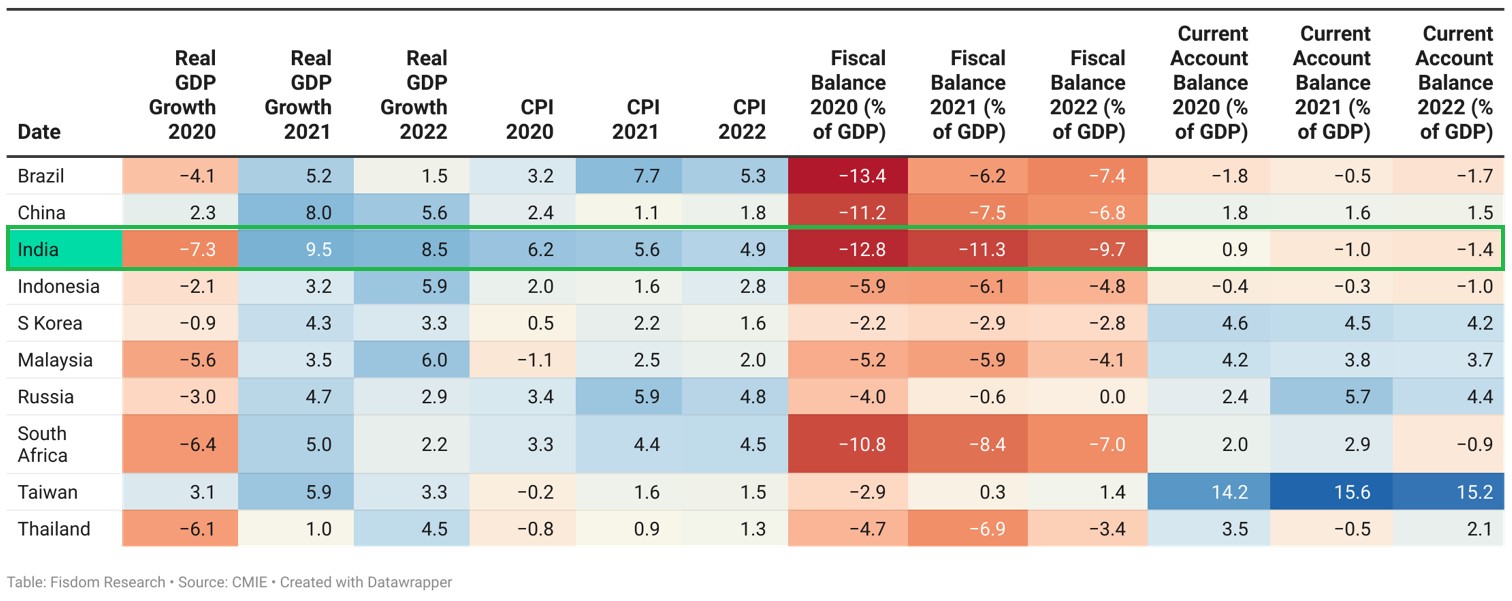

IMF projects Indian economic expansion to be the fastest paced in CY21 and CY22 versus key EMs

Following a sharp contraction in GDP last year, growth is expected to rebound to 9.5 percent this year and 8.5 percent in FY2022/23.

The recovery in consumption and investment is expected to be gradual given the second wave and concerns about a third wave, and the need to further strengthen the financial sector. Uncertainty about the economic outlook remains elevated, with pandemic-related uncertainties contributing to both downside and upside risks

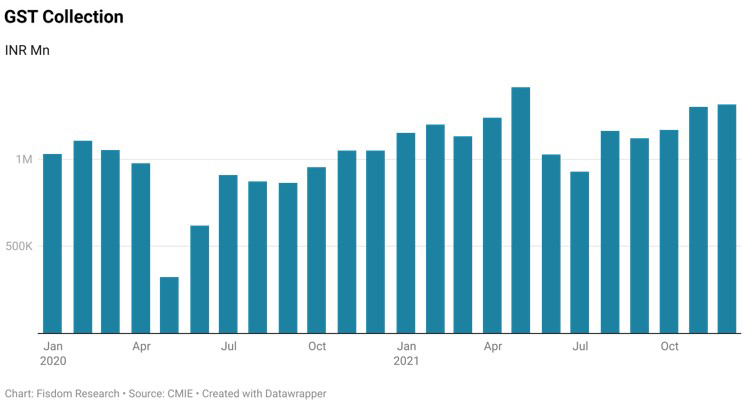

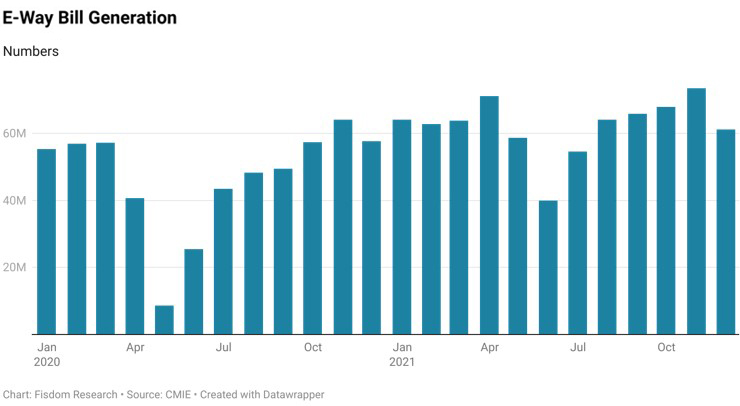

GST Collections Second Highest Since Inception & E-way Bill Generation To Lowest in Five Months

GST collections for November 2021 went up by 25% YoY to INR. 1.31 Tn. It is the second-highest collection since the implementation of GST.

Various policy and administration measures are taken to improve compliance contribute more to the increase In GST collection. A large number of initiatives undertaken in the last one year like enhancement of system capacity, nudging non-filers after the last date of filing of returns, auto-population of returns, blocking of e-way bills, and passing of input tax credit for non-filers has led to consistent improvement in the filing of returns over the last few months.

E-way bill generation touched a five-month low in November, indicating a moderation in good dispatches post festival. We will have to be wary and expectant to demonstrate whether this fall in e-way bills is expressive of waning in the pent-up demand post the festive season or from the higher number of holidays in the early part of November.

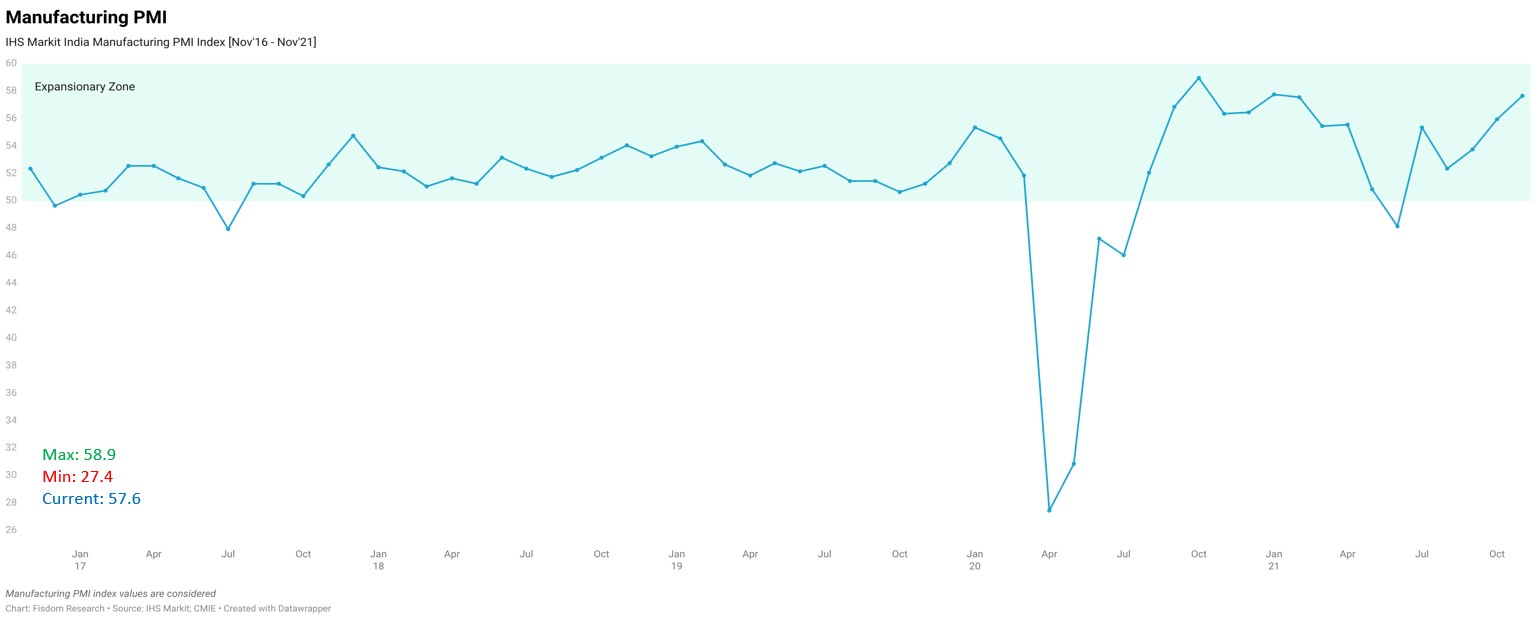

Manufacturing continues its ride in the expansionary zone for the fifth month straight

The Indian manufacturing sector continues expansion aided by recovering domestic demand, improving market conditions & successful marketing. Factory orders expand at the fastest pace since February. Output increased at the fastest pace in nine months.

The rate of expansion was substantial and surpassed the long term average by 11%. Upbeat business confidence and projects in the pipeline should also support production in the coming month. Increasing input prices continue to pose a challenge to manufacturers where the ability to pass costs will remain critical to manufacturer earnings and incentivize further capital expenditure.

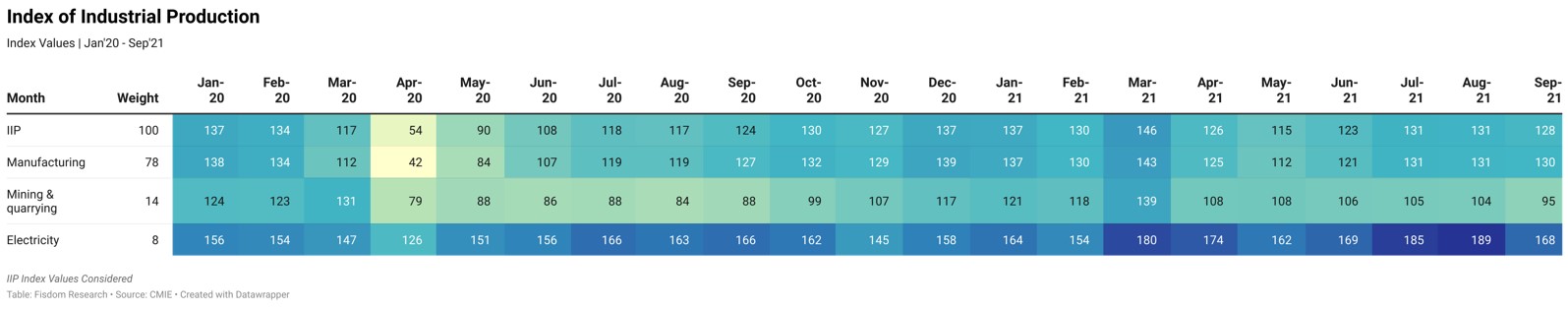

Industrial production dips; mostly attributable to fading of favourable base effect

IIP fell by -2.6 percent on a sequential basis and grew by 3.1 percent YoY. Unfavorable base & slowdown in industrial activities led to the loss in Index on a sequential basis.

Supply side issues, heavy rains during September impacted mining activities and led to lower power production. Electricity production & mining activities contracted by -11.0 percent & -8.4 percent respectively on a sequential basis, which was the primary reason for the overall fall in Index on an MoM basis.

We expect the Efficient implementation of public policies can be expected to bolster the economy at large and trickle into the PMI charts.