Technical Overview – Nifty 50

Post the truncated week the Nifty50 witnessed a flat opening at 22,500 levels and entered below its 9 EMA on the intraday chart drifted lower through the day and formed a bearish candle on the daily time frame. The selling intensified toward the end and the Index drifted below 22,400.

Nifty50 on the daily chart is trading in a rising wedge pattern and prices have reached near the upper band of the pattern and are facing resistance at the higher levels. The Index closely follows the 9-day exponential moving average on the daily chart, and the prices on today’s session have taken support near the 9 EMA.

The momentum oscillator RSI (14) has again entered inside the breakout levels and drifted below 60 levels with a bearish crossover on the daily time frame. The market breadth favors the bears with a 1:2 ratio where sellers were more active than buyers.

The immediate support for the index is placed near 22,150 levels near its 21 EMA and resistance is likely to be faced near 22,550 levels.

Technical Overview – Bank Nifty

Post the truncated week the Banking Index witnessed a flat to negative opening at 47,800 levels and entered below its 9 EMA on the intraday chart drifted lower through the day and formed a bearish candle on the daily time frame. The selling intensified toward the end and the Banking Index drifted below 47,500.

The bearish candle mark on the daily chart signifies the profit booking scenario in the Banking Index. The momentum oscillator RSI (14) has again entered inside the breakout levels and drifted below 55 levels with a bearish crossover on the daily time frame.

The Index has entered near its 9-day exponential moving average range and this level will act as an immediate support for the index. The immediate support for the Bank Nifty is placed near 47,000 levels and resistance is likely to be faced near 48,000 levels.

Indian markets:

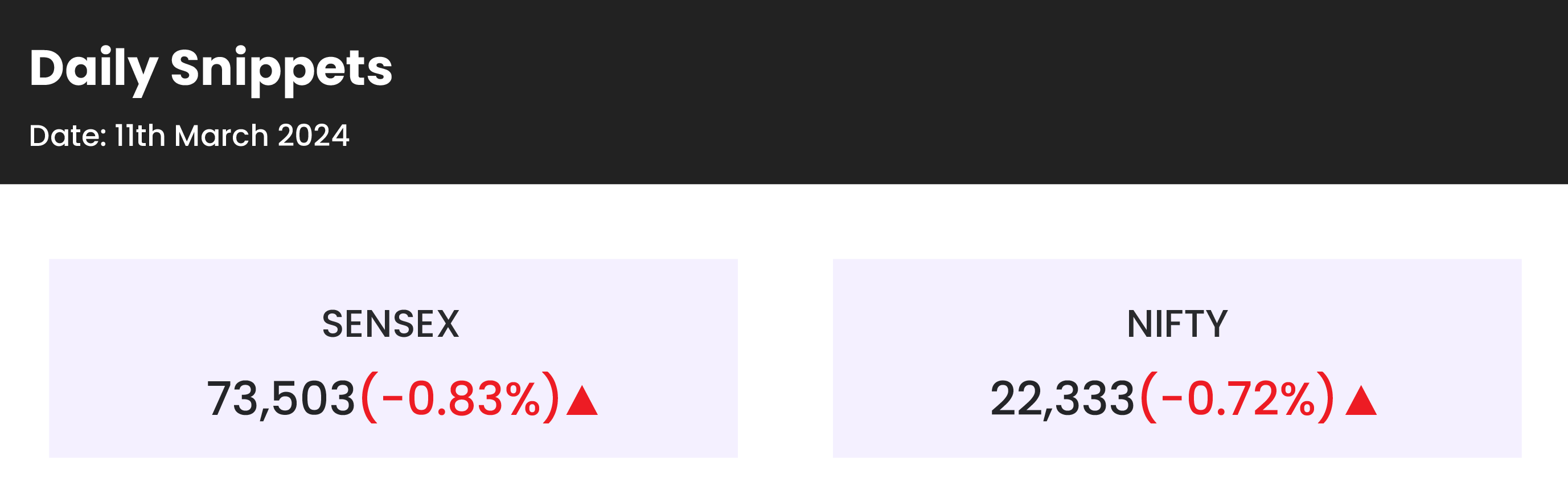

- On Monday, March 11, the domestic equity market witnessed a significant sell-off, influenced by global uncertainties and a cautious outlook for key macroeconomic data.

- Both the Nifty 50 and the Sensex closed the day with losses nearing one percent.

- Market sentiment remains guarded ahead of the upcoming inflation data releases in the US and India on Tuesday, with potential implications for the monetary policy decisions of the Fed and the RBI.

Global Markets:

- Japan stocks led losses in Asia-Pacific markets after the country averted a technical recession, paving the way for its central bank to raise rates, while investors also assessed China’s inflation numbers.

- U.S. stock futures fell slightly Sunday night after the Dow Jones Industrial Average closed out its worst week since October. Investors are also looking ahead to inflation data due out later this week.

- European markets had a negative start the new trading week, following declines in the Asia-Pacific region overnight.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- NLC India shares surged by 6.06 percent as the company initiated its offer-for-sale (OFS) to retail investors. The government plans to divest a 5 percent stake, equivalent to 6.93 crore equity shares, through the OFS route, with an additional option to sell up to 2 percent in case of oversubscription. The floor price for the issue is set at Rs 212 per share.

- Torrent Power witnessed a 12 percent intraday rally, reaching an all-time high, following the company’s successful bid for a 306 megawatt (MW) solar project in Maharashtra valued at Rs 1,540 crore. Despite some retracement, the stock closed 1.52 percent higher.

- Gensol Engineering shares declined by 7.67 percent despite securing an order for a 70 MW/140 MWh portion of a 250 MW/500 MWh standalone Battery Energy Storage Systems (BESS) project. The project is expected to contribute Rs 450 crore in revenue to the company.

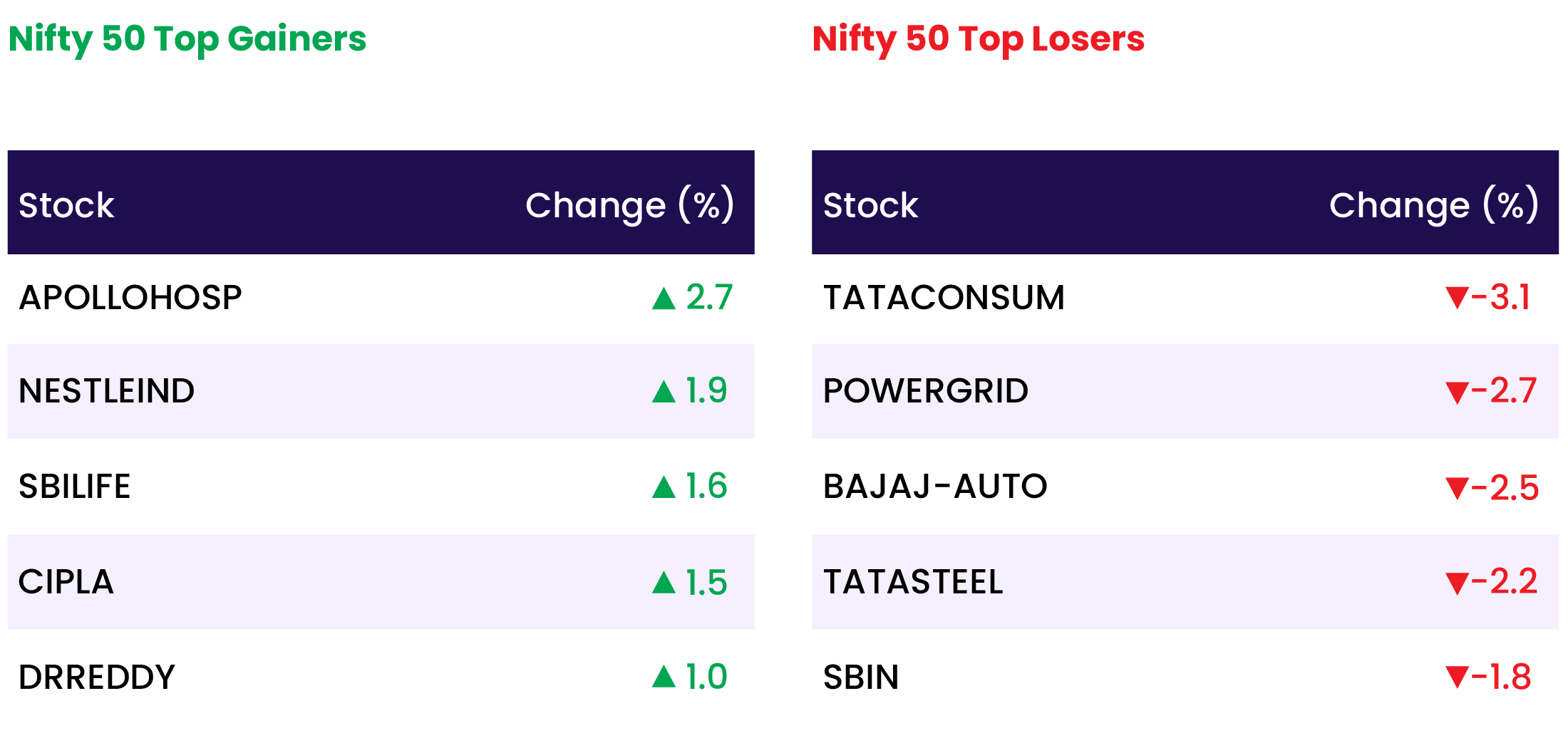

- Cipla’s shares experienced a 2.5 percent intraday gain, reaching a new all-time high. Nuvama Institutional Equities raised the target price for the stock from Rs 1600 to Rs 1750, citing its stable domestic franchise and robust US pipeline. Nuvama highlighted Cipla’s strategic shift towards becoming an integrated health player. The stock closed 1.47 percent higher than the previous day’s closing.

News from the IPO world 🌐

- Shares worth $21 billion to enter market in 4 months as IPO lock-in period expires for 66 companies

- Reddit targets up to $6.4 billion valuation in much-awaited US IPO

- Popular Vehicles sets price band of Rs 280-295 for its Rs 602-crore IPO on March 12

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY HEALTHCARE INDEX | 0.4 |

| NIFTY PHARMA | 0.0 |

| NIFTY IT | -0.3 |

| NIFTY AUTO | -0.6 |

| NIFTY FMCG | -0.6 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 925 |

| Decline | 3039 |

| Unchanged | 118 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,723 | (0.2) % | 2.7 % |

| 10 Year Gsec India | 7.0 | (0.2) % | (2.1) % |

| WTI Crude (USD/bbl) | 78 | (1.4) % | 10.8 % |

| Gold (INR/10g) | 65,842 | (0.0) % | 1.8 % |

| USD/INR | 82.85 | (0.1) % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer