Dear Investors,

As we move through 2025, we would like to take a moment to update you on the evolving market landscape, key trends shaping our investment outlook, and how we are positioning ourselves in response.

Market Recovery in Motion

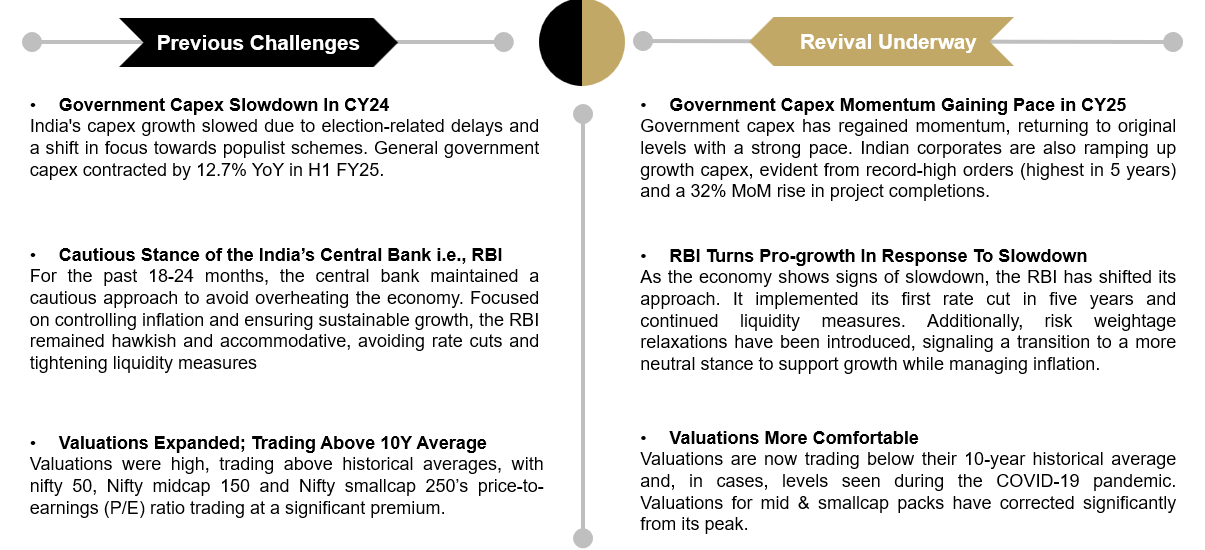

While the past year posed challenges—including a slowdown in government capex, cautious monetary policy, and valuation corrections—the underlying trends now indicate a structural revival is underway.

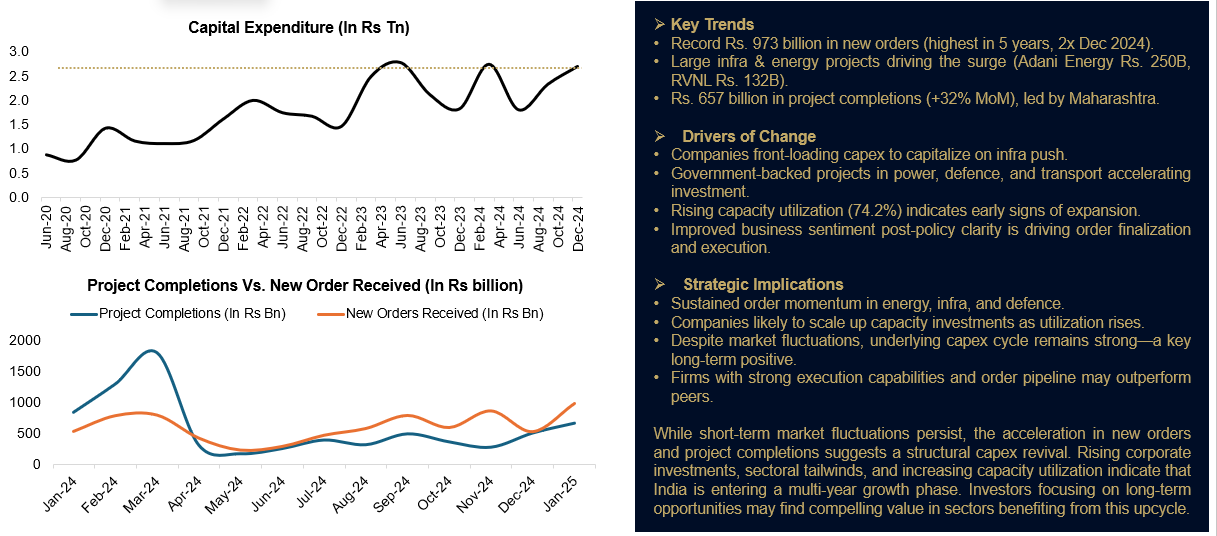

i.Government Capex Rebounds: After a slowdown in CY24 due to election-related delays, government capex is accelerating, with a record ₹973 billion in new orders (highest in 5 years). This resurgence, led by infrastructure and energy, signals strong long-term investment cycles.

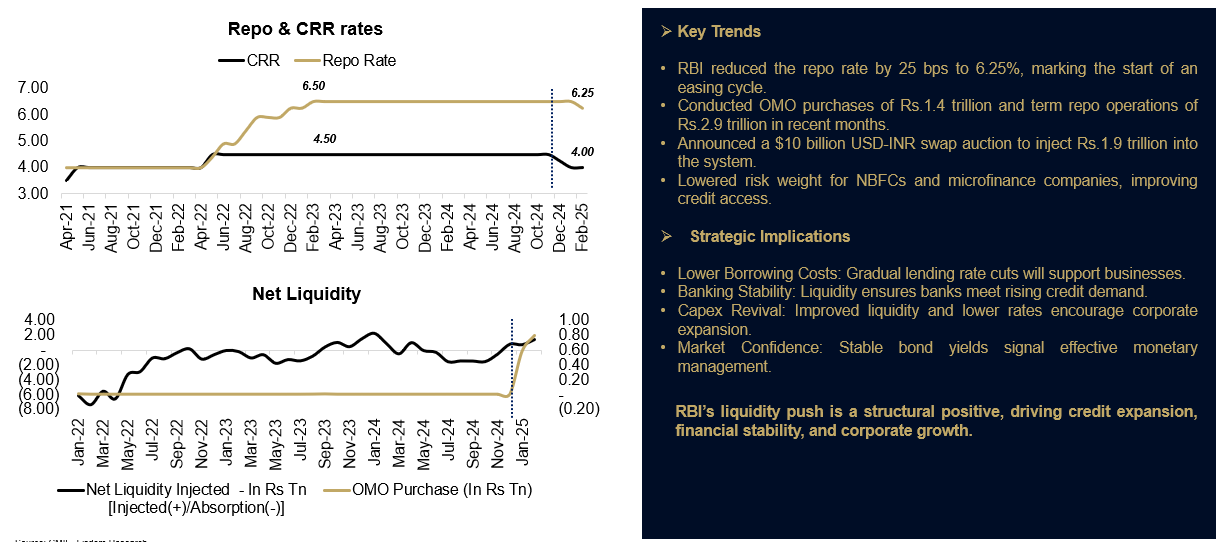

ii. Monetary Policy Pivot: The RBI has shifted towards a pro-growth stance, cutting the repo rate for the first time in five years and introducing liquidity measures. This move supports lower borrowing costs, improved credit access, and stronger corporate expansion.

iii . Market Sentiment & Valuations: Valuations, which were trading above their 10-year averages, have now corrected significantly, offering attractive long-term entry points. The Nifty 50 P/E and P/B ratios are near historical lows, resembling levels seen during the COVID-19 correction—historically an opportunity for long-term investors. Small and midcap segments, which saw sharp corrections, are now better valued, though quality remains key.

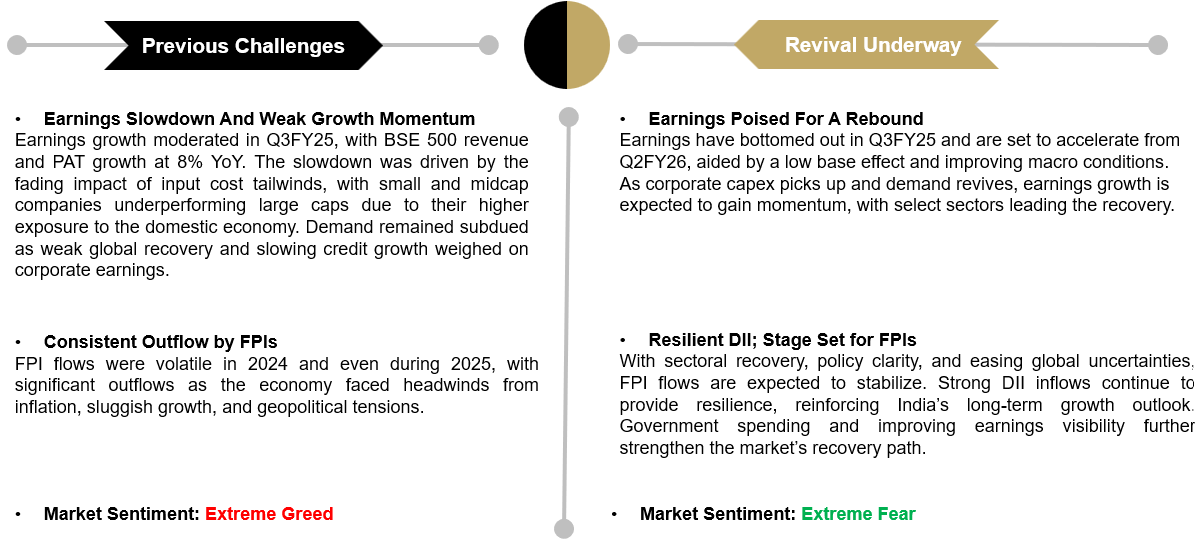

iv. Earnings & Market Sentiment Outlook: Earnings Rebound Expected: Corporate earnings bottomed out in Q3FY25 and are projected to recover from Q2FY26, aided by a low base effect and stronger macro tailwinds. FPI Flows to Stabilize: While FPI outflows have been persistent, historical trends show strong rebounds post-global crises. Domestic investors (DII & MFs) continue to provide resilience, with DII inflows exceeding ₹5.7 trillion in FY25, offsetting FII selling pressure.

Strategic Positioning & Investor Takeaways

Despite short-term volatility, the Indian economy remains on a multi-year growth trajectory, driven by:

I. Government-led infra push and record-high corporate capex.

ii. Supportive monetary policy fostering growth-friendly liquidity.

iii. Attractive valuations, presenting an opportunity for staggered investments over the next 3-6 months.

To briefly touch the risks posed by Trump’s tariff talks, India is relatively insulated from potential tariff hikes due to its lower trade deficit with the U.S. Unlike export-heavy economies, India’s domestic-driven growth reduces its vulnerability to global trade disruptions. If tariffs rise under new U.S. policies, inflationary pressures may slow global growth, but India’s limited export dependence provides a buffer against major economic risks.

Historically, markets bottom out when sentiment is at extreme fear-as we are witnessing today. While near-term fluctuations persist, staying invested in quality opportunities and sectors benefiting from the capex cycle remains key.

We continue to monitor these developments closely and remain committed to navigating these opportunities with a disciplined, long-term approach.

As always, we appreciate your trust and confidence in our investment philosophy. Should you have any questions or require further insights, please feel free to reach out.

Previous challenges to growth now dissipating (1/2)

Previous challenges to growth now dissipating (2/2)

Acceleration in new orders and project completion suggest a structural capex revival

RBI shifts stance towards liquidity infusion signaling a structural boost for credit growth and economic expansion