Technical Overview – Nifty 50

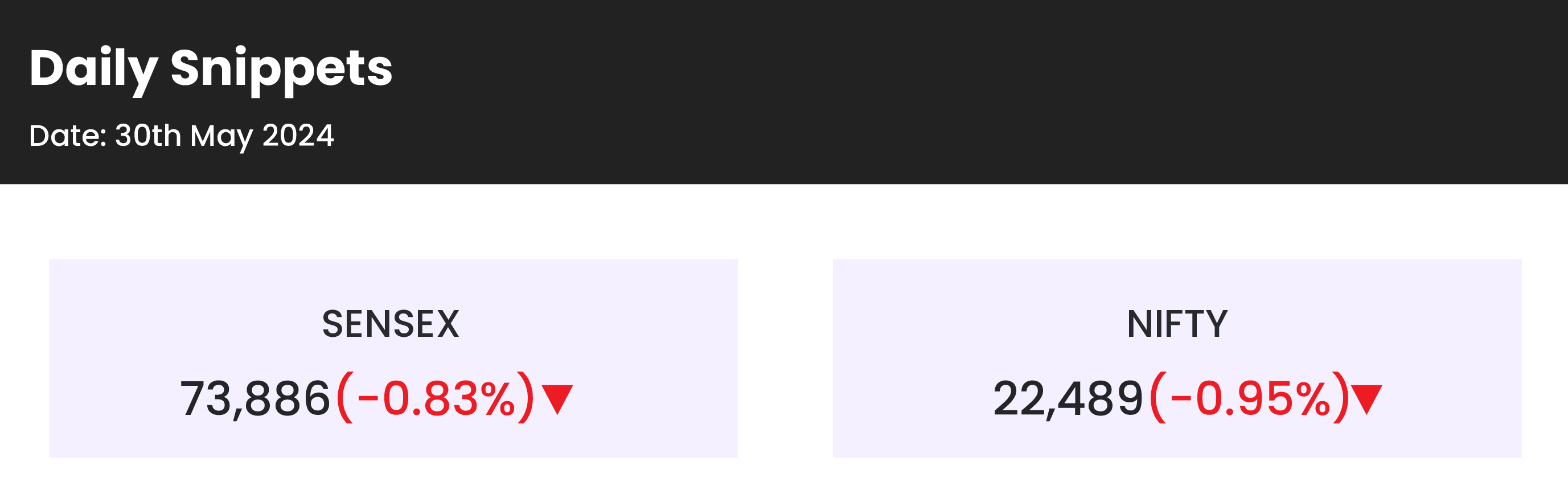

At 22,489, the benchmark index, NIFTY, closed down 216 points, or -0.95%.

Another profit booking in for the benchmark index has now moved below 22,500. The rising channel upper band reversal seems working perfectly in line. The index is now down close to 700 points from its All-Time High level. The index is now trading below 10&20 DEMA and selling pressure seems to continue. The 22,800 level breakout has seemed to fail. With upcoming election results, the INDIA VIX stays above 24, indicating huge premiums to be paid.

Immediate support levels in the index can be seen at 22,350, 22,200 levels, and resistance levels at 22,600, and 22,800 levels to be closely watched.

Technical Overview – Bank Nifty

At 48,682 points at the closing, the BANK NIFTY index was up 181 points, or 0.37%, on the day.

The banking index beat the benchmark index for the day and doesn’t appear to be giving up its gains from the previous week. The index is approaching the consolidation breakout retest of around 48,200 from last week. Even though the index could not sustain its gains for the day, it managed to maintain its low and open at 48,314; it is still trading above the 20 DEMA.

A double-bottom pattern may form every week if the index fails to maintain levels above fifty thousand.

The resistance levels 49,000 and 49,500 might be considered in the upcoming sessions, but it is important to watch the support levels 48,000 and 47,500 carefully.

Indian markets:

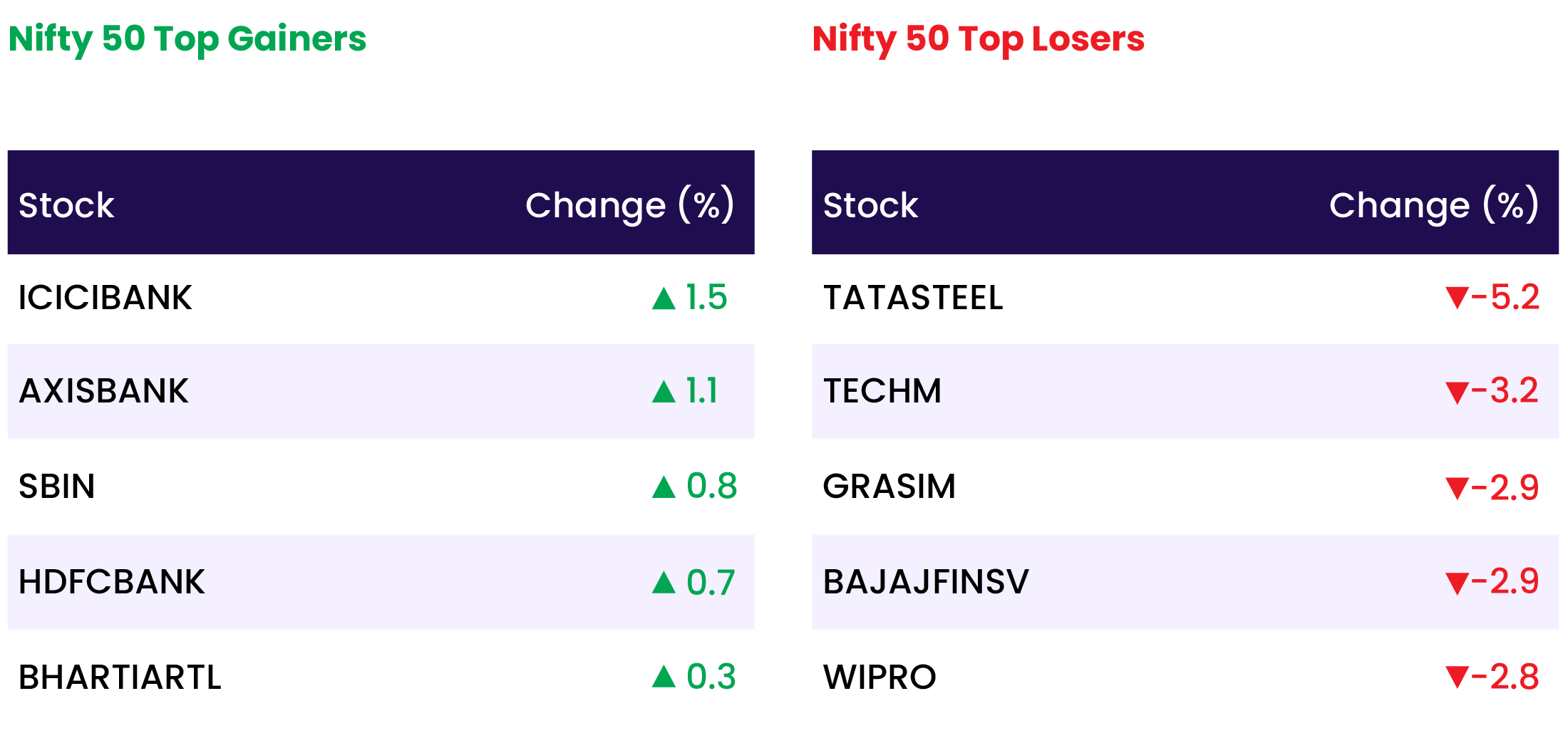

- The Indian stock market experienced a widespread selloff on Thursday, May 30, on the expiry day of May futures and options (F&O) contracts.

- Market participants remained jittery ahead of the Lok Sabha election 2024 results, which are set to be announced next week on June 4.

- Among sectors, the Bank index gained 0.5 percent, while Auto, FMCG, Metal, IT, Healthcare indices shed 1-2 percent.

- The BSE midcap and smallcap indices shed 1.2 percent each.

Global Markets:

- Asia-Pacific markets extended their losses on Thursday, mirroring Wall Street’s decline ahead of a series of economic data releases from the region expected on Friday.

- South Korea’s Kospi dropped 1.56% to close at 2,635.44, while the smaller cap Kosdaq fell 0.77% to 831.99.

- Japan’s Nikkei 225 fell by about 1.3%, recovering slightly after an initial plunge of over 2% at the open, and the broader Topix decreased by 0.56%.

- Australia’s S&P/ASX 200 continued its decline from the previous session, falling by 0.49% to end at 7,628.2, with miners among the biggest losers.

- Hong Kong’s Hang Seng index plummeted 1.26%, and mainland China’s CSI 300 index decreased by 0.53%, closing at 3,594.31, marking its lowest level in about a month.

Stocks in Spotlight

- Shares of Paytm surged by 5 percent for the second consecutive session. This sharp rally followed a report suggesting that billionaire Gautam Adani is considering acquiring a stake in Paytm’s parent company, One97 Communications. However, Paytm later clarified that this report was purely speculative.

- The stock of Lemon Tree Hotels jumped over 6 percent on May 30 after the company reported a strong performance for the January-March quarter (Q4FY24). The company’s net profit increased by 52.1 percent year-on-year to Rs 67 crore, while revenue from operations grew by 29.7 percent year-on-year to Rs 327 crore. Despite the initial surge, the stock ended marginally lower.

- Shares of Tata Steel fell by 5 percent, closing at Rs 165.20, after the Tata Group firm reported a 64 percent drop in net profit for the quarter ended March. The net profit attributable to owners fell to Rs 611.48 crore, primarily due to lower steel realizations and poor performance in its international operations.

News from the IPO world🌐

- Hero FinCorp approves Rs 4,000 crore fundraise via IPO

- Ztech India IPO opens on May 29

- OYO withdraws DRHP, to refile IPO post refinancing

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 0.5 |

| NIFTY BANK | 0.4 |

| NIFTY PRIVATE BANK | 0.3 |

| NIFTY FINANCIAL SERVICES | -0.1 |

| NIFTY PSU BANK | -0.5 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1098 |

| Decline | 2733 |

| Unchanged | 86 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,442 | (1.1) % | 1.9 % |

| 10 Year Gsec India | 7.0 | (0.1) % | (1.2) % |

| WTI Crude (USD/bbl) | 79 | (0.8) % | 12.6 |

| Gold (INR/10g) | 71,975 | (0.2) % | 6.8 % |

| USD/INR | 83.17 | 0.1 % | 0.2 % |

Please visit www.fisdom.com for a standard disclaimer