Mutual fund industry AUM and SIP flows reach record highs

|

In Rs Crores |

Jan-25 |

Jan-24 |

Growth (Y-O-Y) |

Dec-24 |

Growth (M-O-M) |

Jan-20 |

Growth (5 Yrs) |

|

Industry AUM |

₹ 67,25,450 |

₹ 52,74,001 |

27.52% |

₹ 66,93,032 |

0.48% |

₹ 27,85,804 |

19.28% |

|

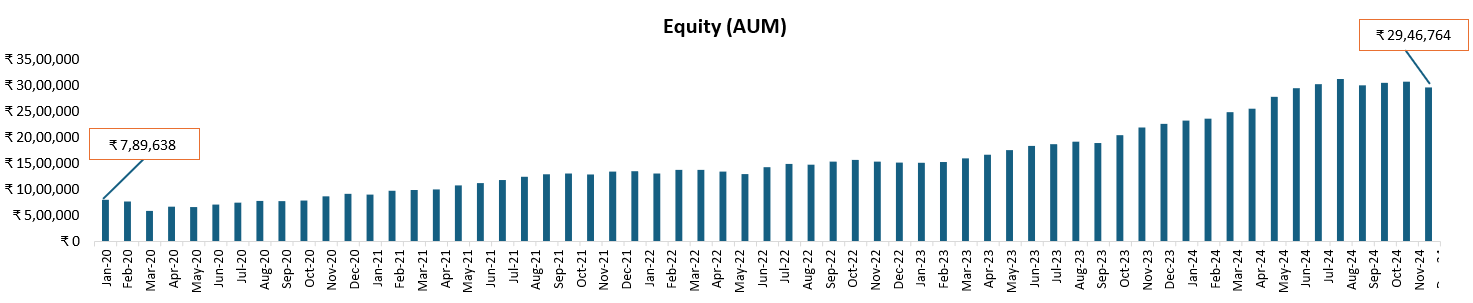

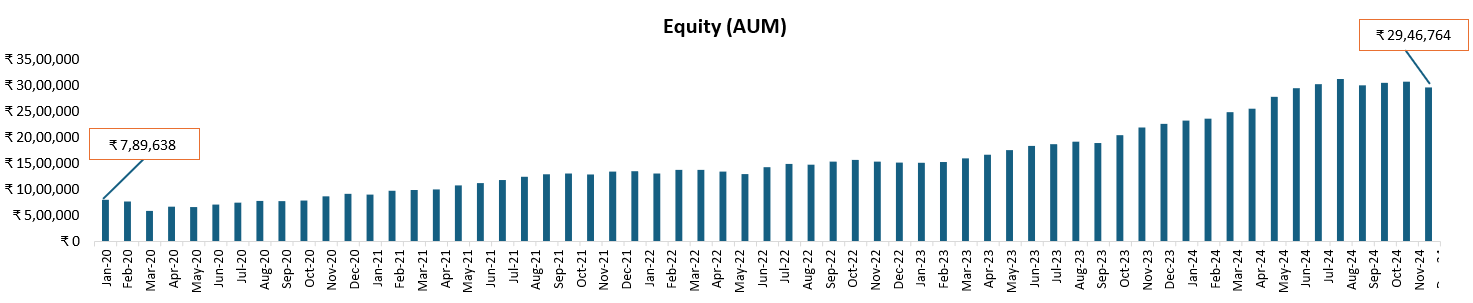

Equity Oriented AUM |

₹ 29,46,764 |

₹ 22,50,336 |

30.95% |

₹ 30,57,549 |

-3.62% |

₹ 7,89,638 |

30.13% |

|

Fixed Income Oriented AUM |

₹ 17,06,315 |

₹ 13,76,504 |

23.96% |

₹ 15,67,477 |

8.86% |

₹ 12,41,737 |

6.56% |

|

SIP Flows |

₹ 26,400 |

₹ 18,838 |

40.14% |

₹ 26,459 |

-0.22% |

₹ 8,532 |

25.35% |

|

No. of Folios (In no’s) |

22,91,99,377 |

16,95,59,182 |

35.17% |

22,50,03,545 |

1.86% |

8,85,33,153 |

20.95% |

Source: AMFI, ACE MF, Fisdom Research, Amount in crores

Mutual fund AUM for Jan 2025 is ₹67.25 lakh Cr, with a historic shift from fixed income to equity, reflecting growing investor confidence in equities.

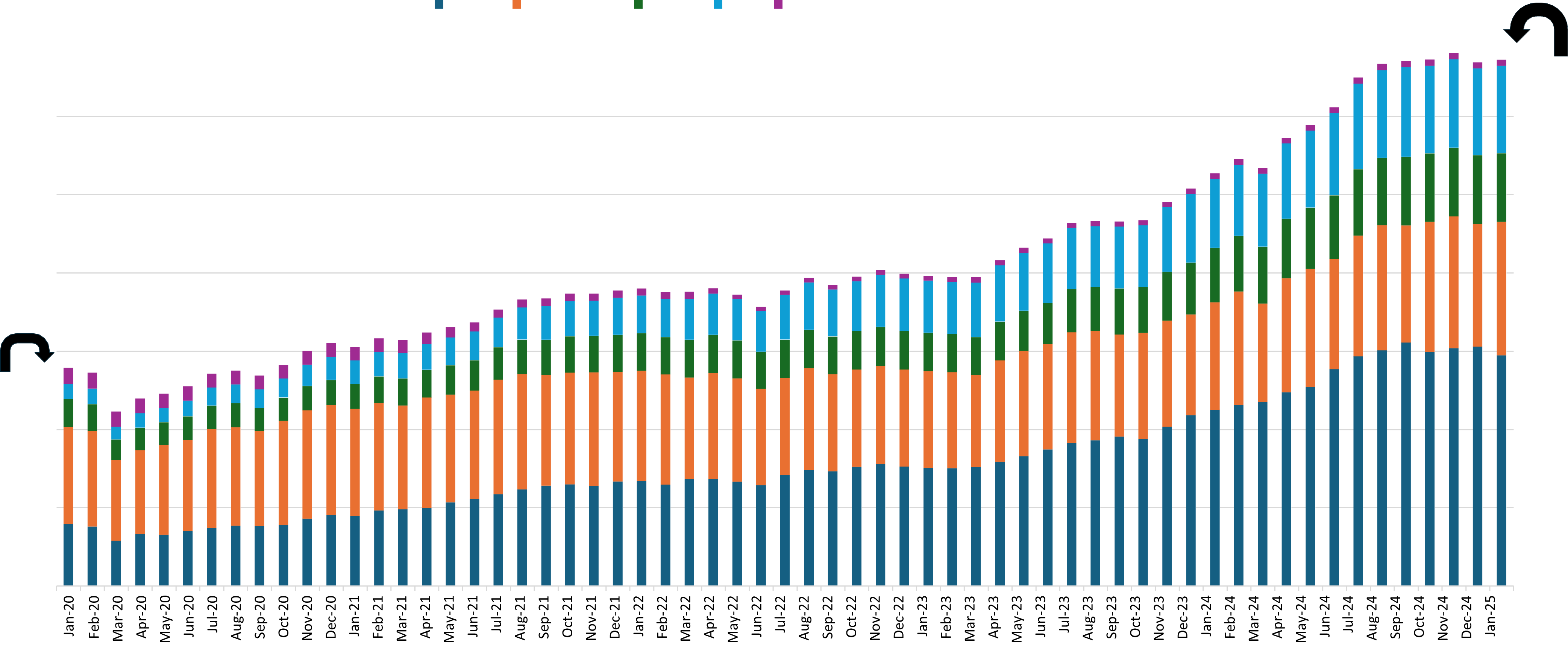

Overall AUM Contribution Across Category 5 Years

Source: AMFI, ACE MF, Fisdom Research, Amount in crores

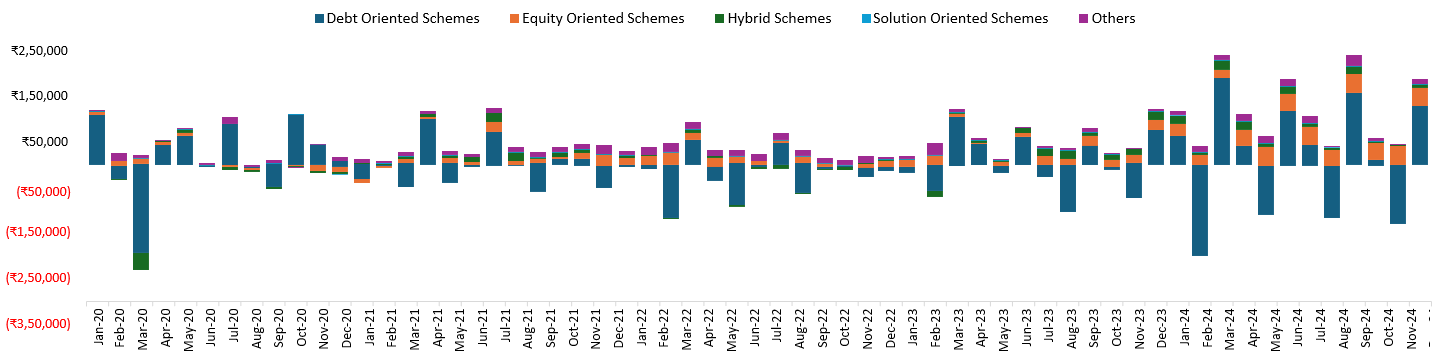

Broder Category wise inflow and outflow

|

Months |

Debt Oriented Schemes |

Equity Oriented Schemes |

Hybrid Schemes |

Solution Oriented Schemes |

Others |

Total |

|

Jan-20 |

₹ 1,09,306 |

₹ 7,877 |

₹ 1,260 |

₹ 117 |

₹ 2,345 |

₹ 1,20,904 |

|

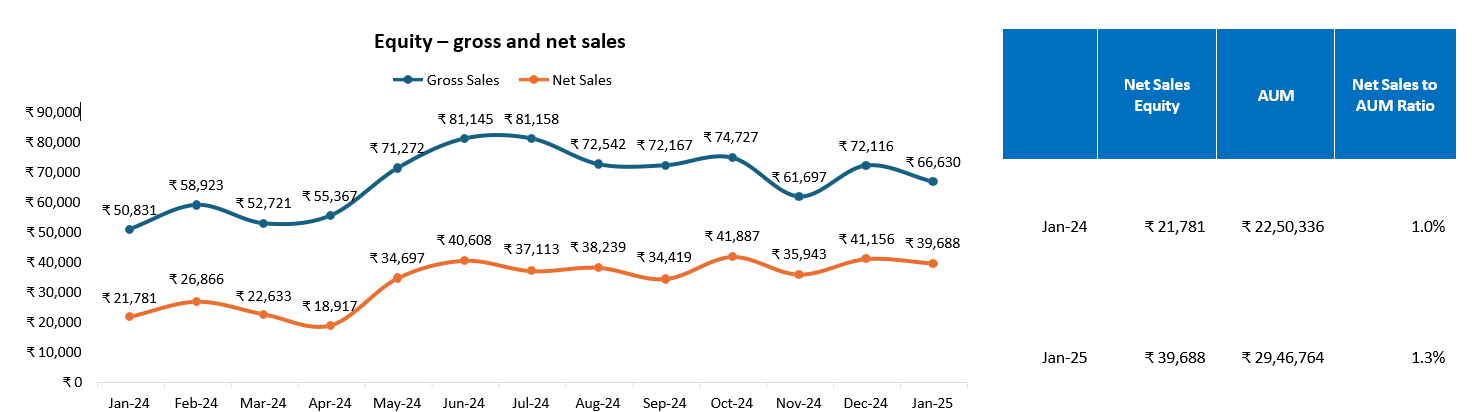

Jan-24 |

₹ 76,469 |

₹ 21,781 |

₹ 20,637 |

₹ 248 |

₹ 3,983 |

₹ 1,23,117 |

|

Jan-25 |

₹ 1,28,653 |

₹ 39,688 |

₹ 8,768 |

₹ 243 |

₹ 10,255 |

₹ 1,87,606 |

Source: AMFI, ACE MF, Fisdom Research, Amount in crores

Equity AUM Surges to Record ₹ 29.47 Lakh Cr in Jan’25, Driven by Robust Equity Inflows

Equity – gross and net sales

Source: AMFI, ACE MF, Fisdom Research, Amount in crores