Cover Image : Ratan Tata reimagined as Dr. Brown from Back to the Future Trilogy by the Fisdom content team

Hot Stuff this week: TATA Motors and Uber sign an MoU for XPRES-T EVs

TATA Motors has signed MoU with Uber to supply 25,000 XPRES – T EVs. This deal is one of the industry’s most significant 4-wheeler electric vehicle fleet orders.

About the deal:

- TATA Motors will assist Uber in electrifying its services across major cities like Mumbai, Chennai, Delhi, Bengaluru, Hyderabad, and Ahmedabad.

- The delivery of cars to Uber will begin in a phased manner starting this month.

- The XPres-T is an electric sedan with two options, 213km (XT+) and 165km (XM+), priced at Rs. 13.54 lakhs and Rs. 13.04 lakhs. XPRES-T EV was launched exclusively for fleet customers in July 2021. In the past ten months, the company has secured over 23,000-unit orders, and the recent order by Uber takes the Xpres T business book to over 50k units.

Speaking about the deal Mr Shailesh Chandra, MD, TATA Motors TATA Passenger Electric Mobility and TATA Motors Passenger Vehicles said,

“In line with our commitment to grow sustainable mobility in the country, we are delighted to partner with Uber, India’s leading ridesharing platform. Offering customers our environmentally friendly EV ride experiences via Uber’s Premium Category service, will accelerate the adoption of green and clean personal ride sharing. The XPRES-T EV is a very attractive option both for customers and operators. While enhanced safety, silent and premium in cabin experience provides the customers with a relaxed ride, the fast-charging solution, driving comfort and the cost effectiveness of the EV makes it an attractive business proposition for our fleet partners. This partnership will further cement our market position in the fleet segment”.

Here is a quick look at key deals made by TATA Motors in the EV segment:

| Date | Space | Partnership with | Comments |

| May-22 | Commercial goods carrier EV | Flipkart, Amazon, Lets Transport, Big Basket, DOT, City Link and Yelo EV | The company had already received a cumulative order of 39,000 units from above mentioned players. |

| Jun-22 | EPRES – EV | BluSmart Electric Mobility | The order size of 10,000 units had made this deal biggest ever EV fleet order in India |

| Dec-22 | XPres – T EVs | Everest Fleet | Bagged an order of 5,000 XPres – T EVs |

| Dec-22 | Electric buses | Delhi Transport Corporation | Order for operating 1500 electric buses |

| Dec-22 | Electric buses | Bengaluru Metropolitan Transport Corporation | Order for operating 921 electric buses |

TATA Motors joined HDFC Bank for Electric Vehicle Dealer Financing Program in Nov’22. Under this scheme, Tata Motors will provide its dealers additional inventory funding over and above their ICE finance limit.

A favourable policy environment, positive word of mouth from existing customers, practical product options, better ride and handling and attractive cost of ownership have helped TATA Motors achieve a strong presence in the EV Space. It is reflected in the milestone that Tata Motors achieved in Nov’22 when the company rolled out its 50,000th EV from its Pune facility.

TATA Motors EV Landscape

TATA Motors clearly has a first mover advantage in the passenger EV space & clearly dominated the space since then. It plans to introduce 10 EVs in India by FY26 and aims to continue to be the market leader in this sunrise space.

Here’s how TATA Motors has dominated the EV space:

Electric Car Sales (Units sold)

| Carmakers | Apr-22 | May-22 | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Total | Market share |

| TATA | 1,812 | 2,495 | 2,724 | 2,891 | 2,765 | 2,831 | 15,518 | 85.5% |

| MG | 245 | 247 | 235 | 268 | 316 | 280 | 1,591 | 8.8% |

| Hyundai | 23 | 27 | 51 | 61 | 73 | 74 | 309 | 1.7% |

| BYD | 21 | 42 | 49 | 44 | 45 | 63 | 264 | 1.5% |

| M&M | 13 | 9 | 19 | 26 | 17 | 112 | 196 | 1.1% |

| BMW India | 17 | 9 | 5 | 5 | 25 | 27 | 88 | 0.5% |

| Others | 30 | 26 | 28 | 34 | 26 | 32 | 176 | 1.0% |

| Total | 2,161 | 2,855 | 3,111 | 3,329 | 3,267 | 3,419 | 18,142 | 100.0% |

Source: Autocar

Tata Motors uses electric vehicle disruption to its advantage in the passenger vehicle segment. It has clocked a sale of 11,500 units of EVs in the second quarter of FY22-23, which is the highest-ever sales for the company in a quarter. The EV business has grown by 326% Y-o-Y and over 371% in the fiscal year’s first half.

The success of the EV business can be attributed to the Tata group’s diversified business & their contribution. Seven group companies have come together to build an EV ecosystem in India. When companies from the same group family come together to share their resources, they can quickly produce a high-quality product at a competitive price. It has played out in favour of TATA Motors in the EV space.

- TCS aided TATA Power in setting up EV charging stations with its ‘charge core’ platform, because of which the project saw 300 charging stations in just 12 weeks.

- TATA Elxsi partners with TATA Motors to develop their unified, connected vehicle platform.

- TATA Motors and TATA Capital Finance are other vehicle finance and insurance pillars.

- When it comes to charging infrastructure, TATA Power is aiming to build 10,000 charging stations over the next five years and has partnered with brands like Hyundai Motors, Indian Hotels, JP Infra etc., to set up EV infra.

- TATA Chemicals makes lithium-ion cells, and TATA Autocomp Systems assemble battery packs.

Here is how Tata motors managing its finances

TATA Motor raised $1 bn from TPG and Abu Dhabi company ADQ for its EV segment at a valuation of $9 bn. It was mainly for Capex spending on products, platforms, drive trains, dedicated EV manufacturing, charging infra and other advanced technologies.

As per Reuters report, TATA Motors is planning to raise funds through its electric vehicle business. As per media sources, the company is looking out for private equity investors and sovereign wealth funds to raise funds via equity stake sale in the EV business. TATA Motors is estimated to look for a valuation of $10.5 bn from the deal.

Key Takeaways

With Rs. 6000 crore Capex announcements specifically for the EV space, and 1st leg of fundraising already done and getting ready for the second one indicates the company’s aggressive stance to penetrate the EV space further. Electric Vehicles contribute ~8% to the overall passenger vehicle sales of Tata Motors and have a market share of 86% in this segment. The margin of electric vehicles is not very different from the internal combustion engine segment; hence any further uptick in market share will contribute to the overall profitability. We believe Tata has the prospect of gaining a share as EV adoption grows.

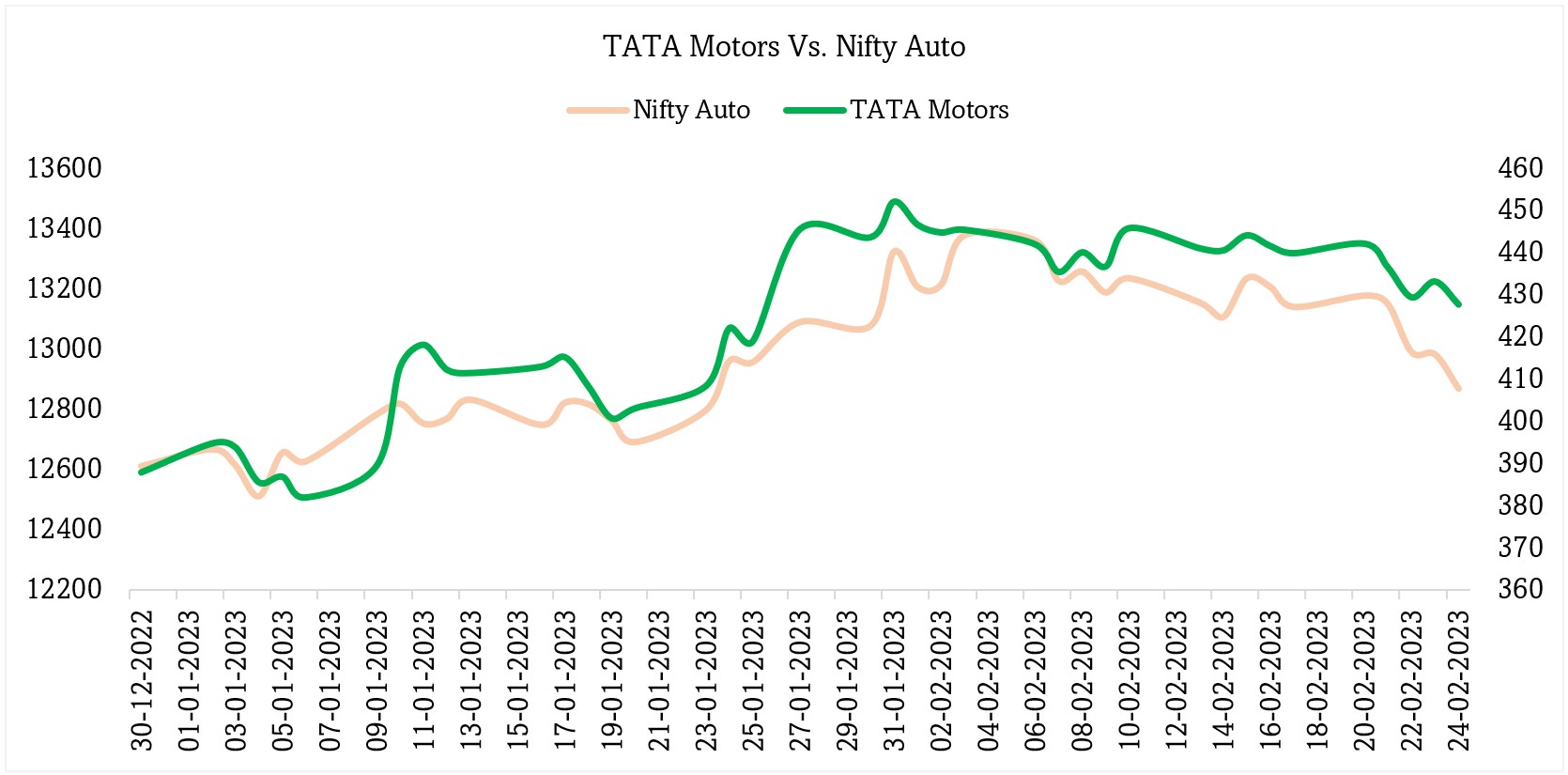

Here is how Tata motors shares performed against the Nifty auto index:

Source: ACE MF, NSE, Fisdom Research

Markets this week

| 20th February 2023 (Open) | 24th February 2023 (Close) | %Change | |

| Nifty 50 | 17,966 | 17,466 | -2.8% |

| Sensex | 61,113 | 59,464 | -2.7% |

- Markets witnessed volatility and ended on a negative note.

- The Nifty index witnessed biggest weekly fall since June 2022. Weak global cues and a hawkish SU Fed stance on rates impacted investor sentiments.

- India’s forex reserve dipped by $5.68 bn to $561.26 bn for the week ended Feb 17th, 2023. It is the third weekly consecutive drop in reserves. The reserves have been declining on account of central bank’s actions to defend rupee.

- Finance Ministry released economic review for Jan’23 which said that downside risk to global economic outlook have emerged amid geopolitical tensions in Europe, spiralling energy, food and fertiliser prices, monetary tightening and inflationary trends.

- During the week both FOMC and RBI released their monetary policy meet minutes. The minutes of Federal Reserve showed that the US Central bank is far from convinced about inflation coming down.

- Meanwhile RBI MPC meet minutes highlighted the continuing concerns around elevated inflation while some member cautioned about the impact of excessive rate tightening on economic growth.

Weekly Leaderboard

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Divi’s Lab | ▲ +3.02% | Adani Enterprises | ▼ -23.63% |

| NTPC | ▲ +1.76% | Cipla | ▼ -6.23% |

| Power Grid Corporation | ▲ +0.58% | JSW Steel | ▼ -5.96% |

| ITC Limited | ▲ +0.44% | M&M | ▼ -4.57% |

| — | — | HDFC | ▼ -4.32% |

Source: BSE

Stocks that made the news this week:

?NCLT’s declared that Zee Entertainment is bankrupt as three entities Aditya Birla Finance, IndusInd Bank and Yes Bank have filed appeals in the NCLT for recoveries of Rs. 130 cr., Rs. 90 cr., and Rs. 540 cr., respectively. Concerns around ZEE Sony merger has risen amid NCLT declaring ZEE Entertainment insolvent. The merger is the only possible way out for the company as Synergies would cut costs and there is potential to become the number one broadcaster.

?Spice Jet stock price skyrocketed during the week as the company’s standalone net profit jumped five-fold to Rs 107 crore in the Q3FY23. Company officials see renewed signs of recovery and some very positive developments and restructuring initiatives in the immediate offing that would significantly strengthen and deleverage fleet operator’s balance sheet.

?Olectra Greentech announced its partnership with oil to telecom conglomerate Reliance Industries to develop hydrogen buses. The stock hit upper circuit on Friday.

?SBI announced that it has raised Rs 4,544 crore through allotment of Basel III compliant AT-1 bonds in debentures. These non-convertibles, taxable, perpetual, subordinated, unsecured, fully paid-up Basel III compliant AT- 1 bonds in debentures have a coupon rate of 8.20% p.a. The bonds are perpetual and there is no maturity date.