Technical Overview – Nifty 50

A highly volatile week to monitor, with the benchmark index reaching an all-time high and setting a new swing low in the same week. The index reached a top of 23,339 and a low of 21,884. On the weekly timeframe, the index formed a massive long-legged pin bar candle. The index closed quite close to the ATH.

Following a significant fall in the previous session, the index resumed its upward momentum. The index is now trading at the upper band of the ascending channel and has reached a high of 23,282 near the ATH level. This week, the index tested 200-DEMA and gained 2,000 points from there.

Momentum Indicator RSI (14) has now gone above the 55 level on the daily timeframe and has formed a double bottom structure on the weekly timeframe above 55.

Immediate support levels in the index are at 22,650 and 23,000, while potential resistance levels of 23,350 and 23,500 should be closely monitored.

Technical Overview – Bank Nifty

The BANK NIFTY index finished at 49,803, up 511 points, or 1.04% on the day.

The banking index had an extremely turbulent week, reaching lows of 46,077 and highs of 51,133, trading within a 5000-point range. On the weekly timeframe, the index has created a long-legged hammer candlestick pattern. On a weekly basis, the index tested 50-EMA and rose by about 3900 points from 50-EMA.

Another positive session for the banking index, which finished over 49,800 levels. Momentum Indicator RSI (14) has crossed 55 levels on the daily time frame and has exited consolidation on the weekly timeframe. The index is trading above the main exponential moving averages of 10, 20, 50, 100, and 200 daily.

Immediate support levels in the index include 49,500, and 48,900, while 50,100 and 50,600 are possible resistance levels that should be attentively monitored.

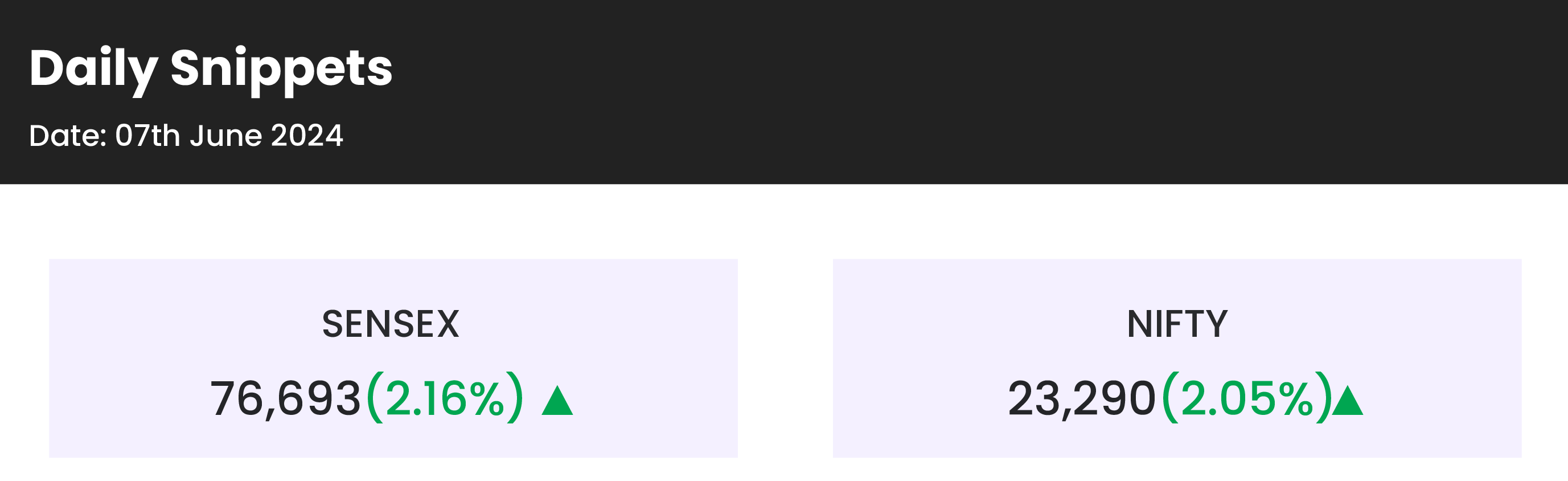

Indian markets:

- Extending gains for the third consecutive session, Indian stock market benchmarks Sensex and Nifty 50 closed at new highs on Friday, June 7, after the Reserve Bank of India maintained the repo rates and policy stance, while also revising the GDP estimates for FY25 upwards.

- Following a flat start, the market gained momentum, ending 2 percent higher and recording the biggest weekly gain in 2024 amid volatility.

- All sectoral indices finished in the green, with auto, IT, power, telecom, and metal sectors up 2-3 percent.

- The BSE midcap index increased by 1.2 percent, while the smallcap index rose by 2 percent.

Global Markets:

- Asia-Pacific stocks were mixed on Friday as investors reviewed economic data from China and Japan’s household spending figures, while also considering the European Central Bank’s rate cut.

- Hong Kong’s Hang Seng index reversed earlier gains to fall 0.75% following the trade data announcement, and mainland China’s CSI 300 decreased by 0.50%.

- Japan’s Nikkei 225 edged down 0.05%, with the broad-based Topix seeing a slight decline.

- South Korea’s Kospi rose 1.23% as investors returned from a public holiday, and the small-cap Kosdaq increased by 1.81%.

- Australia’s S&P/ASX 200 climbed 0.49%, marking a three-day winning streak.

Stocks in Spotlight

- Paytm shares surged 10 percent after the stock’s circuit filter was revised upwards to 10 percent from the previous 5 percent. The rally was also driven by the company’s report of early signs of recovery and strong stabilization in its UPI business.

- IRB Infra shares climbed approximately 11 percent after the company reported a significant increase in toll collections in May, which rose 30 percent year-on-year to Rs 536 crore. Brokerage firm CLSA also highlighted IRB Infra as a key beneficiary of the Modi government’s return to power and its push on infrastructure capex.

- Bajaj Finance shares rose around 4 percent after the board approved the sale of Rs 3,000 crore worth of shares in the Bajaj Housing initial public offering (IPO). The Bajaj Housing Finance IPO aims to raise around Rs 4,000 crore through a fresh issue and an offer-for-sale component separately.

News from the IPO world

- Hero FinCorp approves Rs 4,000 crore fundraise via IPO

- Bajaj Housing Finance board approves plan to raise Rs 4,000 crore via IPO

- Kedaara-backed Ajax Engineering is said to plan India IPO

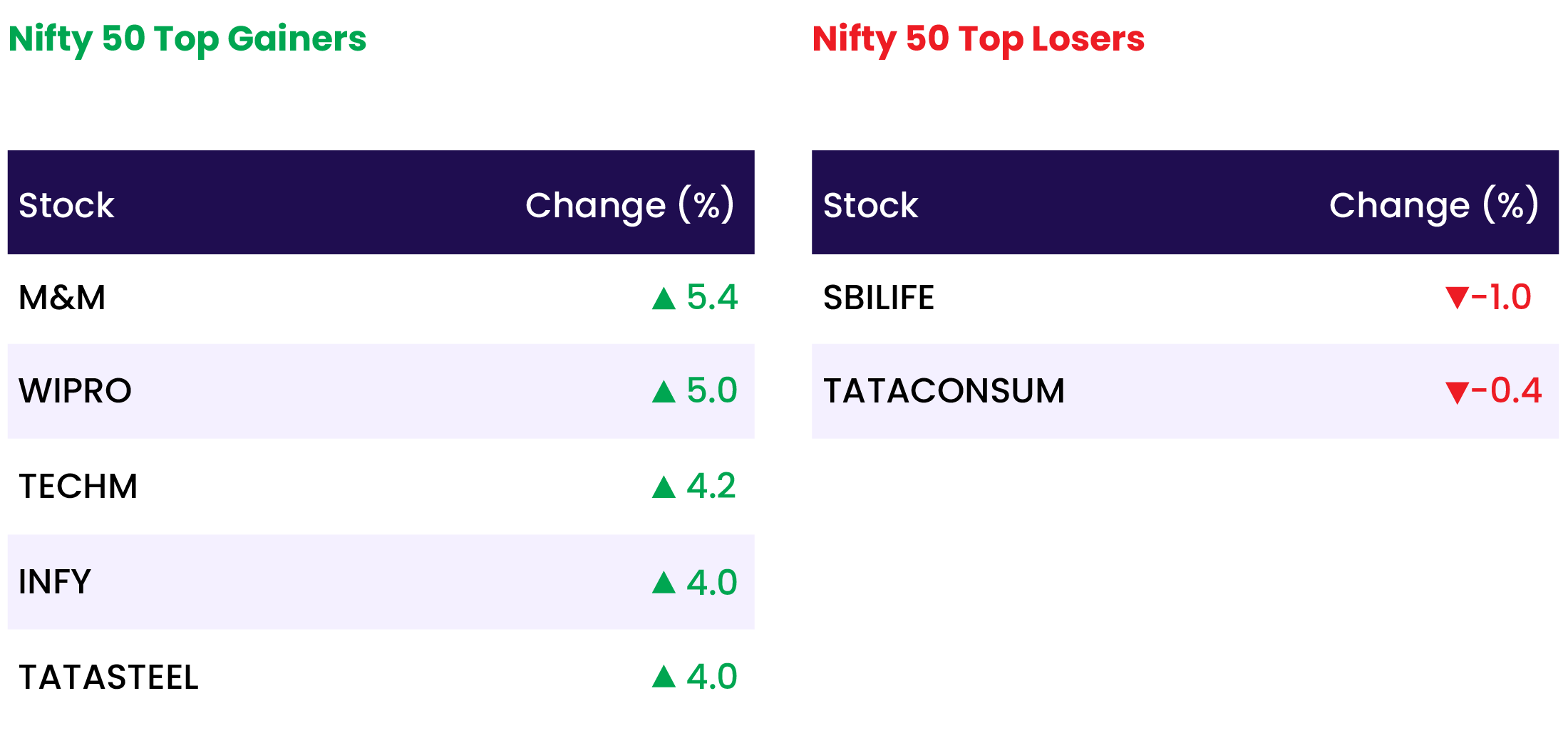

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY IT | 3.4 |

| NIFTY AUTO | 2.6 |

| NIFTY OIL & GAS | 2.1 |

| NIFTY METAL | 2.1 |

| NIFTY REALTY | 2.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2890 |

| Decline | 970 |

| Unchanged | 92 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,886 | 0.2 % | 3.1 % |

| 10 Year Gsec India | 7.0 | 0.03 % | (0.3) % |

| WTI Crude (USD/bbl) | 74 | 1.1 % | 5.2 % |

| Gold (INR/10g) | 72,000 | (1.3) % | 7.0 % |

| USD/INR | 83.42 | (0.1) % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer