Technical Overview – Nifty 50

The benchmark index ended the day unchanged. The benchmark index started the week gapping down but bounced back to reach a high of 23,560 levels today. With no significant movement on either side, the markets have been rather boring.

The index found support close to the 10-DEMA and began its daily retreat from there. Volumes on index constituents are below the daily average, and there doesn’t appear to be much action overall.

The RSI (14) momentum indicator has entered a consolidation phase. The MACD is rising upward and above its polarity, indicating that the bullish trend will continue. The fact that the index is above every significant DEMA further supports the general bullishness.

The levels of support and resistance for the next sessions are 23,400 and 23,200, respectively, and 23,700 and 23,850.

Technical Overview – Bank Nifty

At the day’s conclusion, the benchmark index remained steady. The banking index had an erratic start to the week, opening the gap lower but managing to recoup all of today. The index formed a bullish candlestick daily. Despite this, the upmove index for today is consolidating between the levels of 51,050 and 51,960.

The momentum indicator, or RSI (14) stays at 65 levels for the day. The index held and bounced back from the previous day’s low. Overall, the index is trading above all of its main DEMAs, supporting the overall bullishness.

Additionally, the daily time frame confirms the overall bullish attitude with the MACD being above its polarity. For the forthcoming sessions, the resistance and support ranges are 52,000–52,500 for resistance and 51,000–50,600 for support.

Indian markets:

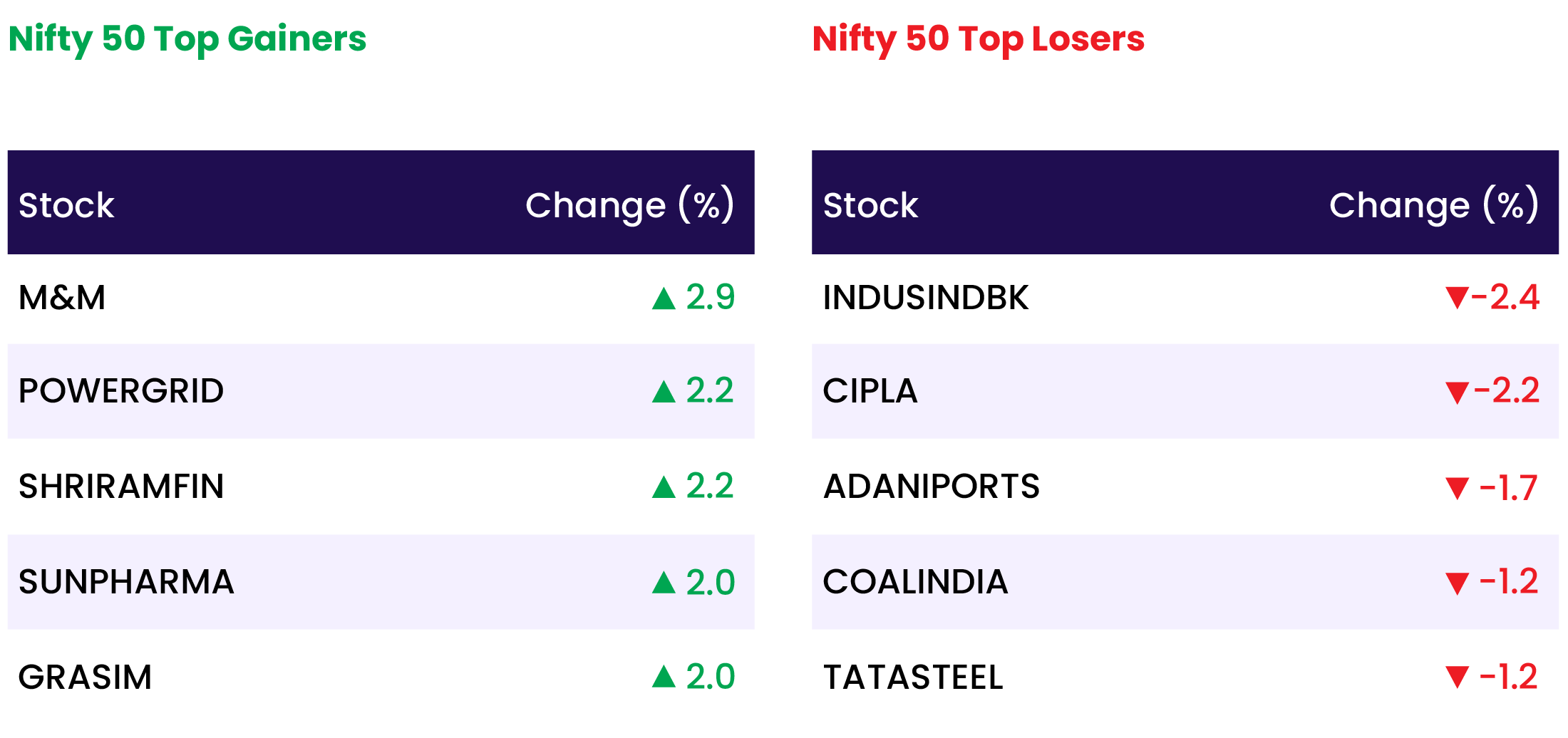

- Indian benchmark indices closed higher after a volatile session on June 24, with the Nifty maintaining a level above 23,500, driven by gains in auto, capital goods, power, and FMCG stocks.

- Sector-wise, capital goods, auto, FMCG, telecom, and power indices rose by 0.5-1 percent, while metal, oil & gas, PSU Bank, and media indices declined by 0.5-1 percent.

- The BSE midcap and smallcap indices each gained 0.3 percent.

Global Markets:

- Asia-Pacific markets mostly declined on Monday as investors awaited inflation data from Australia and Japan later this week.

- Australia’s S&P/ASX 200 fell 0.8%.

- Japan’s Nikkei 225 rose 0.54%, while the Topix increased by 0.57%.

- Hong Kong’s Hang Seng index was down 0.88% in its final hour of trading, while mainland China’s CSI 300 experienced its fourth consecutive day of losses, dropping 0.54%.

- South Korea’s Kospi dipped 0.70%, and the small-cap Kosdaq fell 1.31%.

Stocks in Spotlight

- TBO Tek shares surged 7 percent to reach a new 52-week high after Goldman Sachs initiated coverage with a buy recommendation. The brokerage set a target price of Rs 1,970 per share, anticipating a 24 percent increase from current levels.

- Route Mobile shares soared by as much as 14 percent, reaching a 52-week high of Rs 1,798.70, after the company announced a partnership with Billeasy to facilitate WhatsApp-based ticketing for the Nagpur, Pune, Hyderabad, and Delhi metros.

- Mazagon Dock shares surged by 4 percent amid advanced talks to acquire additional Kalvari-class (Scorpene) submarines for the Navy. This potential Rs 35,000-crore deal aims to strengthen India’s submarine fleet.

News from the IPO world🌐

- Allied Blenders IPO to open on Tuesday

- Vraj Iron and Steel IPO price band fixed at Rs 195-207/share. Issue to open on June 26

- Insurer Niva Bupa plans $360 million IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY AUTO | 0.9 |

| NIFTY CONSUMER DURABLES | 0.8 |

| NIFTY FMCG | 0.7 |

| NIFTY FINANCIAL SERVICES | 0.4 |

| NIFTY REALTY | 0.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2107 |

| Decline | 1890 |

| Unchanged | 159 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,150 | 0.0 % | 3.8 % |

| 10 Year Gsec India | 7.0 | (0.0) % | 0.5 % |

| WTI Crude (USD/bbl) | 81 | (0.7) % | 14.7 % |

| Gold (INR/10g) | 71,436 | 0.0 % | 6.3 % |

| USD/INR | 83.57 | 0.2 % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer