Letter To Investor

Dear Investors,

I hope this letter finds you in good health and spirits. As promised, we are providing you with an update on the global economic and market trends for the past month.

The global sentiment saw a significant improvement in April 2023, and we witnessed a sharp rally in the global equity markets. The Indian equity market performed exceptionally well, and the BSE S&P Small cap index recorded its best monthly returns since July 2022. We are keeping a close eye on the banking crisis in the developed markets, and the markets expect a pause in the US interest rate hiking cycle beyond the May policy.

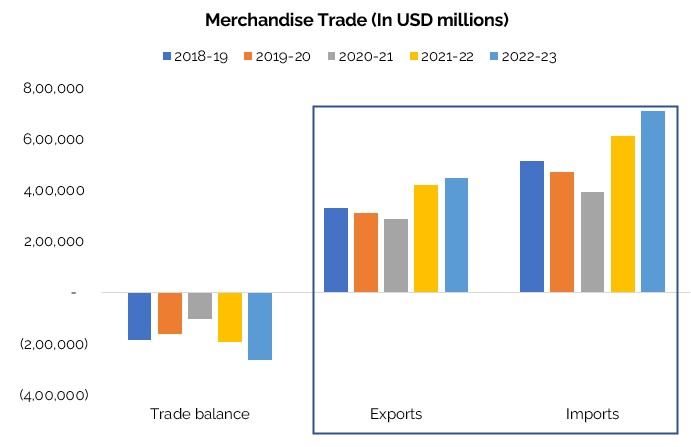

The Indian economy continues to display optimism towards growth, and we have seen a significant improvement in employment numbers. The foreign exchange reserves of India have increased again in April 2023, indicating economic stability. The passenger vehicles and two-wheeler sector is showing a turnaround, and foreign trade has also inched up. Furthermore, we have seen a record high merchandise export in FY23.

The performance of the Indian market during April 2023 was primarily driven by the strong performance of cyclical sectors, and small and mid-cap stocks made a strong comeback during the first month of the new fiscal year. However, the Indian rupee depreciated marginally against the US dollar, and we saw gold prices reach a one-year high.

On the debt side, Yields have softened across categories, and there has been a fall in inflation, which can be primarily attributed to the high base of last year. However, the CPI went up sequentially. We anticipate that the RBI may retain its current stance in the June’23 MPC. It is worth noting that India’s attractive real interest rates make it a favorable investment destination, and foreign investors have continued to show interest in the Indian market

We will continue to monitor the economic and market trends and keep you updated on any significant changes that may impact your investment portfolio.

Fundamental Tracker

Tracking the fundamental metrics that drive investment decisions

Key Themes for FY24:

- Capital Expenditure(Capex)

- Energy Transition/De-carbonization

- 5G Roll Out

- Re-rating for banks

- Mix of value & growth

- Quality fixed income over credit

Policy Makers Display Optimism Towards Economic Growth

Factors Contributing to Positive Outlook for Fiscal Year 2023-24

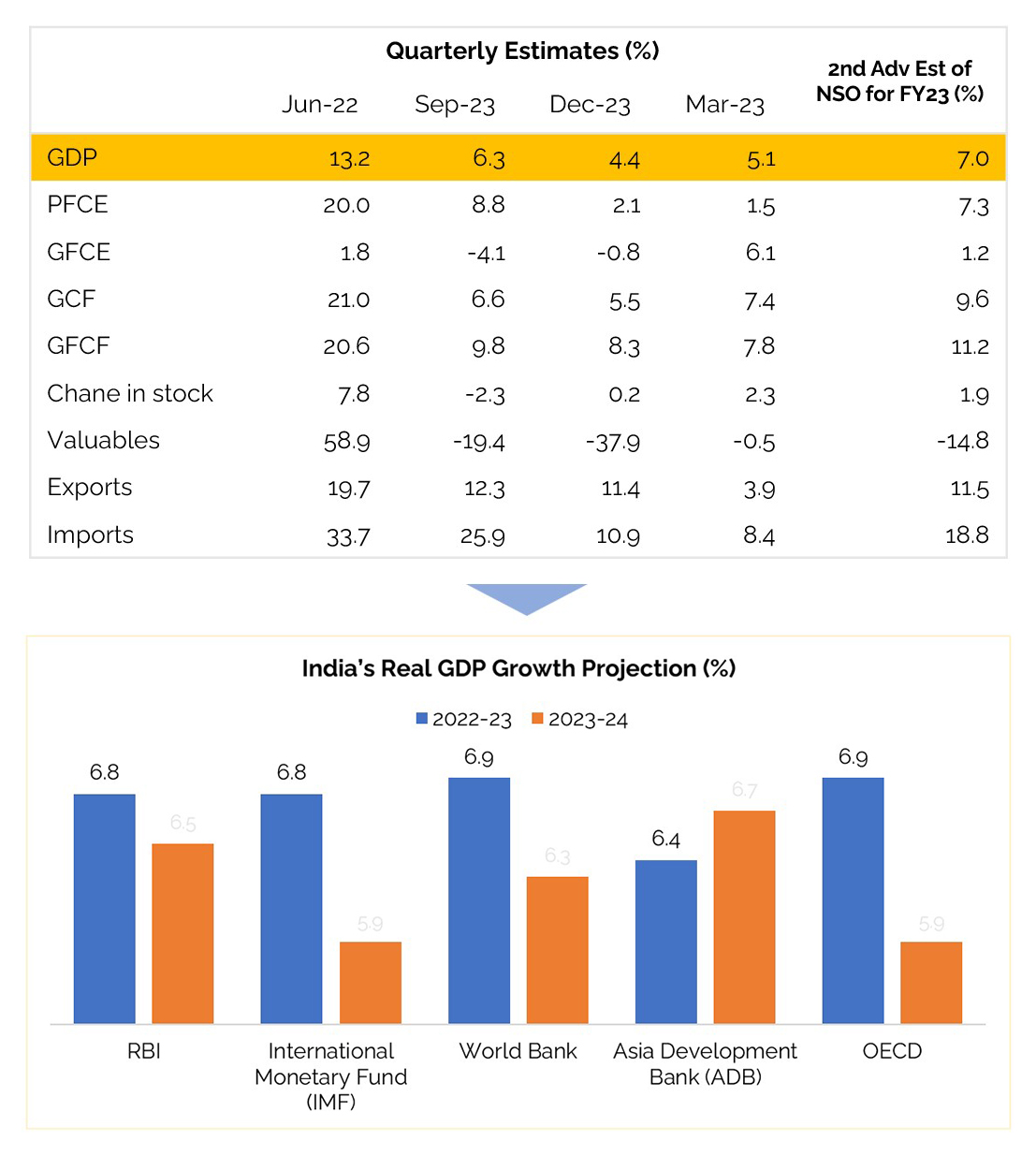

- Policy makers in India’s esteemed finance ministry are expressing noteworthy optimism regarding the country’s economic growth prospects for the fiscal year 2023-24, in contrast to the more conservative projections by multilateral agencies and private forecasters. While the World Bank and IMD have revised their India real GDP growth forecast downwards to 6.3% and 5.9% from 6.6% and 6.1%, respectively, policymakers remain positive.

- The optimism is fueled by multiple factors, including a projected rebound in private consumption, increased capital expenditure, a rise in spending on contact-based services, reduced housing market inventory, strengthened corporate balance sheets, sound health of public sector banks, and a willingness to increase credit supply to Micro, Small, and Medium Enterprises (MSMEs). These favourable conditions collectively contribute to the positive sentiment and confidence in India’s potential for economic growth in the upcoming fiscal year.

- Overall, while the multilateral agencies and private forecasters are taking a more conservative stance, India’s policymakers are displaying a notable optimism about the country’s economic growth prospects in the upcoming fiscal year. The favourable conditions and positive sentiment towards India’s growth potential could pave the way for a more robust and sustained economic recovery.

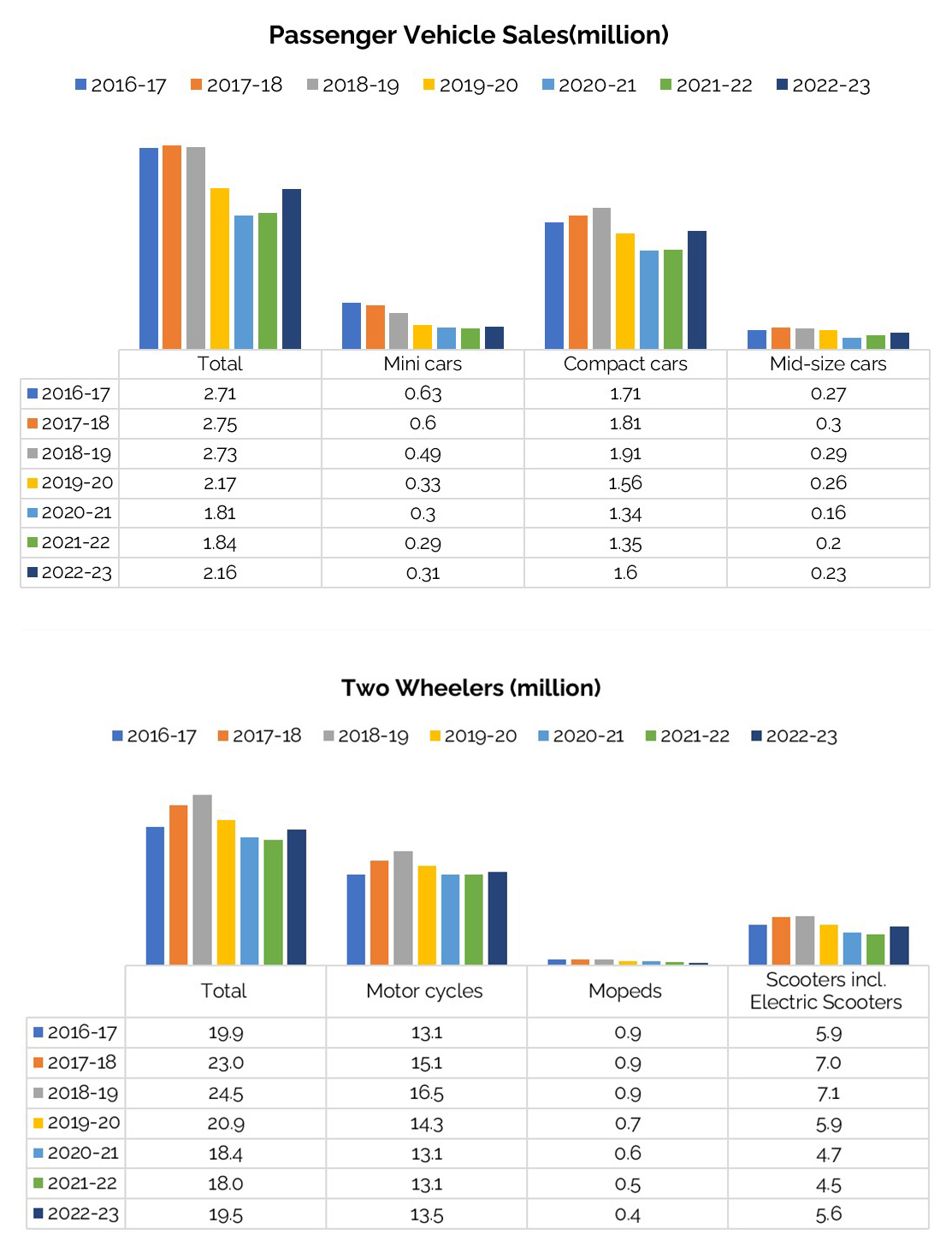

Consumption: Auto Industry Recovery

Passenger vehicles & two-wheeler show turnaround

- In FY22-23, passenger cars and two-wheeler sales witnessed a commendable turnaround, exhibiting growth rates of 17.3% and 8.3%, respectively. This growth in two-wheeler sales is a relief after three consecutive years of declining sales. The passenger vehicle segment grew for the second year, indicating a sustained trend.

- The growth in the passenger vehicle segment was mainly driven by the uptick in the compact car segment, which grew by 18.6% in FY23, compared to a mere 0.7% in the previous year. The compact vehicles had a 75% share in the passenger vehicle segment, with Wagon R being the highest-selling compact car.

- This rise in sales can be attributed to various factors such as pent-up demand, favourable financing schemes, and improving consumer sentiment due to overall economic recovery. However, the trend is likely to moderate in the near term due to supply a sustained slowdown in the export market, coupled with weak rural sentiments posing challenges for the industry. Nevertheless, with a strong order book run. at present, the growth is expected to remain impressive, aided by a favourable economic outlook, increasing disposable incomes, and a shift towards personal mobility.

Trade: Export-Import

Foreign trade inches up & record high merchandise export witnessed in FY23