RBI Monetary Policy Committee Meeting Update

| Executive Summary Monetary Policy Committee

Fisdom Research Commentary

|

Key Announcements

The Monetary Policy Committee (MPC) met on August 10, 2023, and made the following decisions based on their assessment of the current and evolving macroeconomic situation:

- The policy repo rate under the liquidity adjustment facility (LAF) will remain unchanged at 6.50%.

- The standing deposit facility (SDF) rate will also remain at 6.25%

- The marginal standing facility (MSF) rate and the Bank Rate will be maintained at 6.75%

The MPC will gradually withdraw accommodation to ensure inflation meets the medium-term target. The objective is to achieve a consumer price index (CPI) inflation rate of 4% within a band of +/- 2% while supporting economic growth.

| MPC Members | Decisions |

| Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof.Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra, and Shri Shaktikanta Das | Policy repo rate to be maintained at 6.50% |

| Dr Shashanka Bhide, Dr Ashima Goyal, Dr Rajiv | Focus on withdrawal of accommodation. |

| Prof. Jayanth R. Varma | Expressed reservations |

Inflation Projection

| Aspect | Projection |

| Spike in Vegetable Prices (led by tomatoes) | Upside pressure on near-term headline inflation |

| Correction in Vegetable Prices | Expected fresh market arrivals |

| Progress of Monsoon and Kharif Sowing | Significant improvement in July; uneven rainfall distribution monitored |

| Crude Oil Prices | Increased due to production cuts |

| Enterprise Surveys | Input costs to ease, output prices to harden |

| Assumptions and Projections for CPI Inflation | |

| Fiscal Year 2023-24 | 5.40% |

| Quarter 2 (Q2) | 6.20% |

| Quarter 3 (Q3) | 5.70% |

| Quarter 4 (Q4) | 5.20% |

| CPI Inflation for Q1:2024-25 | 5.20% |

Fisdom Research Commentary

- Anticipating the upcoming inflation landscape, our analysis points to an imminent surge in near-term inflation figures, steered mainly by a pronounced hike in vegetable prices. Particularly noteworthy is the expected impact of tomato prices, a seemingly minor component accounting for a mere 0.57% of the Consumer Price Index (CPI). However, the sheer magnitude of the price alteration is poised to wield a substantial influence on July’s overall retail inflation trajectory.

- The considerable influence of onions, another prominent commodity within the CPI basket, amplifies the inflationary effect. Their presence is projected to exert additional pressure on near-term inflation levels. This scenario is expected to be transitory, with the trajectory of inflation not projected to sustain such elevated levels over an extended period.

- Crucially, the anticipated price surge in tomatoes is predicted to revert to lower levels by early September or October, primarily due to the arrival of fresh stock in the market. However, it’s crucial to exercise vigilance concerning the potential impact of two key factors: the emergence of possible El Niño weather conditions and the trajectory of global food prices. These aspects demand careful monitoring against an uneven and skewed southwest monsoon pattern.

Growth Projection

| Aspect | Projection |

| Factors Supporting Household Consumption and Capex Renewal | Recovery in kharif sowing and rural incomes |

| Buoyancy in services and consumer optimism | |

| Healthy bank and corporate balance sheets | |

| Supply chain normalisation and business optimism | |

| Robust government capital expenditure | |

| GDP Growth Projections | |

| Fiscal Year 2023-24 | 6.50% |

| Quarter 1 (Q1) | 8.00% |

| Quarter 2 (Q2) | 6.50% |

| Quarter 3 (Q3) | 6.00% |

| Quarter 4 (Q4) | 5.70% |

| GDP Growth for Q1:2024-25 | 6.60% |

| Risks to the Outlook | Broadly balanced |

Fisdom Research Commentary

The current outlook by RBI is anchored on the expectation of domestic demand for household consumption and investment activity to remain buoyant.

Our outlook for India’s real GDP growth in the fiscal year 2023-24 maintains an underlying optimism, albeit with caution considering external challenges. Among the significant factors that could challenge our optimistic projection is the vulnerability posed by weak external demand. The intensity of the El Niño impact on weather patterns also looms as a substantial variable that could affect the growth outlook. Additionally, the ever-present volatility in global financial markets is another factor that might sway the growth trajectory.

Effective Liquidity Management Measures: Incremental Cash Reserve Ratio (I-CRR) Implementation

| Point | Description |

| Stated Liquidity Stance | Maintain sufficient liquidity for productive economic needs, while excessive liquidity poses price and financial stability risks. |

| Efficient Liquidity Management | Continuous assessment of surplus liquidity to apply necessary measures against excess liquidity. |

| I-CRR Implementation | Effective August 12, 2023, banks are to maintain an Incremental Cash Reserve Ratio (I-CRR) of 10% on Net Demand and Time Liabilities (NDTL) growth between May 19, 2023, and July 28, 2023. |

| Purpose of I-CRR | Absorb surplus liquidity due to factors including the return of ₹2000 notes, a temporary solution for liquidity management. |

| Post-Impoundment Liquidity | Adequate liquidity to meet economic credit needs despite temporary impoundment. |

| I-CRR Review | Review scheduled by September 8, 2023, or earlier to release impounded funds ahead of the festive season. |

| Existing CRR | Cash Reserve Ratio (CRR) remains unchanged at 4.45% |

Debt Market Outlook:

The monetary policy committee’s decision and stance align with broad expectations. The absence of surprises is a healthy development. We expect the central bank to be cautious about indicating any reversal in the interest rate regime anytime soon. The expectation is for rates to plateau longer even as the central bank maintains a quasi-hawkish undertone on inflation. We expect the lag effect of rate decisions to be visible as changes continue transmitting and percolating through the upcoming quarter(s).

We continue to view yields offered by highly rated (Sov/AAA) securities in the four-to-six-year period as attractive. Longer-term investors could initiate marginal allocation towards the longer end, i.e., 7+ years. The overall strengthening credit environment lends some confidence for highly aggressive fixed-income investors to take marginal exposure to sub-AAA investment grade securities while maintaining duration towards the shorter end.

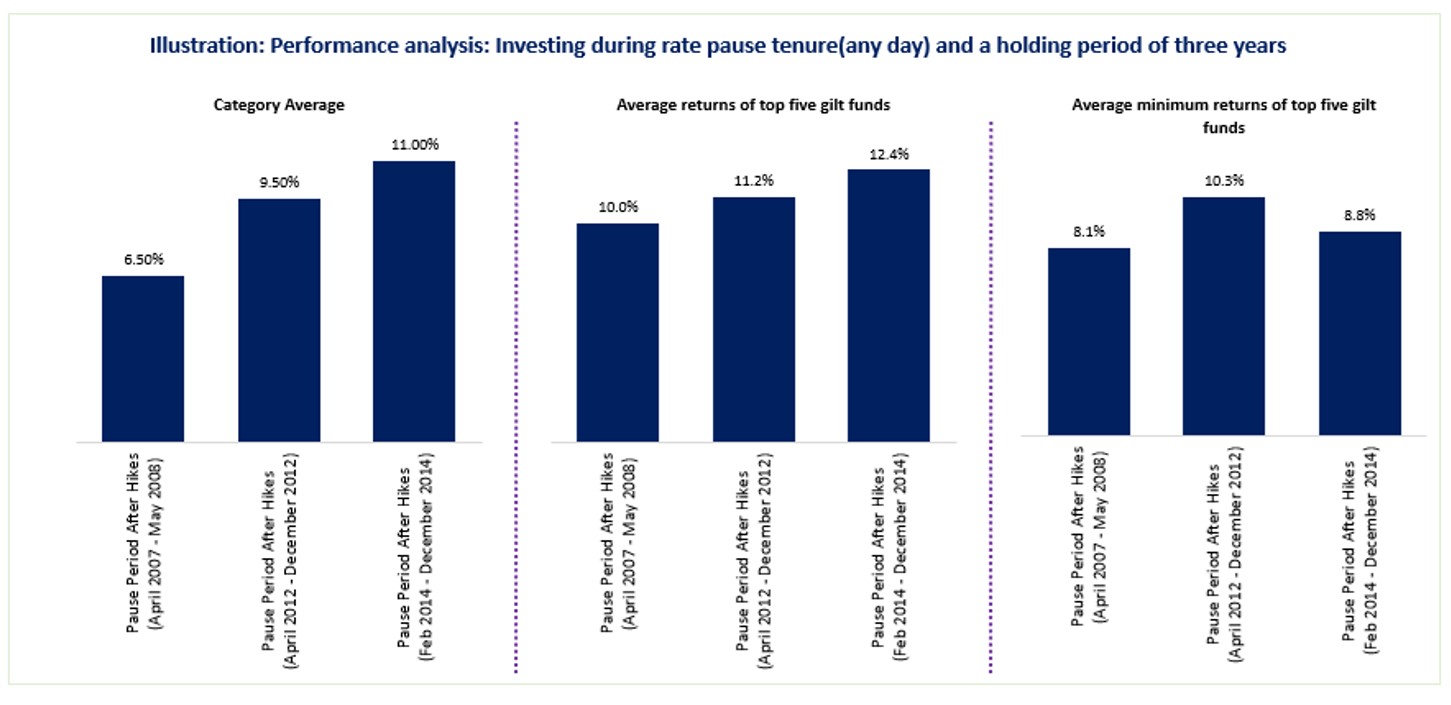

RBI has hit the pause button on interest rates; historically, this has been a great time to invest.

Source: CMIE, Fisdom Research