Daily Snippets

Date: 19th January 2024 |

|

|

Technical Overview – Nifty 50 |

|

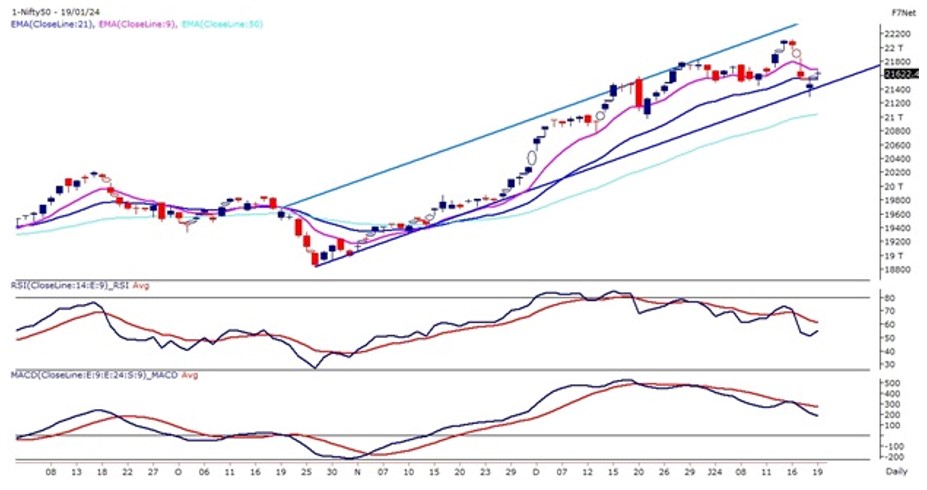

After three consecutive days of selling the Benchmark index witnessed a gap-up opening and traded near 21,600 levels most of the time. The Index on the daily chart has left its gap unfilled and will act as immediate support for the Index.

The Nifty50 on the daily chart is trading in a rising channel pattern and the index has taken support near the lower band of the pattern. The momentum oscillator RSI (14) has formed a bearish divergence on the daily chart near 70 levels and oscillator drift below 60 levels with a bearish crossover on the cards.

The Nifty has drifted below its 9 EMA and the prices have tilted lower. The immediate support for the index is placed near the lower band of the rising channel pattern at 21,400 – 21,300 levels. The resistance is likely to be capped near 21,850 levels.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty continued to be an underperformer for the day as the Benchmark index moved higher but the Banking index continued to hover below its line of polarity.

On the weekly chart, the index has already lost more than 4 percent and tested its 21 EMA which is placed at 45,700 levels. The Banking index has come closer to refilling its gap created near 45,000 levels. The momentum oscillator RSI (14) is reading in a lower high lower low formation below 40 levels with bearish crossover. The Index has also closed below its 9 & 21 EMA and the averages have sloped lower.

The MACD indicator has given a bearish crossover above its line of polarity. The immediate support for the Bank Nifty stands at 45,300 – 45,000 and resistance is capped below 46,300 – 46,700 levels.

|

Indian markets:

- The domestic benchmark indices rebounded today, breaking a three-day losing streak, supported by positive global cues.

- Auto, metal, and railway stocks were in demand, leading to a more than one percent increase in the broader indices.

- The Nifty50 has regained the 21,600 mark, but its decisiveness is yet to be demonstrated.

- Traders are remaining watchful of corporate earnings and global cues, acknowledging their impact on near-term market movements.

|

Global Markets

- Dow Jones index futures were up 116 points, indicating a strong opening in the US stocks today.

- European shares advanced while Asian stocks traded mixed on Friday, tracking an overnight rise in US stocks.

- Japan’s headline inflation rate fell to 2.6% in December, down from 2.8% in November and hitting its lowest level since June 2022. Japan’s core inflation rates which strip out prices of fresh foods also fell to 2.3% from November’s figure of 2.5%.

- US stocks ended with strong gains on Thursday, as AI optimism drove gains in Nvidia and other chipmakers. Atlanta Fed President Raphael Bostic said he would be open to reducing U.S. interest rates sooner than he had anticipated if inflation fell faster than he expected.

|

Stocks in Spotlight

- Reliance Jio, India’s leading telecom and digital services provider, reported a 12.3% YoY increase in Q3 net profit to Rs 5,208 crore, driven by strong subscriber additions. Revenue rose by 10.3% to Rs 25,368 crore, with 11.2 million users added in the quarter, totaling 470.9 million. EBITDA increased by 12%, and total data traffic on the Jio Network surged 32% to 38.1 exabytes in the December quarter.

- Hindustan Unilever Limited, a consumer goods company, disclosed its fiscal third-quarter results for 2023-24 (Q3FY24), revealing a 17.3% increase in standalone net profit to ₹2,519 crore, as opposed to ₹2,505 crore in the same period the previous year. The company’s revenue for the nine months ending December 31, 2023, amounted to ₹15,473 crore, slightly surpassing the ₹15,456 crore reported in the corresponding period last year.

- Paytm released its Q3FY24 results, revealing a significant 38% increase in revenue to ₹2,850.5 crore, compared to ₹2,062.2 crore in the corresponding period the previous year, according to a regulatory filing. Concurrently, the company reported a reduced consolidated net loss of ₹221 crore, down from ₹392 crore in the previous financial year. It’s noteworthy that Paytm has not reported a net profit since its initial public offering in November 2021.

|

News from the IPO world🌐

- Nova AgriTech IPO price band fixed at Rs 39-41 per share

- Epack Durables was subscribed 37% so far on Friday, the first day

- Capital SFB, Krystal Integrated Services and Vibhor Steel get Sebi nod to launch IPOs

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | ONGC | ▲ 3.6 | | BHARTIARTL | ▲ 3.3 | | NTPC | ▲ 3.2 | | TECHM | ▲ 2.6 | | SBILIFE | ▲ 2.6 |

| Nifty 50 Top Losers | Stock | Change (%) | | INDUSINDBK | ▼ -3.3 | | KOTAKBANK | ▼ -0.9 | | HDFCBANK | ▼ -0.8 | | ADANIENT | ▼ -0.1 | | DIVISLAB | ▼ -0.1 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY OIL & GAS | 1.66 | | NIFTY METAL | 1.35 | | NIFTY FMCG | 1.23 | | NIFTY PSU BANK | 1.15 | | NIFTY AUTO | 1.07 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2450 | | Declines | 1366 | | Unchanged | 96 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,469 | 0.5 % | (0.7) % | | 10 Year Gsec India | 7.2 | 0.40% | 0.50% | | WTI Crude (USD/bbl) | 74 | 2.1 % | 5.3 % | | Gold (INR/10g) | 62,105 | 0.50% | 1.00% | | USD/INR | 83.14 | 0.1 % | 0.1 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|