Mutual Fund Industry AUM at All-Time High

| MF Industry | Mar-24 | Mar-23 | Change |

| Industry AUM (in Crores) | ₹ 53,40,195 | ₹ 39,42,031 | 35.47% |

| Equity Oriented AUM (in Crores) | ₹ 23,48,949 | ₹ 15,17,082 | 54.83% |

| Fixed Income Oriented AUM (in Crores) | ₹ 12,62,224 | ₹ 11,81,982 | 6.79% |

| SIP Flows (In Crores) | ₹ 19,271 | ₹ 14,276 | 34.99% |

| No. of Folios | 17,78,56,760 | 14,57,30,600 | 22.04% |

Following a marginal decline in overall mutual fund Assets Under Management (AUM) in September 2023, March 2024 marked a notable event with a significant contraction in AUM. As of March 2024, the total AUM of Indian mutual funds amounted to ₹53.40 Trillion, reflecting a decrease of 2.1% compared to the previous month.

On a quarterly basis, March 2024 quarter witnessed an increase from ₹50.78 Trillion recorded at the close of the December 2023 quarter, ₹46.58 Trillion at the end of the September 2023 quarter, and ₹44.39 Trillion at the conclusion of the June 2023 quarter. The rapid growth in AUM can primarily be attributed to the surge in equity valuations observed during the period.

Despite a monthly decline, mutual fund AUMs remained elevated by 35.46% since the commencement of FY24. While equity appreciation and non-debt flows contributed positively in March 2024, the liquid fund sell-off exerted substantial pressure on overall AUM figures.

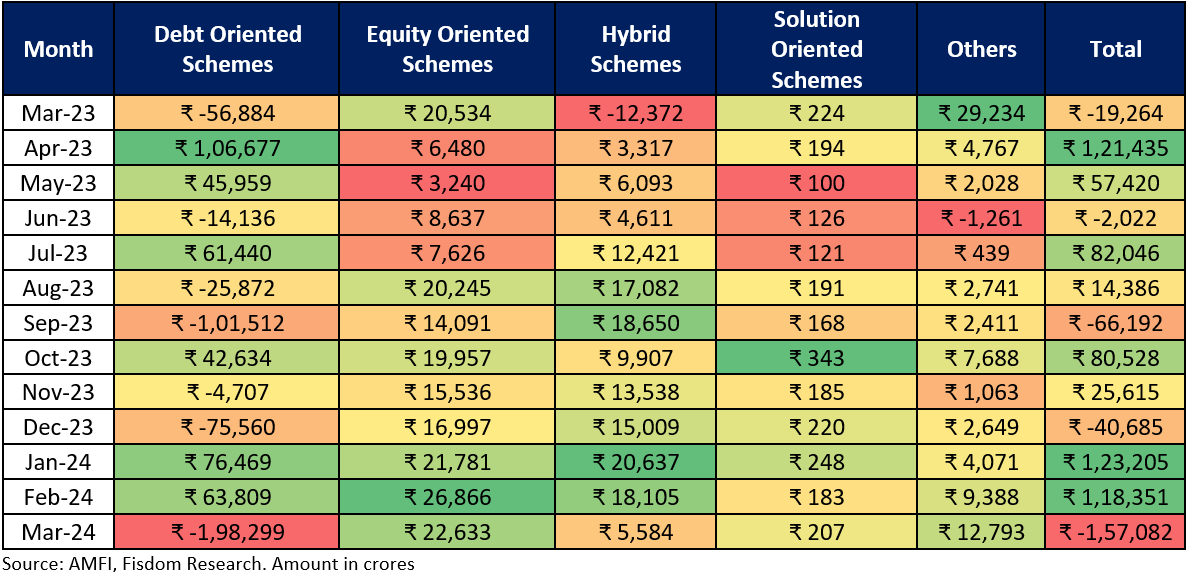

Broad Category Inflows:

In March 2024, the mutual fund industry witnessed net outflows at an overall industry level majorly dominated by debt inflows.

The net outflows observed in March 2024 were primarily due to treasury outflows from liquid funds, a typical occurrence during the year-end quarter to accommodate advance tax and GST payments.

Equity categories witnessed net inflows during the month. Retail participation through SIPs and consistent NFO flows has kept equity inflows in positive zone.

Debt funds witnessed significant inflows taking into consideration the quarterly advance tax payments and GST payments for corporates.

Multi asset allocation funds dominated the hybrid category inflows whereas Arbitrage funds saw a minor outflow in March 2024.

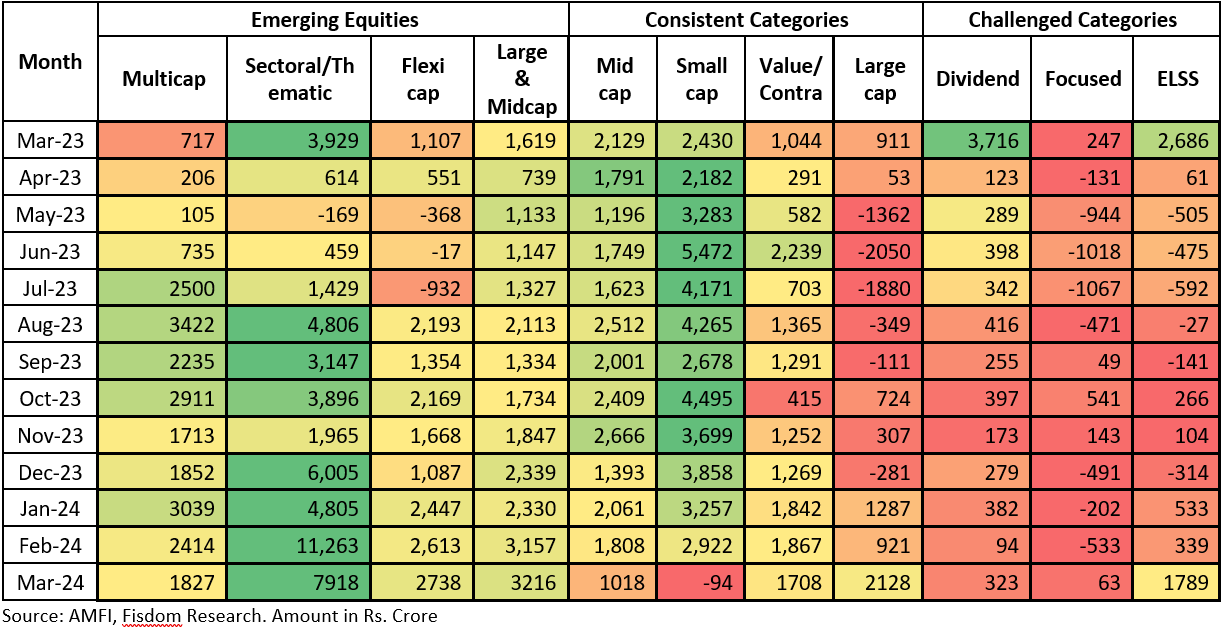

Equity Category Flows:

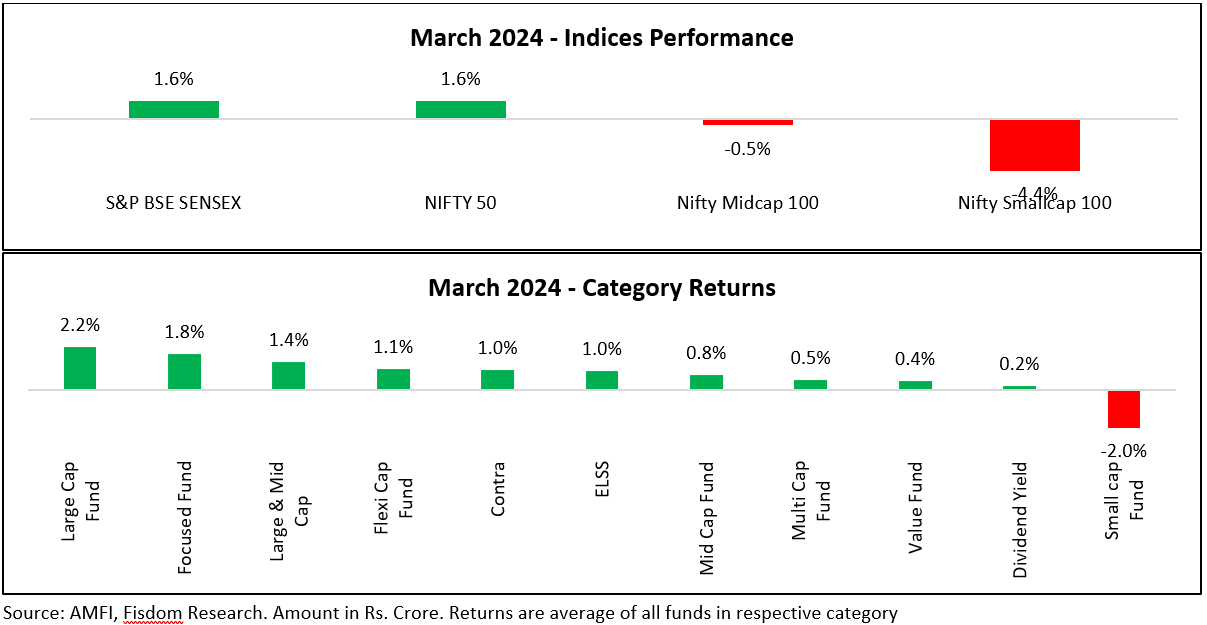

Equity Category Performance – March 2024

Equity fund inflows in the March 2024 surged. The sustained enthusiasm in equity fund flows, even at elevated levels, can be attributed to a spike in SIP flow numbers and the launch of numerous NFOs, especially in sectors and thematic funds.

SEBI’s warnings to AMCs regarding small-cap funds led to a slowdown in fund flows towards small and mid-cap funds, with investors shifting focus to large-cap funds.

Sector funds and thematic funds have an advantage in launching multiple NFOs for different themes and sectors, driving their dominance in recent NFO flows.

The trend towards alpha generation in mid-cap and small-cap funds diminished towards the end of the March 2024 quarter, while index funds and index ETFs continued to attract interest. Small cap funds witnesses net outflows after 2.5 years. Midcap category saw a decline of 43% on a month on month basis. Does this mean the tide is turning against Small and midcap valuations?

Affirmative flows into equity funds were observed across various categories, except for focused funds, which experienced outflows. Sectoral funds led the way with flows of ₹7,918 Crore, followed by large and midcap funds at ₹2,738 Crore.

The total AUM of equity funds at the end of March 2024 stood at ₹23.49 Crore, representing a market share of 43.99% in overall AUM.

Notably, the quarter saw a reduction in alpha hunting in small and mid-cap funds, with large-cap funds and sectoral funds gaining prominence, while index funds contributed significantly to AUM accretion.

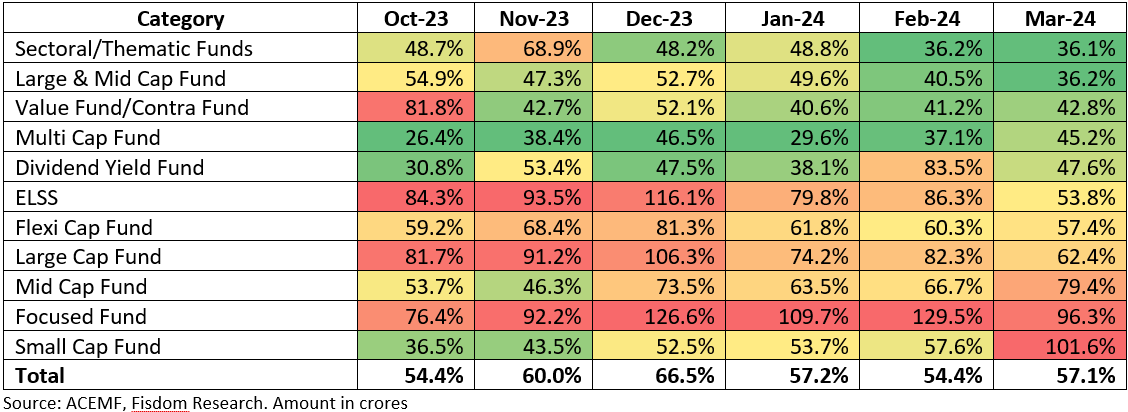

Equity Category Redemptions:

- Certain categories show a stark contrast between the funds mobilized and redemption/repurchases during the month.

- Focused funds, for instance, demonstrate consistent net outflows.

- In January, as the equity market became volatile, the redemption-to-gross-purchases ratio declined across different categories, suggesting heightened investor caution.

- Categories like large-cap funds, dividend yield funds, and ELSS (Equity Linked Savings Schemes) exhibit higher redemption percentages in months where market volatility is pronounced, reflecting investor tendencies to reallocate or liquidate their investments during uncertain market conditions.

- On the other hand, multi-cap funds and sectoral/thematic funds show relatively lower redemption percentages, indicating a more stable investor sentiment towards these categories during the observed period. Small caps on the other hand saw higher redemptions vis a vis other categories.