In 2023, the Indian equity market witnessed a robust rally across the board with the BSE Sensex and Nifty 50 equity benchmarks hitting an all-time high. However, a robust seven-week rally was abruptly disturbed in on 20th December 2023, as the Nifty witnessed a staggering drop of nearly 500 points from its peak.

Market participants were left puzzled trying to explain the sudden downturn, with speculations about the potential impact of a new variant of COVID spreading across the country, profit booking, and the repercussions of alterations in margin norms.

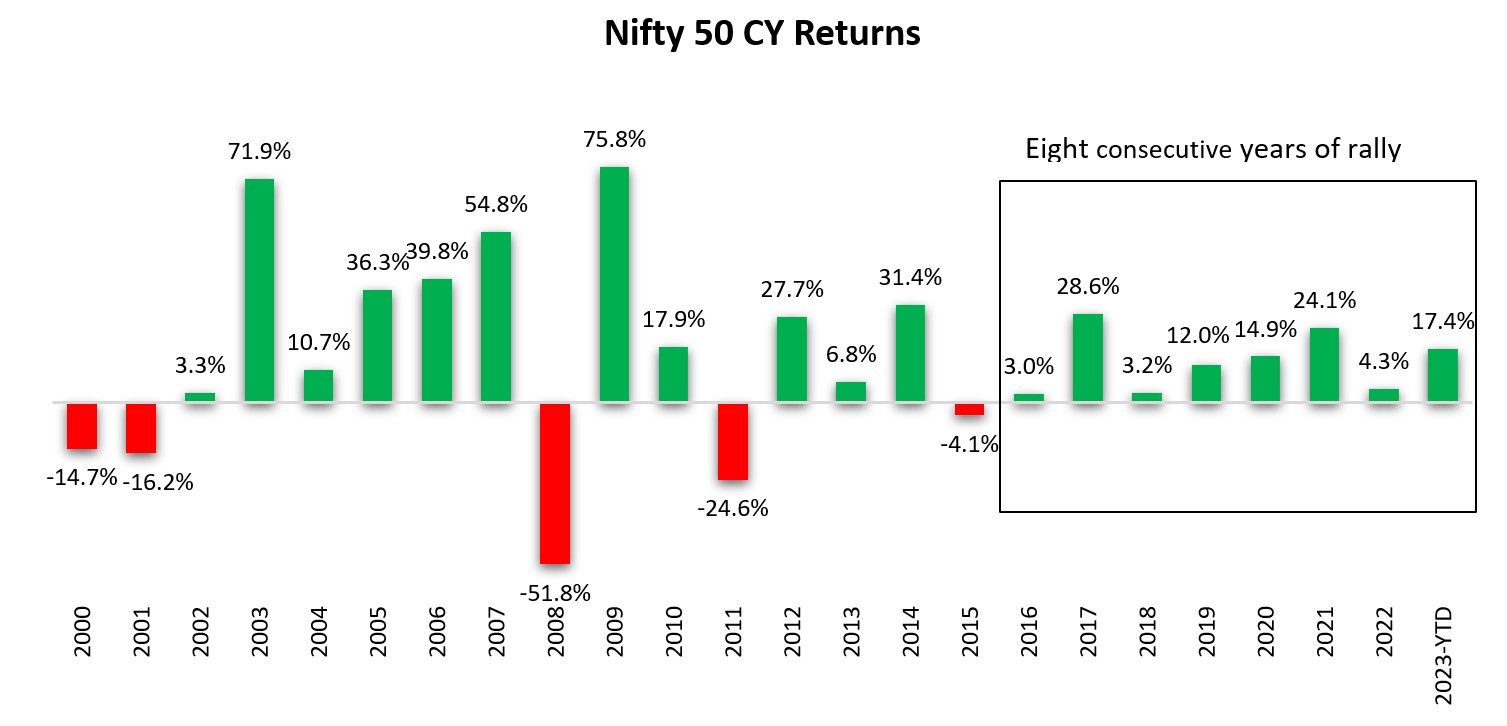

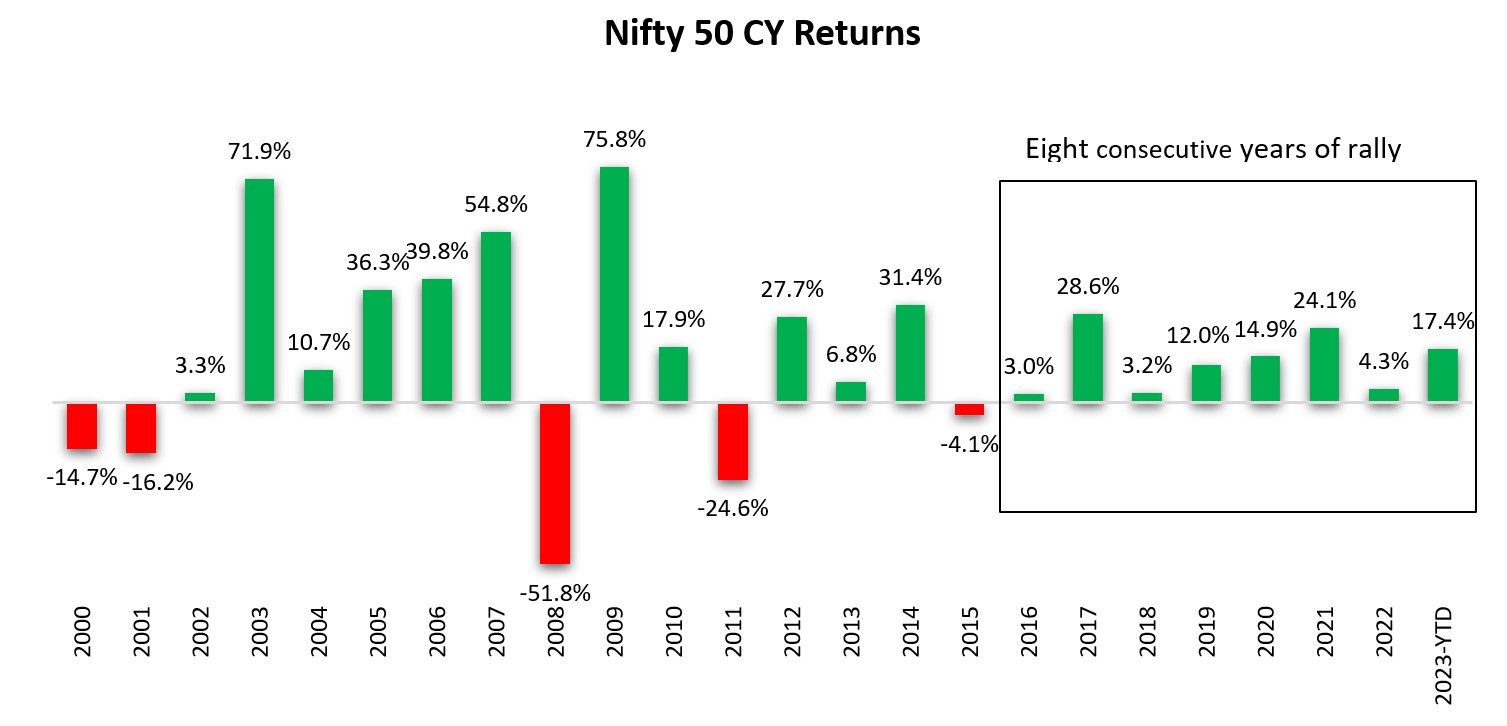

Despite a sudden healthy correction, 2023 was the eighth consecutive year of positive returns for benchmark indices, which had been a while before.

|

Source: RBI, Fisdom Research |

|

|

Most experts and brokerages discussed a 2024 calendar year-end target of around 23,500-24,500 for Nifty 50, assuming a stable government and economic growth continuing and a two-year forward price-to-earnings multiple (PE multiple) estimated at 19-20 times. While valuations for Indian equities were not considered cheap by analysts and were much higher than those seen during the 2003-2004 economic growth phase, the expectation was that these valuations would continue to expand.

This was partly due to a resilient domestic economy and growth relative to other countries, favouring India. Investors were keen to explore opportunities in listed equity, given the strong tailwinds driving interest in the asset class. Despite the rally and 17 per cent return delivered by benchmarks in 2023, domestic inflation seemed under control, gross domestic product (GDP) growth had surpassed forecasts, the political landscape looked stable, and interest rates had peaked. All this could translate into a positive impact on corporate earnings on the back of capex expansion, higher revenue, and profits.

Equity markets have certainly delivered exceptional performance in 2023 however there were other trends within different asset classes:

- Interest rates remained stable in 2023, with inflation at an average of 5.6%, down from 6.7% in 2022.

- Returns on fixed-income instruments did not improve substantially despite interest rate hikes peaking out. This might be due to tax changes made for debt mutual funds to bring them at par with other fixed-income instruments.

- Real estate demand is trending upwards, but the average annual price growth in the Indian housing sector is only around 3.5% for 2023, hardly comparable with equities.

- Gold had a good run since COVID-19 but pales in comparison to equities.

- Cryptocurrencies appeared to replace equity as a growth asset but lost appeal after the Bitcoin values nearly halved in 2021.

- Investing in start-ups is an option, but the risk-return balance is only some people’s cup of tea, leaving it a binary all-or-nothing game.

- In 2023, the count of mainboard IPOs that got launched was the second-highest in more than a decade.

So, all in all retail investors are left out with equity as a preferred asset class however at this point of time the money should start flowing into debt instruments as the segment is seen to be looking attractive from yields standpoint.

However, investors needed to be cautious, watch out for global geopolitical outcomes and commodity price pressures, and not take growth for granted. If the equity bull run continued, it was essential to take a reality check on the stocks chosen or the systematic investment plans.

Consensus had it that the rally might moderate in mid and small caps and favour front-rung stable companies compared to the robust 30-40 per cent return seen in mid- and small-caps in 2023. It is a good to time to look at one’s asset allocation and rejig their portfolio if there any under or overweight exposures.

|

🔔 31st December is the last date to file ITR for AY 2023-24 📑 |

Market this week | | 06th Nov 2023 (Open) | 10th Nov 2023 (Close) | %Change | | Nifty 50 | ₹ 21,435 | ₹ 21,349 | -0.40% | | Sensex | ₹ 71,437 | ₹ 71,107 | -0.50% |

Source: BSE and NSE |

- Despite hitting new highs earlier in the week, market pressure persisted and broke a seven-week rally due to foreign investor selling prompted by concerns over rising Covid-19 cases in India.

- The BSE Sensex declined by 0.52 percent, closing at 71,106.96, while the Nifty50 finished at 21,349.40, shedding 0.49 percent for the week.

- Broader indices achieved fresh highs but ended with marginal declines or remained flat.

- The ‘buy on dips’ strategy remained prominent among investors, particularly favoring mid and small-cap stocks due to eased oil prices and the anticipation of potential rate cuts in CY24, supported by slower US GDP growth and a weakened dollar hinting at early rate cuts.

- Despite high valuations, short-term positivity prevailed, buoyed by increased FIIs buying and targeted stock actions. Expectations suggest a range-bound trade in the festive season and year-end with limited data.

- Sector-wise, the Nifty PSU Bank, Nifty Media, Nifty Auto, and Nifty Metal indices experienced declines, while Nifty FMCG and Pharma indices registered gains of 1 percent each.

- FIIs turned net sellers for the week, selling equities worth Rs 6,422.24 crore, contrasting with DIIs buying equities worth Rs 9,093.99 crore. However, in December, FIIs purchased equities worth Rs 23,310.82 crore, while DIIs acquired equities worth Rs 12,276.19 crore.

|

|

Weekly Leaderboard:

NSE Top Gainers | Stock | Change (%) | | Britannia Industries | ▲ 5.03% | | Nestle India | ▲ 4.11 % | | Tata Consumer | ▲ 3.99 % | | Coal India | ▲ 3.79% | | Wipro | ▲ 3.61% |

| NSE Top Losers | Stock | Change % | | Adani Enterprises | ▼ 6.13% | | M&M | ▼ 5.26% | | HDFC Life Insurance | ▼ 4.94% | | UPL | ▼ 4.78% | | Adani Ports & SEZ | ▼ 4.73% |

|

Source: BSE |

Stocks that made the news this week:

- In November, credit card spending surged by 40 percent year-on-year, reaching Rs 1.6 lakh crore, compared to October’s 38 percent growth. SBI Cards notably outpaced the industry average with a remarkable 50 percent year-on-year increase, totaling spends of Rs 31,400 crore for the month, as per Jefferies citing RBI data. Market share in spending saw upticks for HDFC Bank (+88 basis points month-on-month) and RBL (+26 bps MoM), while ICICI Bank (-184 bps MoM) and Axis Bank (-60 bps MoM) experienced declines among other prominent credit card players.

- BEL’s shares surged by 1 percent intraday on December 22 following significant order acquisitions worth Rs 2,673 crore from Goa Shipyard and Garden Reach Shipbuilders & Engineers. The specific order values stand at Rs 1,701 crore from Goa Shipyard and Rs 972 crore from Garden Reach Shipbuilders & Engineers. These orders, encompassing 14 types of sensors for Next Generation Offshore Patrol Vessels (NGOPV), are set to involve participation from electronics and associated industries, including MSMEs, acting as sub-vendors for BEL. The equipment manufactured by BEL aligns with the ‘Atmanirbhar Bharat’ initiative, emphasizing indigenous production.

- Shares of several pharmaceutical and diagnostic companies surged up to 8 percent, marking their respective 52-week highs. This spike coincided with a fresh wave of Covid-19 cases, notably 640 infections attributed to the new sub-variant JN.1, elevating India’s active cases to 2,997. Piramal Pharma’s stock notably soared over 8 percent, hitting its 52-week high. The pharmaceutical sector has seen substantial growth in 2023, reflected in the Nifty Pharma Index’s 30 percent year-to-date increase, with over 70 percent of pharma stocks showing positive returns in this quarter alone.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|