Technical Overview – Nifty 50

Following a sideways to gap-down opening, the Benchmark index faced intense selling pressure, pushing it below the 21,900 mark in the first half of trading. However, buying interest surfaced at lower levels, contributing to a V-shaped recovery on the intraday chart.

The Index has formed a hammer candle stick pattern which indices a reversal from the lower levels. Today’s trade was a bear trip for the traders and prices eventually revered and moved above 22,100 levels.

The Momentum oscillator RSI (14) hovers near 60 levels with a bullish crossover on the cards. The MACD indicator is reading above its polarity levels on the daily time frame.

The India VIX drifted 3 percent but has sustained above 14 which will keep a volatility factor alive. The immediate support for the Nifty is placed at 22,000 and the immediate resistance is capped below 22,300 levels.

Technical Overview – Bank Nifty

Following a sideways to gap-down opening, the Banking index faced intense selling pressure, pushing it below the 46,500 mark in the first half of trading. However, buying interest surfaced at lower levels, contributing to a V-shaped recovery on the intraday chart.

The Bank Nifty has completed its retest near the breakout levels and formed a hammer-like formation on the daily chart. The Bank Nifty on the daily chart has witnessed a bullish golden crossover where 9 EMA and crossed above 21 EMA indicating a bullish momentum in the index.

The India VIX drifted 3 percent but has sustained above 14 which will keep a volatility factor alive. The immediate support for the Bank Nifty is placed at 46,500 and the immediate resistance is capped below 47,400 levels.

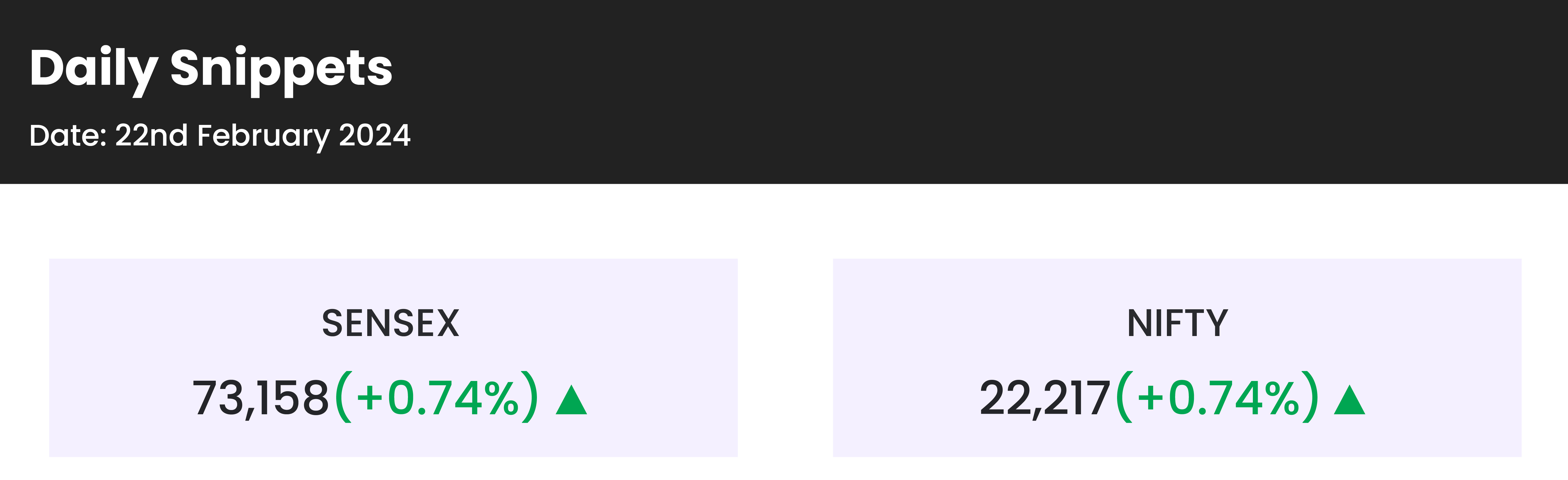

Indian markets:

- In a highly volatile session, benchmark indices managed to erase all previous session losses.

- Nifty reached a fresh all-time high of 22,252.50, driven by buying across sectors.

- However, Mid and Smallcaps remained subdued initially, pulling the overall market lower in the opening trade.

- As the day progressed, the indices gradually recovered their losses.

- By the end of the session, a strong comeback was observed across the board.

- This propelled the Index to close higher at 22,217.45, marking a gain of 162.40 points.

Global Markets:

- Japanese stocks have surged to reclaim a historic peak reached over three decades ago, buoyed by investor confidence in the country’s escape from deflation and its path to sustainable growth.

- The Nikkei 225’s remarkable rally over the past year highlights Japan’s equity market recovery, positioning it as a top choice among global funds, despite being overshadowed by faster-growing markets like China.

- European markets showed strength on Thursday, anticipating a busy day of earnings and data releases in the region.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Shares of rice milling companies such as LT Foods, KRBL, and Chaman Lal Setia Exports experienced a decline of up to 4 percent. This downturn followed the government’s decision to extend the 20 percent export levy on parboiled rice beyond March 31. Year-to-date, LT Foods and KRBL have seen declines of 7-8 percent, while Chaman Lal Setia recorded a modest gain of 0.5 percent. This performance contrasts with the benchmark Sensex, which remained flat-to-negative over the same period.

- Devyani International Limited saw a nearly 3 percent decline in morning trade, dropping to Rs 162.50 and breaking its four-day gaining streak on the bourses. Stock exchange data revealed that Nippon India Mutual Fund acquired 80 lakh shares, representing a 0.66 percent stake, at an average price of Rs 164. This move follows Yum Restaurant India Private Ltd’s divestment of its entire 4.4 percent stake in the KFC operator, resulting in a transaction valued at Rs 871 crore.

- ABB India experienced a significant surge of almost 8 percent in morning trading, reaching a fresh all-time high of Rs 5,373.80 on the NSE. The stock’s upward momentum has been fueled by positive market sentiment following the announcement of strong financial results by the large-cap technology firm earlier in the week. The sharp rally is further supported by ‘buy’ ratings and raised target prices provided by multiple brokerages, contributing to the bullish sentiment surrounding the stock.

News from the IPO world🌐

- IPO bound Ola Electric slashes prices of e-scooters by up to Rs. 25000

- Hyundai seeks expansion higher valuation with India IPO

- Platinum Industries sets Rs. 162-171 price band for IPO

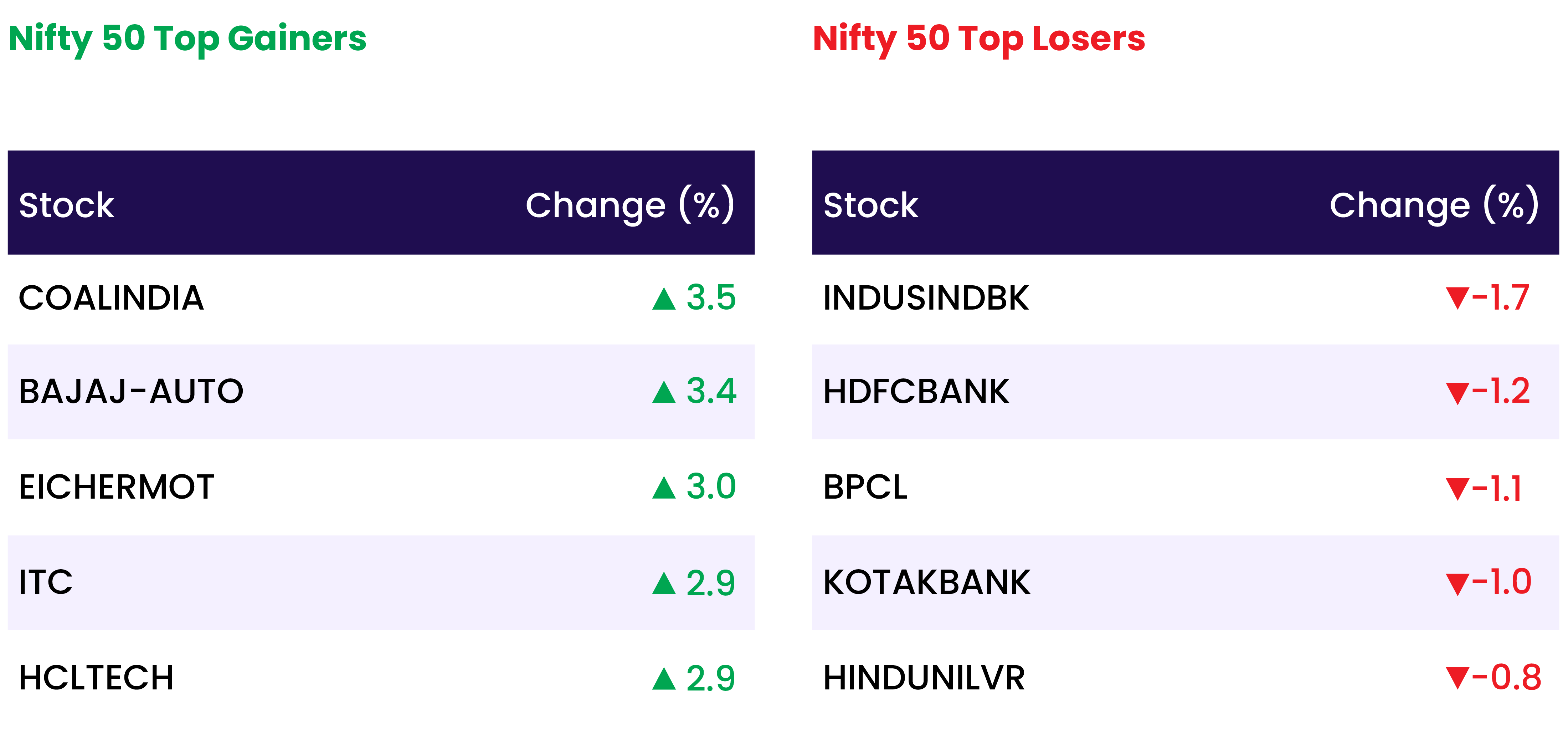

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY IT | 1.9 |

| NIFTY AUTO | 1.6 |

| NIFTY METAL | 1.2 |

| NIFTY MEDIA | 1.0 |

| NIFTY FMCG | 1.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2076 |

| Decline | 1743 |

| Unchanged | 114 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,612 | 0.1 % | 1.7 % |

| 10 Year Gsec India | 7.0 | (0.2) % | (1.8) % |

| WTI Crude (USD/bbl) | 78 | (0.4) % | 8.2 % |

| Gold (INR/10g) | 61,736 | (0.1) % | (1.4) % |

| USD/INR | 82.9 | 0.0 % | (0.4) % |

Please visit www.fisdom.com for a standard disclaimer