A few months back, the central bank raised the risk weights for unsecured personal loans, money lent to NBFCs and credit cards. As a result, banks have to set aside more capital to cover the additional risk associated with these loan types. The topic has been in the news for quite some time now, and recently, Finance Minister Nirmala Sitharaman also applauded the cautionary move by RBI. | ||||||||||||||||||||||||||

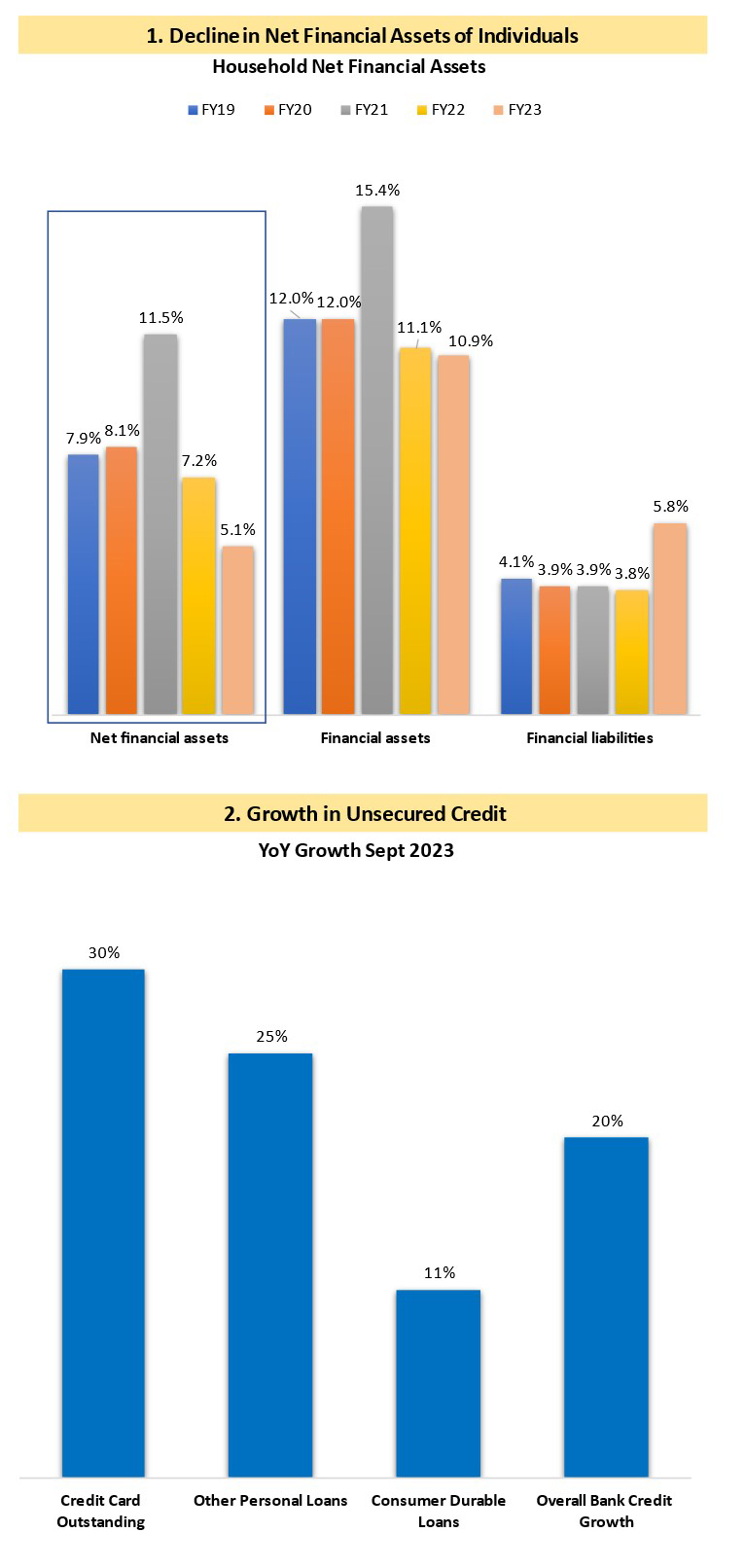

Let us understand why RBI could have arrived at this decision: The RBI has been attempting to persuade banks to be more wary of their loan practices for some time. While overall bank credit in the fiscal year of 2023 increased by 15%, the growth in small unsecured loans ranging from ₹10,000 to ₹50,000 rose by an impressive 48%. Unfortunately, defaults have already risen. The overall bad loans within the retail segment are below 1.5%. Still, the proportion of delinquent loans in the personal loan category has jumped to 8.1%. Unsecured personal loan growth has increased from Rs. 7.4Tn in 2018-19 to Rs. 14.63 Tn in by 2022-23, by the end of September 2023 this amount has grown to Rs. 16.01 Tn. This is a record-breaking annual growth of 18.7 percent over the last 4.5 years. | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

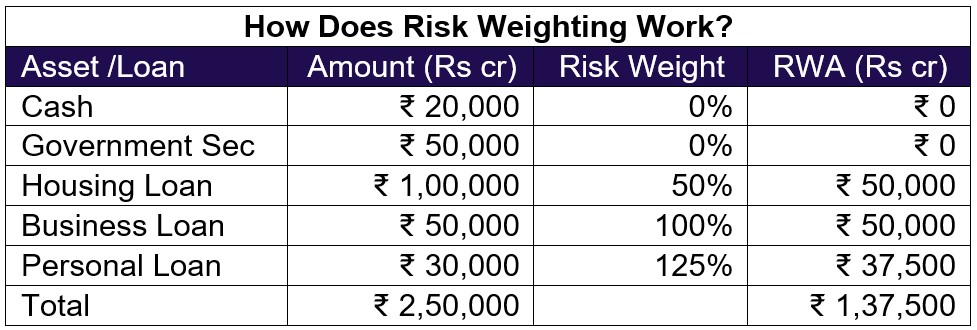

What is Risk weighting? The RBI has mandated that a bank set aside at least 9% of its capital for contingencies when issuing a loan of ₹100. That means that a minimum of ₹9 of the bank’s funds is locked up in the event of such a transaction. Loans represent an asset to the bank since interest is earned and repayment is expected at the end of the period. Regulators employ a concept referred to as “risk-weighting” of assets. This indicates that not all loans are considered equal. For instance, if a bank issues a home loan, the property can be repossessed in case of default. Similarly, a gold loan has collateral. However, a personal loan has no security, making it more precarious. Therefore, the regulator may determine that for every ₹100 of home loans, a risk weight of 50% applies, meaning only ₹50 of the loan is considered a risk. Thus, ₹4.5 worth of the bank’s capital (9% of ₹50) needs to be set aside. Contrarily, if a personal loan is issued, the risk weight is 100%, meaning that if ₹100 is loaned, ₹9 of capital must be retained. Banks have a straightforward task: they take deposits from customers and use those funds to provide loans to those who require it. No one can simply play with the depositor’s money. So, the bank has to contribute its own money or capital. This is because if things do not turn out well, the bank will have its own invested capital in danger, not just depositors’ funds. | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

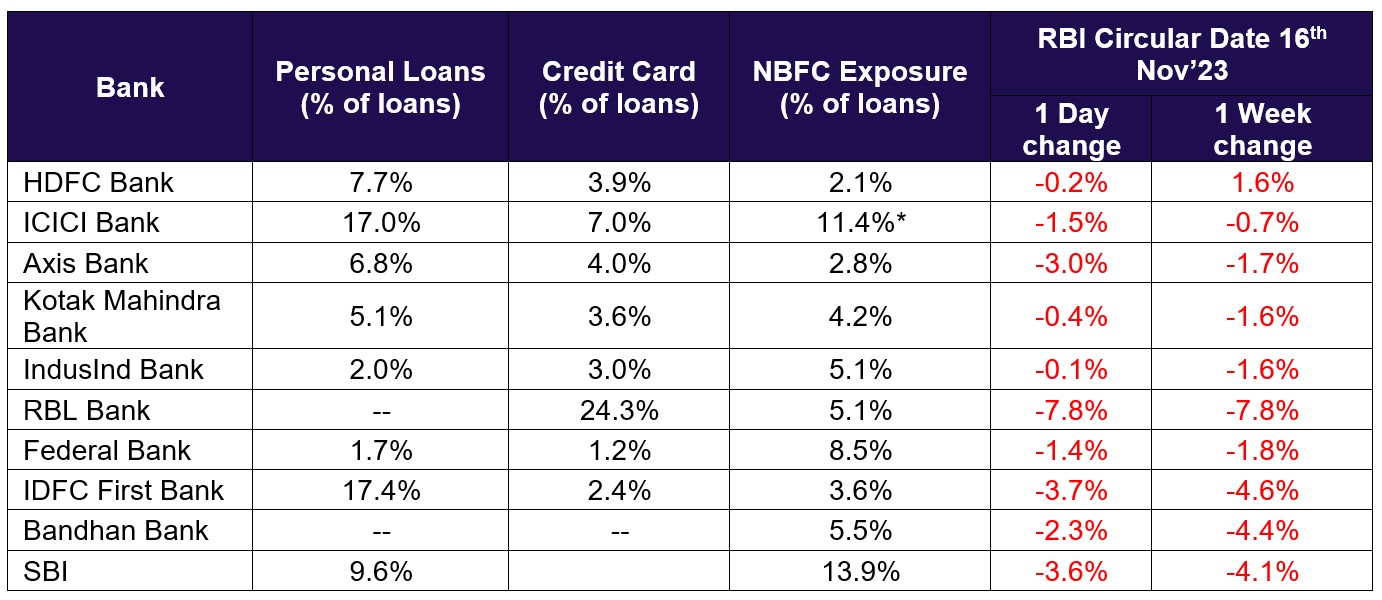

How will this impact Banks and NBFCs? Higher risk weight means higher capital requirement and lower CAR – (the ratio provides a quick idea of whether a bank has enough funds to cover losses and remain solvent under difficult financial circumstances) for banks and NBFCs. Banks with higher exposure to personal loans, credit cards, and loans to NBFCs are at greater risk. Financial institutions must allocate extra funds for personal loans and credit cards. This applies even to ones they have already granted. This money is inactive, meaning the bank profits nothing from it. They may have to increase the interest rate for new personal loans to make up for this deficit. Non-banking financial companies (NBFCs) and their fintech partners, such as Paytm, are not exempt from the effects of the current economic situation. These entities will be affected by the value of their assets and the liabilities they have incurred. Paytm’s recent move to pull back from specific segments in the loan distribution business and focus on higher ticket sizes for private and merchant loans highlights the increasing vigilance on non-banking financial company (NBFC) operations in India. The company’s shares tumbled more than 15% following the announcement, which was made during an analyst call where the management informed investors about its decision to move away from postpaid and personal loans below Rs 50,000. While Paytm’s management stated that the move was aimed at improving its underwriting process and maintaining asset quality, the real reason behind the move was the recent directive from the Reserve Bank of India (RBI) to increase risk weights on unsecured personal loans and credit card receivables. This directive has put pressure on NBFC companies to adopt more stringent risk management practices and has led to a greater focus on asset quality and underwriting processes. Among prominent NBFCs, Bajaj Finance is expected to have an impact on margins, whereas SBI cards with 100% unsecured loans might have a major negative impact. Below is a list of banks along with their portfolio exposures to unsecured loan categories: | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

Considering the overall impact on the banking sector, as per the chief economist of SBI, the banking system will require an excess capital of Rs. 84,000 crore due to the revised unsecured loan risk weights introduced by the Reserve Bank of India. To sum up, the Reserve Bank of India has implemented regulations that have caused the cost of borrowing to increase. The central bank expects that the demand for loans will be reduced by requiring higher interest rates. | ||||||||||||||||||||||||||

Market this week

Source: BSE and NSE | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

|

Weekly Leaderboard:

Source: BSE | ||||||||||||||||||||||||||

Stocks that made the news this week:

| ||||||||||||||||||||||||||

|

Please visit www.fisdom.com for a standard disclaimer. |