The IT sector experienced a remarkable rebound in 2023, surging by almost 25 percent, largely fueled by expectations of a dovish pivot from the Fed and subsequent low-interest rates encouraging discretionary tech spending globally. However, as Q3 earnings of key players like TCS and Infosys are unveiled, it becomes evident that the anticipated recovery is yet to materialize fully.

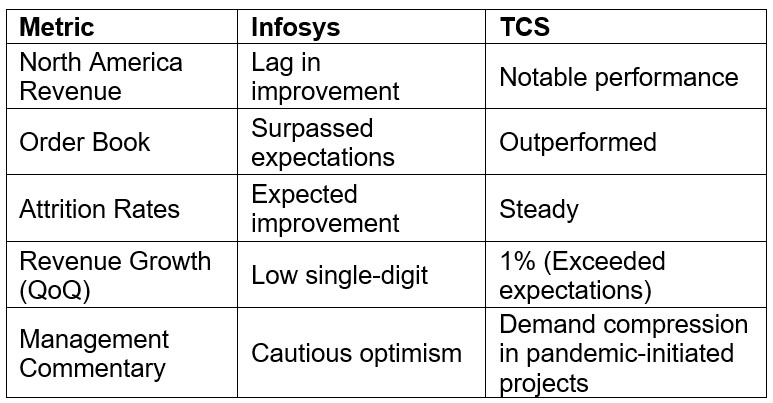

Q3 Performance Overview: Both Infosys and TCS reported their December quarter results, reflecting a mixed bag for the IT sector. Despite a lag in improvement from North America, a key market, Infosys exceeded expectations with a robust order book. TCS, on the other hand, outperformed expectations in a quarter known for seasonal weakness due to increased holidays and furloughs. |

Q3 Performance Overview |

|

Market Reaction to earnings:

The market response to the Q3 results of major IT players has been largely positive. Investors seem to be reassured by the absence of negative surprises, even though the sector did not witness a material upturn in demand. However, there is ongoing speculation about whether the worst is truly behind the IT sector.

|

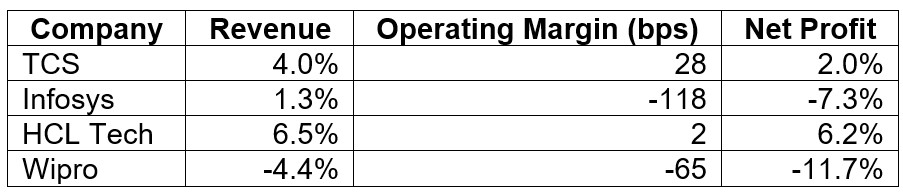

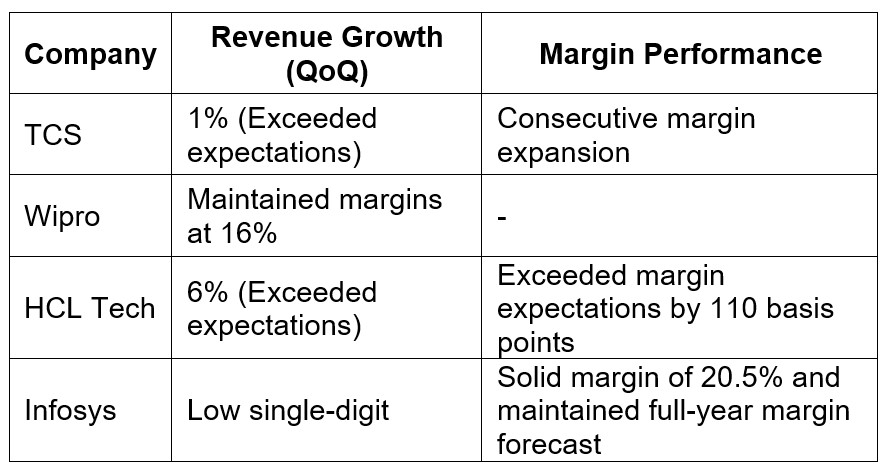

Individual Company Performances:

Beyond TCS and Infosys, other IT companies have showcased resilience and strong financial performances. TCS achieved a 1% revenue growth, surpassing street expectations, while HCL Tech outperformed with a 6% topline revenue growth. Margins have also been a highlight, with TCS, Wipro, and HCL Tech displaying robust margin performances

|

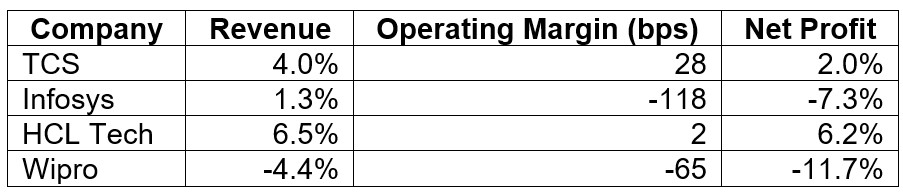

Q3 Scorecard (Change%): |

Source: Business standard, Company Financials, Fisdom Research |

|

|

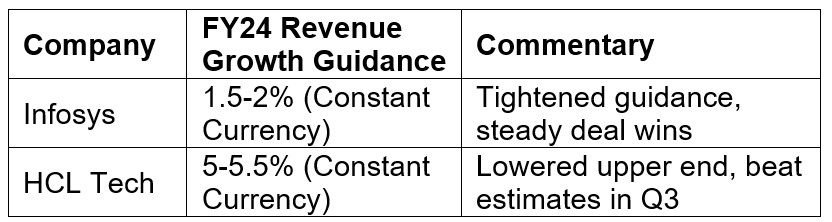

Outlook and Guidance:

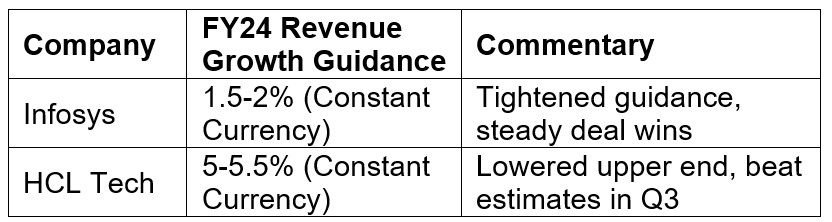

The management guidance for FY24 growth reflects a cautious yet optimistic stance. Infosys tightened its revenue growth guidance to 1.5-2%, while HCL Tech narrowed its full-year revenue growth guidance to 5-5.5%. Despite the cautious approach, there are positive signals in the form of steady deal wins and notable improvements in attrition rates.

|

Source: Company, Fisdom Research |

|

Conclusion: As the IT sector navigates through the aftermath of Q3 earnings, it is evident that while challenges persist, there are positive indicators such as robust margins, steady deal wins, and cautious optimism from management. The market will closely monitor the sustainability and recovery of demand trends, and the sector’s overall resilience as it progresses into FY25.

|

Market this week | | 08th Jan 2024 (Open) | 12th Jan 2024 (Close) | %Change | | Nifty 50 | ₹ 21,748 | ₹ 21,895 | 0.70% | | Sensex | ₹ 72,043 | ₹ 72,568 | 0.70% |

Source: BSE and NSE |

- The Indian market rebounded, erasing the losses from the previous week, and closed at fresh record highs in the week ending January 12.

- The surge was primarily attributed to the positive performance of IT stocks, supported by firm global cues and expectations of a rate cut by the end of the financial year.

- Notable sectoral gains included a 4.5 percent rise in the BSE Information Technology index, a 4.3 percent rise in the BSE Realty index, and 2 percent additions in the BSE Energy, BSE Oil & Gas, and BSE Auto indices.

- However, there were declines in the BSE FMCG index, which was down 1.7 percent, and the BSE Bank index, which fell 0.9 percent.

- Foreign institutional investors (FIIs) sold equities worth Rs 3,901.27 crore, while domestic institutional investors (DIIs) bought equities worth Rs 6,858.47 crore during this period.

|

|

Day Leader Board

NSE Top Gainers | Stock | Change (%) | | Hero Motocorp | ▲ 9.85% | | HCL Tech | ▲ 7.54 % | | Infosys | ▲ 5.23 % | | Reliance Industries | ▲ 5.13% | | LTIMindtree | ▲ 4.87% |

| NSE Top Losers | Stock | Change % | | Nestle India | ▼ 4.38% | | Bajaj Finserv | ▼ 3.37% | | Divis Lab | ▼ 3.26% | | HUL | ▼ 2.90% | | UPL | ▼ 2.78% |

|

Source: BSE |

Stocks that made the news this week:

- Ultracab (India) Ltd witnessed a second consecutive day of hitting the lower circuit, with investors offloading the stock in response to a significant decline in promoter holding over the last quarter. By the end of September 2023, promoters held a substantial 59.59 percent stake, which drastically dropped to 27.89 percent by the conclusion of the December quarter. While stake sales by promoters are not uncommon, the absence of disclosure regarding these trades in Ultracab has raised concerns among market participants. This deviation from the standard practice adds an element of uncertainty to the situation

- Macrotech Developers experienced a surge of approximately 6 percent, propelled by a “buy” rating assigned by Jefferies. The brokerage expressed optimism about the sales outlook for residential projects, revising the target price for the stock to Rs 1,290 from Rs 884, citing potential long-term upside despite the doubling of land prices in the past three years. Jefferies analysts highlighted the positive impact on connectivity in Mumbai with the upcoming Mumbai Trans Harbour Link, further enhancing the prospects for Macrotech Developers.

- KPI Green Energy witnessed a surge of over 3 percent, reaching a fresh 52-week high, following an announcement that its subsidiary, KPIG Energia Pvt Ltd, secured an order for a solar power project. Sanwariya Processors Pvt Ltd commissioned KPIG Energia to construct 2 MW solar power projects, slated for completion by FY25 in various tranches. The filing indicates that KPI Green Energy, known for solar power generation as an Independent Power Producer (IPP) under the Solarism brand and as a service provider to Captive Power Producer (CPP) customers, is set to capitalize on this new project.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|