Technical Overview – Nifty 50

The Benchmark Index continues its bearish trend and witnessed a gap down opening below 22,000 levels on 19th March. The Nifty50 breached 21,800 levels on the intraday chart and has taken support near its 50 EMA.

The Index has formed a bearish candle on the daily chart and the prices have also witnessed a rising channel pattern breakdown on the intraday charts. The Nifty has given a bearish dead cross where 9 EMA has crossed below 21 EMA suggesting a bearish crossover.

The momentum oscillator RSI (14) witnessed a breakdown below 50 levels and continued to drift lower with sharp bearish momentum. The trend remains on the bearish side and immediate support is placed on a 21,600 level and resistance is placed at 22,100 levels.

Technical Overview – Bank Nifty

Like other indices, the Bank Nifty closed in red signaling a selloff in the Indian markets. The Banking Index has formed a bearish candle on the daily chart and continued to move lower.

The Bank Nifty on the daily chart has closed below its 9, 21, and 50 EMA suggesting the bears are at driving seats. The momentum oscillator RSI (14) has formed a lower low below 50 levels with a bearish crossover on the cards.

The market context has changed for now as sellers use every smaller rally as a selling opportunity. The immediate support for the Bank Nifty is placed at 45,500 levels and 47,000 will act as an immediate resistance for the Banking index.

Indian markets:

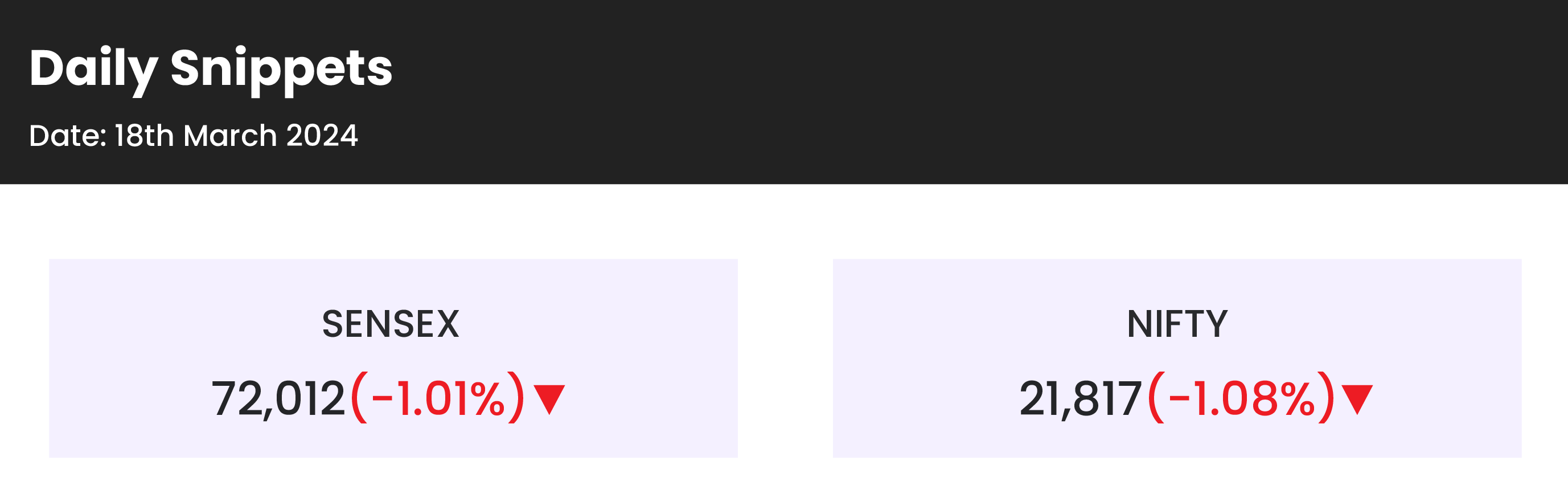

- On Tuesday, March 19, a sharp decline in the domestic stock market led to a substantial depletion of investors’ wealth.

- The combined market value of companies listed on the BSE fell from ₹378.8 lakh crore to approximately ₹373.9 lakh crore, resulting in a collective loss of around ₹5 lakh crore in just one trading session.

- The Nifty 50 and the Sensex, key equity benchmarks, suffered notable losses on Tuesday, driven by extensive selling activity.

- Investor caution prevailed following the Bank of Japan’s decision to raise interest rates for the first time in 17 years, marking the end of an eight-year period of negative interest rates, as anticipated by the market.

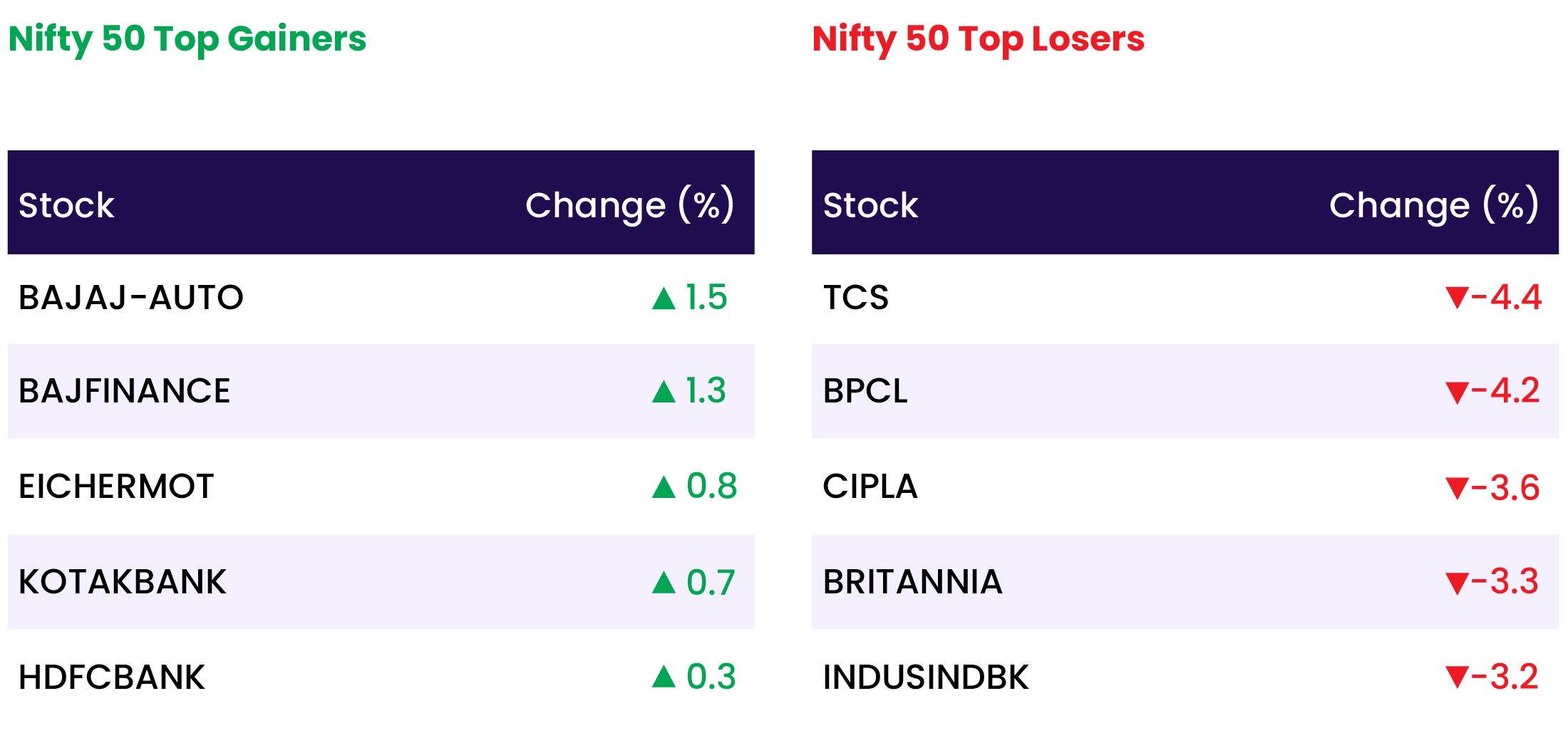

- All sectoral indices concluded the day in negative territory, with Healthcare, IT, FMCG, Capital Goods, Oil & Gas, and Power sectors experiencing declines ranging from 1 to 2 percent.

Global Markets:

- On Tuesday, Japan’s Nikkei 225 index surpassed 40,000 points following the central bank’s decision to raise interest rates for the first time since 2007.

- The S&P/ASX 200 closed 0.36% higher at 7,703.20 after the announcement, continuing its upward momentum from Monday.

- South Korea’s Kospi declined by 1.10% to conclude at 2,656.17, whereas the small-cap Kosdaq edged 0.29% lower to finish at 891.91.

- Hong Kong’s Hang Seng index experienced a 1.13% drop, while mainland China’s CSI 300 closed 0.72% lower at 3,577.63.

- In European markets, Tuesday saw a flat performance as global investors awaited the commencement of the U.S. Federal Reserve’s two-day policy meeting.

- The pan-European Stoxx 600 saw a marginal decrease of 0.02% in early trading, with sectors showing mixed results. Oil and gas stocks recorded a 0.7% increase, while utilities experienced a 0.7% decline.

Stocks in Spotlight

- On March 19, one 97 Communications, the parent company of Paytm, continued its upward trend, with its share price rising by nearly 5 percent compared to the previous session. In just three days, the stock has surged by an impressive 14 percent.

- TCS experienced a significant downturn, emerging as the top underperformer by declining 4.3% to ₹3,972 per share. This marked the largest intraday drop since September 2022. The decline followed a notable transaction involving 2.02 million shares, representing 0.6% of equity, which changed hands in a block deal window on Wednesday. The total value of this transaction amounted to ₹9,000 crore.

- JBM Auto Ltd. observed a remarkable increase in its share value, surging approximately 10 percent on Tuesday, driven by a significant announcement. The company disclosed to the exchanges that its subsidiary, JBM Ecolife Mobility Pvt. Ltd., secured the L1 (Lowest Bidder) position and was awarded a tender for an electric bus order. This announcement highlights the subsidiary’s success in the electric mobility sector, bolstering JBM Auto Ltd.’s standing in the market.

News from the IPO world🌐

- Shares worth $21 billion to enter market in 4 months as IPO lock-in period expires for 66 companies

- Rekha Jhunjhunwala-backed Baazar Style Retail files IPO papers with Sebi

- Transrail Lighting files IPO papers with Sebi; eyes Rs 450-cr via fresh issue

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY IT | -2.9 |

| NIFTY MEDIA | -2.5 |

| NIFTY PHARMA | -2.2 |

| NIFTY FMCG | -2.2 |

| NIFTY HEALTHCARE INDEX | -1.9 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1233 |

| Decline | 2584 |

| Unchanged | 111 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,790 | 0.2 % | 2.9 % |

| 10 Year Gsec India | 7.1 | 0.1 % | (1.1) % |

| WTI Crude (USD/bbl) | 81 | 1.9 % | 15.5 % |

| Gold (INR/10g) | 65,390 | (0.1) % | 1.3 % |

| USD/INR | 82.89 | 0.0 % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer