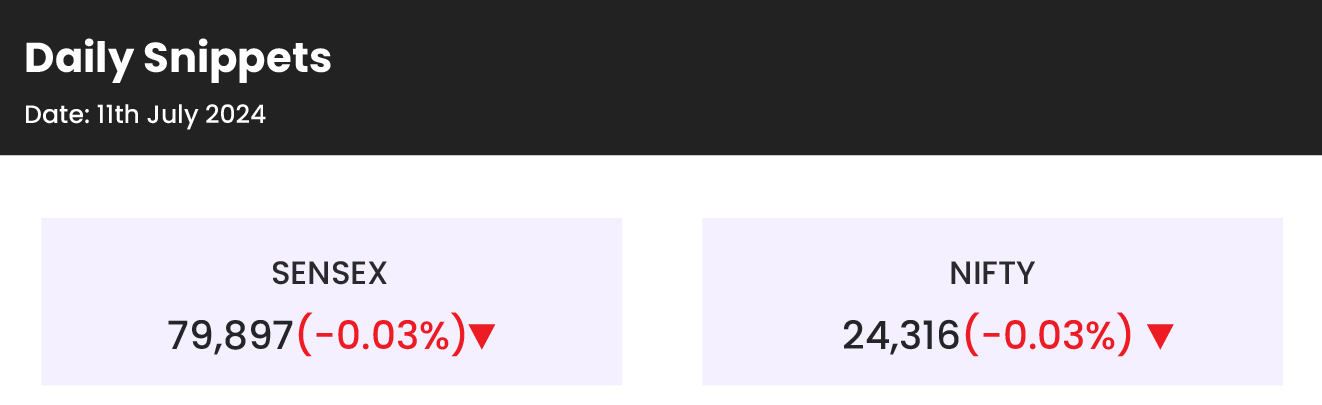

- Indian benchmark indices ended marginally lower in a volatile session on July 11, ahead of the release of U.S. inflation data later in the day.

- Amid positive global cues, the benchmarks started the session on a positive note but erased all the gains in the initial hours. Under selling pressure, the Nifty dropped below 24,200 but managed to recover all losses in the second half to close on a flat note.

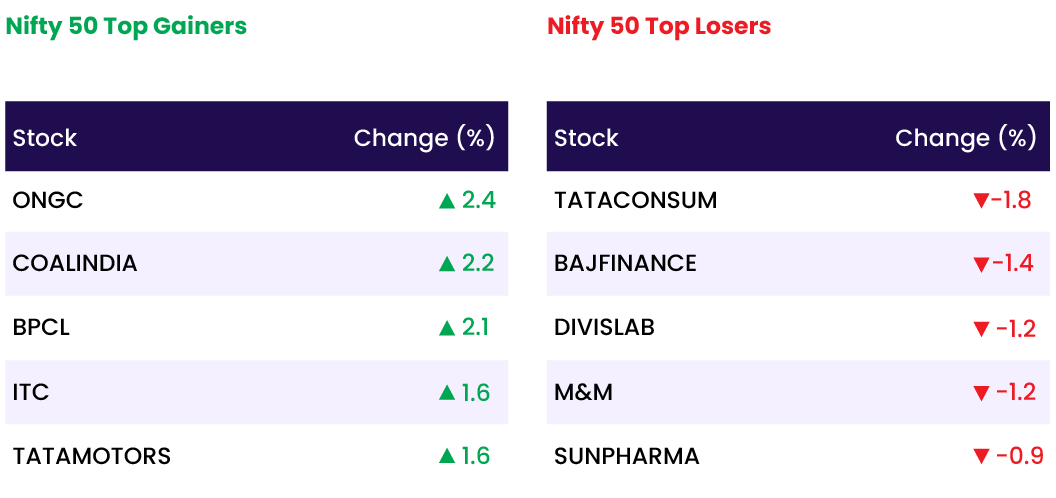

- Among sectors, the realty index declined by 1.5 percent, and the pharma index fell by 0.6 percent, while the media and oil & gas indices each dropped by 1 percent.

- The BSE midcap index rose by 0.3 percent, and the smallcap index added 0.6 percent.

Global Markets:

- Japan’s Nikkei 225 crossed the 42,000 mark for the first time amid a broader rise in Asia-Pacific markets on Thursday, following a rally in U.S. Big Tech stocks driven by optimism over potential Federal Reserve rate cuts.

- The Nikkei rose 0.94%, powered by technology stocks, while the broad-based Topix gained 0.69%.

- South Korea’s Kospi rose 0.81% as the Bank of Korea held rates at 3.5% for the 12th consecutive time, though the Kosdaq fell 0.71%.

- Australia’s S&P/ASX 200 increased by 0.93%, marking its highest closing level since March.

- Hong Kong’s Hang Seng index surged 1.96%, while the mainland Chinese CSI 300 index climbed 1.14%.

- Overnight in the U.S, all three major indexes rose, with the S&P 500 and Nasdaq Composite gaining 1.02% and 1.18% respectively.

Stocks in Spotlight

- Tata Consultancy Services (TCS) has reported its Q1 FY25 financial results, meeting market expectations. The company’s consolidated net profit rose by 9 percent year-on-year to ₹12,040 crore. Additionally, TCS’s revenue from operations increased by 5.4 percent on a yearly basis, reaching ₹62,613 crore for the April-June quarter.

- Oriental Rail Infrastructure’s share price reached a 52-week high and was locked at a 5 percent upper circuit in early trade on July 11 after the company received an order from Indian Railways.

- Ambuja Cements’ shares soared over 3 percent after brokerage firm Nomura double upgraded the cement manufacturer to a ‘buy’ rating. This upgrade factors in the company’s aggressive capacity expansion plans.

- YES Bank’s shares jumped over 7 percent after global ratings agency Moody’s revised its outlook to ‘positive’ from ‘stable’. This revision is based on expectations of improvement in the lender’s depositor base and lending franchise.

News from the IPO world🌐

- Sebi puts SK Finance’s Rs 2,200-cr IPO in abeyance

- Softbank backed Firstcry, Unicommerce get SEBI approval for IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY OIL & GAS | 1.1 |

| NIFTY MEDIA | 1.0 |

| NIFTY CONSUMER DURABLES | 0.6 |

| NIFTY FMCG | 0.3 |

| NIFTY PSU BANK | 0.2 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2172 |

| Decline | 1739 |

| Unchanged | 112 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,721 | 1.1 % | 5.3 % |

| 10 Year Gsec India | 7.0 | 0.1 % | 1.2 % |

| WTI Crude (USD/bbl) | 81 | (1.1) % | 15.7 % |

| Gold (INR/10g) | 72,732 | 0.1 % | 8.0% |

| USD/INR | 83.49 | 0.0 % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer