In an era where the secondary markets continue to scale new heights, there’s a similar kind of buzz resonating from the primary markets through IPOs. The year 2023 has ushered in remarkable success for the Indian IPO market, as companies eagerly seize the opportunity to capitalize on the record-breaking rally on Dalal Street. With 62 out of 72 IPOs trading above their issue prices, the bullish undercurrent of the secondary market is undeniable.

|

| Particulars | 2023-YTD | CY 2022 | CY 2021 | | Total IPOs | 72 | 90 | 91 | | No. of Mainboard IPOs | 28 | 38 | 64 | | No. of SME IPOs | 44 | 52 | 27 | | Money Raised by mainboard IPOs | ₹ 20,760 | ₹ 39,300 | ₹ 1,20,182 | |

Source: BSE India, Fisdom Research, Data as on 23rd September 2023 |

Factors behind the Latest IPO Frenzy: The boom in the IPO market could be attributed to investors’ faith in India’s robust macroeconomic outlook and healthy corporate earnings, which have given a strong push to the mid and small-cap space. Here are some key factors driving this resurgence:

Heightened Investor Interest and Dalal Street’s Strong Performance: The resurgence in IPO enthusiasm in 2023 can be attributed to increased investor appetite an d Dalal Street’s record run.

Main Market IPOs Up 50% in Q2 2023: Compared to Q1, the second quarter of 2023 witnessed a 50% surge in main market IPOs, with a strong IPO pipeline indicating sustained interest.

India Leads Globally in IPO Count: According to an EY report in August, India leads the world in IPO count and ranks eighth in issue proceeds in 2023, with no cross-border deals.

Optimism Amid Global Instability: Despite global instability, benchmark indices have gained over 8%, boosting optimism for domestic market performance and new IPOs.

|

What Should Investors Do?

Beware of Overvalued IPOs: While the IPO market is exceeding expectations, analysts are cautious about the frenzy. Lessons from previous IPOs like Paytm, Zomato, and Nykaa in 2021, which saw steep losses after unjustified valuations, serve as a reminder of the risks involved.

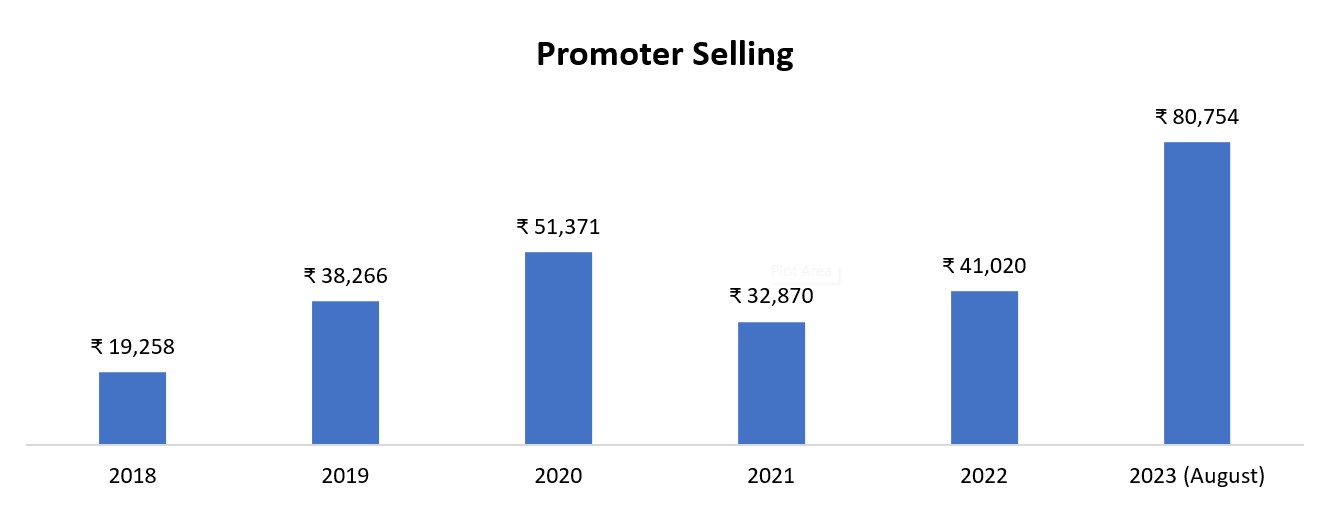

Promoter Selling: Pay attention to promoter and insider activity. Promoter selling can indicate tough times ahead or that the stock has run ahead of its fundamentals. Be cautious when promoters cash out, but also consider the context.

|

|

Figure 1Source: Moneycontrol, Fisdom Research

Focus on Quality: Emphasize assessing IPO quality, issue price, and valuation. Global market weakness, high inflation, and geopolitical tensions may affect future IPOs. Choose fundamentally strong IPOs with reasonable pricing and a clear business roadmap.

Avoid Relying on Grey Market Data: The IPO grey market provides unofficial indications of listing prices and can be volatile. However, investors should not base their investment decisions solely on grey market quotations.

while the surge in IPO activity is undoubtedly encouraging, market dynamics are unpredictable. It is suggested to investors to adopt a long-term perspective, focusing on a company’s true fundamentals rather than short-term valuations. As India’s IPO market continues to flourish, informed and prudent investing remains key to navigating this exciting yet dynamic landscape.

|

Markets this week | | 28th Aug 2023 (Open) | 01st Sep 2023 (Close) | %Change | | Nifty 50 | ₹ 19,525 | ₹ 19,820 | 1.50% | | Sensex | ₹ 65,525 | ₹ 66,599 | 1.60% |

Source: BSE and NSE

|

- Market experienced pressure in the week ending September 22, despite hitting record highs the previous week.

- The selling trend affected most sectors as investors expressed concerns about various factors.

- The hawkish stance of the US Federal Reserve, along with rising US treasury yields and increasing crude oil prices, contributed to investor unease.

- Continuous selling by foreign institutional investors (FIIs) persisted for the ninth consecutive week.

- FIIs were net sellers, offloading equities worth Rs 8,681.30 crore during the week.

- In contrast, domestic institutional investors (DIIs) showed a buying trend, purchasing shares worth Rs 1,938.94 crore in the same week.

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | Power Grid Corporation | ▲ 2.60% | | Asian Paints Ltd | ▲ 2.45 % | | Coal India | ▲ 1.45 % | | Titan Company | ▲ 0.80 % | | NTPC | ▲ 0.74 % |

| NSE Top Losers | Stock | Change % | | HDFC Bank | ▼ (7.95) % | | Ultratech Cement | ▼ (6.20) % | | Dr Reddys Lab | ▼ (5.20) % | | Wipro | ▼ (5.11) % | | JSW Steel | ▼ (4.77) % |

|

Source: NSE |

Stocks that made the news this week:

- HCLTech announced a significant deal with ANZ, one of Australia’s largest banks and the largest banking group in New Zealand and the Pacific. The deal involves the transformation of ANZ’s digital employee experience across 33 countries. HCLTech will deliver digital workplace services and experience management, encompassing end user devices and applications like laptops, mobile phones, and tablets. The partnership will leverage cutting-edge technologies such as extended reality, GenAI, and IoT-powered workspaces to create experiential, sustainable, and inclusive workplaces.

- Concord Biotech witnessed a 3 percent increase in its shares as Kotak Institutional Equities and Antique Broking initiated coverage with a positive outlook. Kotak Institutional Equities, in particular, anticipates a 15 percent upside potential from the current price levels, citing robust discounted cash flows and the company’s expertise in the high entry barrier fermentation active pharmaceutical ingredients (API) segment. They have assigned an ‘add’ rating to the company’s stock.

- JSW Infrastructure, owned by Sajjan Jindal, successfully raised Rs 1,260 crore from 65 anchor investors on September 22, a day prior to the issue’s opening. Notable global investors like the Government of Singapore, Monetary Authority of Singapore, Morgan Stanley, and others, along with prominent domestic investors, participated in the diversified maritime ports company’s anchor book.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|