Technical Overview – Nifty 50

Just around 25,000, the NIFTY 50 marked a new all-time high. The benchmark index had a tumultuous session on July 29 and ended the day flat with a positive bias, creating a DOJI candlestick pattern on the daily chart. The benchmark index has retested the 20-DEMA, and on each decline, buying from bulls appears imminent. In the upcoming weeks, 25,200, and 25,500 can be observed if the benchmark index maintains above 24,800 levels.

The fact that the RSI (14) momentum indicator took support at the 60 mark and had a hidden positive divergence gave confirmation of upside continuation. On the weekly and daily charts, the index is still moving higher above the important moving average (EMA), suggesting that the upward momentum is still in place. The MACD is still above the polarity and positive for the benchmark index.

Based on benchmark index OI data, a base formation may take place at the 24,500 level, where put writing is almost 61 lakhs. At 25,000, call writing is almost close to 92 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.91.

The view remains buy on dips. The support levels for the upcoming sessions are at 24,700 and 24,600 and resistance at 24,900 and 25,000, respectively.

Technical Overview – Bank Nifty

The banking index saw a somewhat volatile day. It began the day with a fairly optimistic surge, but following a strong profit-booking period, the index fell by 1200 points. On July 29, the banking index closed unchanged, creating an inverted hammer candlestick on the daily chart.

The RSI (14) momentum indicator took support near the 41 mark, acting as a base. The banking index still appears to be under pressure, as evidenced by the closing below both the 10 and 20 DEMAs, which provided support for the index. Though a bullish momentum in a short time frame, 10 DEMA has crossed under 20 DEMA indicating sell on rise market. A negative crossover of the MACD over the daily chart indicates a lagging upward trend.

Based on benchmark index OI data, a base formation may take place at the 51,500 level, where put writing is close to 24 lakhs. At 52,000, call writing is almost close to 35 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.71.

The resistance and support levels for the upcoming sessions are 51,600, and 52,000 for resistance, and 50,950, and 50,450 for support.

Indian markets:

- Markets began the trading week on a strong note, continuing the previous session’s record run on July 29. Benchmark indices reached new all-time highs, driven by banking stocks following robust earnings reported over the weekend.

- Buoyed by strong global cues, the Indian indices opened at fresh record highs and extended gains in the first half. However, they erased all gains in the second half, ending with little change from the previous close.

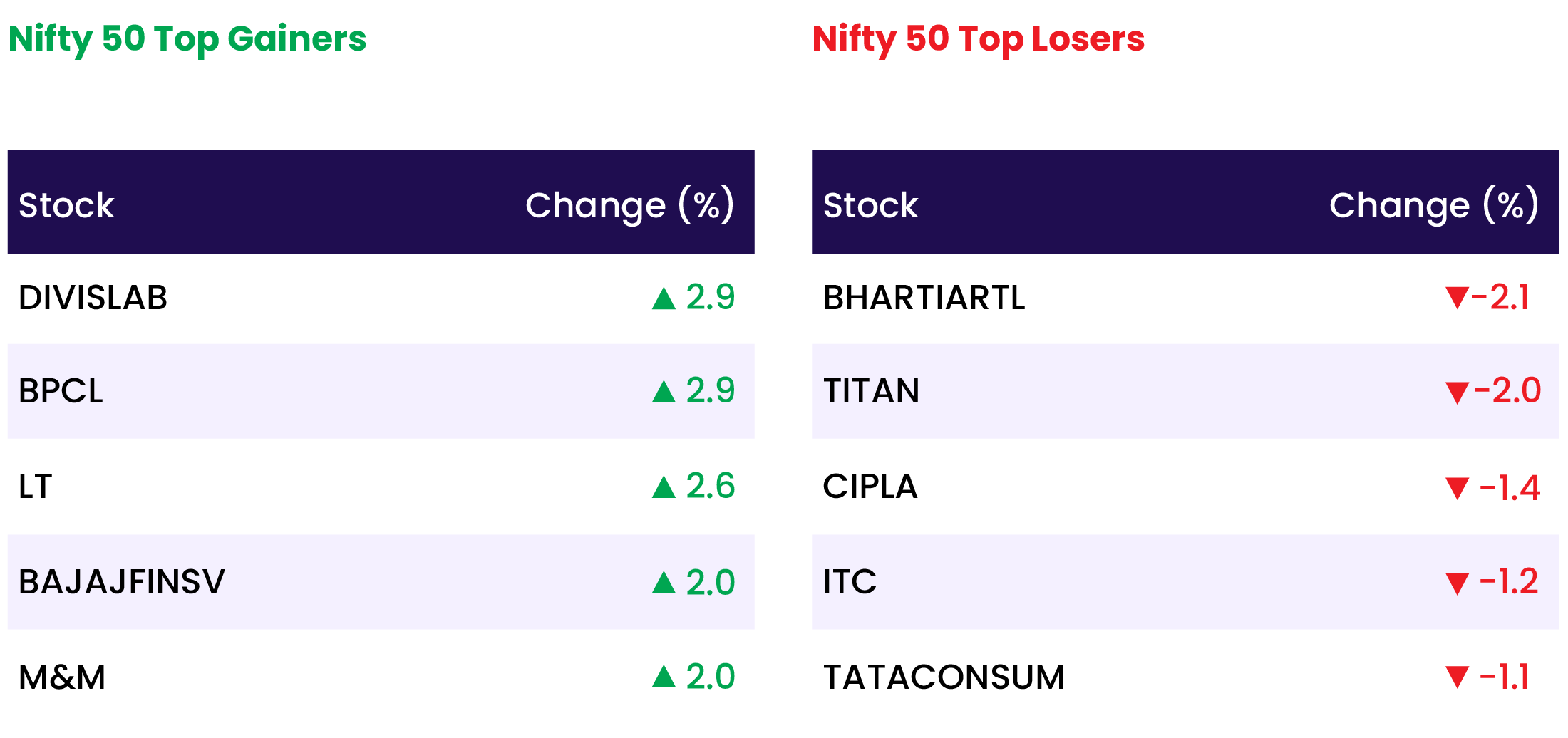

- Sectorally, IT, FMCG, and telecom declined by 0.4 percent each, while auto, banking, media, capital goods, oil & gas, power, and realty sectors rose between 0.5 and 2.5 percent.

- The BSE midcap index rose nearly 1 percent, and the smallcap index added 1.2 percent.

Global Markets:

- Asia-Pacific markets climbed on Monday, with Japan’s Nikkei 225 leading the gains in the region after a key U.S. inflation report late Friday raised hopes for an interest rate cut.

- Hong Kong’s Hang Seng index was up 1.64% as of its final hour of trade, but mainland China’s CSI 300 bucked the trend, falling 0.54% to 3,390.74, dragged down by real estate stocks.

- South Korea’s Kospi rose 1.23% to end at 2,765.53, while the small-cap Kosdaq gained 1.31% to finish at 807.99.

- Australia’s S&P/ASX 200 increased by 0.86%, closing at 7,989.6. On Friday in the U.S., the Dow Jones Industrial Average rallied 1.64%, the S&P 500 climbed 1.11%, and the Nasdaq Composite gained 1.03%.

Stocks in Spotlight

- Shares of RITES soared more than 14 percent after the railway-linked state-run company announced that it will hold a board meeting on July 31 to consider a bonus issue of shares.

- Larsen & Toubro shares rose nearly 3 percent, emerging as one of the top gainers on the Nifty 50, after the company’s Power Transmission and Distribution (PT&D) business secured large orders both domestically and internationally to build grid elements. L&T classifies orders between Rs 2,500 crore and Rs 5,000 crore as ‘large’.

- Shares of KEC International rose over 3 percent in early trade following the company’s robust fiscal first-quarter earnings. The electric transmission tower manufacturer reported a net profit of Rs 87.6 crore for the quarter ending in June, more than doubling from Rs 42 crore a year ago.

News from the IPO world🌐

- Ola Electric to launch $734 million IPO, investors eye bids at lower valuation

- FirstCry set to file final papers for $3-3.5 billion IPO

- Insurer Niva Bupa plans $360 million IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 2.3 |

| NIFTY MEDIA | 1.8 |

| NIFTY REALTY | 1.4 |

| NIFTY OIL & GAS | 1.0 |

| NIFTY AUTO | 0.7 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2348 |

| Decline | 1706 |

| Unchanged | 144 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 40,589 | 1.6 % | 7.6 % |

| 10 Year Gsec India | 7.0 | 1.4 % | 5.5 % |

| WTI Crude (USD/bbl) | 78 | 0.9 % | 11.2 % |

| Gold (INR/10g) | 68,470 | 0.4 % | 1.9 % |

| USD/INR | 83.74 | 0.0 % | 0.8 % |

Please visit www.fisdom.com for a standard disclaimer