Technical Overview – Nifty 50

Yesterday’s Bulls’ stampede occurred in the second half of the day’s session, as Nifty formed a strong bullish candle with a long tail signaling a super reversal from the day’s low. Nifty finally broke the shackles of a wobbly resistance near 22,400 levels.

After a smart reversal in yesterday’s trade, the Nifty50 traded within the limited narrow range on the last day of the truncated week and formed a Doji-like candle stick formation on the daily time frame. Broader markets were somehow not seen participating in the rally, as Nifty Midcap 100 Index was down 0.25% and the Nifty Small Cap Index was down even more by 2.50% on the weekly time frame.

On the weekly chart, the Index has given a bullish breakout of a consolidation pattern and prices are trading above the upper band of the range. The momentum oscillator RSI (14) has given a consolidation breakout above 62 levels with a bullish crossover.

It’s a buy-on-dips market presently and any dip towards 22,300 can be utilized as a fresh buying opportunity. The immediate resistance is likely to be capped near 22,700 levels.

Technical Overview – Bank Nifty

After a smart reversal in yesterday’s trade, the BANK NIFTY traded within the limited narrow range on the last day of the truncated week with some volatility and formed a spinning top candle stick formation on the daily time frame.

It’s the fourth consecutive week where the Banking Index has closed in green suggesting a strength in the current momentum. The Banking Index is trading above its 9, 21, and 50 EMA, and the slope of the average is moved higher indicating a bullish stance. The prices on the weekly chart are trading in a rising wedge pattern and prices have reversed from the lower levels of the pattern.

It’s a buy-on-dips on Bank Nifty presently and any dip towards 47,500 which be utilized as a fresh buying opportunity with support placed at 47,000 levels. The immediate resistance is likely to be capped near 48,500 levels.

Indian markets:

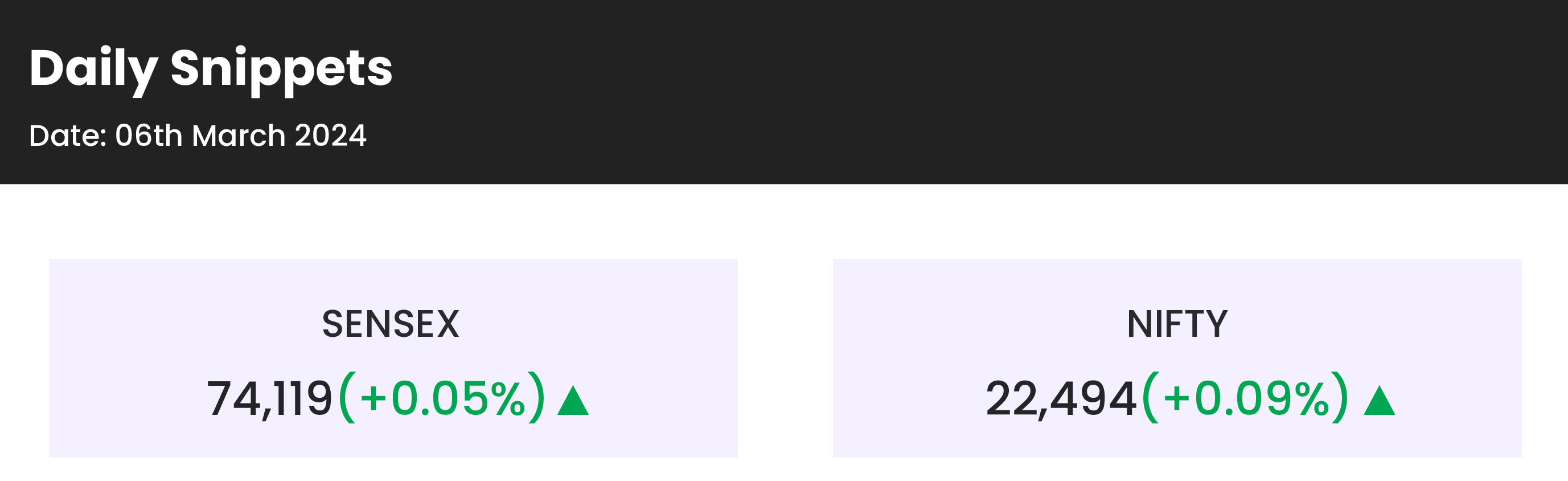

- Domestic equity benchmarks the Nifty 50 and the Sensex closed flat on Thursday, March 7, while the mid and smallcap segments saw healthy gains despite weak global cues.

- The market opened with record highs, Nifty surpassing 22,500 and Sensex reaching 74,245.17, but closed marginally higher at 22,493.50 and 74,119.39, respectively.

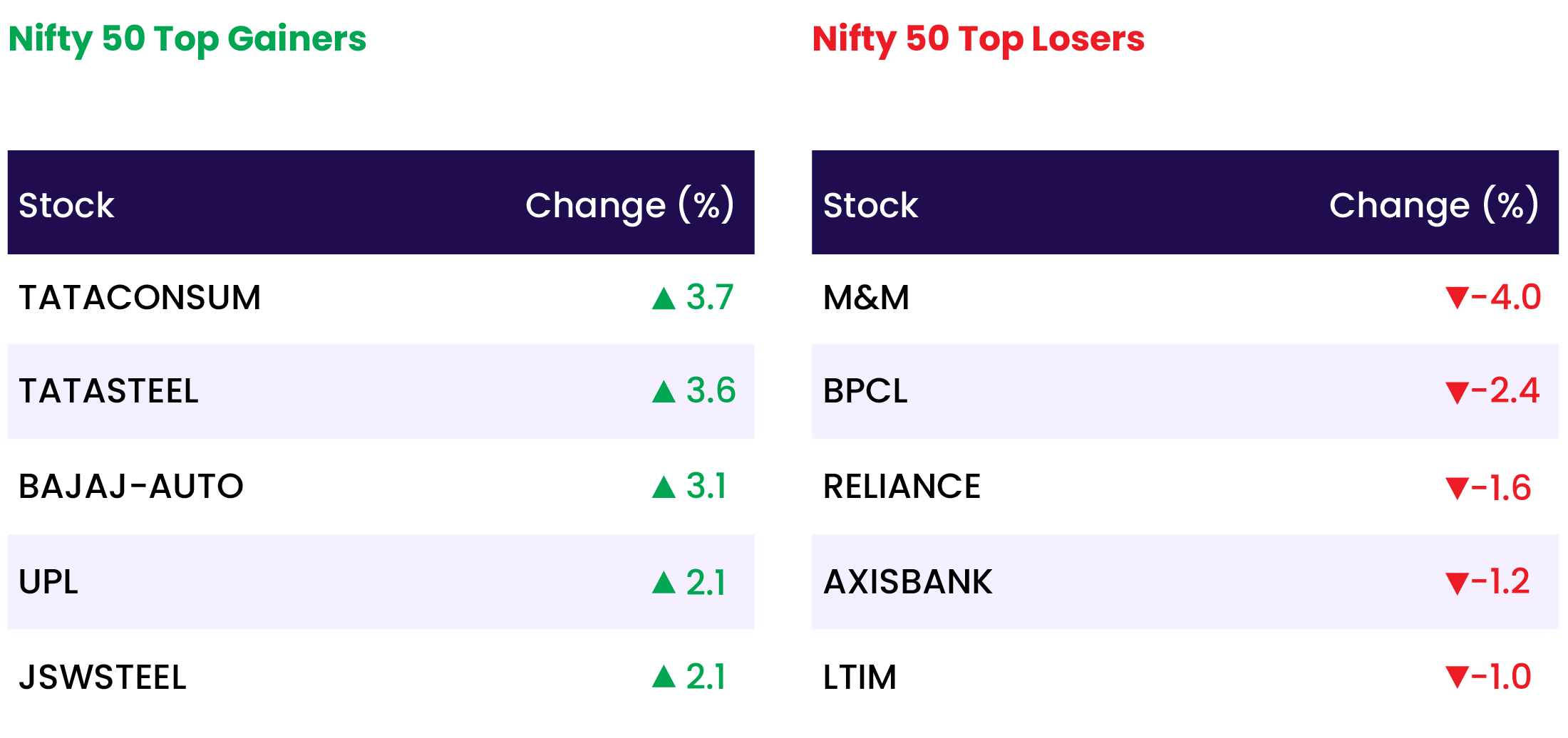

- Among sectors, bank, oil & gas, auto, realty ended in the red, while metal, capital goods, media and FMCG up 1-2.5 percent each.

Global Markets:

- Asian stocks gained overnight following comments from U.S. Federal Reserve Chair Jerome Powell, who emphasized that although the central bank might consider rate cuts, it wasn’t an immediate move.

- In Japan, stock indexes retreated from record highs on Thursday, with the Nikkei 225 hitting a record before closing 1.2% lower at 39,598.71, just below the 40,000 marks. The broader Topix also ended 0.4% lower at 2,718.54 after reaching a record earlier in the session.

- European markets reversed course and turned higher ahead of the European Central Bank’s policy meeting on Thursday.

- U.S. stock futures edged lower on Thursday after the major averages had their first winning session in three days.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Tata Chemicals stock zoomed 11.3 percent with strong trading volumes. 5 crore shares were traded compared to the monthly average of 23 lakh. The stock has been rallying since March 1 after the company said that Fitch Ratings affirmed its Long-Term Foreign Currency Issuer Default Rating (IDR) at BB+.

- On March 7, Tata Group stocks, including Tata Motors, Tata Chemicals, Rallis India, Tata Power, Nelco, and Tata Investment Corporation, surged up to 15% amidst heightened anticipation of Tata Sons’ upcoming IPO. The potential listing is expected to simplify the group’s holding structure, unlock value, and enable some listed companies to divest their stakes in the conglomerate. Tata Sons, classified as an ‘upper-layer’ NBFC by the RBI in 2023, is required to list by September 2025 according to regulatory guidelines.

- Shares of Suzlon Energy rallied 4.91 percent after the renewable energy solutions provider bagged an order for wind power project from Juniper Green Energy. Suzlon will develop a 72.45 MW wind power project for Juniper Green Energy.

- Shares of GR Infraprojects surged 3.28 percent after the promoters decided to divest up to 5 percent equity stake in the company to meet SEBI’s minimum public shareholding norms.

News from the IPO world🌐

- Shares worth $21 billion to enter market in 4 months as IPO lock-in period expires for 66 companies

- JG Chemicals IPO subscribed 10.62 times so far on final day

- Popular Vehicles sets price band of Rs 280-295 for its Rs 602-crore IPO on March 12

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 2.5 |

| NIFTY METAL | 1.4 |

| NIFTY FMCG | 1.0 |

| NIFTY CONSUMER DURABLES | 0.4 |

| NIFTY PHARMA | 0.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2114 |

| Decline | 1691 |

| Unchanged | 117 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,661 | 0.2 % | 2.5 % |

| 10 Year Gsec India | 7.0 | (0.3) % | (1.9) % |

| WTI Crude (USD/bbl) | 79 | (1.5) % | 11.9 % |

| Gold (INR/10g) | 65,223 | 0.3 % | 1.8 % |

| USD/INR | 82.90 | 0.0 % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer