Daily Snippets

Date: 29th December 2023 |

|

|

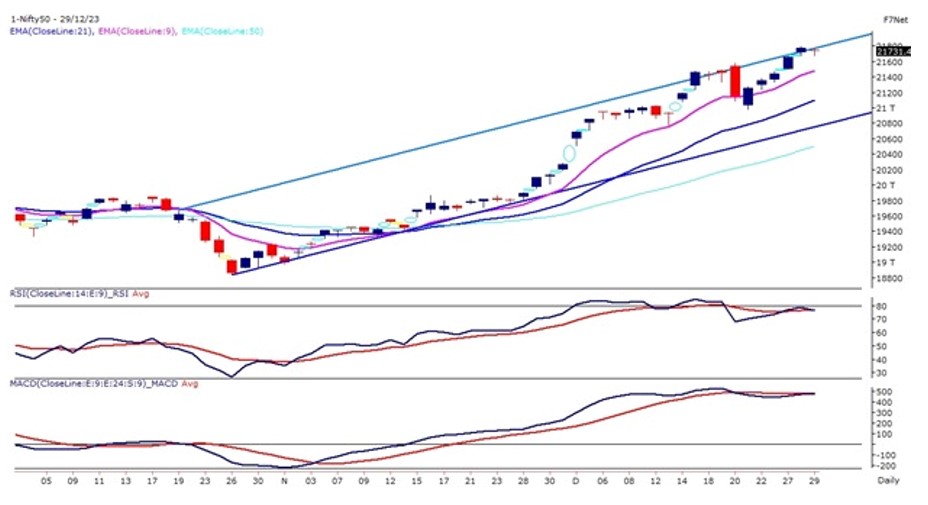

Technical Overview – Nifty 50 |

|

Nifty rose 8.17% during the December month expiry. Nifty futures rollover stood at 79.54%, which is higher compared to last month’s expiry rollover of 73.06% and its three/six/nine months’ average of 78.64%,79.07% & 76.30% respectively. Rollover is a process of forwarding an existing position from one month to another month. A high rollover indicates a strong sentiment while a lower rollover is usually considered as a sign of weak sentiment.

Nifty has started the January series with an open interest of 1.38 crore shares compared to an OI of 1.07 crore shares at the beginning of the December series. Nifty saw a higher rollover with a higher cost of carry (+0.68%) and a rise in open interest, compared to its previous month, indicating a buildup of fresh long positions in the December series.

The Benchmark was in a profit-taking mode on the last trading day of 2023 as the index witnessed a gap-down opening and stayed below its line of polarity for the entire trading session. On the weekly chart, the Index has gained more than 1.50% and formed a green candle signaling a bullish texture in the market.

The immediate support for the Index is placed at 21,600 – 21,550 levels and the upside is capped near 21,900 levels.

|

Technical Overview – Bank Nifty |

|

The BANKNIFTY on the daily chart witnessed a gap-down opening and traded in bearish zones for the majority of the time. The Banking index on the 30-minute chart has given a rising channel pattern breakdown and prices are sustained below the same.

On the weekly chart, the Index has gained more than 1.50% and formed a green candle signaling a bullish texture in the market. The Banking index on the daily chart is trading in a higher high higher low formation indicating a perpetual bullish tone in the market.

The Banking Index continues to trade above the breakout levels and is trading above its 9 & 21 EMA. The momentum oscillator RSI (14) is reading near 70 levels and the momentum is strongly poised towards a bullish stance.

The positive takeaway from today’s trading session was that the Bank Nifty still appears to be the only bullish deal in the town. The immediate support for the Index is placed at 48,000 – 47,800 levels and the upside is capped near 48,700 levels.

|

Indian markets:

- Domestic equity indices closed marginally lower on the last trading day of 2023, ending a five-day winning streak. The Nifty fell below the 21,750 mark, prompting concerns about the sustainability of the recent uptrend due to high valuations.

- Auto, FMCG, and realty shares saw increased demand during today’s trading session, while energy, PSU banks, and IT shares faced downward pressure.

- Despite challenges like rising interest rates, US bank collapses, geopolitical tensions, elevated crude prices, and a slowdown in the Chinese economy, the Indian equity market concluded the year on a positive note.

- Throughout 2023, the Nifty 50 surged by 20.03%, the Sensex recorded a gain of 18.74%, and the Bank Nifty witnessed a rise of 12.34%.

|

Global Markets

- European shares advanced while Asian stocks ended mixed on the last trading day of 2023, with investors assessing prospects of electric-vehicle companies after Chinas Xiaomi unveiled its first EV. Chinese consumer electronics company Xiaomi on Thursday detailed plans to enter China’s oversaturated electric-vehicle market.

- US stocks finished marginally higher Thursday, closing in on a new all-time high in the penultimate trading day of what’s been a strong year for stocks.

|

Stocks in Spotlight

- Railtel Corporation of India shares surged 15% on December 29 following a substantial Rs 120.45 crore order from South Central Railway. The order involves implementing an automatic block signaling system in the Yermaras-Nalwar section within 720 days, emphasizing Railtel’s commitment to railway technology and safety.

- Tata Motors soared 3.5% on December 29, becoming the first Nifty company to double its share price in 2023. The surge was driven by a strong JLR outlook, the shift to electric vehicles, and increased SUV demand due to rising disposable incomes. Since the year’s start, the leading Indian EV player has surged by 102%.

- Innova Captab had a stellar 21% higher debut on December 29 after its IPO at Rs 448. The pharmaceutical company’s Rs 570-crore public issue was oversubscribed massively, with QIBs at 116.73 times, HNIs at 64.95 times, and retail investors at 17.15 times their allotted quotas.

|

News from the IPO world🌐

Waaree Energies files papers for Rs 3,000-crore IPO

Ratan Tata to sell all his 77,900 shares in FirstCry IPO

Emmforce Autotech files draft papers; to mop-up funds via IPO

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | TATACONSUM | ▲ 4.6 | | TATAMOTORS | ▲ 3.4 | | BAJAJ-AUTO | ▲ 1.7 | | NESTLEIND | ▲ 1.5 | | ADANIENT | ▲ 1.4 |

| Nifty 50 Top Losers | Stock | Change (%) | | BPCL | ▼ -3.2 | | SBIN | ▼ -1.5 | | ONGC | ▼ -1.3 | | INFY | ▼ -1.3 | | COALINDIA | ▼ -1.3 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY AUTO | 1.14 | | NIFTY FMCG | 0.85 | | NIFTY REALTY | 0.73 | | NIFTY METAL | 0.65 | | NIFTY MEDIA | 0.36 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1990 | | Declines | 1794 | | Unchanged | 107 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,710 | 0.1 % | 13.8 % | | 10 Year Gsec India | 7.2 | -0.40% | -0.50% | | WTI Crude (USD/bbl) | 72 | (5.0) % | (6.7) % | | Gold (INR/10g) | 62,947 | -0.30% | 12.90% | | USD/INR | 83.27 | 0.1 % | 0.7 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|