Daily Snippets

Date: 30th August 2023 |

|

|

Technical Overview – Nifty 50 |

|

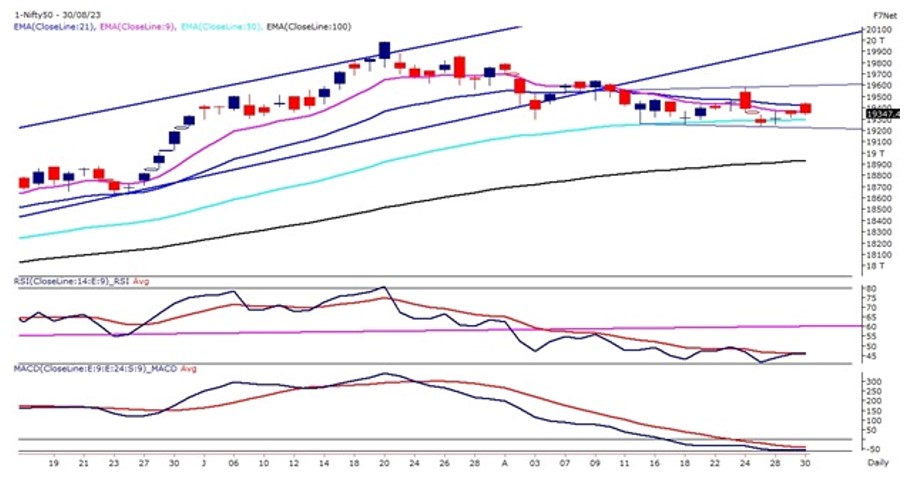

Nifty struggles for direction in a choppy and uninspiring session. Risk aversion continued to be the preferred theme. The benchmark index witnessed a gap-up opening of more than 80 points following its global peers on 30th August.

The prices recorded an intraday high at 19,452 levels and post that couldn’t hold on to its gains and drifted lower by more than 70 points towards the close. The Nifty continues to trade in a narrow-range rectangle pattern from the past 13 trading sessions which indicates a sideways trading range for the market. The momentum oscillator RSI (14) has been hovering below 50 levels for the past couple of weeks suggesting weak momentum on the cards.

The immediate support for the index is placed near the lower band of the rectangle pattern at 19200 levels. A sustained move below the said levels will witness a breakdown in the index. The hurdle for the index is placed near its short-term EMA at 19,450 levels.

|

Technical Overview – Bank Nifty |

|

It was all red towards the end for the Bank Nifty which didn’t capitalize on its opening gains and traded in a lower low formation throughout the day. The daily bearish candle of the banking index has engulfed its previous four days’ candle which indicates the active bear’s participation.

The index on the daily chart is trading within the rectangle pattern and got tangled between 50 & 21 EMA. The momentum oscillator RSI (14) has been hovering below 50 levels for the past couple of weeks suggesting weak momentum on the cards.

Maximum Call Open Interest Build Up witnessed in 44500-45000 Call & on the Put Side Maximum Open Interest is being witnessed in 44000-43000 levels. The PCR ratio holds at 0.58.

The immediate support for the Banking index is placed near the lower band of the rectangle pattern at 44000 levels. A sustained move below the said levels will witness a breakdown in the Banking index. The hurdle for the index is placed near the upper band of the rectangle pattern at 45,000 levels.

|

Indian markets:

- Equity benchmark indices closed nearly flat on Wednesday.

- Nifty 50 index dipped from its earlier high during the day.

- Initial gains were driven by positive sentiment from favorable US labor data and lower mortgage rates from Chinese banks. However, global markets weakened later due to unimpressive European economic data.

- This impacted domestic banking stocks; mid- and small-cap segments remained resilient.

- Among NSE’s sectoral indices, Nifty Realty, Nifty Metal, and Nifty IT outperformed the Nifty 50.

- Nifty Bank, Nifty Financial Services, and Nifty Private Bank underperformed during the day.

|

Global Markets

- The European shares mostly declined, while Asian shares ended higher on Wednesday, following a rally on Wall Street led by technology stocks.

- German import prices saw a significant decline of 13.2% year-on-year in July, the largest drop since January 1987, indicating a retreat in inflationary pressures for the Eurozones largest economy.

- In light of a contraction in eurozone business activity, ECB President Christine Lagarde hinted at a potential pause in the rate-hiking cycle in September.

- US stocks closed higher on Tuesday as weak job openings data suggested a possible halt in interest rate hikes by the US Federal Reserve. Job openings in the US decreased for the third consecutive month in July, reaching the lowest level since March 2021, according to the Labor Departments monthly Job Openings and Labor Turnover Survey (JOLTS) report.

|

Stocks in Spotlight

- Zomato’s stock price increased by more than 5 percent following a block deal where 1.17 percent of the company’s equity was traded on the stock exchange. About 10 crore shares, which make up 1.17 percent of the company, were sold at an average price of Rs 94.70 each. This deal’s total value was approximately Rs 947 crore. Interestingly, this sale comes shortly after another investor, Tiger Global Management, sold its entire 1.44 percent stake in Zomato on August 28, earning Rs 1,123.85 crore from the transaction.

- Titagarh Rail Systems saw a 2 percent increase in its trading value after securing a significant contract worth Rs 350 crore from Gujarat Metro Rail Corporation. This marks the company’s second contract from the same entity, with the previous order received on June 28 amounting to Rs 857 crore. The earlier order was for the supply of 72 metro coaches to be utilized in the first phase of the Surat Metro Rail project.

- Mahindra & Mahindra Financial Services experienced a 1.5 percent surge in its stock value. This rise followed a report by domestic broking firm Motilal Oswal, which predicted a positive growth path for Mahindra Finance. This growth aligns with the historical pattern of stronger asset under management (AUM) growth in fiscal years leading up to elections. The company’s Mission 2025 outlines plans for market expansion and operational efficiency through technology, innovative product creation, and process improvements.

|

News from the IPO world🌐

- Mono Pharmacare IPO fully booked on bidding debut

- Cryogenic tank maker Inox India files draft papers with Sebi for IPO

- Chennai based Basilic Fly Studio to launch IPO on September 1

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | JIOFIN | ▲ 5.00% | | TATASTEEL | ▲ 2.10% | | MARUTI | ▲ 1.80% | | EICHERMOT | ▲ 1.20% | | M&M | ▲ 1.20% |

| Nifty 50 Top Losers | Stock | Change (%) | | BPCL | ▼ -1.50% | | POWERGRID | ▼ -1.50% | | HEROMOTOCO | ▼ -1.40% | | DRREDDY | ▼ -1.30% | | SBIN | ▼ -1.30% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY REALTY | 1.42% | | NIFTY METAL | 0.92% | | NIFTY IT | 0.77% | | NIFTY AUTO | 0.64% | | NIFTY FMCG | 0.57% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2230 | | Declines | 1425 | | Unchanged | 135 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 34,853 | 0.9 % | 5.2 % | | 10 Year Gsec India | 7.2 | 0.20% | 5.00% | | WTI Crude (USD/bbl) | 80 | 0.3 % | 4.1 % | | Gold (INR/10g) | 58,843 | 0.60% | 7.30% | | USD/INR | 82.63 | 0.1 % | (0.1) % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|