|

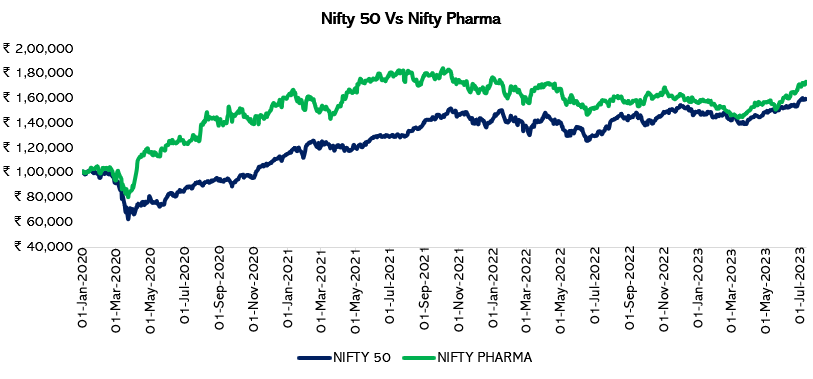

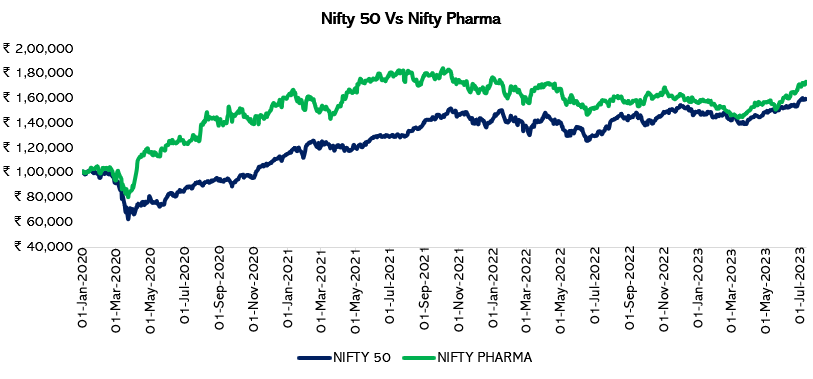

Source: NSE India, Fisdom Research

Since the onset of the Covid-19 pandemic in January 2020, the Nifty Pharma index has experienced a remarkable surge, outpacing the broader Nifty 50. With a gain of 17 percent compared to the Nifty 50’s 14 percent rally, the pharma sector initially showcased promising growth. However, this outperformance took a downturn in the subsequent years of 2021 and 2022, as the Nifty Pharma index significantly underperformed the Nifty 50 by a wide margin.

Recently, however, the pharma space has once again caught the attention of several investors, thanks to the anticipation of strong demand and promising growth prospects.

In this article, we will delve into the volatile journey of the pharma sector, understanding the key points that have shaped its performance over time.

Some of the performance of pharma companies which have gained between 4-41 percent in the past three months:

The growing optimism around the sector has translated into gains across different players within the entire healthcare universe. Additionally, the sector is currently being propelled by strong tailwinds, fuelling optimism regarding a robust demand trajectory for the industry as a whole.

One event that has particularly fuelled this renewed interest is the record-breaking initial public offering (IPO) of Mankind Pharma, which has reinvigorated confidence in the healthcare industry. Since the announcement of Mankind Pharma IPO in April 2023 the Nifty 50 index has rallied by 48 percent whereas Nifty Pharma reported a 69 percent growth during the same period. Some other factors that have led to this rally are:

Firstly, there seems to be a noticeable shift in consumer sentiment, particularly after the COVID-19 pandemic. This shift is characterized by a heightened emphasis on health and well-being. Analysts have observed a significant increase in demand for acute therapies related to seasonal flu, air pollution, and post-COVID side effects. This unexpected trend indicates a rise in health awareness among individuals, which has implications for the pharmaceutical sector. The pharmaceutical industry asserts that this change in consumer behaviour was not initially anticipated to persist beyond the pandemic but has now become prominent.

In order to cater to this shifting demand more and more companies are trying to raise capital in order to fulfil the capital expenditure requirements of several players.

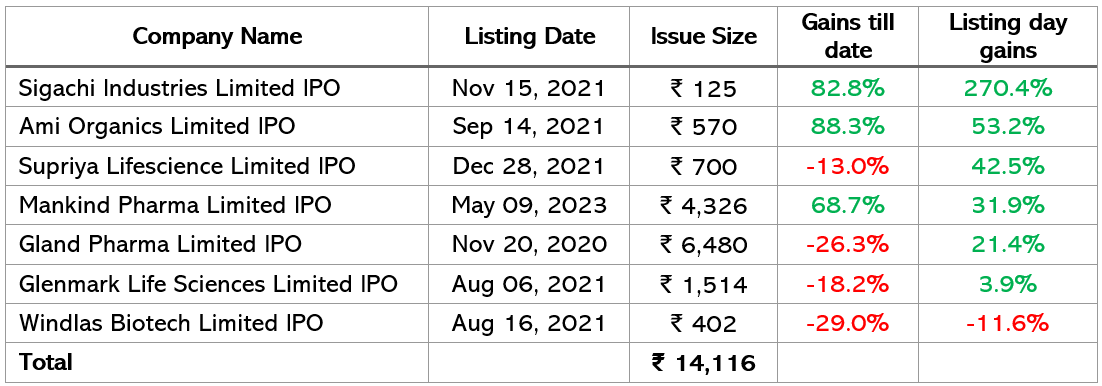

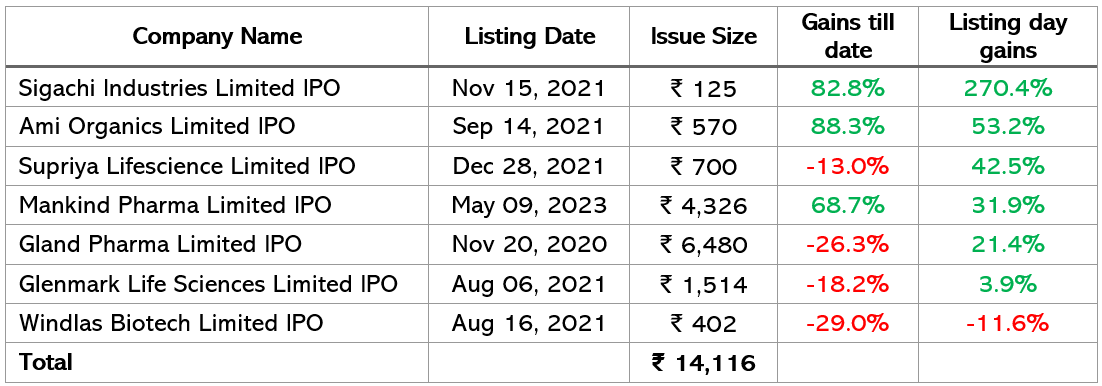

Mainline IPOs of Pharma Companies from Jan 2020:

|

|

Source: Chittorgarh, Fisdom Research, Data as on 13th July 2023

Secondly, India’s projected economic growth is expected to result in an increase in disposable income in the coming years. This rise in disposable income, coupled with changing consumer sentiment and easier access to healthcare, forms the foundation for sustained demand in the healthcare sector.

An additional factor contributing to the growth of the pharmaceutical industry is the aging population in India. Currently, there are 300 million individuals above the age of 50 in the country. Over the next decade, this number is projected to reach 450 million. This aging population is susceptible to chronic diseases like diabetes, which require long-term medication, thereby driving up demand for healthcare products and services.

Moreover, there has been a notable shift in consumer behaviour towards proactively seeking regular check-ups. This change can be attributed to various factors, including government incentives, industry-led awareness campaigns, and heavy advertising efforts aimed at promoting healthcare awareness.

Furthermore, both the government and industry participants have taken initiatives to foster this evolving consumer sentiment, contributing to the growth of the pharmaceutical industry. These efforts include implementing policies to enhance healthcare accessibility and affordability for individuals across the country.

Lastly, expansion of healthcare services to tier II and tier III cities through capital expenditure by companies has led to increased access to healthcare for a larger population.

The growth of the pharmaceutical industry in India has been noteworthy, with a CAGR of 6%-8% between FY18-FY23. This growth can be attributed to a 8% increase in exports and a 6% growth in the domestic market during the same period.

In terms of exports, the Indian pharma market saw a modest growth of 3% in FY23, while the domestic market continued to exhibit a strong growth rate of 7% during the same period. The developed markets showed a growth of approximately 8% on a year-on-year basis, while the emerging markets remained relatively stagnant. Export growth to emerging markets was hampered by factors such as the Russia-Ukraine war, shortage of foreign currency in African countries, and depreciation of local currencies.

Amid challenges of pricing pressures in the US generics market, companies have managed to maintain their margins at around 22% in FY23, all thanks to their focus on complex and specialty products. On the other hand, the operating margin of APIs/bulk drugs companies declined by 170 basis points (bps) and stood at approximately 18% in FY23.

Moving forward, as raw material prices stabilize, freight rates normalize, and pricing pressures in the US generics market ease, there is an increased focus on complex and specialty products. This, along with strong profitability and lower reliance on debt, is expected to maintain the stable credit profile of Indian pharmaceutical companies.

|

| | 17th July 2023 (Open) | 21st July 2023 (Close) | %Change | | Nifty 50 |

₹ 19,612 | ₹ 19,745 | 0.70% | | Sensex | ₹ 66,148 | ₹ 66,684 | 0.80% |

Source: BSE & NSE |

- The market continued its record run during the week, with the Nifty nearing the 20,000 mark and the Sensex crossing 67,000 points for the first time. This was driven by positive factors such as progress in monsoon, decent earnings from Indian companies, and steady foreign capital inflow, despite mixed global cues.

- However, on Friday, there was some selling pressure, particularly in IT stocks, after Infosys lowered its guidance for the rest of the fiscal year.

- For the week, the Sensex gained 0.94 percent, rising by 623.36 points to close at 66,684.26, while the Nifty50 added 0.92 percent or 180.5 points, ending at 19,745.

- Both the Sensex and Nifty touched fresh record highs during the week, reaching 67,619.17 and 19,991.85, respectively. The BSE Large-cap and Mid-cap indices increased by 0.5 percent each, and the Small-cap index surged by 1.3 percent.

- Among the sectors, Nifty PSU Bank index saw a significant gain of 4 percent, followed by Nifty Media index at 3 percent, Nifty Bank index at 2.8 percent, and Nifty Pharma and Energy indices each adding 2 percent. However, the Nifty IT index faced a decline of 3.5 percent during the week.

|

|

Weekly Leaderboard:

NSE Top Gainers | Stock | Change (%) | | Kotak Mahindra Bank | ▲ 5.41% | | SBI | ▲ 5.25 % | | L&T | ▲ 4.61 % | | NTPC | ▲ 4.36 % | | Dr. Reddys Labs | ▲ 3.48 % |

| NSE Top Losers | Stock | Change (%) | | Reliance Industries |

▼ 7.37 % | | Infosys |

▼ 6.62 % | | TCS |

▼ 4.16 % | | HDFC Life Insurance |

▼ 3.40 % | | LTIMindtree |

▼ 3.34 % |

|

Source: NSE |

Stocks that made the news this week:

👉Jio Infocomm, the telecom division of Reliance Industries, posted a standalone net profit of Rs 4,863 crore for the quarter ending in June, showing a YoY growth of 12.17 percent. Compared to the previous quarter, the net profit rose by 3.11 percent. The company reported a revenue from operations of Rs 24,042 crore, with a YoY increase of 9.91 percent and a sequential rise of 2.76 percent. The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) for the quarter stood at Rs 12,278 crore, marking a 0.55 percent increase QoQ. The EBITDA margin remained steady at 52.3 percent. The debt equity ratio rose to 0.21 times from 0.16 times a year ago, while the net profit margin increased to 17.2 percent with a 30 basis points rise.

👉Nifty’s march towards the highly anticipated 20,000 mark was halted by Infosys, as the IT giant’s disappointing June quarter results led to a decline in the index on July 21. Infosys, with a 6.9 percent weightage on the Nifty 50, witnessed an 8 percent drop in its stock price to Rs 1,331 on the NSE, falling below the crucial 200-day moving average. The Q1 report card not only erased all recent gains but also resulted in analysts reducing their ‘Buy’ calls on the stock from 28 to 21, as the company cut its revenue growth guidance from 4-7 percent to 1-3.5 percent.

👉Persistent Systems witnessed a decline of over 2.5 percent in its share price on July 21 after reporting a 9 percent sequential fall in net profit at Rs 228.8 crore for the quarter ended June. Although the company’s revenue in rupee terms grew by 3 percent QoQ to Rs 2,321.2 crore, and its topline in dollar terms also increased by 3 percent to $282.90 million, both the topline and bottom line numbers missed Street estimates. Additionally, the order booking for the quarter ending June 2023 stood at $380.3 million in total contract value, marking a 10 percent sequential decline.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|