Mutual fund Industry AUM at All-Time High

| MF Industry | Feb-24 | Feb-23 | Change |

| Industry AUM (in Crores) | ₹ 54,54,214 | ₹ 39,46,257 | 38.21% |

| Equity Oriented AUM (in Crores) | ₹ 23,12,396 | ₹ 15,25,013 | 51.63% |

| Fixed Income Oriented AUM (in Crores) | ₹ 14,49,974 | ₹ 12,41,543 | 16.79% |

| SIP Flows (In Crores) | ₹ 19,187 | ₹ 13,686 | 40.19% |

| No. of Folios | 17,41,95,535 | 14,42,50,756 | 20.76% |

The mutual fund industry has witnessed robust growth, with the net assets under management (AUM) reaching ₹54.54 Trillion in February 2024, translating to nearly $660 Billion in dollar terms. This represents an increase of 3.41 percent from ₹52.74 trillion in January 2024 and a substantial surge of 38.21 percent from ₹39.46 trillion in February 2023.

Despite the impressive expansion in mutual fund AUM and investor participation, evidenced by 17.42 Crore mutual fund folios, a comparison with other financial products and services in India reveals a significant gap. For instance, there are 35 Crore life insurance policies, 65 Crore bank accounts, and a staggering 110 Crore mobile phone connections in the country. Clearly, there remains ample room for growth, and the mutual fund industry is poised to capitalize on this opportunity.

Drawing parallels with the United States, where it took considerable time to reach an AUM of $1 Trillion, the subsequent leap to $5 Trillion occurred within a decade. Presently, India’s AUM of $660 Billion mirrors the US mutual fund industry’s AUM approximately 35 years ago.

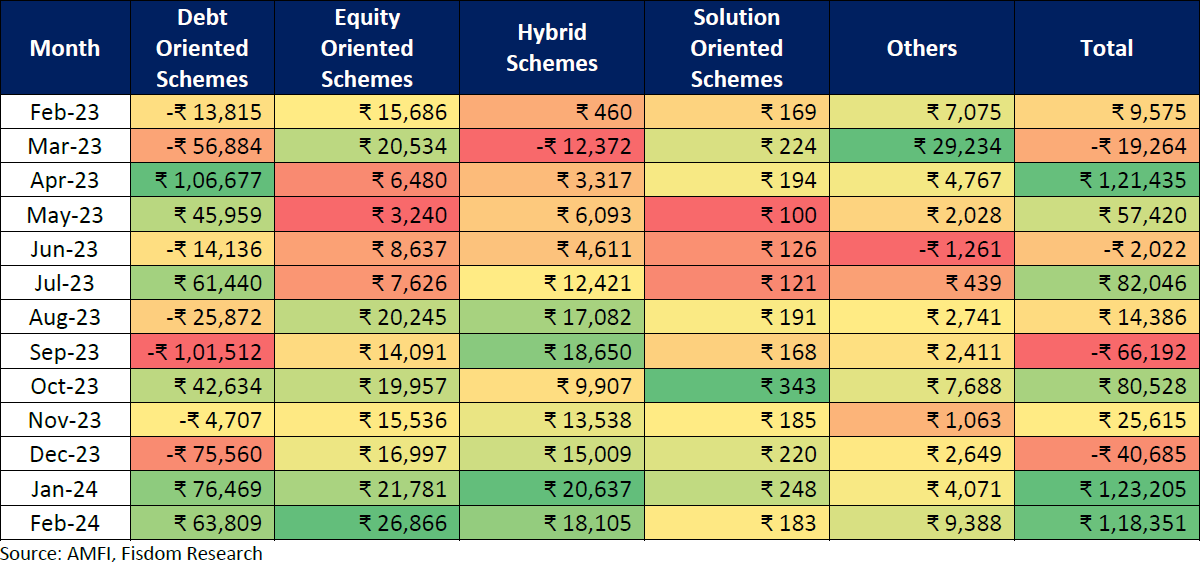

Broad Category Inflows:

In February 2024, the mutual fund industry continued to demonstrate resilience, maintaining robust inflows despite a shorter month compared to January. While January boasted impressive inflows of ₹1.23 Trillion, February saw inflows nearly on par, reaching ₹1.18 Trillion.

Delving into the breakdown of inflows for February 2024, it’s noteworthy that debt funds emerged as the dominant player, constituting a substantial 53.91% of the total fund inflows. This indicates a preference for debt instruments among investors, possibly driven by perceived stability and income generation.

Equity funds also made a significant contribution, comprising 22.7% of the net inflows. This suggests continued investor interest in capital appreciation opportunities offered by the equity market, despite potential volatility.

Hybrid funds and passive funds accounted for 15.45% and 8.24% of net inflows respectively, reflecting investor diversification strategies and an increasing inclination towards passive investment approaches.

However, closed-ended funds experienced net outflows in February 2024, albeit marginal. This could be attributed to various factors such as the maturity of existing schemes or investor preference for more liquid options. Overall, the steady inflows across different fund categories signify investor confidence in the mutual fund industry’s ability to navigate market dynamics and provide attractive investment avenues.

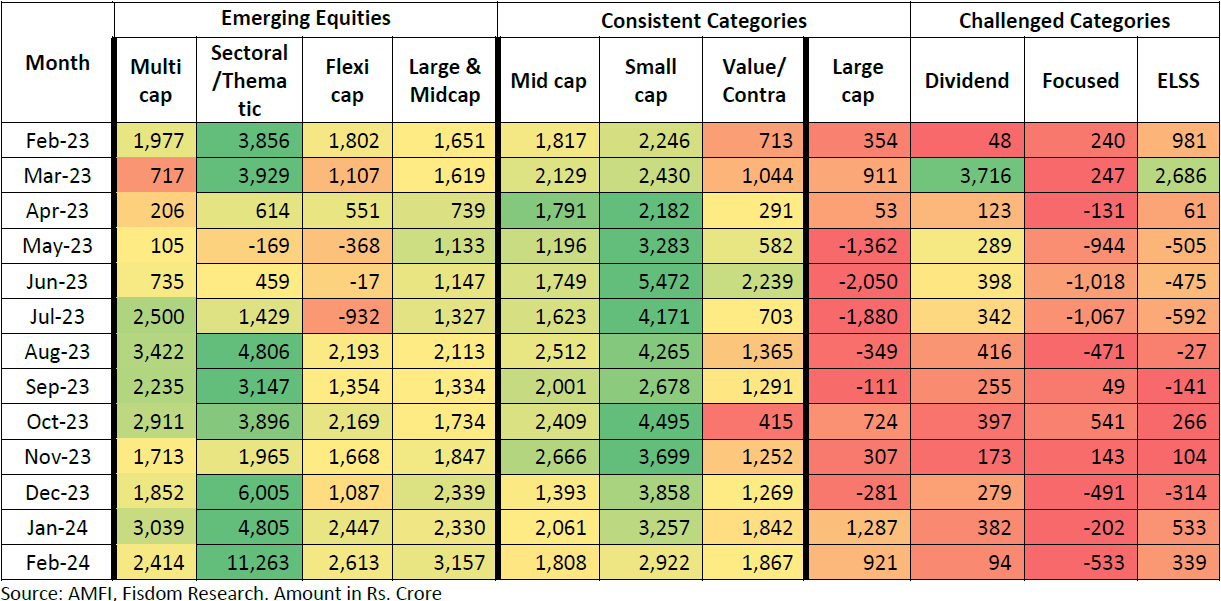

Equity Category Flows:

Equity Category Performance – Feb 24

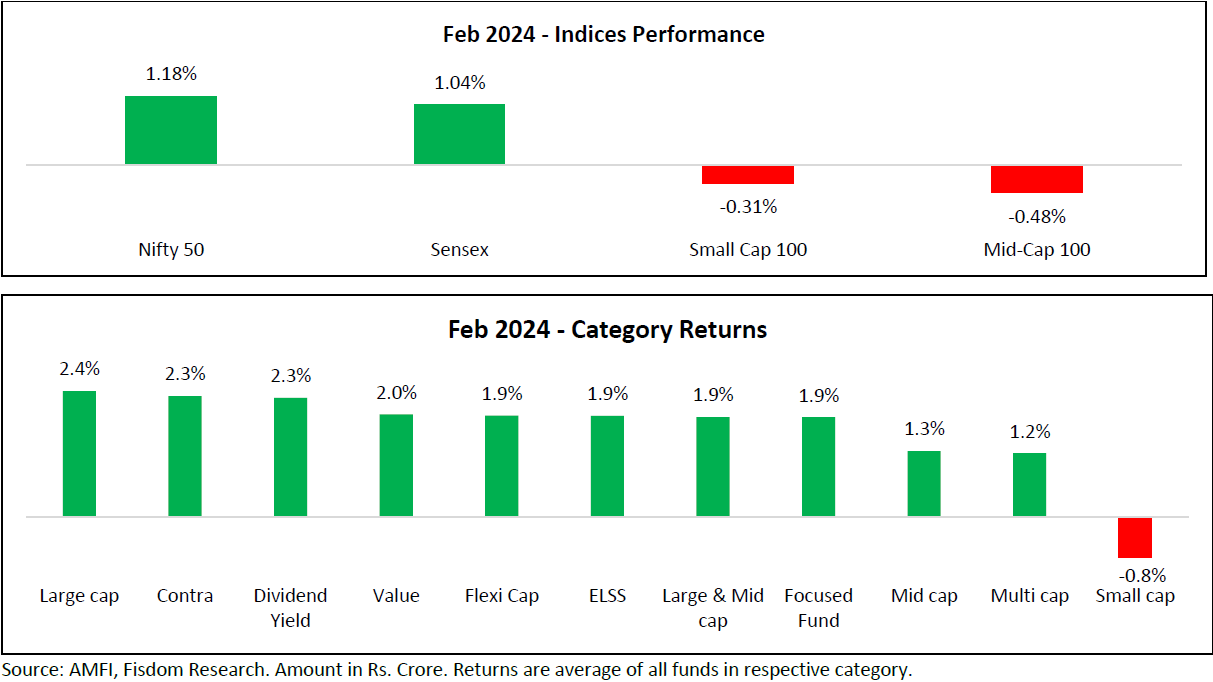

In February 2024, the stock market exhibited mixed performances across various indices, with notable shifts in investor sentiment towards different market segments.

Performance in Feb 2024, suggests a shift in investor focus towards the large-cap category, driven by valuation concerns in small and midcaps.

February 2024 witnessed a surge in net inflows into equity funds, reaching a 23-month high at ₹26,866 Crore. This surge was predominantly fuelled by an increase in both Systematic Investment Plan (SIP) flows and New Fund Offer (NFO) flows.

SIP flows played a significant role in increasing equity fund inflows, with gross SIP inflows totaling ₹19,186 Crore for the month. It’s crucial to highlight that while these are gross SIP numbers, the net flows remained robust, indicating sustained investor interest and acting as a significant driver for active equity fund flows.

Additionally, NFOs garnered considerable attention from investors, accumulating ₹11,720 Crore in February 2024. A substantial 74% of the NFO flows originated from equity funds, underlining investor confidence in this asset class.

Within the realm of equity funds, thematic funds emerged as the dominant narrative, largely propelled by the launch of the SBI Energy Opportunities Fund NFO during the month.

Overall, the surge in equity fund inflows, driven by robust SIP and NFO flows, signifies investor optimism and appetite for equities as an investment avenue.