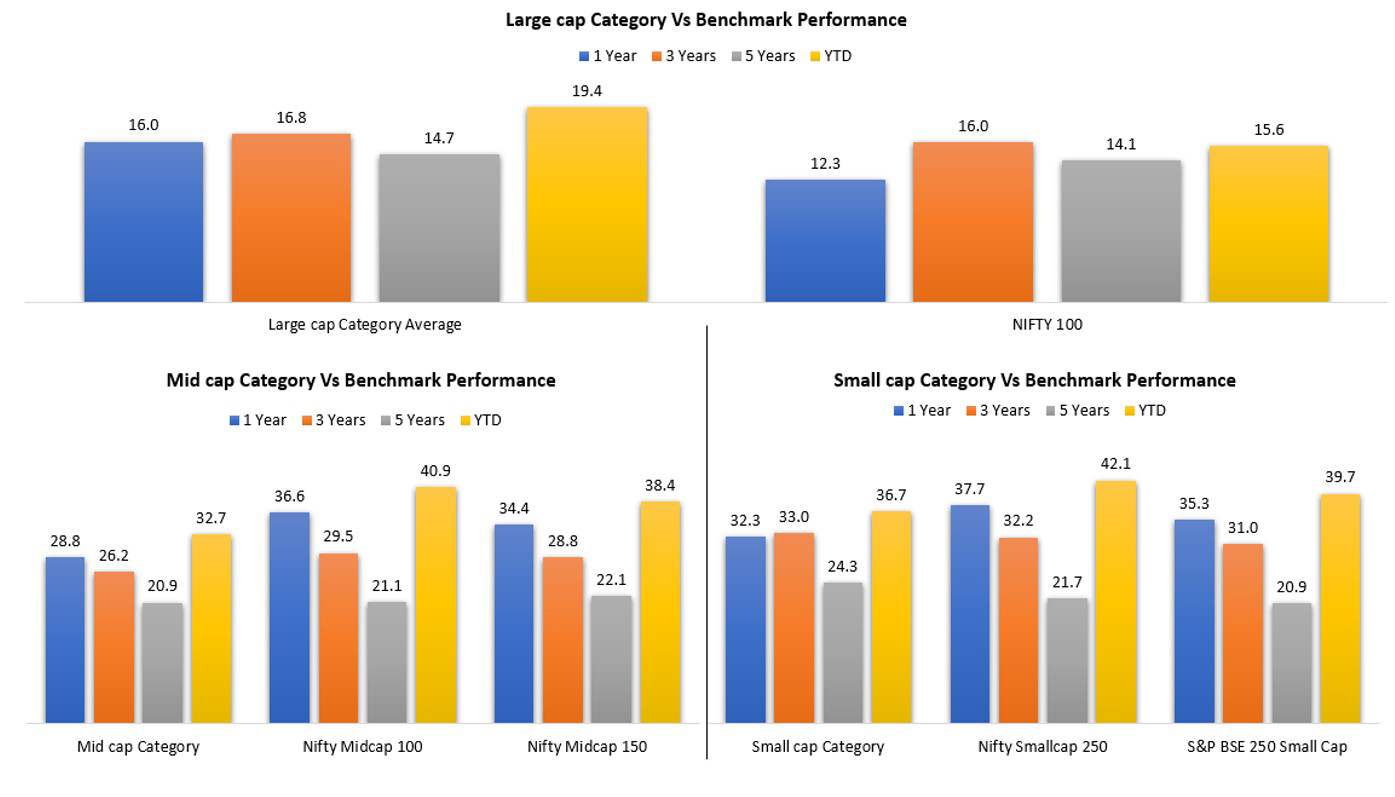

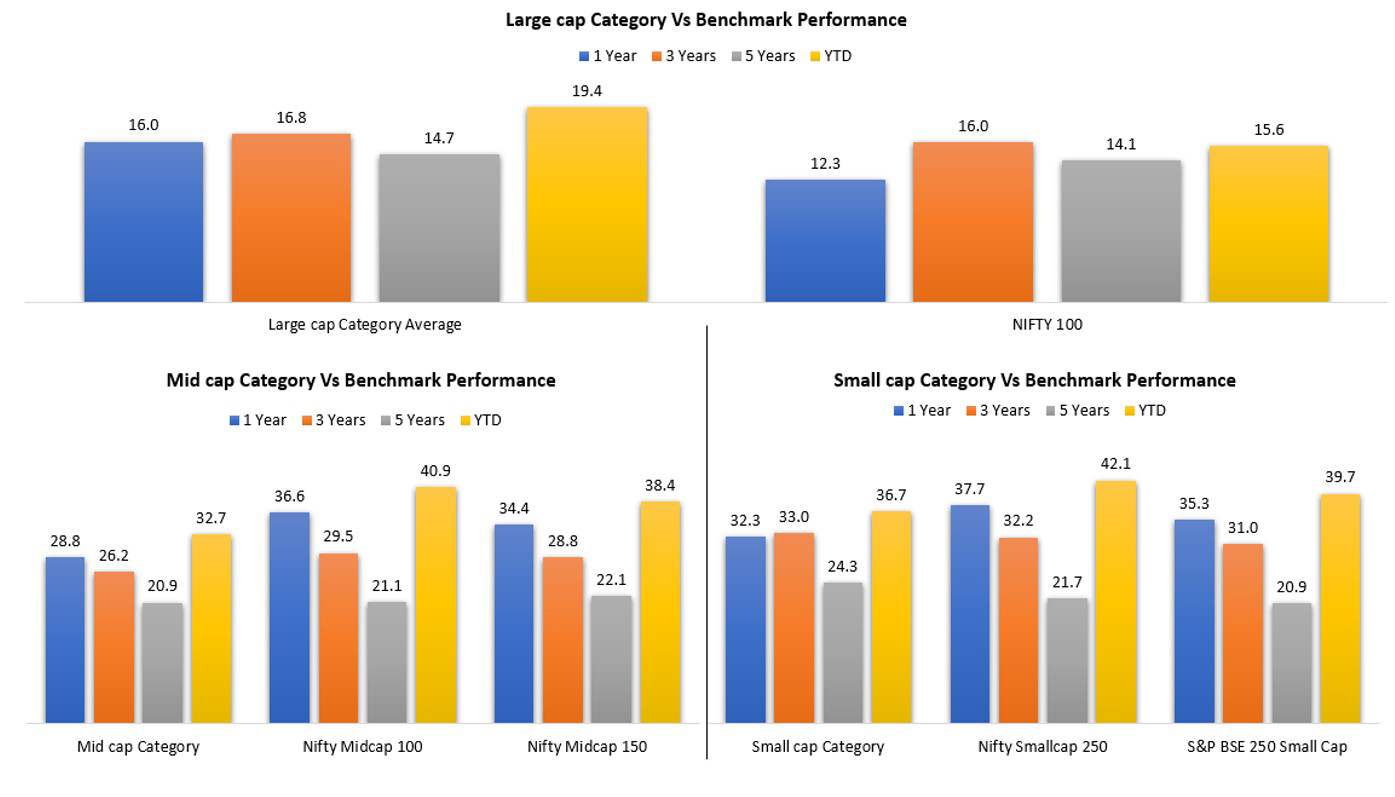

The mid and small-cap segments of the Indian stock market have witnessed a remarkable rally in 2023, with the Nifty Midcap 150 and Nifty Smallcap 250 indices surging by nearly 38 percent and 42 percent, respectively. This is in contrast to the 16 percent rise in the benchmark Nifty index. The upward trend continued in November, with the Nifty Midcap index rising by 10 percent and the small-cap index by 12 percent, while the Nifty gained just 5.5 percent. The favorable valuations of these stocks and rising investor interest have been attributed to the strong recovery of mid and smallcaps from their earlier correction. However, experts suggest that investors should exercise caution before making significant investments in these stocks, considering their current valuations.

|

Data as on 9th December 2023. Source: Fidsom Research |

|

Despite large caps delivering lower returns, the overall category has outperformed the Nifty 100 index, whereas the Small-cap category has either shown returns at par with the benchmark or midcap has clearly underperformed the benchmarks across time frames.

One of the key reasons for this situation is that small-cap funds have a limit on how much money they can deploy at any time due to liquidity constraints in this smaller scale companies.

When money comes faster than it can be deployed, funds either experience a shift in their style, run higher cash positions, or build more extended tail portfolios. Several small-cap funds have even ventured into names beyond the 500th stock by market capitalisation, the predefined cut-off for these funds. This has led to dispersion in returns, making it difficult for small-cap funds to beat the index.

However, the underperformance of mid-cap and small-cap funds against their benchmarks does not imply poor investment choices. In fact, they have delivered alpha over other categories. The small-cap universe is much larger, and there is still a lot of information asymmetry in this space that quality active fund managers can exploit to outperform the index.

Here are a few more factors that warrant a relook at your small and midcap portfolios at this point of times:

As of October 2023, small-cap category has done well, drawing in over Rs 26,547 crore, while large-cap funds have witnessed a net outflow of Rs 4,975 crore. In fact, nearly 60-65 per cent of mutual fund net flows are in small, mid and small/mid heavy fund categories for the financial year 2022-23 to date. There is an expectation of resumed FPI flows across emerging markets, including India, as the US interest rates ease and the US dollar weakens along with changes in domestic politics.

This may lead to large-cap outperformance in the times to come. Due to the preference of FIIs to allocate funds to larger companies with deep liquidity, large-cap can remain in focus if FII flow drives the next wave of the market rally. Although there has been a meaningful price correction in Indian equities across market caps and sectors, mid and small-cap stocks have seen relatively small price corrections compared to the rally they have witnessed in recent months.

It is an excellent time to review your overall allocation to small and midcaps from a pure equity portfolio standpoint. If you think the mid and small-caps exposure has exceeded their original allocation, investors must trim that exposure and reallocate those funds to large caps for less volatility.

|

Market this week | | 04th Dec 2023 (Open) | 8th Dec 2023 (Close) | %Change | | Nifty 50 | ₹ 20,602 | ₹ 20,969 | 1.80% | | Sensex | ₹ 68,435 | ₹ 69,826 | 2.00% |

Source: BSE and NSE |

- Indian markets experienced their most significant weekly gain since July 2022, buoyed by positive global and domestic cues.

- Despite hitting a fresh record low of 83.58 against the US dollar, the Indian rupee closed the week at 83.39, losing 10 paise compared to the previous week’s closure at 83.29.

- Foreign Institutional Investors (FIIs) displayed strong support, purchasing equities worth Rs 9,285.11 crore during the week. Meanwhile, Domestic Institutional Investors (DIIs) also contributed, buying equities worth Rs 4,326.47 crore.

|

|

Weekly Leaderboard:

NSE Top Gainers | Stock | Change (%) | | Adani Ports & SEZ | ▲ 23.57% | | Adani Enterprises |

▲ 19.45% | | Power Grid Corporation |

▲ 8.75% | | SBI | ▲ 7.42% | | BPCL | ▲ 7.41% |

| NSE Top Losers | Stock | Change % | | Divis Lab | ▼ 2.93% | | HUL | ▼ 1.61% | | HDC Life Ins | ▼ 1.60% | | Bharti airtel | ▼ 1.41% | | Hero Motocorp | ▼ 1.18% |

|

Source: BSE |

Stocks that made the news this week:

- Network18 Media & Investments witnessed an 8% drop, while TV18 Broadcast fell 7% following Network18’s announcement of its board’s approval for the amalgamation of e-Eighteen.com and TV18 Broadcast with itself. As per the proposed terms, shareholders of TV18 Broadcast are slated to receive 100 shares of Network18 for every 172 shares held, while E18 shareholders will get 19 shares of Network18 for each E18 share held. This development spurred market reactions, leading to declines in the respective stock prices of Network18 Media & Investments and TV18 Broadcast.

- Adani Green Energy’s stock gained 20 percent and got locked in the upper circuit after the company announced that it secured an additional $1.36 billion in funding via a senior debt facility. The renewable energy company plans to use the funds to finance its under-construction renewable assets. The announcement was well-received by investors, who are optimistic about the company’s growth prospects in the renewable energy sector.

- The Bajaj Group recently joined the prestigious league of business houses surpassing the Rs 10-lakh-crore market cap milestone, marking its place alongside other giants like Tata Group, Mukesh Ambani Group, HDFC Bank, and Adani Group. The conglomerate comprises five listed companies associated with the late Rahul Bajaj Group, each showcasing diverse performances. Bajaj Finserv and Bajaj Finance, under Sanjiv Bajaj’s leadership, stand alongside Bajaj Auto, helmed by Rajiv Bajaj. Notably, Bajaj Auto experienced notable growth post the launch of the Triumph Bike earlier this year, driving an uptick in its shares. CEO Rajiv Bajaj unveiled ambitious targets, aiming for a monthly sales figure of 10,000 units for Bajaj Triumphs, with expectations of production and sales surging to 18,000 units in the third quarter of this fiscal year. Additionally, Maharashtra Scooters operates as a subsidiary of Bajaj Holdings & Investment within this conglomerate.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|