Technical Overview – Nifty 50

The Benchmark Index on 04th March witnessed a marginal gap up opening and prices registered a new life high at 22,400 levels. It was an overall sideways trading session with a bullish bias. The Index has formed a Doji candle stick on the daily chart. After a strong bullish move, some narrow-range candles are normal.

On the weekly chart, the Index has given a bullish breakout of a consolidation pattern and prices are trading above the upper band of the range. The Index on the daily chart is trading near the upper band of the rising wedge pattern.

Nifty has started the March series with an open interest of 1.40 crore shares compared to an OI of 1.28 crore shares at the beginning of the February series. Nifty saw a lower rollover with a higher cost of carry (+0.90%) and a rise in open interest, compared to its previous month.

It’s a buy-on-dips market presently and any dip towards 22,250 which be utilized as a fresh buying opportunity. The immediate resistance is likely to be capped near 22,500 levels.

Technical Overview – Bank Nifty

It was a mixed-bag trading session for the Banking Index where the index was taking support near the lower levels and formed a regular bullish candle on the daily chat. The Bank Nifty on the daily chart has given a cup and handle pattern breakout and the index is trading above the upper band of range.

The Bank nifty’s rollover rate in the March series decreased compared to the previous series, registering at 74.24% in contrast to the 77.05% from the preceding month. This rollover falls below the average of the last three months.

The Banking Index is trading above its 9, 21, and 50 EMA, and the slope of the average is moved higher indicating a bullish stance. The prices on the weekly chart are trading in a rising wedge pattern and prices have reversed from the lower levels of the pattern.

It’s a buy-on-dips on Bank Nifty presently and any dip towards 47,200 which be utilized as a fresh buying opportunity. The immediate resistance is likely to be capped near 48,200 levels.

Indian markets:

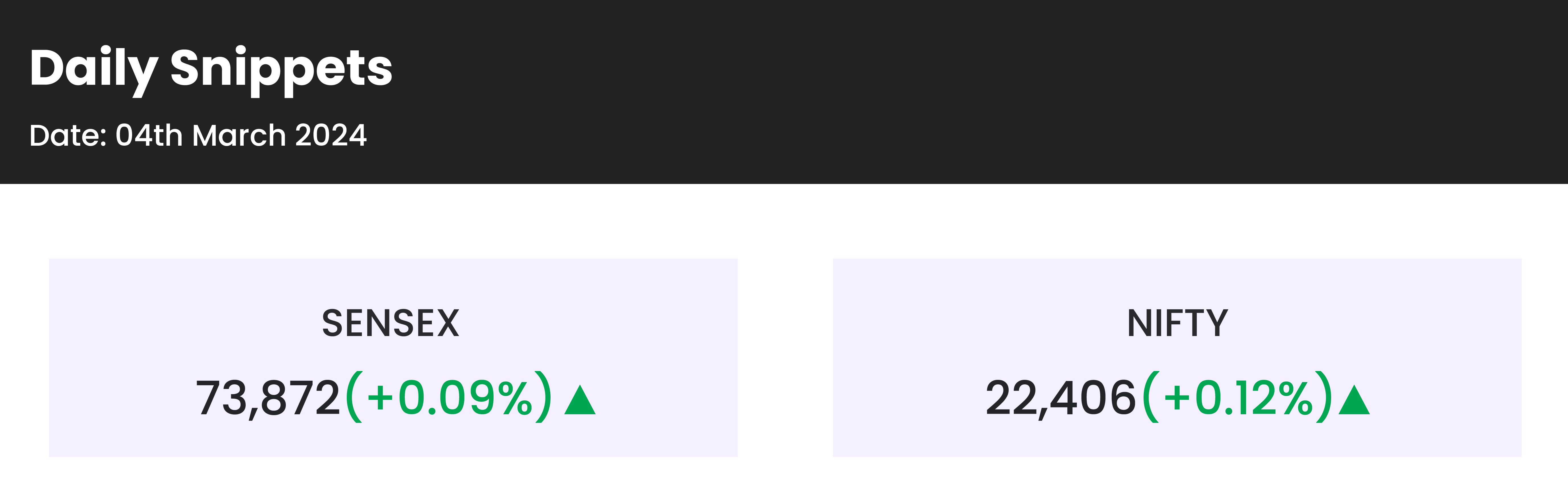

- Continuing their upward trend for the fourth consecutive session, the Sensex and the Nifty 50 reached new closing peaks on Monday, March 4.

- However, the market experienced moderate gains as a result of mixed global signals and the absence of notable catalysts.

- Currently, the market is in a range, lacking fresh triggers, with experts noting that many positives, such as strong economic growth and political stability post the General Elections 2024, are already factored in.

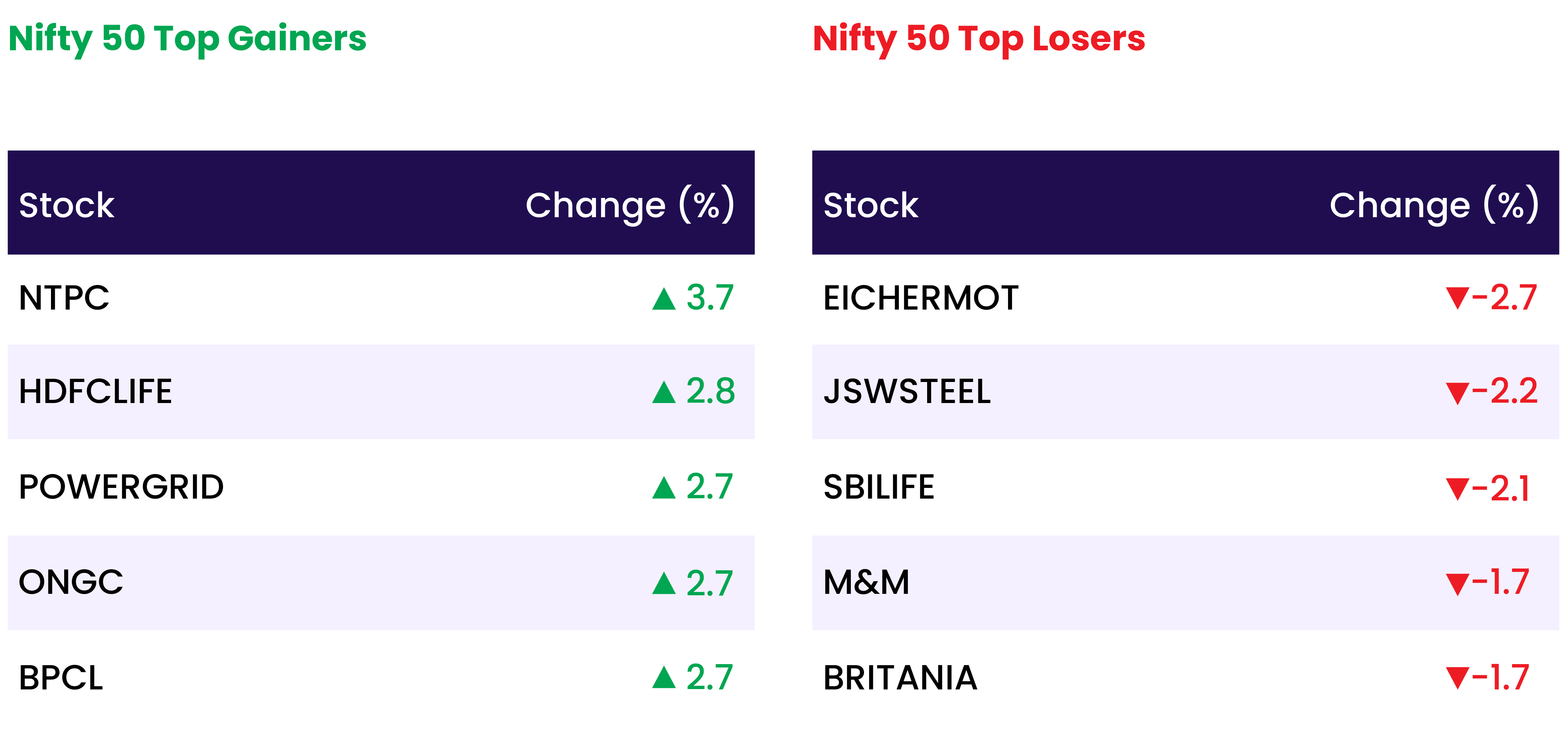

- Among sectoral indices, Nifty oil & gas rose 1.8 percent, while Nifty bank and PSU indices were up 0.3 percent each.

- Nifty Media was down 1.9 percent, Nifty IT closed 0.8 percent and FMCG 0.5 percent lower.

Global Markets:

- In Asia-Pacific markets Monday, Japan’s Nikkei 225 crossed the 40,000 mark, gaining 0.46% and setting a record high after the S&P 500 and the Nasdaq Composite both hit fresh all-time highs on Friday.

- European markets traded in mixed territory on Monday as investors look ahead to a new trading week and the upcoming interest rate decision from the European Central Bank.

- U.S. stock futures were little changed overnight Sunday as stocks attempt to continue their weeks-long rally.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Moil shares surged by 6.76 percent following an announcement from the manganese ore mining company, revealing a 15 percent year-over-year increase in February production. MOIL achieved its highest-ever February production, reaching 1.51 lakh tonnes of manganese (Mn) ore, marking a 15 percent YoY growth. Additionally, sales for the month stood at 1.56 lakh tonnes, demonstrating an 18 percent increase compared to the corresponding period in the previous year.

- Inox Wind and Suzlon Energy fell after reports suggested the Ministry of New and Renewable Energy was revisiting its stance on reverse auctions, considering bringing it back as a result of undersubscription and higher tariff discovery in recent wind bids.

- BHEL shares experienced a significant 12.4 percent surge, supported by robust trading volumes. A total of 24 crore shares were exchanged, surpassing the monthly average of 4 crore shares. The stock gained after the board of another state-run peer NTPC approved an investment worth Rs 17,195.3 crore for the third phase of the Singrauli Super Thermal Power Project for which BHEL was the only bidder for the construction.

News from the IPO world 🌐

- JG Chemicals’ Rs 251-crore IPO to open on March 5

- Gopal Snacks IPO price band fixed at Rs 381-401/share; issue to open on March 6

- Sebi clears Fairfax-backed Digit’s IPO after delay, letter shows

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY OIL & GAS | 1.9 |

| NIFTY PRIVATE BANK | 0.4 |

| NIFTY FINANCIAL SERVICES | 0.4 |

| NIFTY BANK | 0.3 |

| NIFTY PHARMA | 0.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1426 |

| Decline | 2525 |

| Unchanged | 134 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,087 | 0.2 % | 3.6 % |

| 10 Year Gsec India | 7.1 | 0.0 % | (1.6) % |

| WTI Crude (USD/bbl) | 80 | 2.2 % | 13.6 % |

| Gold (INR/10g) | 63,229 | 0.2 % | 1.6 % |

| USD/INR | 82.90 | 0.0 % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer