Technical Overview – Nifty 50

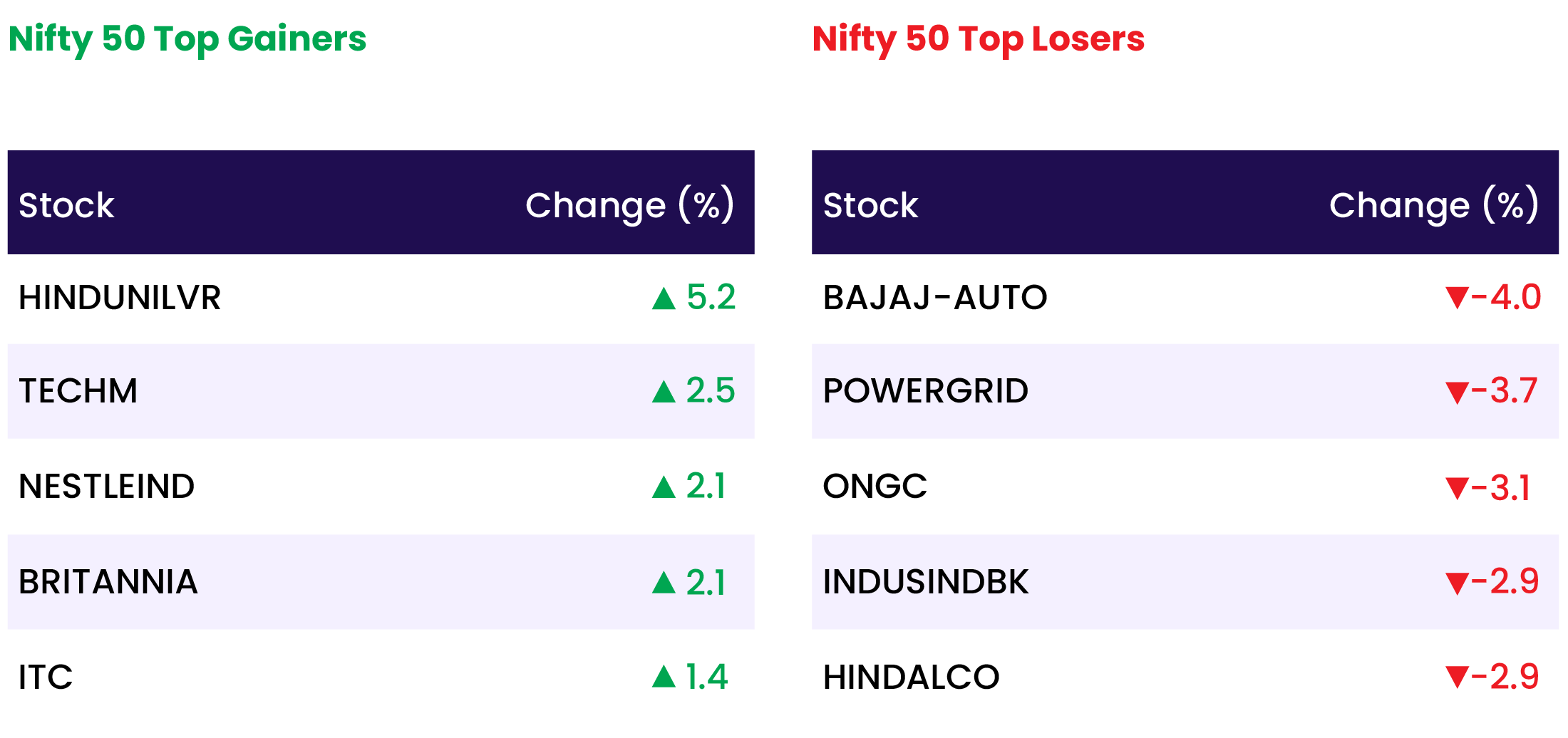

Benchmark index NIFTY closed at 22,475.85, down by 140 points/-0.62%. 3rd a consecutive bearish day for of index. Benchmark index now below 10 & 20 DEMA. Index managed to cover 50 points reversing from 50-DEMA. India Vix is now above 17 levels. FMCG stocks lead the highest gains HUL, Britannia, Nestle. The biggest losers of the index were Bajaj Auto, Power Grid, and Hindalco.

A Double Top structure is forming at an all-time high. A big bearish candle has formed on a daily time frame indicating huge selling pressure at an all-time high. RSI is now at 47 levels and there is a huge negative divergence on daily time frame.

NSE Midcap 100 Index and NSE Small Cap 100 Index both cracked down by 1.90% on Tuesday.

Index is facing resistance at 22,585, 22,780 level and need to sustain above the same for further move. Immediate next support levels are 22,200, 22,000. CNX REALTY, CNX METAL, and CNX HEALTHCARE were major indices that dragged most on Friday.

Technical Overview – Bank Nifty

BANK NIFTY index closed at 48,285, down by 610 points/-1.25%. Index cracked for 5th consecutive session and closed near today’s low. Major fall in the index after 10 sessions. The election results ahead index is experiencing quite high volatility.

Shooting Star candle formed on 30th April at an all-time high level, follow-up selling is seen in the index. RSI is now near 51 and has a negative divergence on the daily time frame. The index is now below 10 & 20 DEMA. PNB, Bandhan Bank, and IndusInd Bank were the biggest losers of the index today while Kotak Mahindra Bank was the sole riser and was up 1.20%.

Index resistance levels are 49,130, 49,600, and 49,950 for upcoming trading sessions. Immediate support levels for the index are 48,000 and 47,700.

Indian markets:

- India’s key indices, the Sensex and Nifty 50, concluded lower on May 7, as widespread selling persisted amid disappointing Q4 earnings, denting market confidence near record highs.

- Leading sectors included the Nifty FMCG Index, which rose by 2%, and Nifty IT, which gained 0.77%. Conversely, Nifty realty and metals saw declines of 3.5% and 2.4%, respectively. Other laggards were the Nifty PSU Bank Index (down 2.3%), Nifty Healthcare (down 2%), and Nifty Auto (down 1.8%).

- The midcap and smallcap segments experienced significant declines, with the BSE Midcap index dropping by 1.90% and the Smallcap index closing with a loss of 1.65%.

Global Markets:

- South Korean stocks led Asia-Pacific markets on Tuesday, boosted by Wall Street’s overnight gains amid expectations of a Federal Reserve interest rate cut. The Kospi surged 2.16%, hitting a one-month high, driven by heavyweights Samsung Electronics and SK Hynix. The Kosdaq rose 0.66%.

- In Australia, the S&P/ASX 200 climbed 1.44%, extending its winning streak to four consecutive days.

- Japan’s Nikkei 225 returned to trading after a holiday, closing 1.57% higher, while the broader Topix index rose by 0.65%.

- However, Hong Kong’s Hang Seng index experienced a slight decline of 0.51%, potentially ending a 10-day streak of gains, while Mainland China’s CSI 300 remained unchanged at 3,659.0.

- In Europe, markets kicked off Tuesday positively as investors kept a close eye on a flurry of earnings reports across the region.

Stocks in Spotlight

- Lupin stock dropped by 4 percent following the company’s Q4 FY24 earnings report, which revealed a lower-than-anticipated increase in net profit, driven by heightened raw material expenses. Despite a year-on-year bottom line growth of 52 percent, reaching Rs 359.4 crore compared to Rs 235.96 crore in the same period last year, this figure fell short of CNBC-TV18’s projection of Rs 498.9 crore.

- SRF stock fell by 7 percent after the company disclosed a 24 percent year-on-year decline in consolidated net profit, amounting to Rs 422 crore for the fourth quarter of FY24. Its revenue from operations also experienced a 5 percent decrease, settling at Rs 3570 crore. The Specialty Chemicals Business encountered challenges during the quarter, attributed to inventory rationalization by select key customers, despite an improved performance compared to Q3FY24.

- Godrej Consumer Products shares saw a 5 percent increase as the company’s fourth-quarter earnings surpassed expectations, driven by growing domestic volumes and stronger-than-projected international growth, which maintained bullish sentiments among brokerages. The consumer staples company reported total revenue of Rs 3,385.61 crore, marking a 6 percent increase from Rs 3,200.16 crore recorded a year ago.

News from the IPO world🌐

- Swiggy secures shareholder nod for a potential $1.2 billion IPO

- Indegene IPO booked over 4x so far on Day 2.

- FirstCry’s parent firm Brainbees Solutions re-files IPO papers

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY FMCG | 2.0 |

| NIFTY IT | 0.8 |

| NIFTY CONSUMER DURABLES | -0.9 |

| NIFTY FINANCIAL SERVICES | -0.9 |

| NIFTY BANK | -1.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1084 |

| Decline | 2738 |

| Unchanged | 110 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,852 | 0.5 % | 3.0 % |

| 10 Year Gsec India | 7.1 | 0.3 % | 0.5 % |

| WTI Crude (USD/bbl) | 78 | 0.0 % | 11.0 % |

| Gold (INR/10g) | 71,160 | (0.2) % | 6.4 % |

| USD/INR | 83.38 | (0.1) % | 0.4 % |

Please visit www.fisdom.com for a standard disclaimer