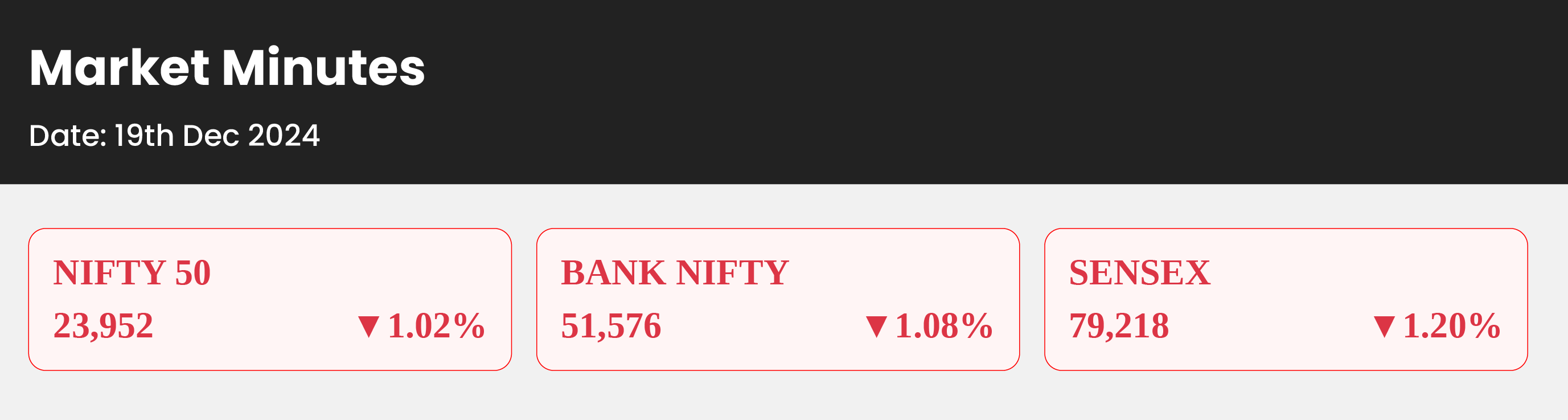

Market Snapshot

- India’s benchmark indices Sensex and Nifty recorded their steepest weekly declines in over two years, dropping more than 5 percent each amid global market volatility that weighed heavily on investor sentiment.

- The selloff was triggered by the US Federal Reserve’s cautious stance on rate cuts. The Fed revised its forecast to just two rate cuts in 2025, down from an earlier projection of four, unsettling markets globally.

Sectoral Trends

| Sector Name | % Change | Sector Name | % Change |

| NIFTY HEALTHCARE INDEX | -0.8 | NIFTY MIDSMALL HEALTHCARE | -1.4 |

| NIFTY PHARMA | -0.9 | NIFTY BANK | -1.6 |

| NIFTY FMCG | -1.0 | NIFTY CONSUMER DURABLES | -1.6 |

| NIFTY FINANCIAL SERVICES | -1.3 | NIFTY OIL & GAS | -1.7 |

Top News

- MTAR Technologies shares jumped 6% after securing Rs 226 crore worth of orders across clean energy and aerospace sectors. Of these, Rs 191 crore orders came from Bloom Energy for clean energy products, while Rs 35 crore orders were from key aerospace clients such as Rafael, IMI Systems, and IAI.

- Mazagon Dock Shipbuilders shares fell over 6% as investors booked profits following a 17% surge over the past month, capitalizing on the stock’s recent rally.

- General Insurance Corporation of India shares soared 17% on a surge in trading volumes, with over one crore shares traded, significantly surpassing the one-month daily average of 14 lakh shares.

- Concord Enviro Systems IPO subscribed 87% on Day 2 so far.

- Transrail Lighting IPO subscribed 3.49x on Day 2 so far.

Technical Outlook: Key Indices

| Indices Name | Support | Resistance |

| Nifty | 23,400 | 24,000 |

| Bank Nifty | 50,000 | 52,000 |

Top Gainers and Losers

| Top Gainers | % Change | Top Losers | % Change |

| DRREDDY | 1.5 | TECHM | -3.9 |

| JSWSTEEL | 0.6 | AXISBANK | -3.5 |

| ICICIBANK | 0.4 | INDUSINDBK | -3.5 |

Trade Ideas Update

- Our trade ideas success rate has 75% over the past month, even with increased volatility in the benchmark index. Follow Trade Ideas for timely stock insights.