Daily Snippets

Date: 06th September 2023 |

|

|

Technical Overview – Nifty 50 |

|

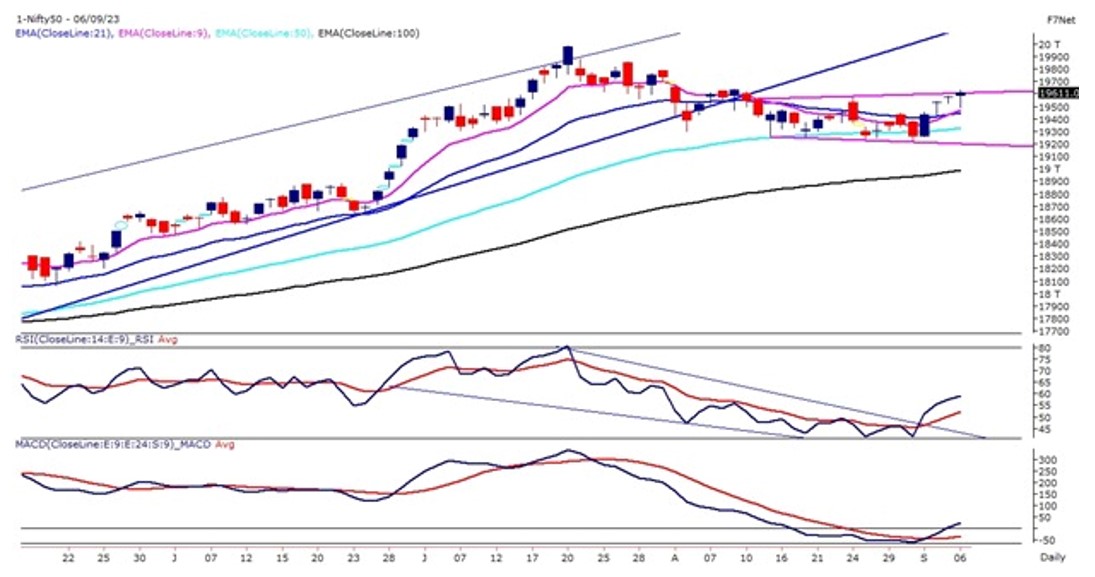

The Benchmark Index on 6th Sept witnessed a flat opening and traded in a very stagnant manner between the range of 50 – 80 points for the majority of the time. The index witnessed a massive breakout in the last 30 minutes of trade reversed more than 100 points from the day’s low and closed above 19,600 levels and formed a green candle with a long wick indicating a reversal from the lower levels.

The Nifty on the daily chart has formed a bullish golden cross where 9 EMA has crossed above 21 EMA suggesting bullish momentum is likely ahead. The RSI (14) on the daily chart has witnessed a falling wedge pattern breakout above 50 levels with a bullish crossover.

The Index on the daily chart has closed above its psychological mark of 19,600 levels and a sustained move above the same will induce a breakout towards 19,700 – 19,750 levels for the coming days. On the flip side, 19,500 will act as immediate support for the index.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty underperformance continues for to third straight where the Benchmark index closed in gains and the Banking index witnessed a sideways trading range. The daily candle of the Bank Nifty suggests a short-covering rally towards the end and formed a wick on the lower end.

The index on the daily chart is trading within the rectangle pattern and moved above 50 & 21 EMA. The momentum oscillator RSI (14) has formed an intermediate bottom at 40 levels and presently moved above 50 levels with a bullish crossover.

On the broader time frame, the banking index is trading in a higher high bottom formation and taking support near its 21-week exponential moving average which is placed at 43,916 levels. Now the immediate hurdle for the bulls will be near 45,000 levels and a breakout above the said levels will initiate a bullish breakout in the Banking index. Similarly, on the lower side, 44,200 & 44,000 will act as immediate support for the Banking index.

|

Indian markets:

- Local shares had a mixed trading day, with indices ultimately gaining for the fourth consecutive session.

- Investor caution prevailed due to rising global uncertainty, US bond yields, and the dollar index.

- Foreign institutional investors offloaded local shares in response to this caution.

- The Nifty technically found support near the 19500 level and showed a midday turnaround, suggesting potential positive developments ahead.

- Sector performance varied. FMCG and pharma sectors rebounded strongly. Realty and metal sectors closed on a downbeat note

|

Global Markets

- Markets in Europe declined across the board while Asian stocks ended mixed on Wednesday after Saudi Arabia and Russia extended voluntary oil production cuts to the end of the year.

- Australias gross domestic product expanded 2.1% in the second quarter from a year ago, lower than the 2.3% year-on-year growth recorded in the first quarter.

- US stocks ended lower on Tuesday as the rise in crude oil prices weighed on stocks.

|

Stocks in Spotlight

- Patel Engineering’s stock closed 3 percent lower, despite the company winning a significant contract. Patel Engineering, in partnership with its joint venture (JV) partner, secured a letter of award for a substantial urban infrastructure development project worth Rs 1,275.30 crore from Madhya Pradesh Jal Nigam. The company’s share in this project, as a 35-percent partner in the JV, amounts to Rs 446.36 crore, with a project completion timeframe of 24 months. Despite this positive development, the stock saw a 3 percent decline in its closing price.

- Sugar stocks experienced a significant surge, with leading companies witnessing gains of up to 10%. This upswing came in response to Avlean, the world’s largest sugar trader, forecasting a sixth consecutive year of sugar shortages. Avlean attributed this expected deficit to a poor crop in India, a major sugar-producing nation. Investors are closely monitoring sugar stocks as the supply shortage is anticipated to drive price increases, potentially boosting the companies’ revenues.

- ABB India saw a 1.5 percent increase in its stock price following Jefferies’ decision to maintain a ‘buy’ rating on the company’s shares. Jefferies also set a target price of Rs 5,260, indicating a potential upside of 16 percent. This positive outlook is based on expectations of a strong ordering outlook, which should enable ABB India to maintain double-digit execution levels and achieve over 40 percent compounded annual growth in Earnings Per Share from 2022 to 2025.

|

News from the IPO world🌐

- Jyoti CNC Automation files papers for Rs. 1000 crore IPO

- 3 main board IPOs to hit this week plan to raise Rs. 1300 crore

- Samhi Hotels IPO to open on 14th September

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | TATACONSUM | ▲ 4.10% | | DIVISLAB | ▲ 1.80% | | BHARTIARTL | ▲ 1.60% | | HDFCBANK | ▲ 1.50% | | BRITANNIA | ▲ 1.40% |

| Nifty 50 Top Losers | Stock | Change (%) | | TATASTEEL | ▼ -1.70% | | HINDALCO | ▼ -1.70% | | AXISBANK | ▼ -1.50% | | NTPC | ▼ -1.30% | | INDUSINDBK | ▼ -1.30% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY FMCG | 1.00% | | NIFTY HEALTHCARE INDEX | 0.92% | | NIFTY PHARMA | 0.92% | | NIFTY OIL & GAS | 0.77% | | NIFTY CONSUMER DURABLES | 0.59% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1886 | | Declines | 1766 | | Unchanged | 139 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 34,642 | (0.6) % | 4.5 % | | 10 Year Gsec India | 7.2 | 0.10% | 5.20% | | WTI Crude (USD/bbl) | 87 | 1.6 % | 12.9 % | | Gold (INR/10g) | 59,252 | -0.20% | 8.10% | | USD/INR | 82.72 | 0.0 % | 0.1 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|