In recent times, India’s emerging tech giants such as Zomato, Nykaa, and Paytm have achieved their most promising quarter since their stock market debuts, marking a significant development over the past couple of years. Investors and analysts are increasingly embracing these stocks.

Performance of new age tech companies:

|

|

Source: ACEMF, Fisdom Research

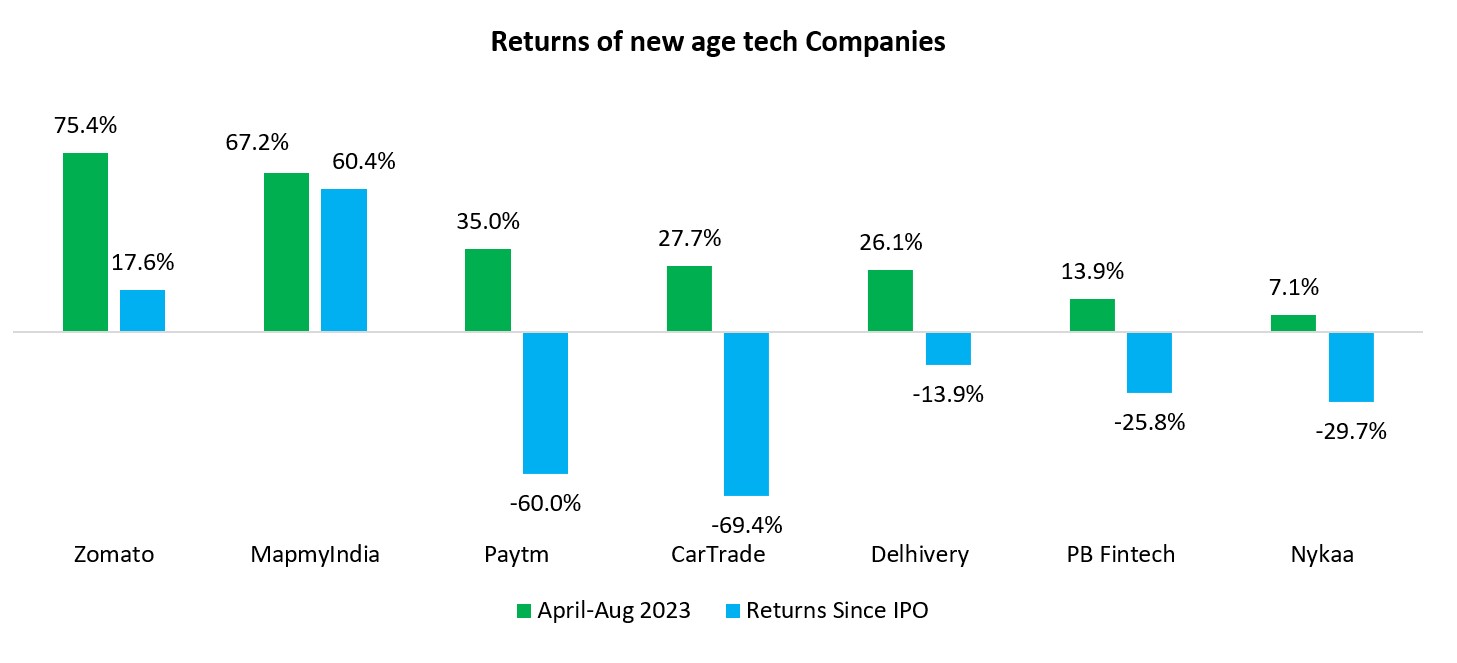

The provided chart underscores the remarkable performance of new-age tech firms during the current financial year. However, it’s important to highlight that a handful of companies still find themselves trading significantly below their IPO price points further indicating a potential upside.

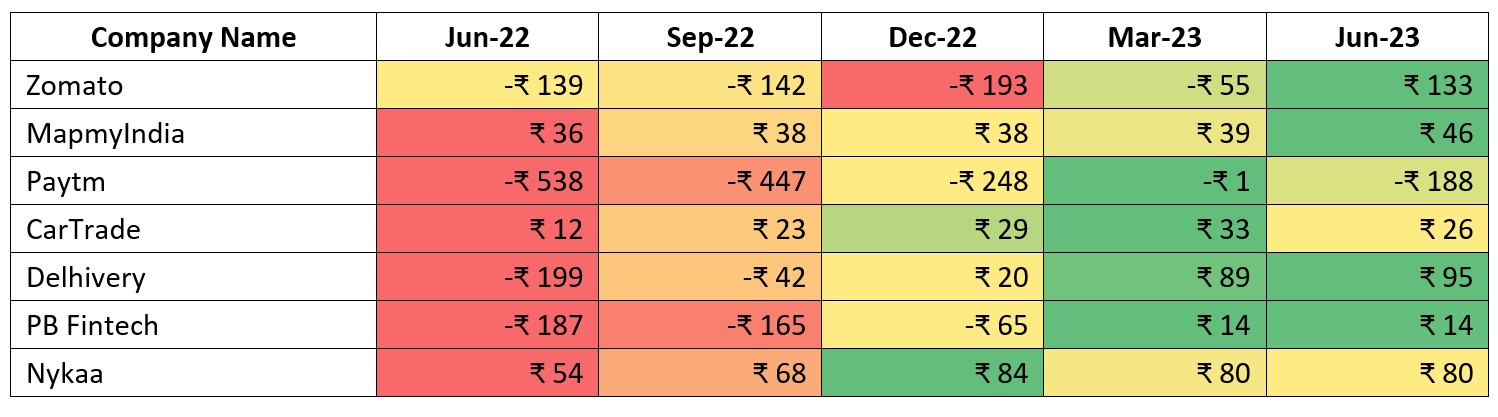

Why have these companies caught the eye of investors recently? Well, in the world of the stock market, there’s a saying that earnings and share price go hand in hand. If the earnings of a company improve share price will follow and create wealth for its investors and vice a versa. This is precisely what has unfolded over the last few quarters for these modern tech platform firms. Take a look at the table below – it shows how these new-age tech companies have been making more money, getting more profitable, as time has gone on in the past few quarters.

Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA) of new age tech companies:

|

|

Source: Tickertape, Fisdom Research. Amount in crores

Digging deeper, there are two main factors driving this renewed interest. Firstly, there’s a positive outlook for many of these companies to become profitable in the near future. Some of them have already achieved this goal. Additionally, their stocks have become more affordable after experiencing significant drops from their initial high prices during their IPOs. Take the example of Paytm: its shares dropped to a low of Rs 438 this year from its IPO price of Rs 2,150. However, since then, the stock has nearly doubled and has increased by more than 35 percent since the start of FY24. Notably, Paytm achieved operational profitability in the December quarter, with reduced net losses in the following March quarter. Similar progress is visible in other companies like PB Fintech and Delhivery.

We have covered a story on how Zomato became profitable👉 here

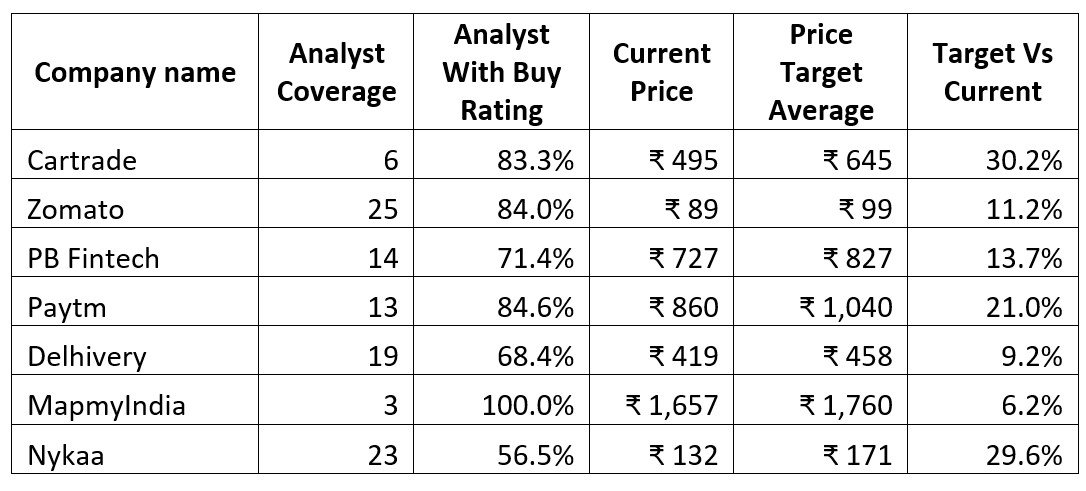

As a result of improved focus on profitability and efficiency, majority of the analyst covering these stocks have turned bullish:

|

|

Source: Refinitive, Fisdom Research. Stock price data as on 18th August 2023

While a takeways for the investor might be that going ahead there could be investment opportunities as most of the stocks have shed weight and have become lighter in terms of valuation from their IPO price some of them are still far away. Retail investors who had invested in these companies during IPOs might still be in losses. Below are important lessons that investors can learn from this:

- First with a flurry of companies that are upcoming with their IPOs in 2nd half of the year, investors need to consciously look out for their pricing and fundamentals, which might not be in line with what market participants agree to.

- Earnings and share price go hand in hand and hence as and when quality of earnings improve companies that are able to multiply their profits will see a rerating and attract investor.

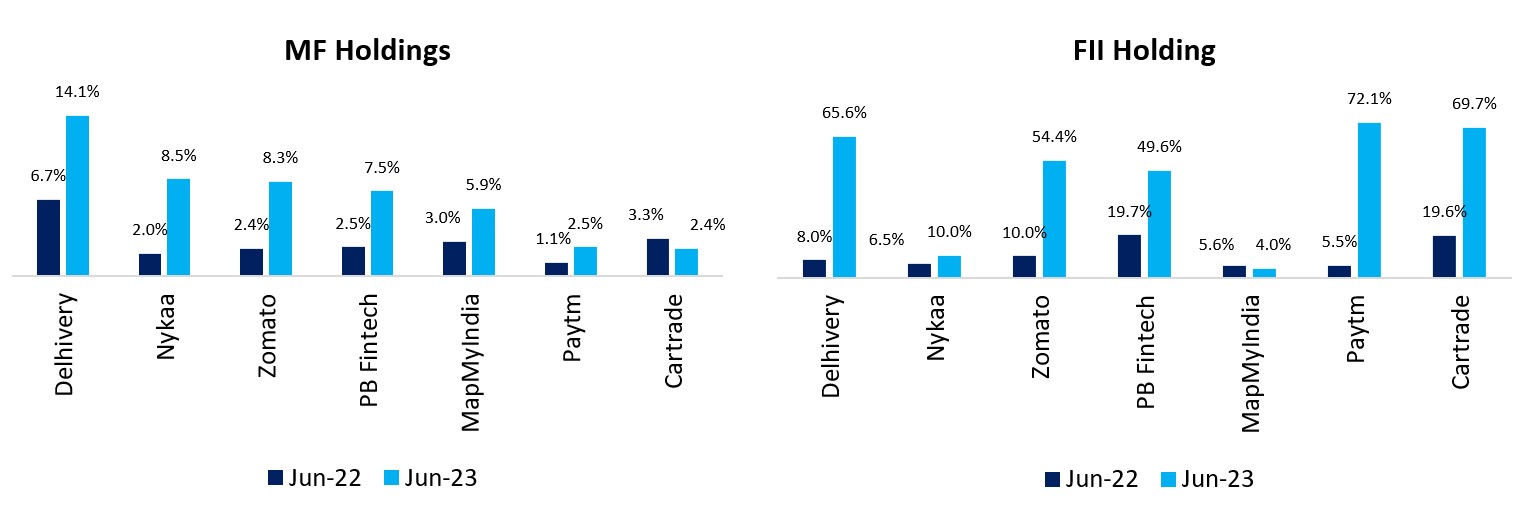

The same has happened in case of these new age tech companies. As and when their fundamentals improved other institutional investors also participated and increased their holdings eventually.

Below is how mutual funds and FIIs increased their holding in these new age companies.

|

|

Source: Trendlyne, Fisdom Research

Markets this week

| | 14th Aug 2023 (Open) | 18nd Aug 2023 (Close) | %Change | | Nifty 50 | ₹ 19,384 | ₹ 19,310 | -0.40% | | Sensex | ₹ 65,153 | ₹ 64,949 | -0.30% |

Source: BSE & NSE |

- Indian equity market sustained a prolonged period of selling, extending for the fourth consecutive week until August 18.

- The extended selling was influenced by weak global cues, including apprehensions about higher interest rates, a slowdown in China, mounting inflation concerns, currency depreciation, and increased bond yields. These factors collectively prompted investors to exit the equity markets.

- FIIs continued their selling streak for the fourth week, disposing of equities valued at Rs 3,379.31 crore.

- In contrast, DIIs stepped in as buyers, acquiring equities amounting to Rs 3,892.3 crore during the same week.

- The cumulative picture for the month reveals that FIIs have sold equities worth Rs 10,925.84 crore, while DIIs have purchased equities worth Rs 9,245.86 crore, indicating ongoing activity in the equity market.

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | Adani Ports | ▲ 4.35% | | HUL | ▲ 2.12 % | | Adani Enterprises | ▲ 1.49 % | | Infosys | ▲ 1.24 % | | Titan Company | ▲ 1.10 % |

| NSE Top Losers | Stock | Change % | | Hindalco Ind | ▼ (4.96) % | | JSW Steel | ▼ (4.09) % | | TATA Steel | ▼ (3.74) % | | UPL | ▼ (3.54) % | | Coal India | ▼ (3.17) % |

|

Source: NSE |

Stocks that made the news this week:

- IndiGo airlines saw its stock price drop by 4.0 percent during the week. This happened because of a block deal. In this deal, 5.1 percent of the company’s ownership changed hands. Two crore shares were sold for a total of Rs 4,837 crore. Even though the exact buyers and sellers aren’t mentioned here, it was reported that the main owner of the company, the Gangwal family led by Rakesh Gangwal, wanted to sell some of their ownership in the company. They were trying to raise $450 million (about Rs 3,735 crore) through this deal, which would reduce their stake in the low-cost airline, IndiGo.

- PVR and Inox, the multiplex chains, witnessed a 5 percent gains during the week. This came after they shared record-breaking achievements in terms of daily and weekend admissions, along with box office earnings. Over the weekend, the combined guest count for both chains reached 33.6 lakh, generating a box office revenue exceeding Rs 100 crore. Notably, on August 13, 2023, PVR and Inox achieved their highest-ever single-day admissions and box office earnings across their theaters, hosting 12.8 lakh guests and accumulating a gross box office revenue of Rs 39.5 crore.

- Ashok Leyland, the main company of the Hinduja group, has announced its complete acquisition of OHM Global Mobility Pvt Ltd. The acquisition involves Ashok Leyland investing Rs 300 crore into the acquired entity. OHM Global Mobility Pvt Ltd, a subsidiary of OHM International Mobility Ltd UK, is the focus of this acquisition. Hinduja Automotive Ltd, the promoter, directly holds 20 percent and indirectly through other subsidiaries holds 43.23 percent in OHM UK. This move is in line with Ashok Leyland’s electric vehicle (EV) strategy to venture into e-Mobility as a Service (eMaaS) business

|