Cover image : Bank run – people waiting outside banks to withdraw their money in San Francisco

The collapse of Silicon Valley Bank (SVB) has brought back memories of the 2008 Global Financial Crisis (GFC) and highlighted the instability of global markets. While it is unclear whether this event marks a “second Lehman moment” for the financial industry. The former was much worse and led by multiple factors.

SVB’s Fallout: The Federal Reserve began raising interest rates a year ago, which had an impact on SVB Bank’s tech stocks. Additionally, the rise in interest rates resulted in the devaluation of long-term bonds acquired by SVB and other banks. As venture capital dried up, start-ups were forced to draw down funds from SVB, which led to unrealized losses in bonds. To mitigate this issue, SVB sold securities at a loss and announced a plan to sell $2.25 billion in new shares to stabilize their balance sheet. This move caused key venture capital firms to advise companies to withdraw their money from the bank. SVB’s stock began to plummet, and other bank shares followed suit, leading to regulators shutting down the bank and placing it in receivership under the Federal Deposit Insurance Corporation. Although SVB’s collapse is not likely to cause a financial crisis, all insured depositors will have access to their deposits, and uninsured depositors will receive an “advance dividend” within a week, as stated by the FDIC.

While it is natural to compare current fallout of small sized US banks to the fall out of banks and financial institutions during the Great Financial Crisis 2008, the actual comparison indicates a much more difference in the two situations:

Here are some of the stark differences between the two independent events:

The Global Financial Crisis (GFC) was a period of severe economic instability that had a significant impact on the banking and financial services sector. The GFC was primarily caused by a housing market bubble in the United States, which eventually burst, leading to a significant decline in the value of housing and mortgage-backed securities. This led to many financial institutions experiencing significant losses, and a crisis of confidence in the global financial system.

The impact of the GFC on the banking and financial services sector was significant. Many banks and financial institutions experienced significant losses, and some institutions were forced to close their doors or be bailed out by governments. As per Wikipedia a total of 85 banking and financial institutions were impacted post the GFC some were majority of them were acquired and rest files for bankruptcy. (Source: https://bit.ly/3LKg3R9)

Like for example if one wants to compare the current banking crisis, following are some of the metrics which one can look at:

1. GFC Credit Crisis and Today’s Bond Market:

- During the Great Financial Crisis, banks took on risky investments in products such as low-quality mortgages, collateralized debt obligations, and CDO-squared.

- These investments lost value as the housing bubble burst, leaving banks with minimal equity capital. However, the current bond market offers a stark contrast to the credit crisis.

- Long-dated bonds held-to-maturity have relatively minimal losses today.

- Even a 10-year US Treasury bond purchased at historically low yields in 2021 retains a value of over 80 cents on the dollar.

- This marks a significant difference from the credit crisis when investments became worthless, and banks’ balance sheets were severely affected.

- Although the bond market is not without risks, the current stability and resilience of long-dated bonds suggest a less volatile and more secure investment landscape than the one that led to the credit crisis.

2. Resilience in US economy.

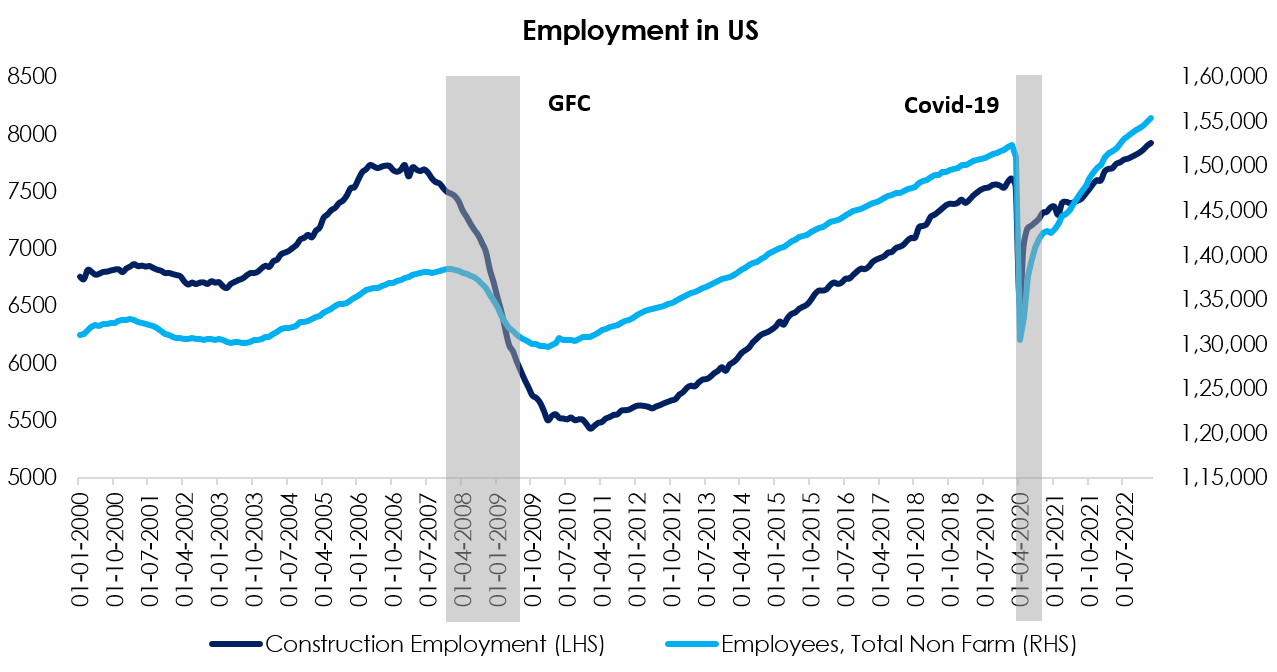

- Despite the overall strength in employment within the US economy, small and mid-sized banks are currently facing stress attributable to the asset-liability mismatch witnessed in the affected banks.

- While the employment rate is a crucial factor in preventing a recession, weakness in certain sectors and signs of stress indicate potential risks.

- It is important to monitor job losses in the construction industry, which is known for its cyclical nature and can serve as a leading indicator for future economic activity. Despite recent layoff announcements in the tech and ecommerce sectors, the employment rate in the US construction industry remains strong compared to the Great Financial Crisis (GFC), as illustrated in the chart below.

- The construction industry often serves as a lead indicator for the future of the US economy, and it is important to keep an eye on its performance to anticipate any potential challenges or opportunities.

Source: FRED

3. Post GFC Reforms

- Central banks responded to the economic decline of 2007 by reducing interest rates to stimulate growth. However, the policy response intensified after the collapse of Lehman Brothers and the resulting hit to global growth.

- Central banks employed “quantitative easing” by lowering interest rates to near zero, lending large sums of money to institutions unable to borrow in financial markets, and purchasing a substantial amount of bonds to support struggling markets and revive economic activity.

- Governments increased spending to stimulate demand, guaranteed deposits and bank bonds to shore up confidence in financial firms, and purchased ownership stakes in some banks and other financial firms to prevent bankruptcies that could worsen panic in financial markets.

- While the policy response prevented a global depression, millions of people lost their jobs, homes, and wealth, and some economies took years to recover.

- Regulators strengthened their oversight of banks and other financial institutions by launching a slew of regulations requiring banks to assess loan risk, use resilient funding sources, operate with lower leverage, and restrict using short-term loans to fund customer loans. The increased vigilance of regulators in monitoring risk propagation across the financial system is essential to prevent future financial crises and safeguard people’s livelihoods.

- To prevent potential banking crises and protect customers, the Treasury Department, Federal Reserve, and FDIC announced that all Silicon Valley Bank clients would be able to access their money, even those exceeding the $250,000 insurance limit.

- The Fed announced an emergency lending program allowing banks to borrow from the Fed to pay depositors instead of selling securities.

- The Treasury set aside $25 billion to offset any losses incurred under the Fed’s emergency lending facility, though it is not expected to be needed.

The government’s actions were limited compared to the 2008 financial crisis, with no failed banks rescued and no taxpayer money provided to them.

In conclusion: The collapse of Silicon Valley Bank (SVB) has raised concerns about the instability of global markets, but it is unclear whether this event marks a “second Lehman moment” for the financial industry. Unlike the Global Financial Crisis (GFC) of 2008, which was primarily caused by a housing market bubble in the United States that led to many financial institutions experiencing significant losses and a crisis of confidence in the global financial system, the current banking crisis in the US is primarily attributable to the asset-liability mismatch witnessed in the affected banks.

While there are signs of stress in certain sectors and potential risks, the US economy remains resilient, and the bond market offers a more stable investment landscape than during the credit crisis. The US housing market is also showing positive signs of stabilizing at low levels, and post-GFC reforms have left a lasting impact on the world’s economy.

Markets this week

| 20th March 2023 (Open) | 24th March 2023 (Close) | %Change | |

| Nifty 50 | 17,067 | 16,945 | -0.7% |

| Sensex | 57,773 | 57,527 | -0.4% |

Source: BSE and NSE

- Markets witnessed volatility and ended on a negative note.

- The Indian equity market faced a challenging week as concerns over a global banking crisis and interest rate hikes from the US Federal Reserve and Bank of England weighed heavily on investor sentiment.

- The market closed lower for the third straight week ended March 24, with selling pressure from foreign institutional investors (FIIs) contributing to the decline.

- FIIs sold equities worth Rs 6,654.23 crore, while domestic institutional investors (DIIs) provided some support by buying equities worth Rs 9,430.59 crore.

- Despite the challenging conditions, falling crude oil prices helped to mitigate some of the losses. Investors remained focused on the outcome of the Fed policy meeting, with worries of a global banking contagion contributing to the cautious mood.

- So far this month, FIIs have sold equities worth Rs 246.04 crore, while DIIs have bought equities worth Rs 25,592.99 crore.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| HDFC Life Insurance | ▲ +4.46% | Adani Enterprises | ▼ -7.24% |

| SBI Life Insurance | ▲ +3.79% | Adani Ports | ▼ -6.22% |

| ICICI Bank | ▲ +1.93% | Coal India | ▼ -5.96% |

| Ultratech Cement | ▲ +1.59% | HCL Technologies | ▼ -5.12% |

| Sun Pharma | ▲ +1.58% | Bajaj Finserv | ▼ -4.69% |

Source: BSE

Stocks that made the news this week:

?Changes to tax gains arising from debt mutual funds have sent shares of asset management companies tumbling on Friday. The Indian government has proposed taxing gains at the investor’s slab rate, regardless of the investment period. This move has led to a drop of between 1.56% and 4.77% for companies such as HDFC Asset Management Company, Aditya Birla Sun Life AMC, UTI Asset Management Company, and Nippon Life India Asset Management.

?Maruti Suzuki, the leading automaker in India, has announced that it will be raising prices in April 2023, citing increased cost pressures that will be passed on to consumers through the price hike. The move comes amid a broader trend among auto companies, who have been grappling with persistent input cost pressures and have been compelled to raise prices to maintain profitability.

?Fitch Ratings, a leading credit rating agency, has affirmed the Long-Term Foreign-Currency Issuer Default Rating (IDR) of India-based port operator Adani Ports and Special Economic Zone Limited (APSEZ) at ‘BBB-‘ with a ‘stable’ outlook. This move comes after recent allegations of governance issues at the Adani group were made in a Hindenburg report. According to Fitch, the affirmation of APSEZ’s rating reflects the agency’s view that the allegations made in the Hindenburg report are unlikely to have a significant impact on the company’s cost of funding or access to capital at its current rating level.