Technical Overview – Nifty 50

After a profit-booking session, the benchmark index regained the upside momentum. The benchmark index has moved in consolidation, ranging between 24,750 and 25,000 levels. The index has a strong resistance at 25,000 level, thus making a reversal mark. The index has sustained above the 24,800 mark with a bullish view. Index has formed a doji candlestick structure neat all-time high levels on the daily chart.

The fact that the RSI (14) momentum indicator took support at the 60 mark and had a hidden positive divergence confirmed upside continuation. On the weekly and daily charts, the index is still moving higher above the important moving average (EMA), suggesting that the upward momentum is still in place. The MACD is still above the polarity and positive for the benchmark index.

Based on benchmark index OI data, a base formation may take place at the 24,700 level, where put writing is almost 41 lakhs. At 25,000, call writing is almost close to 75 lakhs, which might act as a resistance. The PCR value of the benchmark index is 1.13.

The view remains buy on dips. The support levels for the upcoming sessions are at 24,700 and 24,600 and resistance at 24,900 and 25,000, respectively.

Technical Overview – Bank Nifty

The banking index closed flat after the decline on the rise and underperformed the benchmark index on 30th July. On the 75-minute chart, the banking index faced resistance near its falling trend line. The index has not been able to hold steady above DEMAs of 10 and 20. There is no longer any bullish momentum for the banking index.

The 41-point mark served as the basis and provided support for the RSI (14) momentum indicator. The closing below the 10 and 20 DEMAs, which supported the index, suggests that the banking index is still under pressure. Despite a short-term positive momentum, the 10 DEMA has crossed below the 20 DEMA, indicating a sell on a rising market. On the daily chart, a negative crossover of the MACD signifies a trailing upward trend.

Based on benchmark index OI data, a base formation may take place at the 51,300 level, where put writing is close to 14 lakhs. At 51,800, call writing is almost close to 15 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.85.

The resistance and support levels for the upcoming sessions are 51,600, and 52,000 for resistance, and 50,950, and 50,450 for support.

Indian markets:

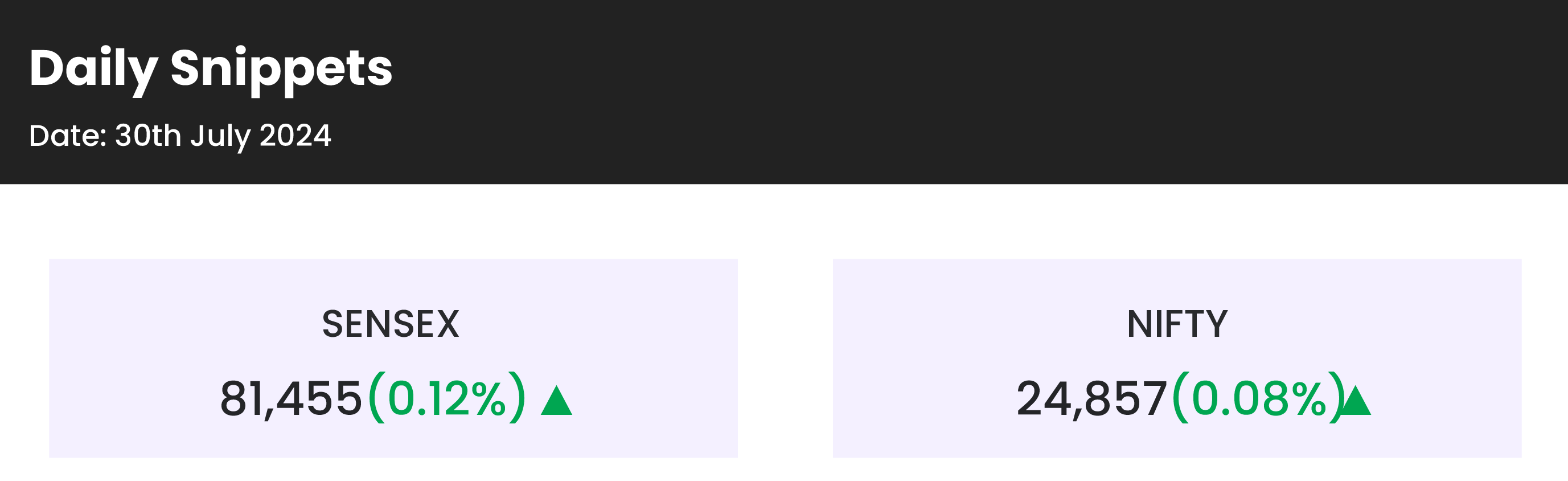

- Indian markets gave up most of their gains and ended flat, mirroring the mixed performance of global equities as investors await key rate decisions from the Bank of Japan (BoJ) and the US Federal Reserve later this week.

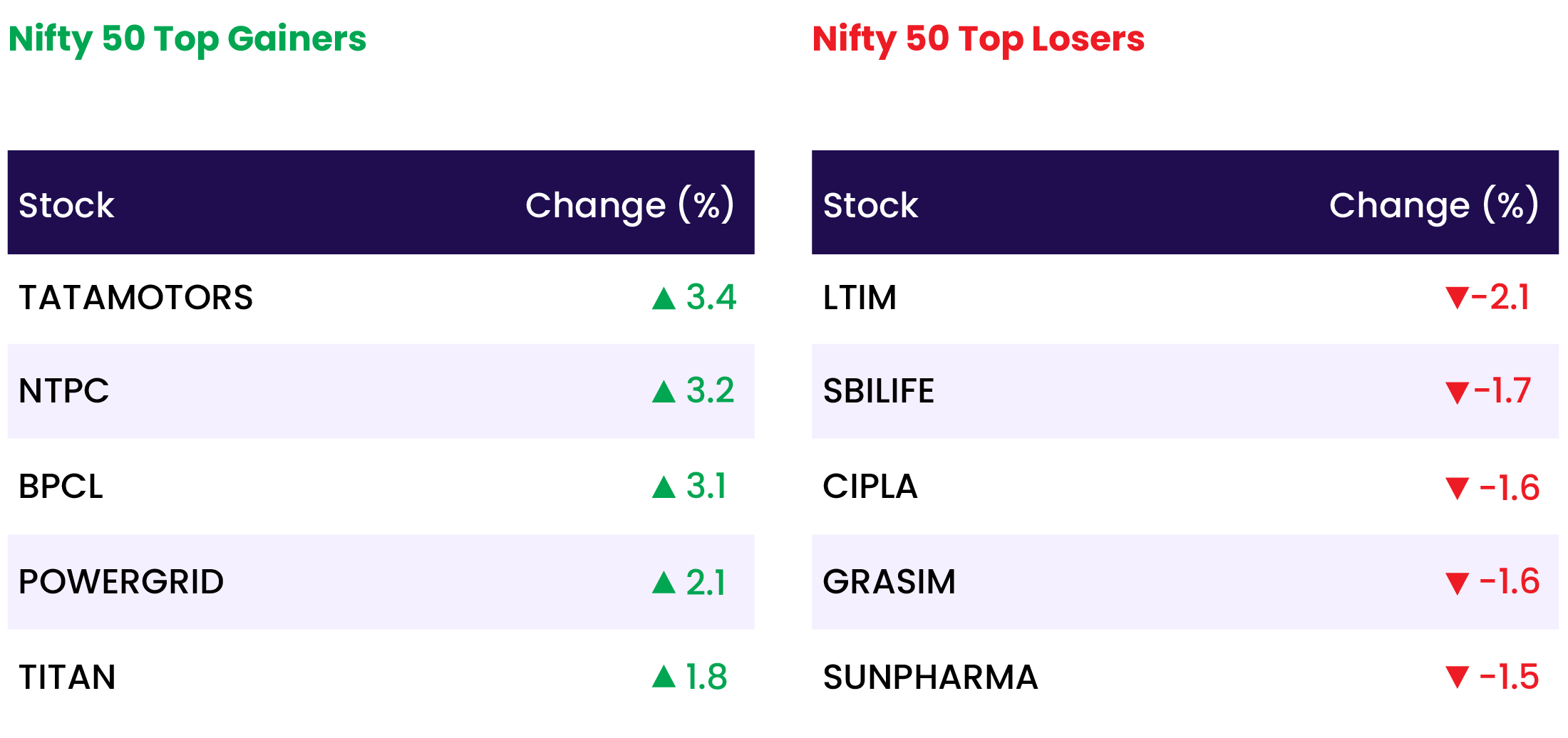

- Sector-wise, Nifty Consumer Durables led with a 1.1% increase, followed by Nifty Oil & Gas and Auto, which rose 0.6% and 0.5%, respectively. On the downside, Nifty FMCG dropped 1.1%, while Nifty Pharma fell by 0.68%.

- The BoJ and the US Fed will begin their two-day meetings on Tuesday, with announcements on policy changes expected on Wednesday.

Global Markets:

- Asian markets declined on Tuesday as the Bank of Japan began its two-day monetary policy meeting.

- Japan’s Nikkei 225 managed a late gain of 0.15%, while the Topix fell 0.19%. Japan’s unemployment rate for July came in slightly below expectations at 2.5%, versus the 2.6% forecast by Reuters economists.

- South Korea’s Kospi dropped 0.99%, and the Kosdaq saw a smaller decline of 0.52%.

- Australia’s S&P/ASX 200 fell 0.46%.

- In Hong Kong, the Hang Seng index was down 1.43% in its final trading hour, while mainland China’s CSI 300 fell 0.63%, reaching new six-month lows.

- In the U.S., the major indexes closed mixed, with the S&P 500 slightly up as Wall Street prepared for a busy week of corporate earnings and awaited a significant policy announcement from the Federal Reserve.

Stocks in Spotlight

- Shares of Suzlon Energy climbed 5% on Tuesday, marking the seventh consecutive session of gains. The stock has surged over 23% since the company announced its Q1FY25 earnings last week. Suzlon reported a 200% year-on-year increase in net profit, reaching ₹302 crore for the June quarter. Revenue also rose by 50% to ₹2,016 crore in Q1 of the current fiscal year, up from ₹1,348 crore in the same period last year.

- Colgate Palmolive shares gained nearly 2% following strong praise for its April-June earnings, which exceeded expectations across the board. Brokerages were particularly impressed by the company’s better-than-expected volume growth, boosted by a recovery in rural demand. Nomura remains optimistic about Colgate’s 6-7% volume growth in Q1 FY25, surpassing its own forecast of a 2% increase.

- NTPC shares surged over 3% to reach an all-time high of ₹412.7 per share on July 30, following robust April-June quarter (Q1FY25) results. Brokerages remain largely bullish on the stock, anticipating growth driven by the thermal and nuclear power sectors. Jefferies maintained its ‘buy’ rating on NTPC, raising the target price from ₹445 to ₹485 per share, expecting an acceleration in order execution.

News from the IPO world🌐

- Ola electric IPO opens august 2 at ₹72-76 per Share

- FirstCry set to file final papers for $3-3.5 billion IPO

- Insurer Niva Bupa plans $360 million IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY CONSUMER DURABLES | 1.1 |

| NIFTY MEDIA | 0.7 |

| NIFTY AUTO | 0.6 |

| NIFTY OIL & GAS | 0.6 |

| NIFTY REALTY | 0.4 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2295 |

| Decline | 1607 |

| Unchanged | 121 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 40,540 | (0.1) % | 7.5 % |

| 10 Year Gsec India | 7.1 | 1.9 % | 6.4 % |

| WTI Crude (USD/bbl) | 76 | (3.2) % | 7.7 % |

| Gold (INR/10g) | 68,283 | 0.1 % | 2.0 % |

| USD/INR | 83.71 | (0.0) % | 0.8 % |

Please visit www.fisdom.com for a standard disclaimer