Technical Overview – Nifty 50

Volatility was the only factor in today’s trading sessions where prices traded with lots of mixed bags and without any range bias. The Nifty50 on the daily chart was trading with wild swings and formed a Doji candle stick pattern.

The momentum oscillator RSI (14) has whipsawed its range breakout and drifted within the pattern with a bearish crossover on the cards. The Nifty50 on the daily chart is trading in a rising wedge pattern and prices have formed a bearish candle near the upper band of the pattern.

The Index closely follows the 9-day exponential moving average on the daily chart, and the prices in today’s session are hovering near the same. The market breadth favors the bears with a 1:4 Ratio where sellers were more active than buyers.

The immediate support for the index is placed near 22,200 levels near its 21 EMA and resistance is likely to be faced near 22,550 levels.

Technical Overview – Bank Nifty

Volatility was the only factor in today’s trading sessions where prices traded with lots of mixed bags and without any range bias. The Bank Nifty formed a long-leg Doji candle stick pattern on the daily chart and the wicks of the pattern are tall on both ends indicating a super volatile day for the Banking Index.

The bearish candle mark on the daily chart signifies the profit-booking scenario in the Banking Index. The momentum oscillator RSI (14) has again entered inside the breakout levels and drifted below 55 levels with a bearish crossover on the daily time frame.

The Index has entered near its 9 and 21 – day exponential moving average range and this level will act as an immediate support for the index. The immediate support for the Bank Nifty is placed near 46900 levels and resistance is likely to be faced near 48,000 levels.

Indian markets:

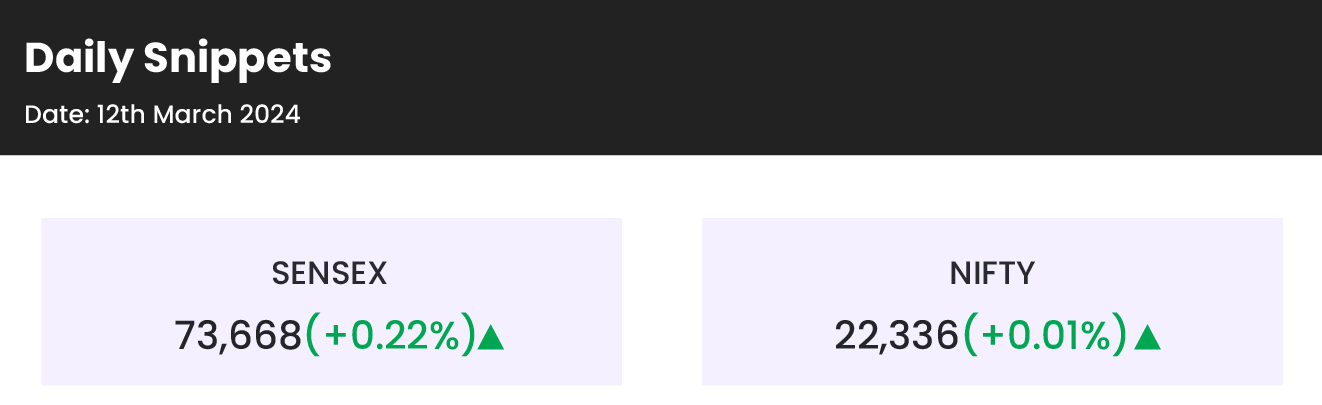

- In another session marked by volatility on March 12, the Indian benchmark indices concluded with a mixed outcome.

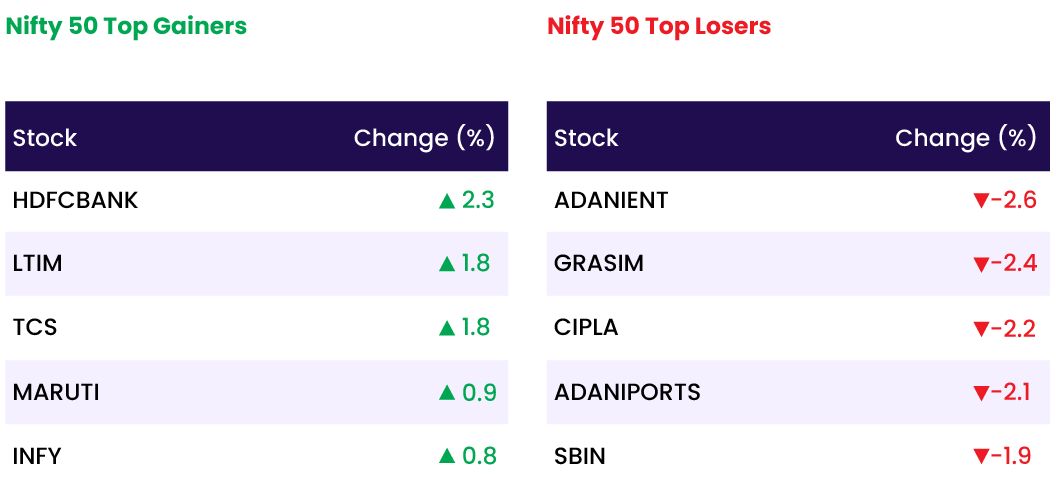

- The domestic market witnessed a broad selloff on Tuesday, where large-cap indices secured only marginal gains, while mid and small-cap segments incurred substantial losses.

- Most sectoral indices closed in negative territory, reflecting a cautious market sentiment, as the domestic market maintains elevated valuations without any fresh triggers.

- On the sectoral front, all indices, except IT, concluded in the red, with the realty index dropping nearly 3.5 percent, PSU Bank and Media indices down two percent each, and capital goods, FMCG, healthcare, metal, and power indices falling one percent each.

- Investors will closely monitor the release of US inflation data tonight to glean insights into when the Federal Reserve might initiate its rate cut cycle.

Global Markets:

- Overnight, Asia-Pacific markets experienced predominantly upward movement, driven by Japan’s corporate inflation figures for January surpassing expectations.

- Japan’s Nikkei 225 slipped for a second straight day, losing 0.06%, while the broad based Topix was down 0.36%. In Australia, the S&P/ASX 200 rebounded and gained 0.11%.

- Hong Kong’s Hang Seng index rose over 3% to lead gains in Asia-Pacific markets and was set to extend its winning streak to three days, while mainland China’s CSI 300 rose 0.23%

- South Korea’s Kospi also regained some ground, trading up 0.83%. while the small cap Kosdaq climbed 1.57% its highest level since September 2023.

- European markets opened higher Tuesday as global investors await the latest U.S. inflation report.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- On March 12, SpiceJet shares crashed by 9 percent following reports indicating the resignation of Chief Operating Officer (COO) Arun Kashyap and Chief Commercial Officer Shilpa Bhatia. In response to this development, the management clarified that these resignations are part of SpiceJet’s strategic restructuring, emphasizing the company’s sustained growth in revenue and load factor.

- Aditya Birla Capital witnessed a 2 percent increase in shares on March 12, a day after the board of directors approved the merger of Aditya Birla Finance Ltd into Aditya Birla Capital Limited on March 11. The announcement of the merger occurred after market hours. Post-amalgamation, Aditya Birla Capital is set to transform from a holding company into an operating NBFC, creating a unified and financially stronger entity with enhanced flexibility and direct access to capital.

- IndiaMART InterMESH shares experienced a nearly 3 percent surge after global brokerage firm Jefferies issued a ‘buy’ recommendation with a target price of Rs 3,400 per share, indicating a potential upside of over 27 percent from the current level. Jefferies analysts addressed previous investor concerns about slow subscriber additions, SaaS investments, and execution challenges, now aligning with the company’s recognized structural growth potential and competitive advantages.

News from the IPO world 🌐

- Shares worth $21 billion to enter market in 4 months as IPO lock-in period expires for 66 companies

- Vishal Mega Mart planning $1 billion IPO

- Popular Vehicles and Services IPO subscribed 23% on Day 1

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY IT | 0.6 |

| NIFTY FINANCIAL SERVICES | 0.2 |

| NIFTY PRIVATE BANK | 0.0 |

| NIFTY BANK | -0.1 |

| NIFTY AUTO | -0.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 669 |

| Decline | 3224 |

| Unchanged | 74 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,770 | 0.1 % | 2.8 % |

| 10 Year Gsec India | 7.0 | 0.2 % | (1.9) % |

| WTI Crude (USD/bbl) | 78 | (1.4) % | 10.8 % |

| Gold (INR/10g) | 65,777 | (0.1) % | 1.7 % |

| USD/INR | 82.75 | (0.1) % | (0.4) % |

Please visit www.fisdom.com for a standard disclaimer