MF Industry At a Glance

Highlights

| Oct-23 | Oct-22 | Change | |

| Industry AUM (in Crores) | ₹ 46,71,688 | ₹ 39,50,323 | 18.26% |

| Equity Oriented AUM (in Crores) | ₹ 18,79,418 | ₹ 15,22,338 | 23.46% |

| Fixed Income Oriented AUM (in Crores) | ₹ 13,54,211 | ₹ 12,44,802 | 8.79% |

| MF Industry AUM Growth in last 5 years | 15.20% | 13.00% | ▲ |

| Nifty 50 Levels | ₹ 19,080 | ₹ 17,787 | 7.27% |

| 10 year G-sec Yield | 7.35 | 7.4 | -1.26% |

| SIP Flows (In Crores) | ₹ 16,928 | ₹ 13,041 | 29.81% |

| No. of Folios | 15,96,46,790 | 13,90,77,745 | 14.79% |

Source: AMFI, Fisdom Research.

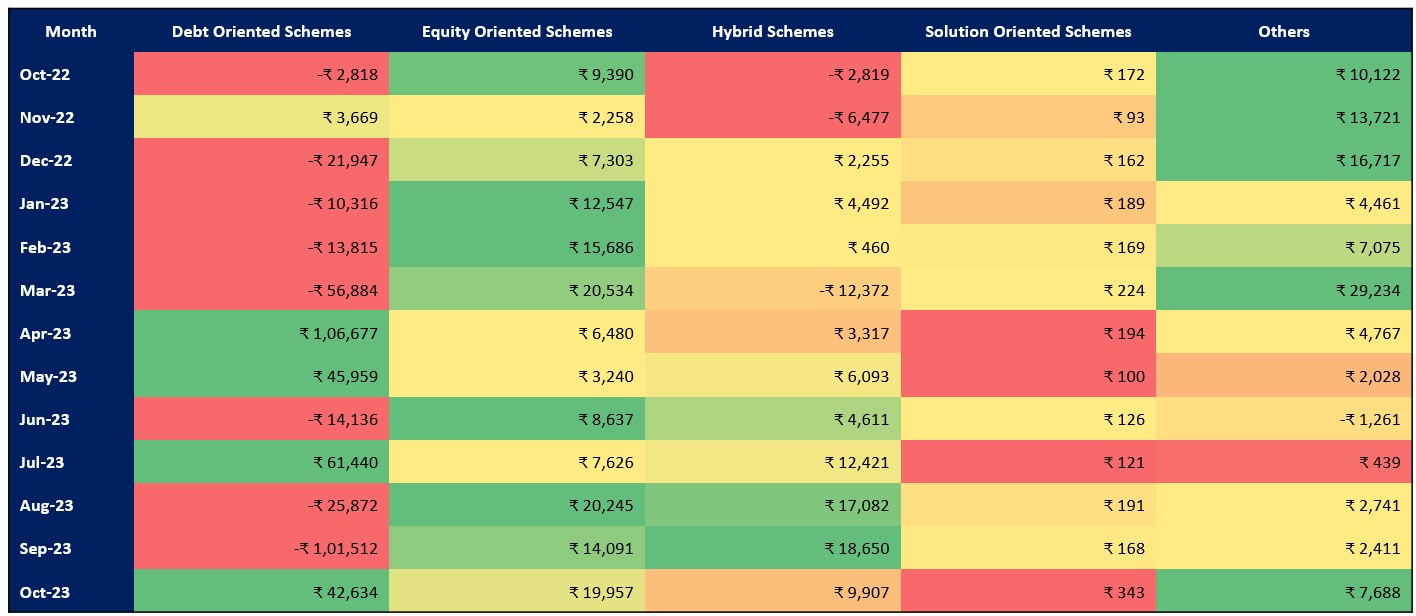

Industry Net Flows

Inflows surge for hybrid, debt categories witness decline

Values in Rs Crore

Trends:

- Debt category inflows surged as volatility gripped the market mood of investors in the October month.

- Equity funds mark 32nd consecutive month of new inflows.

- Within hybrid category Arbitrage funds and multi-asset funds have been driving robust net inflows, contributing to the sustained positive trend in hybrid funds.

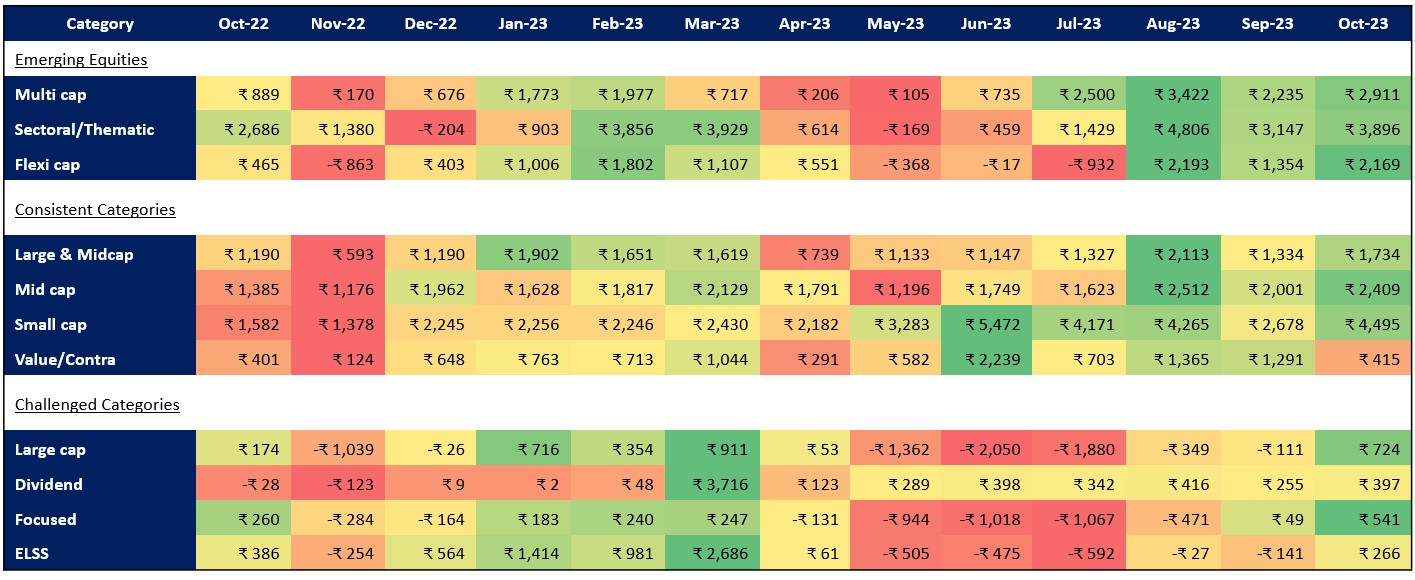

Equity Category: Net Flows

Inflows remain robust despite market volatility; All categories witness inflows

Values in Rs Crore

Trends:

- Small cap category witnessed highest inflows in October 2023. 1 new funds were launched in the Smallcap category accumulating Rs. 1,103 crore AUM during NFO period. The Sectoral/Thematic funds category witnessed the second-highest net inflows. Notably, during their New Fund Offer (NFO) period, HDFC Pharma and Healthcare Fund along with UTI Innovation Fund, both falling under this category.

Higher redemptions indicate Red

Hybrid Category: Net Flows

Arbitrage and Multi asset allocation leading the way

Values in Rs Crore

Trends:

- Hybrid funds have displayed durability, driven by the notable performance of arbitrage funds (Rs 5,523 crore) and multi-asset allocation funds (Rs 2,410 crore).

- This pattern mirrors the prevailing risk-averse mood in the market, as investors aim to diversify their portfolios while prioritizing the safeguarding of capital.

Higher redemptions indicate Red

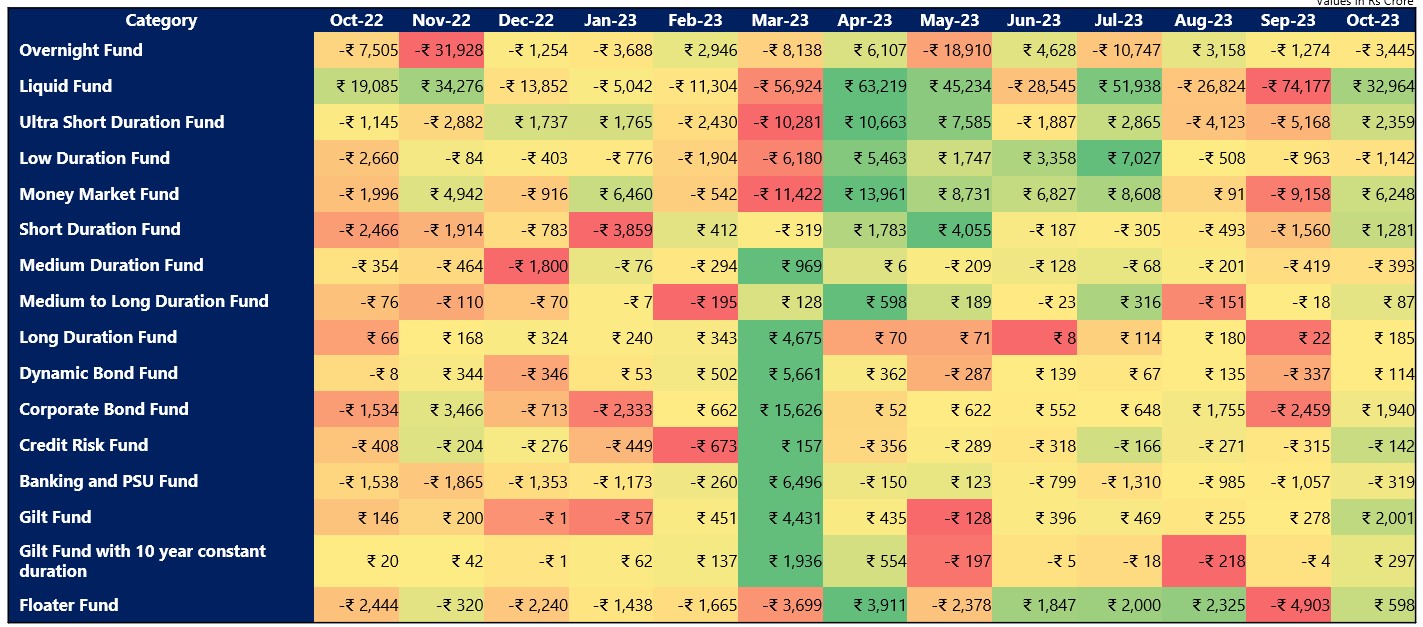

Debt Category: Net Flows

Debt categories witness higher inflows amid equity market volatility in October 2023

Trends:

Investors are increasingly embracing long-term debt funds, as it appears that interest rates in the economy have reached their peak. Government securities (g-sec) funds experienced a remarkable net inflow of Rs 2001 crore, a significant rise from the Rs 278 crore in net inflows observed the previous month.

Another long-term category gaining investor favor is corporate debt funds, which received a net inflow of Rs 1,940 crore. Even short-term debt funds saw a reversal in trends, with net inflows amounting to Rs 1,281 crore, marking a turnaround after four consecutive months of net outflows.