Technical Overview – Nifty 50

Indian markets are highly volatile, trading in a considerably larger consolidation zone spanning 23,900 to 24,400. The index is creating a higher low setup within the consolidation zone. Every rise is followed by a sharp drop in the benchmark index, though the index has sustained above the upper band of the rising wedge.

The momentum indicator RSI (14) found support at 40 and reversed from there. The benchmark index price ended below the 10 and 20 DEMAs, which might act as resistance in the following session, while the 50 DEMA serves as support.

The weekly chart shows the index trading above the main EMA, taking support at the 10 EMA, and consolidating between the 23,900 and 24,400 levels.

The short-term outlook is negative to sideways. Support levels for the upcoming sessions are 23,900 and 23,800, while resistance is at 24,250 and 24,350.

Technical Overview – Bank Nifty

The Banking index has been trading in a very narrow range, ranging from 49,600 – 50,500. The index has been receiving support from 100-DEMA. The Banking index has been moving in a rising channel and now approaching the lower band of the same, where the lower band and 200-DEMA converge.

On the weekly chart, the momentum indicator RSI (14) broke a rising trend line and is near 55 mark, indicating a loss of positive momentum. The banking index closed below the 10, 20, and 50 DEMA, which could act as resistance in the coming session.

MACD has a negative crossover on the daily chart, indicating lagging upside momentum on the daily chart and a negative crossover on the weekly chart.

The resistance and support levels for the upcoming sessions are 50,400, 50,600 for resistance and 49,850, 49,650 for support.

Indian markets:

- The Indian equity indices gave back some of their previous-session gains on August 8, amid high volatility. The RBI’s policy announcement met expectations, with key rates remaining unchanged, while the Monetary Policy Committee maintained its stance on withdrawing accommodation.

- Sector-wise, all indices closed in the red except for pharma, healthcare, and media. The metal, realty, oil & gas, and information technology sectors were down by 1-2 percent.

- The BSE Midcap index declined by 0.4 percent, while the Smallcap index remained flat.

Global Markets:

- Asia-Pacific markets were mostly down in choppy trading on Thursday, following a decline in U.S. stock benchmarks overnight. Investors were also digesting trade data from Japan and anticipating India’s rate decision.

- On Wednesday, the Dow Jones Industrial Average fell 0.60%, the S&P 500 declined 0.77%, and the tech-heavy Nasdaq Composite dropped 1.05%. All three indices had been up earlier in the session before Nvidia and other major technology stocks turned lower.

- In Japan, major indices fluctuated between gains and losses before closing in negative territory.

- The Nikkei 225 dipped 0.74%, while the broader Topix dropped 1.11%.

- Hong Kong’s Hang Seng index gained 1.3% in its final hour of trading, while Mainland China’s CSI 300 after Chinese trade figures were released.

- South Korea’s Kospi declined 0.45% to finish at 2,556.73, and the small-cap Kosdaq slipped 0.44%.

- Australia’s S&P/ASX 200 fell 0.23%.

Stocks in Spotlight

- Suzlon Energy |Shares hit a 5 percent upper circuit, reaching a multi-year high of Rs 73.05 on the NSE. The recent surge follows the renewable energy company’s announcement of definitive agreements to acquire a 76 percent stake in Renom Energy Services from the Sanjay Ghodawat Group (SGG).

- Protean eGov Tech Shares valued at Rs 236 crore were sold in a block deal, with Standard Chartered Bank likely being the seller. Approximately 12 lakh shares, representing a 3.2 percent stake in the IT-enabled solutions provider, changed hands in the transaction. The deal was executed at a floor price of Rs 1,805 per share, reflecting a discount of over 3 percent from the previous close. As a result of the block deal, shares of Protean eGov declined by over 1 percent.

- RVNL shares declined by nearly 5 percent after the company reported a 34.7 percent drop in consolidated net profit to Rs 223.9 crore, compared to Rs 343 crore in the same quarter last year. Revenue from operations stood at Rs 4,073 crore, marking a 26 percent decrease from Rs 5,571 crore in the corresponding quarter of the previous year.

News from the IPO world🌐

- Ceigall India shares to debut tomorrow.

- Saraswati Saree’s Rs 160 crore IPO opens on August 12

- Unicommerce eSolutions IPO subscribed 37X on day 3 so far, retail portion booked 72X

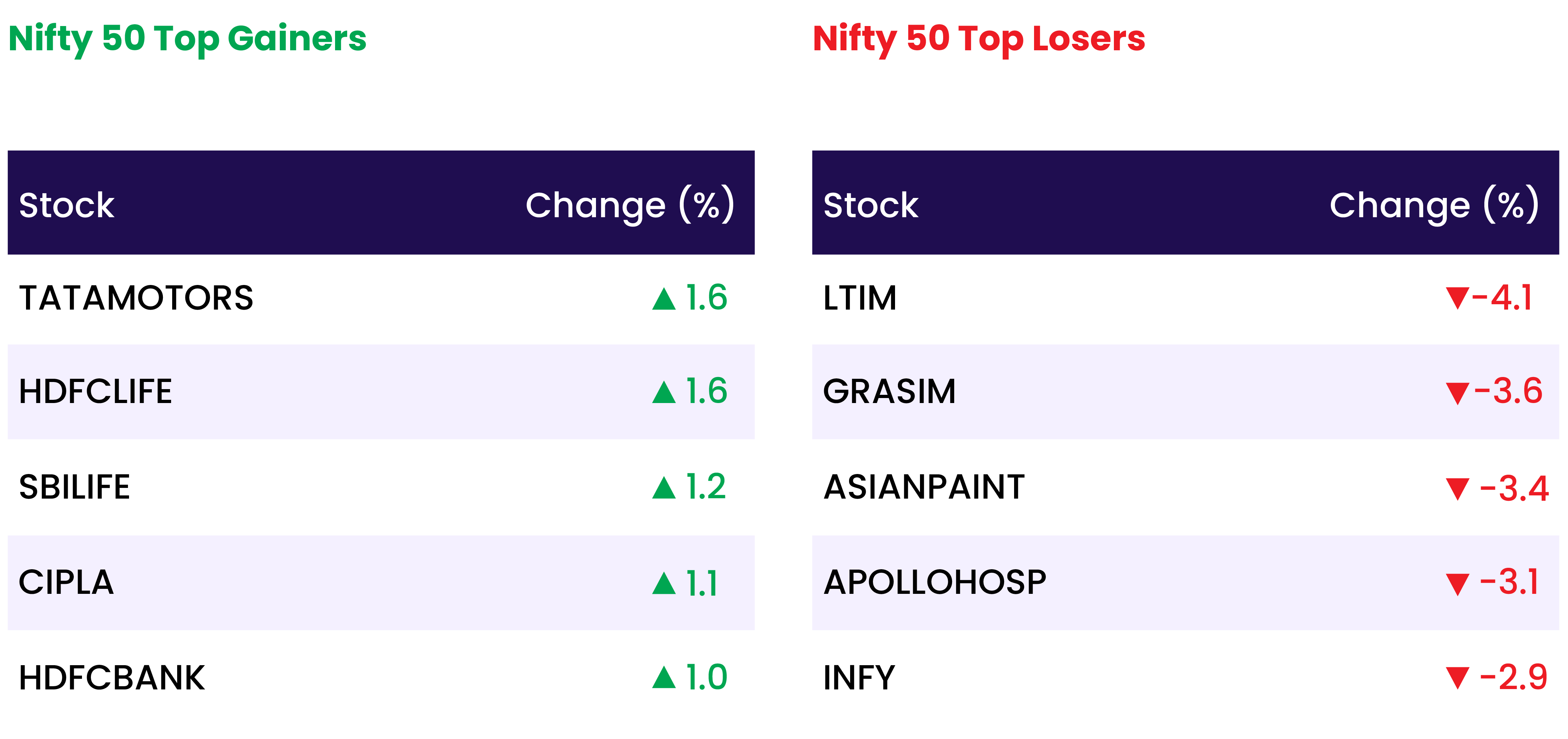

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MIDSMALL HEALTHCARE | 0.9 |

| NIFTY PHARMA | 0.4 |

| NIFTY MEDIA | 0.2 |

| NIFTY FINANCIAL SERVICES | 0.2 |

| NIFTY HEALTHCARE INDEX | 0.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1829 |

| Decline | 2083 |

| Unchanged | 102 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,763 | (0.6) % | 2.8 % |

| 10 Year Gsec India | 7.0 | 1.8 % | 16.5 % |

| WTI Crude (USD/bbl) | 75 | 3.1 % | 6.9 % |

| Gold (INR/10g) | 68,842 | 0.1 % | 3.5 % |

| USD/INR | 83.93 | (0.0) % | 1.1 % |

Please visit www.fisdom.com for a standard disclaimer