Macroscope: RBI Monetary Policy Meet

A move towards new normal

Key MPC Announcements:

- Withdrawal of Accommodation Monetary Policy Stance

- Hiked by 25 bps Repo rate

- 4 out of 6 MPC members were in favour of the 25 basis hike

- Further calibrated MPC action warranted To break persistent core inflation

- 6.5% Real GDP Growth for FY2023 2024

- Outlook on global growth has improved in recent months Positive

- External demand is likely to be dented by a slowdown in global activity Risk to outlook

- 6.5% Inflation target for FY23 revised from 6.7% from last MPC

- Inflation is exhibiting some softening from elevated levels Positive

- Commodity prices are expected to face upward pressures with the easing of COVID related mobility restrictions Risk to outlook

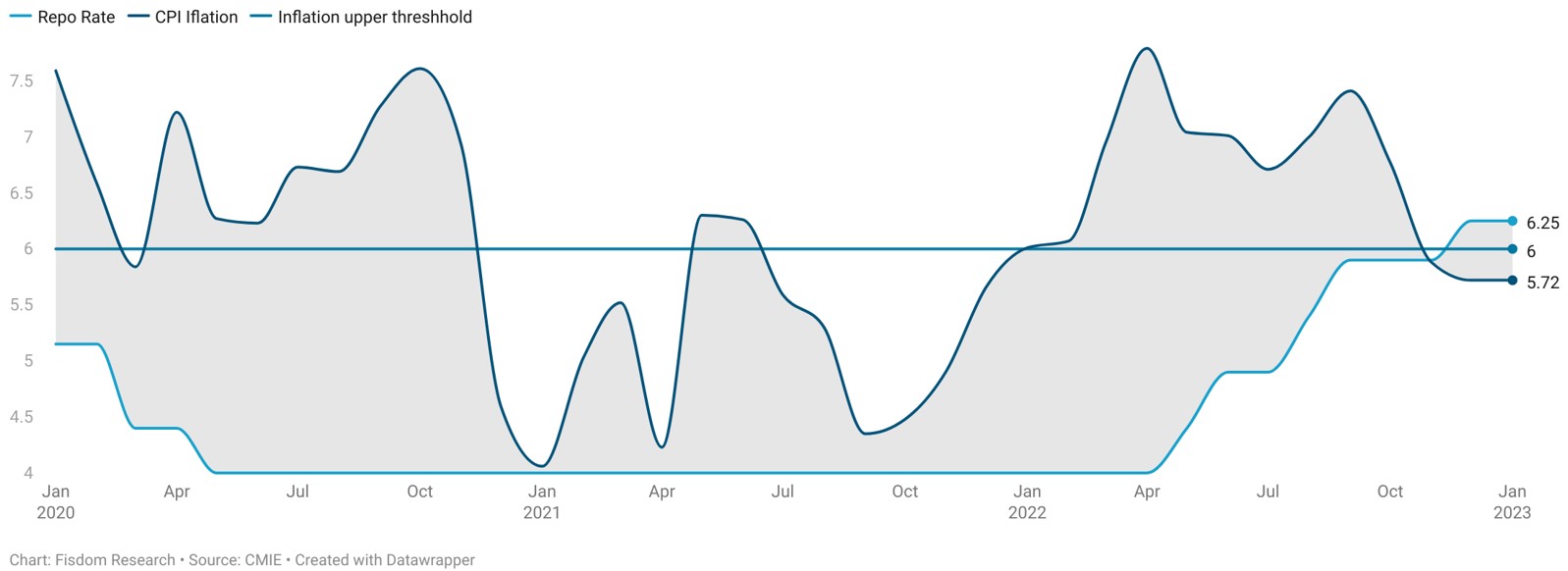

CPI vs Policy rate responses

RBI executes first smaller rate hike of CY23

- The six member Monetary policy Committee of the Reserve bank of India increased the policy repo rate by 25 basis points to 6.50 per cent on February 08 2023. 4 out of 6 members were in favor of 25 bps rate hike and 2 members in favor of no rate hike. The total rate hike done by RBI is 250 bps to date since the start of rate hike cycle in May 2022.

- The outlook on inflation, consumption and growth can be read as optimistic while elevated core inflation remains a challenge. Alongside, contrary to widely held anticipation, the central bank retained its “withdrawal of accommodation” stance with the hawkish undertone in tact. Against this backdrop and after weighing risks against the opportunities, the current rate hike seems to arrive closer to a pause in the regime.

Fixed Income Play

What should investors do?

- Considering elevated probabilities of policy rates hitting a plateau sooner, fixed income investors may seek to optimize the relatively lucrative yields offered in the medium tenure of 3 to 4 years.

- Mutual fund investors can look at target maturity funds holding high-rated instruments and with matching residual maturity. Investors can also seek to increase allocations towards the longer end of the curve and benefit from higher near term accruals and capital appreciation on account of the duration play through the rate reversal cycle that is expected to follow the plateau in the medium term.