Technical Overview – Nifty 50

Benchmark index had a good turbulent day; at ATH, the index formed a bearish engulfing candlestick. The index made corrections during the initial part of the session before rising from the 75-minute timeframe trend line and recovering.

On a 75-minute timeframe, the momentum indicator RSI (14) formed a double bottom pattern at the support 47 level. As long as the MACD on a daily timeframe keeps rising and stays above its polarity, the upward trend should hold. The 10-DEMA served as support for the index, which now trades above the major DEMA, indicating an overall upward trend.

Diffusion Indicator: % of stocks above the RSI 50 mark of the benchmark index are at 78% and have a negative divergence to price.

Based on benchmark index OI data, a base formation may take place at the 24,200 level, where put writing is almost 63 lakhs. At 24,400, call writing is almost close to 90 lakh, which might act as a resistance. The PCR value of the benchmark index is 0.7.

The support and resistance levels for the next sessions are at 24,250 and 24,150 and 24,400 and 24,500, respectively.

Technical Overview – Bank Nifty

On the daily chart, Bank Nifty shows a smaller degree consolidation breakdown and closes below the same. The index was able to hold over 52,000, however, mean reversion is probable. The opinion is still to buy on the dip.

On a daily timescale, the momentum indicator RSI (14) indicates a hidden positive divergence, indicating that the upward momentum is expected to persist. The index has closed below 10 DEMA though is trading above major DEMA and the view remains bullish. MACD has a crossover at resistance faced at the 1050 mark.

Based on benchmark index OI data, a base formation may take place at the 52,000 level, where put writing is almost 61 lakhs. At 52,500, call writing is almost close to 14 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.56.

For the next sessions, the resistance and support levels are 52,450, 52,750 for resistance, and 52,000, 51,750 for support.

Indian markets:

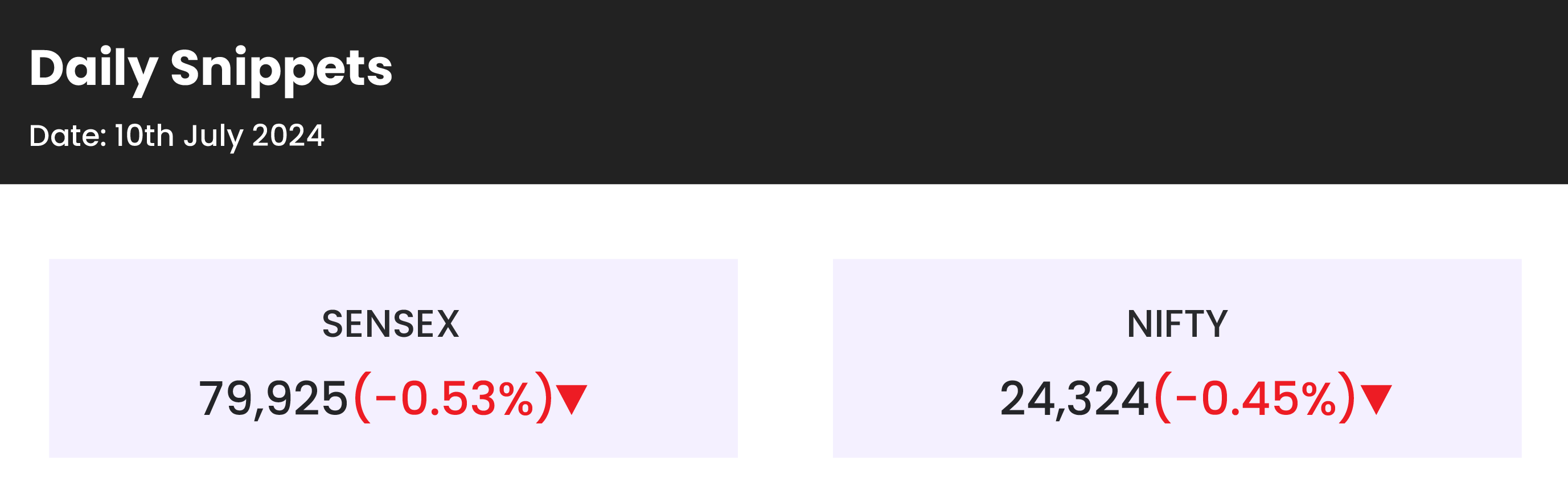

- India’s benchmark indices, Sensex and Nifty, retreated from record highs due to a combination of factors, including price cuts by a major automaker and anticipation surrounding the upcoming earnings season.

- Investors are also closely watching the forthcoming budget for further cues.

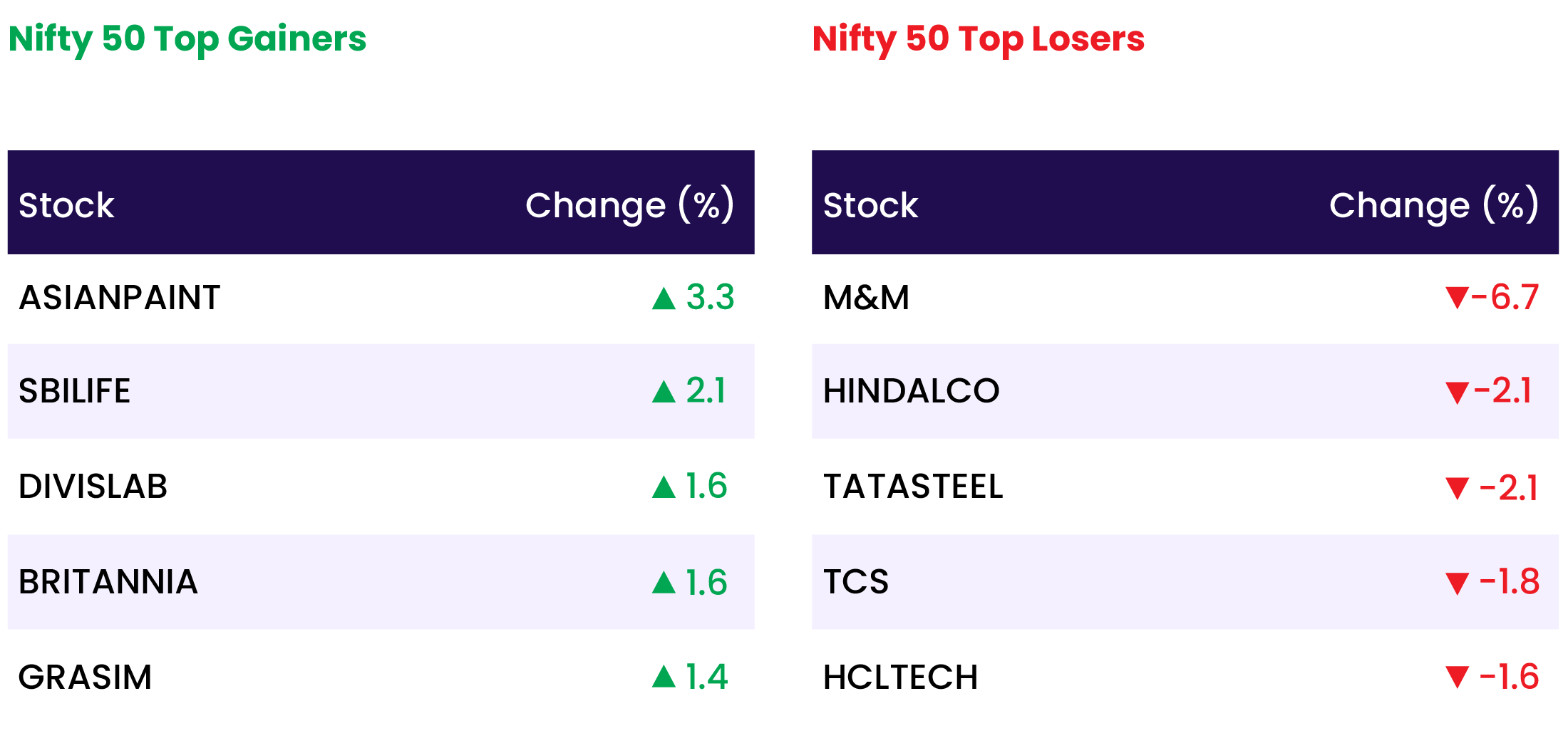

- Sectoral indices saw notable declines, with the Nifty Auto index leading the losses, falling by 2 percent. This was followed by the Nifty Metal and PSU Bank indices, which declined by 1.6 percent and 1.4 percent, respectively.

- The Nifty IT index was down by 1 percent, while the Nifty Bank index slipped by 0.7 percent. These movements underscore the market’s sensitivity to sector-specific developments and broader economic expectations.

Global Markets:

- Asia-Pacific markets showed a mixed performance on Wednesday, with Japan’s markets hitting new records after the country’s inflation data met expectations.

- Japan’s Nikkei 225 extended gains from Tuesday, reaching a fresh closing high of 41,831.99. Similarly, the broad-based Topix gained 0.47% to close at 2,909.2, marking another record closing high.

- In contrast, Hong Kong’s Hang Seng index was nearly flat as of its final hour of trading. Mainland China’s CSI 300 dropped 0.32% to close at 3,428.96, indicating a decline in Chinese market sentiment.

- South Korea’s Kospi showed a marginal increase, rising to 2,867.99. However, the small-cap Kosdaq was 0.22% lower, finishing at 858.55, reflecting mixed performance within South Korea’s markets.

- Australia’s S&P/ASX 200 experienced a slight decline of 0.16%, closing at 7,816.8. This suggests a cautious sentiment among Australian investors.

Stocks in Spotlight

- Rail Vikas Nigam: The company’s share price surged 10 percent intraday, This significant increase was driven by the company securing orders worth Rs 389 crore.

- Delhivery: The share price of Delhivery rose by 3 percent, reaching a current market price (CMP) of Rs 386.95. This increase followed a block deal in which 3.17 percent stake, or 2.34 crore shares, of the logistics company were sold. The Canada Pension Plan Investment Board is the likely seller of these shares.

- Delta Corp: The share price of Delta Corp fell by more than 4 percent intraday, This decline was due to the company reporting disappointing results for the quarter ending in June (Q1FY25). The poor performance was attributed to higher GST rates, the impact of general elections, and seasonal factors.

News from the IPO world🌐

- Sebi puts SK Finance’s Rs 2,200-cr IPO in abeyance

- Softbank backed Firstcry, Unicommerce get SEBI approval for IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PHARMA | 0.4 |

| NIFTY HEALTHCARE INDEX | 0.4 |

| NIFTY FMCG | 0.3 |

| NIFTY OIL & GAS | 0.1 |

| NIFTY MIDSMALL HEALTHCARE | 0.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1363 |

| Decline | 2576 |

| Unchanged | 82 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,292 | (0.1) % | 4.2 % |

| 10 Year Gsec India | 7.0 | (0.2) % | 1.1 % |

| WTI Crude (USD/bbl) | 82 | (1.0) % | 17.0 % |

| Gold (INR/10g) | 72,670 | 0.4 % | 7.9 % |

| USD/INR | 83.47 | (0.0) % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer