In August 2023 while the frontline index experienced a dip, the broader market indices were resilient. The mid-cap segment, represented by the BSE mid-cap index, recorded a notable gain of 2.59 percent. Within the midcap segment top performer was the Indian Railway Finance Corporation, primarily engaged in finance leasing for Indian Railways, which stood out with an impressive growth rate of 30.34 percent during this period.

Railway stocks have been on the radar over the past month. But this time, it’s not just a blip on the screen; it’s a full-fledged locomotive of opportunity that an investor can look at. What’s causing this surge in interest, and why are railway stocks suddenly on everyone’s watchlist?

Below is a snapshot of performance of railway stocks in the past month:

|

|

|

Source: NSE India, Fisdom Research. Data as on 1st September 2023.

Key triggers for the recent rally in railway stocks:

- The recent rally in stocks can be attributed to the government’s strategic initiatives in the railway sector. The government of India is planning to introduce a Production-Linked Incentive (PLI) scheme for train component manufacturers, aimed at attracting foreign manufacturing firms and reducing import dependence.

- This aligns with the goal of streamlining passenger coaches in Indian Railways to just two types—Linke Hofmann Busch (LHB) and Vande Bharat, down from the current 28.

- Despite sustained demand, India still imports critical rolling stock components like wheels and axles, prompting recent domestic procurement orders for 1.54 million forged wheels.

- Additionally, efforts to revamp railway infrastructure and the foundation stone-laying for the redevelopment of 508 railway stations are driving optimism, making the sector appear promising for investors.

|

What are some of the other factors that are poised to drive the railway sector?

|

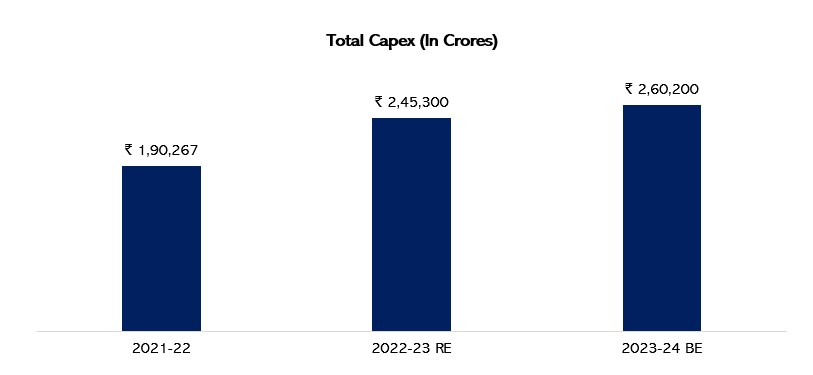

1. Railway capex surge:

- In the Economic Survey of 2021-2022, a significant effort was highlighted to enhance the railway sector by substantially increasing its capital expenditure (capex).

- The railways had an average annual capex of Rs. 5980 crore between 2009-2014.

- The capex outlay for 2023-24 reached Rs 2,60,000 crore, a remarkable five-fold increase from the 2014 level.

- This substantial investment is set to grow even further in the coming years as more projects are undertaken and diverse sources of capital funding are developed.

- As a result, the railway system is poised to become a pivotal driver of national growth.

|

|

Source: Budget Documents, Fisdom Research

2. Capacity Expansion

- The National Rail Plan outlines a comprehensive roadmap for expanding the railway network’s capacity by 2030, with a vision to accommodate growth up to 2050.

- The plan aims to transform the railway system into a future-ready infrastructure capable of not only meeting passenger demands but also increasing the railway’s share in freight transportation to a target range of 40-45 percent, a significant increase from the current 26-27 percent level.

- The National Rail Plan outlines a project pipeline aimed at expanding railway capacity to accommodate 45 percent of the country’s freight traffic.

- Given the substantial number of ongoing sanctioned projects that require completion, there is a deliberate effort to enhance railway capacity systematically.

|

3. Emphasis on Project Completion:

- A total of 68 critical projects have been identified with a specific aim to complete them by March 2024. These projects are strategically focused on boosting capacity on routes that connect vital mineral and industrial hubs, as well as key ports and consumption centers.

- Additionally, the Ministry of Railways has set ambitious targets, including achieving 100 percent electrification of its network by December 2023, upgrading the Delhi-Mumbai and Delhi-Kolkata corridors to 160 kmph, and eliminating level crossings on the Golden Quadrilateral/Golden Diagonal routes.

|

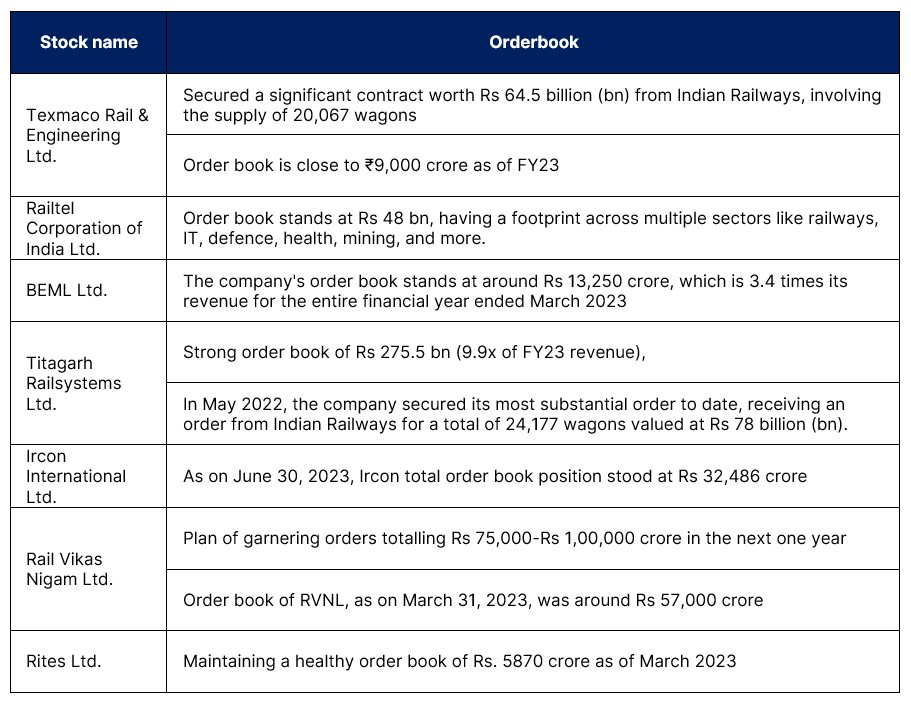

4. Healthy order book: |

|

Source: Company Financials, Fisdom Research

Conclusion:

The Indian railway sector is currently in the spotlight and, has garnered significant attention. The impressive gains in railway stocks, as exemplified by the strong performance of companies like Texmaco Rail & Engineering Ltd., Railtel Corporation Of India Ltd., and Indian Railway Finance Corporation Ltd., underscore the growing interest in this industry.

Several factors are poised to drive the railway sector’s growth. The substantial increase in railway capex, reaching Rs 2,60,000 crore for 2023-24, reflects a significant commitment to modernizing and expanding the railway infrastructure. The National Rail Plan’s roadmap for capacity expansion until 2050 and its focus on freight transportation enhancement are critical drivers. Additionally, the emphasis on completing critical projects, electrification, and infrastructure upgrades underlines the government’s determination to transform the railway sector.

Furthermore, the healthy order books of railway companies indicate a strong pipeline of projects, ensuring sustained growth and business opportunities. With these factors in mind, the railway sector in India appears to be on track for an exciting journey, offering potential benefits for investors willing to hop on board. However, investors should allocate money to these stocks based on their risk profile and goal. Since some of the railway companies are on the verge of revival and shall develop financial strength as they services orderbook. |

Markets this week | | 28th Aug 2023 (Open) | 01st Sep 2023 (Close) | %Change | | Nifty 50 | ₹ 19,298 | ₹ 19,435 | 0.70% | | Sensex | ₹ 64,906 | ₹ 65,387 | 0.70% |

Source: BSE & NSE |

- The market ended a five-week losing streak with substantial gains in the week ending September 1.

- Mixed global cues, weak August monsoons, and rising crude oil prices had kept the benchmarks under pressure.

- However, strong GDP and Manufacturing data on Friday boosted investor confidence.

- Foreign institutional investors (FIIs) continued to sell equities for the sixth consecutive week, with a total offload of Rs 4,311.58 crore.

- On the other hand, domestic institutional investors (DIIs) showed a contrasting trend by purchasing equities worth Rs 9,570.03 crore during the same week.

- In the month of August, FIIs sold equities worth a significant Rs 20,620.65 crore, while DIIs bought equities worth Rs 25,016.95 crore.

|

|

Weekly Board

NSE Top Gainers | Stock | Change (%) | | TATA Steel | ▲ 8.68% | | Maruti Suzuki | ▲ 8.68 % | | NTPC | ▲ 5.87 % | | Hindalco Industries | ▲ 5.17 % | | M&M | ▲ 4.73 % |

| NSE Top Losers | Stock | Change % | | Dr Reddy Labs | ▼ 3.47 % | | HUL | ▼ 2.29 % | | Reliance Industries | ▼ 2.26 % | | Adani Enterprises | ▼ 1.83 % | | BPCL | ▼ 1.73 % |

|

Source: NSE |

Stocks that made the news this week:

- In August, Mahindra & Mahindra (M&M) reported robust auto sales of 70,350 vehicles, marking an impressive 19 percent growth compared to the same month last year when they sold 59,000 units. M&M also revealed that their domestic passenger vehicle sales for the month saw a substantial surge of 25 percent, reaching 37,270 units compared to 29,852 units in the previous year. Notably, the Utility Vehicles segment performed exceptionally well, with M&M achieving its highest-ever sales of SUVs, selling 37,270 vehicles in the domestic market and a total of 38,164 vehicles, including exports. This positive performance underscores M&M’s strength in the auto market.

- Maruti Suzuki announced of its highest-ever monthly wholesales in August, totaling 1,89,082 units. This marked a notable increase of 14 percent in dispatches to dealers compared to the previous August, when they delivered 1,65,173 units. Maruti Suzuki India (MSI) reported robust domestic passenger vehicle sales, with 1,56,114 units sold, reflecting a remarkable growth of 16 percent from the same period the previous year. This strong performance underscores Maruti Suzuki’s leading position in the country’s automobile industry.

- Eicher Motors reported impressive auto sales for August. Eicher Motors recorded the sale of 6,476 vehicles in August, marking a remarkable year-on-year (YoY) growth of 29.4 percent. Specifically, their major business segment, ‘Eicher Trucks and Buses,’ reported a 27.5 percent YoY growth, with 6,239 vehicles sold. In terms of market segments, domestic sales surged by 30.4 percent YoY, totaling 5,907 vehicles, while exports showed a slight decline of 8.5 percent YoY, with 332 vehicles sold.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|