Daily Snippets

Date: 11th January 2024 |

|

|

Technical Overview – Nifty 50 |

|

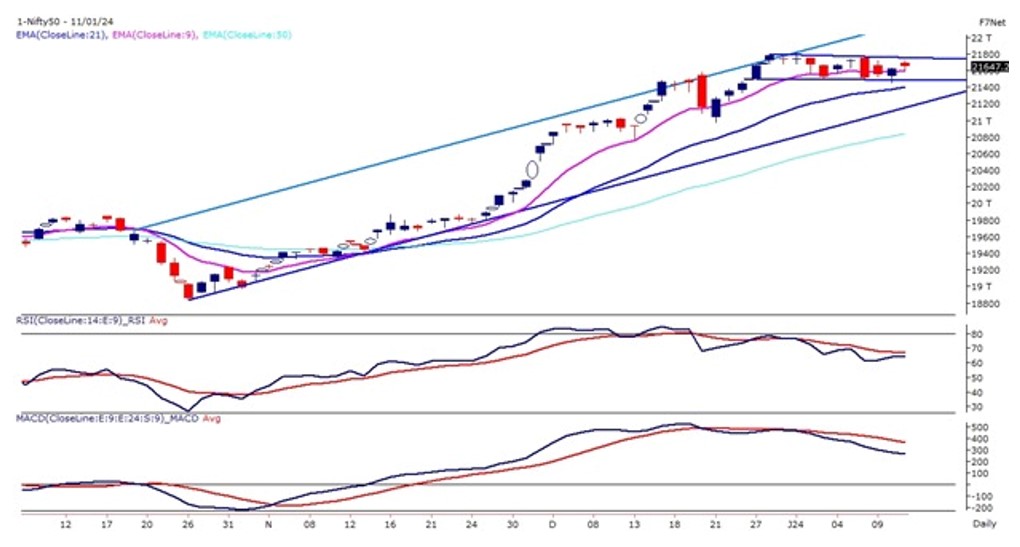

Nothing new for the Benchmark index on the weekly expiry day where prices continued to trade within the narrow range and the Tug of War between the Bulls and Bears continued. The positive takeaway from today’s trading session was that bulls regrouped at lower levels.

Strictly speaking, volatility is the major concern for the traders which keeps traders guessing for the trend. The Nifty50 from the past 12 trading sessions is trading within the 300-point range and has formed a narrow rectangle pattern on the daily time frame. The prices are hovering around its 9 EMA and suggesting a sideways trend for the Index.

The momentum oscillator RSI (14) is reading in a lower low lower high formation and the oscillator is reading near 60 levels with bearish crossover. From a technical perspective, Nifty’s aggressive upside targets are still seen at the psychological 22000 mark. Confirmation of strength is only above the 21,800 mark and the support is placed at 21,450 levels.

|

Technical Overview – Bank Nifty |

|

Nothing new for the Banking index on 11th January where prices continued to trade within the narrow range and the Tug of War between the Bulls and Bears continued. The positive takeaway from today’s trading session was that bulls regrouped at lower levels.

Strictly speaking, volatility is the major concern for the traders which keeps traders guessing for the trend. The Bank Nifty on the daily chart has taken support near the lower band of the rectangle pattern which was acting as a crucial support for the index.

The momentum oscillator RSI (14) is reading in a lower low lower high formation and the oscillator is reading near 50 levels with a bearish crossover. The immediate support for the Banking index is placed near 47,000 and below that bearish breakdown and resistance is placed near 47,800 levels and above 48,000 are likely to be achievable.

|

Indian markets:

- Domestic equity indices closed higher for the third consecutive day, with the Nifty nearing the 21,650 level.

- Market witnessed volatility related to the expiry of weekly index options on the NSE.

- Investor caution prevailed amid marginal gains in choppy trade, anticipating December quarter earnings and US inflation data.

- Energy and auto stocks performed well, while the IT index corrected ahead of Q3 results from Infy and TCS.

- Notably, market attention shifted to broader markets, with mid and smallcaps outperforming the frontline indices.

|

Global Markets

- Most shares in Europe and Asia advanced on Thursday as investors looked forward to key US inflation data.

- The Bank of Korea left its main lending rate unchanged at 3.50% for the eighth time in a row.

- US stocks ended higher on Wednesday led by communications stocks and mega caps. Investors are awaiting the U.S. consumer price index report slated for release Thursday. The producer price index reading is due on Friday.

|

Stocks in Spotlight

- On January 11, Network 18 Media & Investments saw a nearly 10 percent surge, following a 20 percent upper circuit halt in the previous session. A Rs 155.50 crore deal involved 1.3 crore shares 1.3 percent equity, with undisclosed parties. Additionally, a Rs 78 crore transaction occurred in subsidiary TV18 Broadcast, involving 1.2 crore shares (0.7 percent equity on the same day.

- On January 11, Tata Consultancy Services (TCS), India’s largest IT services company, announced a net profit of Rs 11,058 crore for the quarter ending December 31, 2023. This reflects a 2 percent increase from Rs 10,846 crore reported in the corresponding quarter the previous year. Despite challenges such as elevated furloughs in the BFSI and hi-tech sectors, along with a sustained slowdown in discretionary spending, TCS managed a marginal profit growth.

- In the third quarter of FY24, Infosys Ltd, India’s second-largest IT services company, recorded a 7.3 percent year-on-year (YoY) decline in net profit, amounting to Rs 6,106 crore. On a sequential basis, the company’s bottom line declined by 1.7 percent, the Bengaluru-based company said in a regulatory filing on January 11.

|

News from the IPO world🌐

- Jyoti CNC Automation GMP falls sharply on last day despite strong response for IPO

- Firstcry CEO Supam Maheshwari offloaded shares worth Rs. 300 crores before IPO filing

- Medi Assist’s Rs 1,172-cr IPO to open on January 15

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | HEROMOTOCO | ▲ 4.6 | | BAJAJ-AUTO | ▲ 3.4 | | RELIANCE | ▲ 2.5 | | AXISBANK | ▲ 1.6 | | BPCL | ▲ 1.6 |

| Nifty 50 Top Losers | Stock | Change (%) | | HINDUNILVR | ▼ -1.6 | | DRREDDY | ▼ -1.5 | | SBILIFE | ▼ -1.5 | | WIPRO | ▼ -1.1 | | LT | ▼ -1.1 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY OIL & GAS | 1.48 | | NIFTY CONSUMER DURABLES | 1.18 | | NIFTY AUTO | 1.06 | | NIFTY PSU BANK | 0.64 | | NIFTY PRIVATE BANK | 0.41 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2317 | | Declines | 1522 | | Unchanged | 98 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,696 | 0.5 % | (0.1) % | | 10 Year Gsec India | 7.2 | -0.20% | -0.20% | | WTI Crude (USD/bbl) | 72 | 2.1 % | 2.6 % | | Gold (INR/10g) | 62,183 | 0.20% | -0.70% | | USD/INR | 83.1 | 0.0 % | 0.1 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|