India Inc.’s September quarter earnings season showcased a robust performance, marked by an overall outperformance across aggregates. This success was predominantly fuelled by favourable margin tailwinds, contributing to a buoyant quarter for corporate earnings. Q2FY24 was one of those quarters where 19 out of 21 sectors have met analyst expectations.

So far the Nifty earnings has been stable with few sectors such as IT and commodities struggling where as sectors like Banking, pharma and auto showing resilient performance.

Talking specifically about IT companies in Q2, many companies boasted their highest Total Contract Value (TCV) figures, yet executives remained cautious in their outlook. Delays in deal closures, customer reprioritization, and project deferments persisted, attributed to customers manoeuvring high interest rates, macroeconomic hurdles, and geopolitical tensions.

Infosys, HCLTech, and Wipro revised their full-year revenue growth guidance downward, while Tata Consultancy Services and Tech Mahindra typically abstained from providing growth estimates.

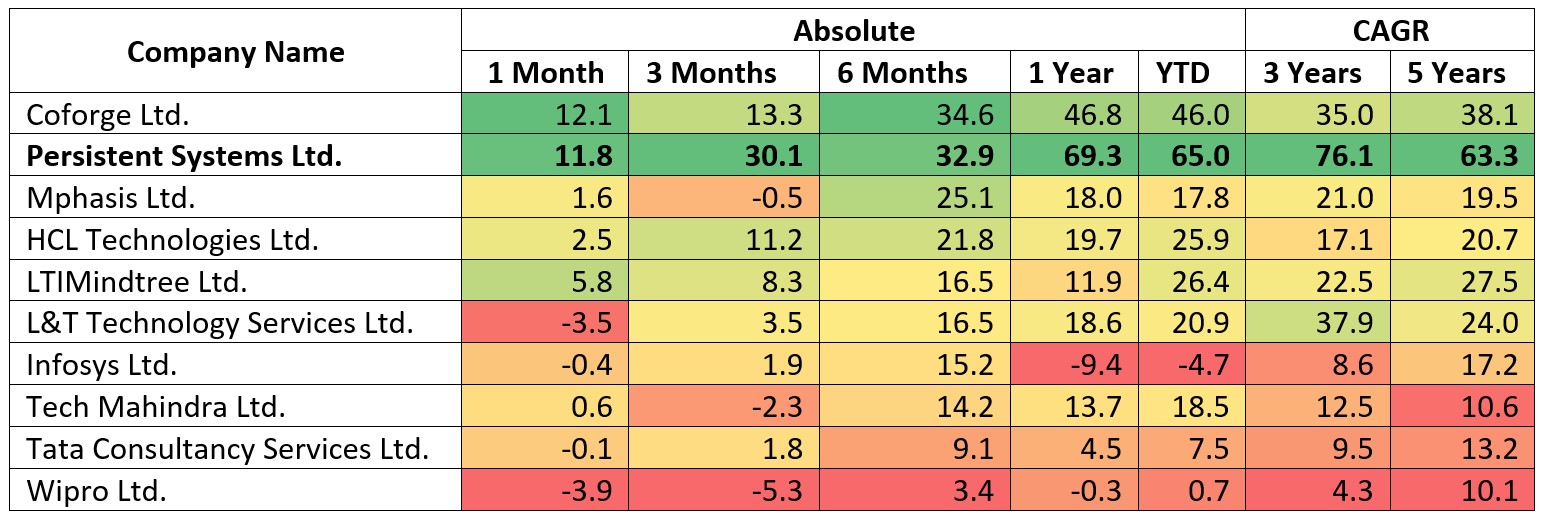

Amid all of this buzz around slowdown in IT sector earnings few stocks within the IT index have outperformed its peers across the board:

|

|

Source: ACEMF, Fisdom Research. Data as on 17th Nov 2023

Persistent Systems is a IT company which majorly caters to engineering research and development services (ERD). While overall IT sector has been a laggard, in the second quarter ending September 30, ERD services companies showcased impressive year-on-year double-digit revenue growth.

Below are other major players in the ERD sector:

|

|

Source: Moneycontrol, EIIRTrend, Fisdom Research

L&T Group, overseeing both LTTS and LTIMindtree, anticipates a potentially stronger growth trajectory for the former in the coming six to twelve months in contrast to its IT services counterpart. The distinction arises from the latter’s dependency on discretionary spending, an area witnessing reduced customer expenditure.

In a departure from its Tier-1 IT counterparts, KPIT Technologies raised its FY24 constant currency (CC) revenue growth projection to more than 37 percent, up from the previous range of 27-30 percent. Additionally, the EBIT margin guidance was revised upward to exceed 20 percent, previously ranging between 19-20 percent. Despite a decrease in the quarter’s order book from $190 million to $156 million, strategic account wins predominated, particularly in the passenger car vertical, electric powertrain, autonomous driving, and digital connected solutions practices.

The ERD services market presents a vast opportunity, albeit not outsourced at the same rate as IT services. Currently, a mere 5 percent of ERD needs, such as software development for automotive companies, are being outsourced. This pattern began shifting during the COVID-19 pandemic, as remote work became feasible and customers sought to trim R&D expenses amidst macroeconomic conditions as per the CEO of EIIRTrend.

|

Conclusion

The IT sector amid India Inc.’s Q2FY24 earnings season depict a mixed landscape. While certain IT segments, like ERD services, have demonstrated impressive growth and potential, others have faced challenges due to factors like customer spending constraints and ongoing geopolitical tensions. Despite downward revisions in revenue growth forecasts for some major players, companies like KPIT Technologies stand out with an upward revision in projections, indicating resilience and promising performance. The evolving nature of the ERD services market, albeit currently underutilized, hints at gradual growth and shifting outsourcing trends, especially highlighted by the sector’s limited 5 percent outsourced needs. So now you know why certain segments of IT industry are rallying and why others are not.

Investors are however suggested to take long term view on the segment and stagger their investments for a longer tenure when allocating money towards the IT sector.

|

Markets this week | | 13th Nov 2023 (Open) | 17th Nov 2023 (Close) | %Change | | Nifty 50 | ₹ 19,487 | ₹ 19,732 | 1.30% | | Sensex | ₹ 65,158 | ₹ 65,795 | 1.00% |

Source: BSE and NSE |

- Indian equity indices concluded the final week of Samvat 2079 on a positive trajectory, marking the second consecutive week of gains until November 10.

- The market witnessed volatility attributed to factors such as the easing of US treasury yields, a decline in crude oil prices, and statements from the Federal Reserve chair regarding potential rate hikes in the future.

- Foreign institutional investors (FIIs) continued their trend of selling, offloading equities amounting to Rs 3,105.27 crore during this period.

- In contrast, domestic institutional investors (DIIs) exhibited a buying trend, acquiring equities worth Rs 4,155.23 crore.

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | Eicher Motors | ▲ 9.17% | | Hero MotoCorp | ▲ 7.39 % | | Coal India | ▲ 6.76 % | | Tech Mahindra | ▲ 5.68% | | TATA Consultancy | ▲ 5.07% |

| NSE Top Losers | Stock | Change % | | Axis Bank | ▼ 3.39 % | | Bajaj Finance | ▼ 3.01 % | | SBI | ▼ 2.84 % | | ICICI Bank | ▼ 1.78 % | | Power Grid Corp | ▼ 0.78 % |

|

Source: BSE |

Stocks that made the news this week:

- JSW Steel experienced a minor decrease of 0.09% in its shares. The company, taking into account the prevailing demand and supply dynamics of Iron Ore in India, made a strategic decision to withdraw its application for the Final Mine Closure Plan. This application, initially submitted on 1st September 2023 to the Indian Bureau of Mines, was intended for the surrender of the Jajang Iron Ore Block situated in Odisha’s Keonjhar district.

- Natco Pharma Ltd marked a staggering 550% surge in its consolidated net profit in the September quarter, attributed chiefly to the expansion in formulation exports and heightened sales in the domestic agrochemical sector. Reporting a net profit of Rs 369 crore compared to Rs 56.8 crore from the previous year, the company saw a substantial increase in total sales, more than doubling to Rs 1,061 crore, up by 134.7% from Rs 452 crore last year. Additionally, the company declared an interim dividend of Rs 1.25 per share.

- Asian Paints observed a 3.5% rise during the week as it enhanced the original installed production capacity of the Khandala plant to 4,00,000 KL per annum. This expansion aims to address the company’s medium-term capacity needs. With an investment of around Rs. 385 crore, funded through internal accruals, Asian Paints augmented the plant’s capacity to meet future demand.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|