Heatmap: High Frequency Macroeconomic Indicators – A journey towards green

Source: CMIE

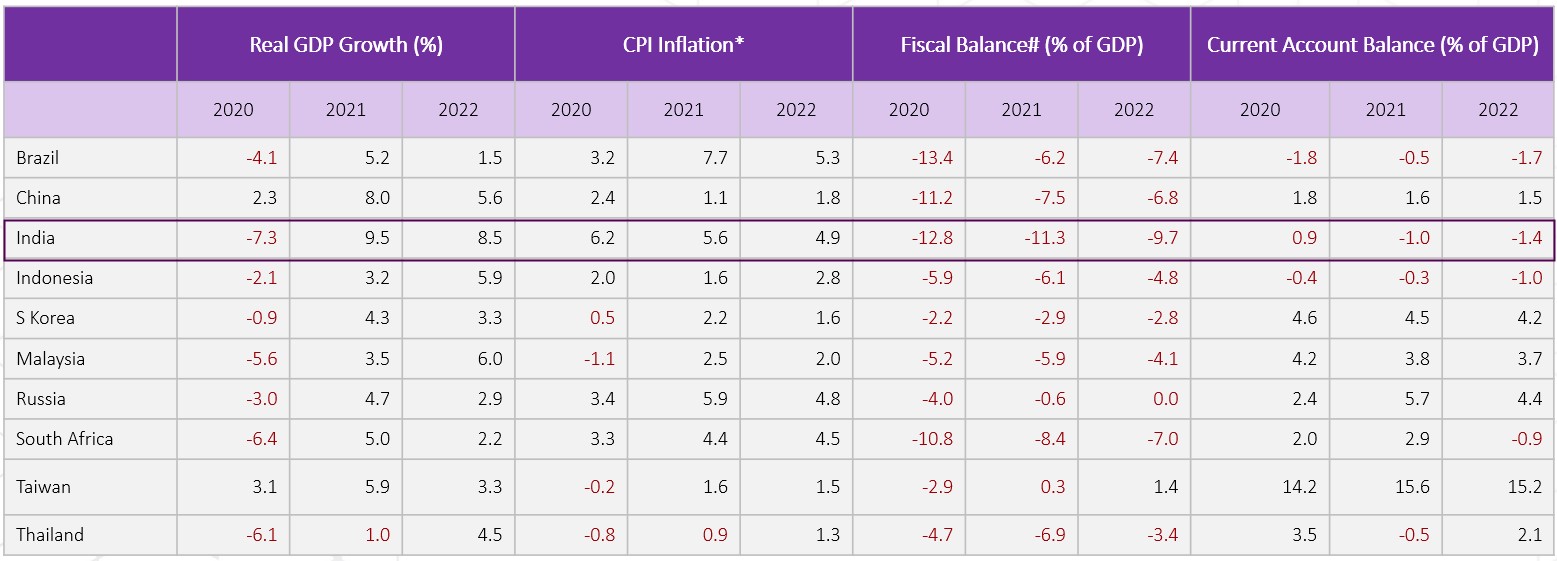

IMF Projected India To Grow At The Fastest Pace In 2021 & 2022 vs. Key Emerging Economies

- Following a sharp contraction in GDP last year, growth is expected to rebound to 9.5 percent this year and 8.5 percent in FY2022/23.

- The recovery in consumption and investment is expected to be gradual given the second wave and concerns about a third wave, and the need to further strengthen the financial sector. Uncertainty about the economic outlook remains elevated, with pandemic-related uncertainties contributing to both downside and upside risks

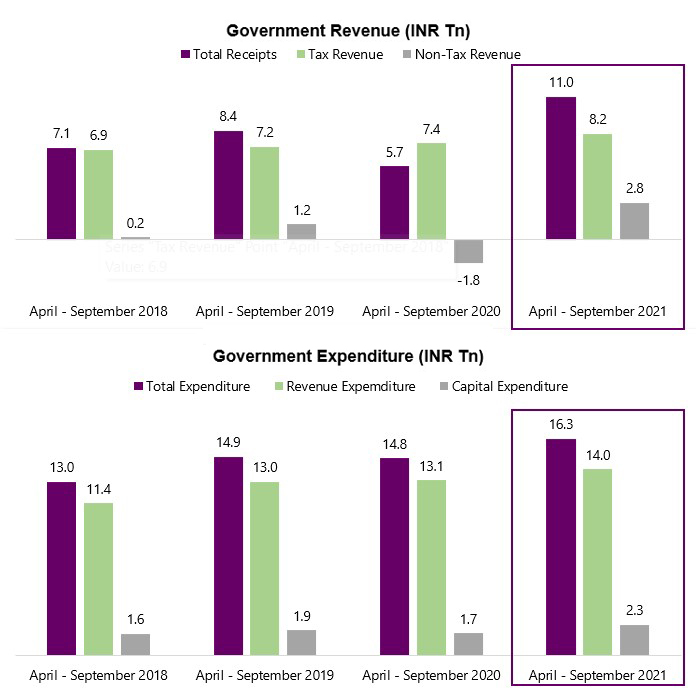

The First Six Months Of The Fiscal Recorded Healthy Accounts For The Administration

- The government’s total receipts for the first six months of this fiscal stand at INR.11.0 trillion, almost 2x of last year’s level, while registering a growth of 93% absolute growth compared to receipts of the first six months FY20.

- The revival in revenues and almost flat expenditure for the first six months of the fiscal year lends appreciable headroom for the government to take up much-needed capital expenditures during the rest of the fiscal year.

- Despite having garnered enough receipts, the government went slow on expenditure during the first half of 2021-22. It spent Rs.16.3 trillion, which was only 46.7 per cent of the expenditure it had budgeted for the entire fiscal year. A bulk of the expenditure was revenue expenditure, which grew year-on-year by 6.3 per cent to nearly Rs.14 trillion. This is 47.7 per cent of the revenue expenditure it has budgeted for the fiscal year 2021-22.

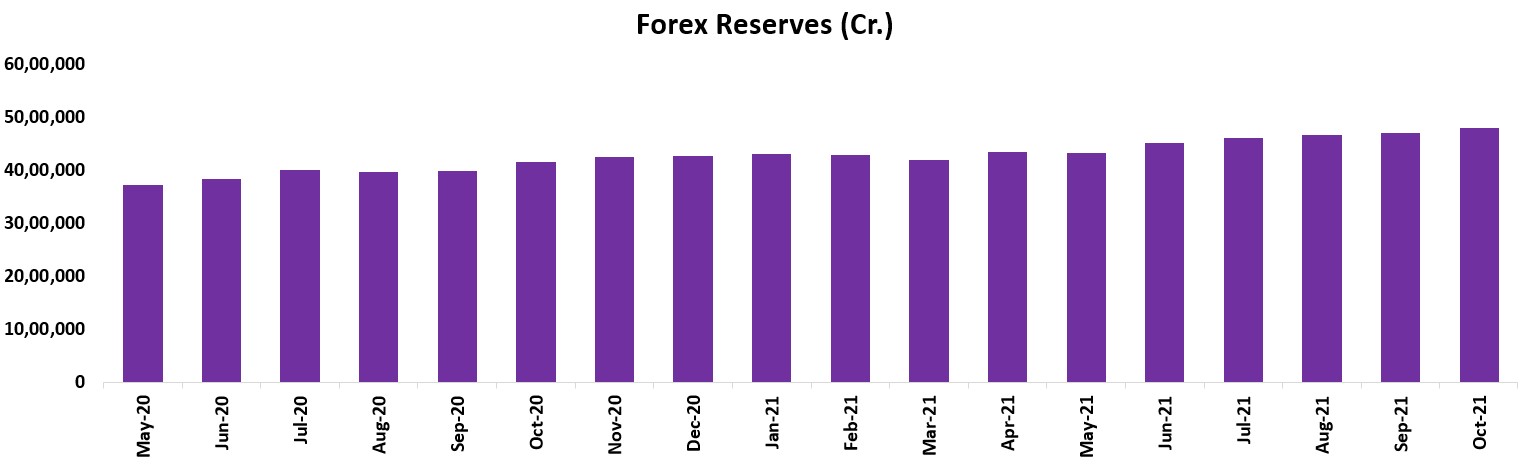

Forex Reserves Surged To A Lifetime High

- India’s forex reserves went up to 40tn in October’21 from 37 tn in May’20. Gold Reserves & SDR were also went up to ~2 tn & ~1tn this month.

- Foreign currency assets, a significant component of the overall reserve, went up. It serves as a critical cushion in an economic crisis and now stands to offer import bill coverage for almost a year at the current run rate. FCA includes the effect of appreciation or depreciation of non-US units like the euro, pound, and yen held in the foreign exchange reserves.