RBI maintains status Quo.

The Monetary Policy Committee (MPC) held the repo rate steady in its August meeting, marking the ninth consecutive pause following six rate hikes. This decision was widely expected, although two members advocated for a 25-basis point reduction in policy rates.

| TL: DR Considering the recent commentary from the Reserve Bank of India’s Monetary Policy Committee (MPC), we do not anticipate any immediate rate cuts. The current stance of the RBI reflects a cautious yet balanced approach, focusing on controlling inflation while supporting growth. With inflation still being a concern and the RBI committed to ensuring price stability, the likelihood of rate cuts in the near term appears limited. RBI will maintain its current policy rates through the remainder of the year, with a strong focus on monitoring inflationary trends and global economic conditions. While the Indian economy continues to show resilience with steady growth projections, the central bank’s priority remains to align inflation with its target before considering any policy easing. |

Inflation Outlook: Balanced yet cautious approach

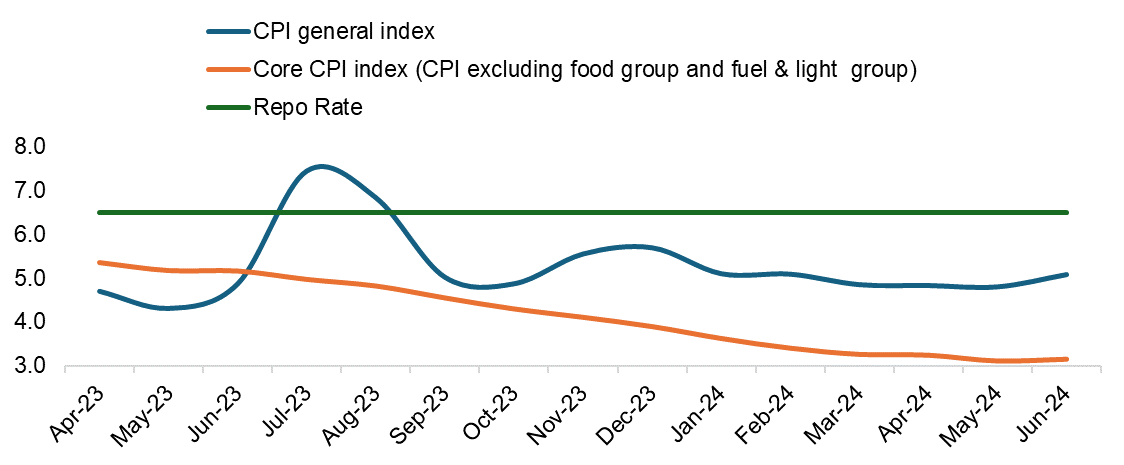

The RBI’s latest commentary on inflation reflects a balanced yet cautious approach. Despite the current trajectory of inflation showing signs of moderation, the recent uptick in headline inflation due to persistent food price pressures has led to a nuanced stance. The RBI has reiterated the importance of maintaining its “Withdrawal of accommodation” stance to anchor inflation expectations while supporting growth. The central bank acknowledges the resilience of the domestic economy but remains vigilant to potential risks, especially given the global economic uncertainties and the impact of food inflation on household expectations.

While the overall tone remains steady, the emphasis on monitoring inflation closely and ensuring that it aligns with the target reflects a vigilant and slightly hawkish undertone. The RBI’s projections for inflation remain stable, but the focus on the effects of monsoon and food prices indicates a cautious outlook moving forward.

The RBI has revised its inflation projections upward in its latest assessment, reflecting a more cautious outlook. For Q2 FY25, the inflation projection has been adjusted from 3.8% in June 2024 to 4.4% in August 2024. Similarly, for Q3 FY25, the projection has been revised from 4.6% to 4.7%. The forecast for Q4 FY25 has been slightly lowered from 4.5% to 4.3%, and the estimate for FY25 remains steady at 4.5%. Looking ahead to Q1 FY26, the RBI projects inflation at 4.4%.

| Period | February 2024 | April 2024 | June 2024 | August 2024 |

| Q2FY25 | 4.0 | 3.8 | 3.8 | 4.4 |

| Q3FY25 | 4.6 | 4.6 | 4.6 | 4.7 |

| Q4FY25 | 4.7 | 4.5 | 4.5 | 4.3 |

| FY25 | 4.5 | 4.5 | 4.5 | 4.5 |

| Q1FY26 | – | – | – | 4.4 |

The RBI’s cautious stance is influenced by the persistently high food inflation, driven by supply-side factors such as erratic weather patterns and global food price volatility. Despite these revisions, the RBI has emphasized that it remains committed to its disinflationary path, aiming to bring inflation closer to its target of 4% over time.

The primary focus will be on headline inflation, despite the moderation in core inflation.

Way Forward

Given the upward revisions in inflation expectations for the near term, our outlook remains cautious. The RBI’s decision to revise inflation projections suggests that it is factoring in ongoing risks, particularly from food prices and potential external shocks. This cautious tone implies that the RBI is not in a rush to cut rates, at least in the near term.

Growth Outlook: Commitment to steady growth while being vigilant about potential risks.

The Reserve Bank of India’s (RBI) recent commentary on the growth and GDP outlook presents a balanced yet cautious tone. The central bank has acknowledged the resilience of domestic economic activity, driven by steady urban consumption, improving rural demand, and robust investment demand. However, it has also highlighted the risks posed by global uncertainties, such as geopolitical tensions, demographic shifts, and technological changes.

| Period | February 2024 | April 2024 | June 2024 | August 2024 |

| Q1FY25 | 7.2 | 7.1 | 7.3 | 7.1 |

| Q2FY25 | 6.8 | 6.9 | 7.2 | 7.2 |

| Q3FY25 | 7.0 | 7.0 | 7.3 | 7.3 |

| Q4FY25 | 6.9 | 7.0 | 7.2 | 7.2 |

| FY25 | 7.0 | 7.0 | 7.2 | 7.2 |

The Reserve Bank of India’s updated GDP growth projections for FY25 reflect a consistent yet cautious outlook on the nation’s economic trajectory. The quarterly growth estimates have seen slight adjustments, indicating the central bank’s responsive approach to evolving economic conditions. For Q1FY25, the growth projection was initially set at 7.2% in February, adjusted slightly to 7.1% in April, then revised up to 7.3% in June, before settling back at 7.1% in August. This pattern of minor revisions continues through Q2FY25, with projections moving from 6.8% in February to 6.9% in April, and finally to 7.2% in June and August. Similar trends are observed in Q3FY25 and Q4FY25, with the final projections indicating steady growth at 7.3% and 7.2% respectively. Overall, the FY25 growth estimate has been revised from 7.0% in February to a more optimistic 7.2% by August. These adjustments underscore the RBI’s adaptive strategy in the face of both domestic and global economic developments, maintaining a positive outlook while managing inflationary pressures and external uncertainties.

Way Forward

We expect India’s GDP growth to remain consistent, with projections holding steady in the range of 7.1% to 7.3% across FY25. This outlook reflects our confidence in the resilience of domestic economic activity, supported by strong consumption patterns, robust investment demand, and a stable macroeconomic environment.

Our outlook is built on the assumption that the current momentum in economic activities, particularly in manufacturing and services, will continue. Furthermore, the progress in agricultural output and government-led capital expenditure are expected to sustain growth. We remain vigilant to global developments but are optimistic that India’s strong macroeconomic fundamentals will help navigate any potential headwinds.

Other key announcements

- Guidance on Deposit Mobilization

The Reserve Bank of India has observed that alternative investment avenues are becoming increasingly attractive to retail customers, posing challenges for banks in terms of deposit mobilization. With bank deposits trailing loan growth, many banks have started relying more on short-term non-retail deposits and other liability instruments to meet incremental credit demand. The RBI has cautioned that this practice could potentially expose the banking system to structural liquidity issues.

In response, the RBI advises banks to focus more on mobilizing household financial savings through innovative products and enhanced service offerings. Leveraging their vast branch networks effectively will be key to securing stable, long-term deposits. This proactive approach is crucial to maintaining liquidity stability and ensuring that the banks are well-positioned to meet future credit demands.

- Enhancing UPI Transaction Limits for Tax Payments

The transaction limit for tax payments through UPI has been enhanced from ₹1 lakh to ₹5 lakh per transaction. This move is intended to ease tax payments for consumers, making it more convenient to use digital payment methods for higher value transactions.

Disclaimer

This document is not for public distribution and is meant solely for the personal information of the authorized recipient. No part of the information must be altered, transmitted, copied, distributed, or reproduced in any form to any other person. Persons into whose possession this document may come are required to observe these restrictions. This document is for general information purposes only and does not constitute investment advice or an offer to sell or solicitation of an offer to buy/sell any security and is not intended for distribution in countries where distribution of such material is subject to licensing, registration, or other legal requirements.

The information, opinions, and views contained in this document are as per prevailing conditions and are of the date appearing in this material only and are subject to change. No reliance may be placed for any purpose whatsoever on the information contained in this document or on its completeness. Neither Finwizard Technology Private Limited (“Fisdom”), its group companies, its directors, associates, employees, nor any person connected with it accepts any liability or loss arising from the use of this document. The views and opinions expressed herein are based solely on the past performance of the schemes and/or securities and do not necessarily reflect the views of Fisdom. Past performance is no guarantee and does not indicate or guide future performance. The information set out herein may be subject to updating, completion, revision, verification, and amendment, and such information may change materially.

Investing in securities markets involves risks, including the potential loss of principal amount in part or in full. The recommendations are based on the past performance of schemes and/or securities, which is not necessarily indicative of future performance. The recommendations do not guarantee future results, and the value of the invested principal amount and investment returns may fluctuate over time. Therefore, it is essential to review your investment objectives, risk tolerance, and liquidity needs before making any investment decisions. While the information and data contained in this document have been obtained from sources believed to be reliable, Fisdom does not guarantee its accuracy, adequacy, completeness, timeliness, reliability, or availability of any information provided in this document. Fisdom is not responsible for any errors or omissions, regardless of the cause, or for the results obtained from the use of information contained in this document. Fisdom accepts no liability for any losses or damages arising directly or indirectly (including special, incidental, or consequential losses or damages) from the use or reliance placed on any information or data contained in this document, including, without limitation, any lost profits, trading losses, or damages resulting from any errors, omissions, interruptions, deletions, or defects in any manner contained herein.

Readers/Investors should be aware that this document may not be suitable for all types of investors. Investors should independently evaluate any investment or strategy discussed herein. Any decision(s) based on the information contained in this report shall be the sole responsibility of the Reader/Investor.

Fisdom is a SEBI Registered Investment Advisor (RIA) [Registration No: INA200005323] and Research Entity [Registration No: INH000010238]. This document is prepared and distributed in accordance with the SEBI (Investment Advisers) Regulations, 2013, and other relevant regulations. Please read all relevant offer documents, risk disclosure documents, and terms and conditions related to the services provided by Fisdom before making any investment decision. For more details, please visit our official websites at www.fisdom.com and www.Finity.in.

Analytical Connects

| Sagar Shinde | Nirav R Karkera | Research Desk |

| VP – Research | Head – Research | Department Connect |

| Sagar.shinde@fisdom.com | nirav@fisdom.com | research@fisdom.com |