Daily Snippets

Date: 05th January 2024 |

|

|

Technical Overview – Nifty 50 |

|

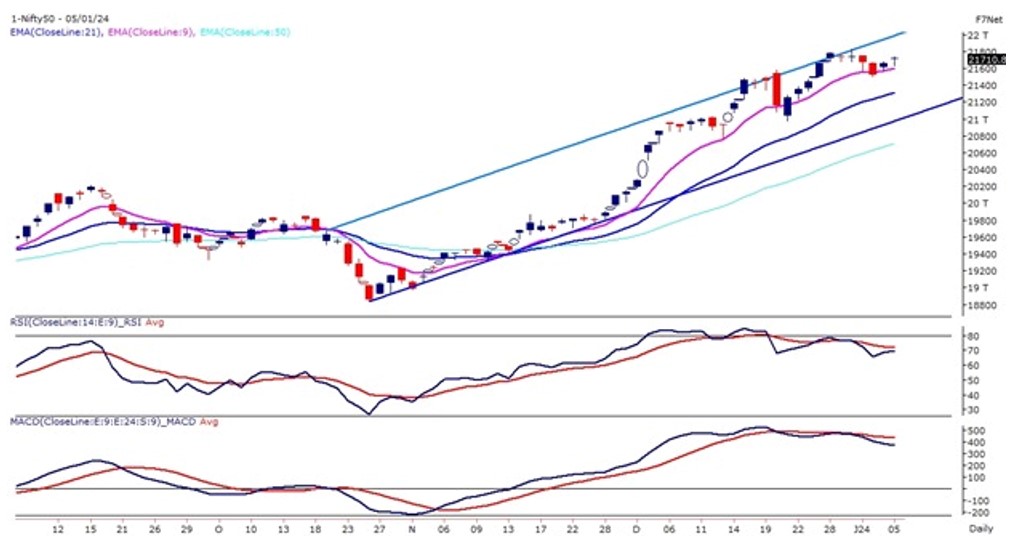

It was a very volatile day for the Benchmark index where prices traded with a very mixed bag of action and prices swing both ways and formed a Doji candle stick pattern on the daily chart. The Nifty50 witnessed a smart reversal from the lower levels in the 60 minutes of the trade.

The Nifty50 on the weekly chart has formed a Doji candle stick pattern within its previous week’s range and given a flat return for the week. Strictly speaking, this week of trading action at Dalal Street is described with one word: “volatility”.

Well, this should not come as any surprise amidst overbought technical conditions. Interestingly, Nifty Bulls have panicked after Nifty formed consecutive bearish candles but the index has taken support near 9 EMA and moved sustained above the same.

The immediate support for the Index is placed at 21,500 – 21,400 levels and the upside is capped near 21,850 levels.

|

Technical Overview – Bank Nifty |

|

Strictly speaking, this week of trading action for the Banking Index is described with one word: “volatility”. On the weekly chart, the Bank Nifty has formed an inside day candle where prices traded with lots of action within the defined range.

It was a very volatile day for the Benchmark index where prices traded with a very mixed bag of action and prices swing both ways. The Bank Nifty witnessed a smart reversal from the lower levels in the 60 minutes of the trade and closed above 48,000 levels.

The Banking Index continues to trade above the breakout levels and is trading above its 9 & 21 EMA on the broader time frame. The momentum oscillator RSI (14) is reading near 70 levels and the momentum is strongly poised towards a bullish stance on the weekly chart.

The positive takeaway from today’s trading session was that the Bank Nifty reversed from the lower levels. The immediate support for the Index is placed at 47,650 – 47,500 levels and the upside is capped near 48,500 levels.

|

Indian markets:

- Domestic Stock Market Performance: Closed with slight gains, the Nifty above 21,700 post-initial volatility. Strong showings in technology, auto, and realty sectors contrasted with declines in PSU banks, healthcare, and pharma stocks. Broader indices surged amid notable retail enthusiasm.

- Global Market Sentiment: Witnessed declines as investors awaited the US jobs report, anticipating its impact on the US Federal Reserve’s potential rate cut timeline.

- HSBC India Services PMI: Showed a substantial rise to 59 in December from 56.9 in November, indicating significant output growth, the most pronounced since September.

- Factors Driving Output Growth: Favorable economic conditions and positive demand trends were identified as primary drivers for the increased output, supported by anecdotal evidence.

- New Business Intakes: Not only increased further in December but also reached the highest level in three months, according to the PMI release.

- HSBC India Composite PMI Output: Elevated to 58.5 in December 2023 from 57.4 in November 2023, reflecting a robust rate of expansion, the strongest since September.

|

Global Markets

- Markets in Europe and Asia declined on Friday as investors were cautious ahead of the release of key European inflation data and the widely-watched monthly U.S. jobs report.

- A survey showed on Friday that the contraction in Japan’s private sector activity was over. The au Jibun Bank Japan composite PMI for December came in at 50, rising from 49.6 in the prior month to signal stabilization in Japan’s private sector output.

- Wall Street shares settled mixed on Thursday. The S&P SPX and Nasdaq Composite closed lower on Thursday, extending their losing streak that kicked off 2024, although the Dow Jones Industrial eked out a win on the back of financial stocks and strong jobs data. Markets were now focused on key U.S. nonfarm payrolls data for December, due later in the day.

|

Stocks in Spotlight

- Suzlon Energy‘s stock surged by 4.91 percent following the company’s successful bid to undertake a 225-MW wind power project from Ever renew Energy. This venture involves the installation of 75 wind turbine generators (WTGs) featuring Hybrid Lattice Tubular (HLT) towers, each with a 3 MW rated capacity, spread across various locations in Tamil Nadu.

- The company producing Tejas fighter jets saw a 3.3 percent increase in its shares following the initiation of coverage by foreign brokerage UBS. They recommended a “buy” with a target price of Rs 3600, projecting a 20 percent upside from present levels. UBS anticipates a significant boost in HAL‘s order book, expecting it to escalate from Rs 80,000 crore in FY23 to Rs 2.4 lakh crore by FY26, attributing this growth to amplified defense spending.

- TCS shares rose by 1.96 percent, mirroring the upward movement in other IT stocks. Market participants remain positive, perceiving the potential conclusion of the interest-rate hike cycle, despite immediate worries regarding the December quarter results.

|

News from the IPO world🌐

- MobiKwik files draft papers for Rs 700 crore IPO

- IPOs to wathcout in 2024: Swiggy, firstcry, Ola Electric, Oyo, Portea Medical.

- Jyoti CNC Automation IPO: GMP robust ahead of issue opening next week

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | ADANIPORTS | ▲ 2.7 | | LT | ▲ 2.6 | | TCS | ▲ 2 | | SBILIFE | ▲ 1.6 | | LTIM | ▲ 1.4 |

| Nifty 50 Top Losers | Stock | Change (%) | | BRITANNIA | ▼ -1.6 | | NESTLEIND | ▼ -1.6 | | JSWSTEEL | ▼ -1 | | KOTAKBANK | ▼ -1 | | DIVISLAB | ▼ -1 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY IT | 1.29 | | NIFTY AUTO | 0.44 | | NIFTY REALTY | 0.36 | | NIFTY OIL & GAS | 0.26 | | NIFTY CONSUMER DURABLES | 0.2 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2181 | | Declines | 1659 | | Unchanged | 96 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,440 | 0.0 % | (0.7) % | | 10 Year Gsec India | 7.2 | 0.20% | 0.80% | | WTI Crude (USD/bbl) | 72 | (0.7) % | 2.6 % | | Gold (INR/10g) | 62,250 | -0.30% | -0.30% | | USD/INR | 83.29 | 0.0 % | 0.3 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|